Last Updated on May 27, 2023 by Anjali Chourasiya

Return on Investment (ROI) is the most crucial metric when analysing and tracking your investment. It allows you to dive deeper into your portfolio and can help you weed out the less-performing investments. In this article, let’s dive into the highest-return mutual funds in the last 5 yrs, factors to consider before investing in them, and how you can build a high-quality debt portfolio using Tickertape. Let’s dive in.

Table of Contents

Best equity mutual fund with high ROI

Here are some of the best-performing mutual funds in India in the last 5 yrs under the equity segment.

Best large-cap fund with high ROI

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Canara Rob Bluechip Equity Fund | 8,860.36 | 0.40 | 15.07 | Allowed | 5,000 | Canara Robeco Asset Management Company Limited |

| Nippon India Large Cap Fund | 13,432.32 | 0.95 | 14.03 | Allowed | 100 | Nippon Life India Asset Management Limited |

| Kotak Bluechip Fund | 5,375.91 | 0.54 | 13.61 | Allowed | 1,000 | Kotak Mahindra Asset Management Company Limited |

| IDBI India Top 100 Equity Fund | 623.19 | 1.26 | 13.59 | Allowed | 5,000 | IDBI Asset Management Ltd. |

| Baroda BNP Paribas Large Cap Fund | 1,407.57 | 0.96 | 13.55 | Allowed | 5,000 | Baroda BNP Paribas Asset Management India Pvt. Ltd. |

| Edelweiss Large Cap Fund | 407.27 | 0.94 | 13.42 | Allowed | 5,000 | Edelweiss Asset Management Limited |

| Mirae Asset Large Cap Fund | 32,851.08 | 0.51 | 13.13 | Allowed | 5,000 | Mirae Asset Investment Managers (India) Private Limited |

| ICICI Pru Bluechip Fund | 34,679.35 | 1.12 | 13.05 | Allowed | 100 | ICICI Prudential Asset Management Company Limited |

| HDFC Top 100 Fund | 23,191.78 | 1.10 | 12.80 | Allowed | 100 | HDFC Asset Management Company Limited |

| SBI BlueChip Fund | 35,770.18 | 0.90 | 12.77 | Allowed | 5,000 | SBI Funds Management Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the high-return large-cap mutual fund.

- Category > Equity > Large cap

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Best mid-cap mutual funds with high ROI

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Quant Mid Cap Fund | 1,872.12 | 0.63 | 20.83 | Allowed | 5,000 | Quant Money Managers Limited |

| PGIM India Midcap Opp Fund | 8,072.13 | 0.43 | 19.77 | Allowed | 5,000 | PGIM India Asset Management Private Limited |

| Motilal Oswal Midcap Fund | 3,800.72 | 0.76 | 18.26 | Allowed | 500 | Motilal Oswal Asset Management Company Limited |

| Axis Midcap Fund | 19,539.49 | 0.54 | 16.75 | Allowed | 500 | Axis Asset Management Company Ltd. |

| Nippon India Growth Fund | 13,420.40 | 0.85 | 16.66 | Allowed | 100 | Nippon Life India Asset Management Limited |

| Invesco India Midcap Fund | 2,803.25 | 0.72 | 16.36 | Allowed | 1,000 | Invesco Asset Management Company Pvt Ltd. |

| Kotak Emerging Equity Fund | 24,406.71 | 0.41 | 16.32 | Allowed | 100 | Kotak Mahindra Asset Management Company Limited |

| SBI Magnum Midcap Fund | 8,733.51 | 0.98 | 16.26 | Allowed | 5,000 | SBI Funds Management Limited |

| Mahindra Manulife Mid Cap Fund | 1,141.46 | 0.63 | 16.04 | Allowed | 1,000 | Mahindra Manulife Investment Management Private Limited |

| Tata Mid Cap Growth Fund | 1,882.43 | 0.97 | 15.85 | Allowed | 5,000 | Tata Asset Management Private Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the high-return mid-cap mutual fund.

- Category > Equity > Mid cap

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

High-return thematic mutual fund

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Tata Ethical Fund | 1,570.10 | 0.92 | 14.48 | Allowed | 5,000 | Tata Asset Management Private Limited |

| Invesco India PSU Equity Fund | 405.59 | 0.96 | 14.41 | Allowed | 1,000 | Invesco Asset Management Company Pvt Ltd. |

| Edelweiss Recently Listed IPO Fund | 826.36 | 0.87 | 13.15 | Allowed | 5,000 | Edelweiss Asset Management Limited |

| Franklin India Opportunities Fund | 681.73 | 1.52 | 13.05 | Allowed | 5,000 | Franklin Templeton Asset Management (India) Private Limited |

| Nippon India Quant Fund | 36.31 | 0.40 | 13.01 | Allowed | 5,000 | Nippon Life India Asset Management Limited |

| SBI Magnum Equity ESG Fund | 4,411.66 | 1.35 | 12.79 | Allowed | 1,000 | SBI Funds Management Limited |

| SBI Magnum Comma Fund | 427.78 | 2.03 | 12.59 | Allowed | 5,000 | SBI Funds Management Limited |

| Taurus Ethical Fund | 84.83 | 1.26 | 12.31 | Allowed | 500 | Taurus Asset Management Company Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the high-return thematic mutual fund.

- Category > Equity > Thematic fund

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Best Flexi cap mutual fund with high return

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Quant Flexi Cap Fund | 1,161.77 | 0.58 | 20.27 | Allowed | 5,000 | Quant Money Managers Limited |

| Parag Parikh Flexi Cap Fund | 31,290.25 | 0.72 | 18.81 | Allowed | 1,000 | PPFAS Asset Management Pvt. Ltd. |

| PGIM India Flexi Cap Fund | 5,310.35 | 0.42 | 17.15 | Allowed | 5,000 | PGIM India Asset Management Private Limited |

| Kotak Multi Asset Allocator FoF-Dynamic | 864.20 | 0.13 | 16.60 | Allowed | 5,000 | Kotak Mahindra Asset Management Company Limited |

| HDFC Flexