Last Updated on Sep 7, 2022 by Vyshakh

Harsh Vora is a proprietary investor and day trader with more than 10 yrs of experience in financial markets and is interviewed on ET NOW.

The Nifty50 as well as Sensex, have taken a 5% fall over the past week. This rout in the broader markets, however, has caused a much deeper slump in the high beta stocks, which are represented by both small caps and midcaps.

The Nifty Midcap index, for instance, has plunged by 10% while the Nifty Smallcap index has declined by 13% from the top. Remember that in financial jargon, high beta simply means those stocks that exhibit higher volatility compared to the broader markets. The obvious question then is whether this presents an opportunity to buy on dips or sell on rise? Before we discuss this, however, it may help to assess the causes of the current market slump.

Table of Contents

The spell of uncertainty

Remember first why the bull market started in the first place. For one, the stock market crash that occurred during early 2020 was an impulsive one, primarily caused due to uncertainty about the nature of the pandemic and its implications on the businesses and the economy.

In a couple of months, however, this uncertainty started waning as lockdowns eased and pent-up demand began resurfacing. Sectors such as information technology, specialty chemicals, and pharma emerged as winners as demand for their products and services surged globally. The need for global supply chains to find an alternative to China proved an added advantage for Indian companies.

The tailwinds to commodity sector

Two, the pandemic also caused a sharp slump in commodity prices as global demand waned, especially for crude oil. Since India imports close to 80% of its total crude oil requirements, low crude prices presented strong tailwinds to sectors that use crude oil derivatives as inputs. These sectors include paints, cement, autos, specialty chemicals, downstream oil and gas distribution companies, and more.

The high-ticket deals of heavyweight RIL

The broader indices were further supported by a slew of strong deals signed by the oil-to chemicals behemoth Reliance Industries (RIL) during the early stage of the pandemic. These deals included companies such as Facebook, Google as well as private equity partnerships with the likes of KKR, TPG, ADIA, and more, and amounted to close to Rs. 2 lakh cr. The sheer magnitude of the deals boosted RIL’s valuation, which in turn boosted the indices as well. This is because RIL carries heavy weightage in Nifty50 – as much as 10%.

Other gusty factors

Other structural tailwinds to India’s economy – including the reduction in the corporate tax rate in late 2019 as well as the indirect tax reform through the introduction of goods and services tax – helped aid foreign investor sentiment towards India.

What triggered a fall in the market?

To be sure, many of these sectoral tailwinds may be structural in nature, meaning they could be here to stay for the next decade. This includes the multi-year technology transformation story in India’s IT sector or the alternative-to-China story in pharma and chemicals. If this is true, however, then what spooked markets of late?

Sharp uptrend in commodity prices

For one, most commodity prices have risen sharply since the start of the pandemic. Crude oil, for instance, has risen to $ 85 per barrel, much to the surprise of many companies. Here’s Deepak Nitrite’s CEO Maulik Mehta discussing how rising crude prices played spoilsport with its business planning in the recent quarters (watch from 4 min 30 sec onwards)

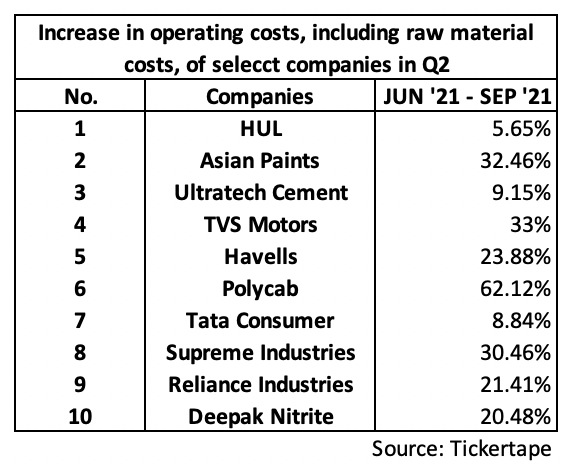

Similarly, the sharp surge in prices of aluminium, copper, zinc, steel, natural gas, as well as a host of agricultural commodities has dented the gross- and operating-margins of most companies in the second quarter of this year (Q2 FY 2022). The table below is a sample of 10 companies across sectors that have seen a sharper rise in raw material costs, which in turn fed into their overall operating costs.

The stock prices of many companies, including the ones above, that have declared their Q2 results so far likely overshot the market’s expectations of their underlying earnings. In other words, the reported quarterly earnings of these companies disappointed the market, thus precipitating a sharp correction in their stock prices.

Downgrades by global investment banks

The other reason that likely triggered the broader market rout is a slew of downgrades by global investment banks including Morgan Stanley, Nomura, and UBS. Morgan Stanley, for instance, downgraded Indian equities to an “equal weight” stance from an “overweight” earlier. This simply means that the bank does not consider the Indian market to be as attractive as previously. For Morgan Stanley, this is primarily because the Indian stock market has outperformed other markets over the past year and is now trading in an overvalued territory.

Consider this: The MSCI Emerging Market Index, which is an index comprising of companies in more than 12 emerging countries including China, Taiwan, and Korea, has fallen by 1.42% this year. On the other hand, the MSCI India index, which comprises 101 mid- and large-cap companies in India, has surged by more than 27%. On the valuations front, while MSCI Emerging Market Index trades at a price-to-earnings (PE) ratio of 15, the MSCI India Index trades at a PE ratio of 31. To read more in this here.

This valuation gap between the Indian market and other emerging countries has prompted global investment banks to prefer the latter over the former. Why do the ratings of these banks matter? Because they guide the institutional flow of money, at least over a shorter time frame. Investment institutions such as sovereign funds, insurance companies, university endowments, as well as high net-worth individuals tend to base their investment decisions on the research provided by these global investment banks. So a change in their ratings may impact the foreign portfolio flows into India. In October, for instance, the foreign institutional investors have offloaded as much as 20,000 cr-worth of Indian equities.

External forces at play

The third and final risk for Indian markets is related to the macroeconomy. Besides the rising cost of raw materials, the risk of the US Federal Reserve raising interest rates sooner rather than later has been weighing on investor sentiments. A rise in US interest rates may further prompt foreign investors to sell Indian stocks and invest in US treasury bonds.

The risk of the US Federal Reserve raising interest rates sooner than later has been weighing on investor sentiment. A rise in US interest rates may prompt foreign investors to sell Indian stocks and invest in US treasury bonds. Click To TweetA defence mechanism

To avoid any macroeconomic instability caused by the sell-off and to manage the interest rate differential between the US and India, the Reserve Bank of India may also be prompted to raise the repo rate in India. Higher interest rates may in turn compress the valuation of Indian companies as their expected future cash flows will have to be discounted at a higher rate. The risk of the third wave of coronavirus, of course, looms.

Higher interest rates may in turn compress the valuation of Indian companies as their expected future cash flows will have to be discounted at a higher rate. Click To TweetWill the correction loom or fade?

To summarize, the second quarter results seem to be disappointing the street. The trinity of (1) high raw material costs denting margins, (2) stretched valuations of Indian markets compared to other emerging countries, and (3) imminent macroeconomic risks, such as the US Fed raising interest rates in the near future or the third wave of coronavirus, may keep Indian markets under pressure.

This correction, however, may only last for a shorter term. It may help to keep in mind that despite facing similar headwinds in the past, Indian markets have bounced back sooner than later. This includes 2013, for instance, when the US Fed announced the tapering of its bond buying programme, as a result of which the Indian markets plunged by about 18% in a span of a few weeks.

The point being any such correction may provide an opportunity to enter quality companies on dips. Over a reasonably longer term, say three to five years, Indian markets may deliver strong gains led by infrastructure development, strong domestic demand, and bank credit growth.

That said, Muhurat Trading is round the corner! Have you watchlisted stocks you want to trade on that day as yet? If not, now is #dimaaglaganekamuhurat. So head to Tickertape and screen Stocks based on over 200 filters.

Here’s wishing you a prosperous Diwali! Happy investing!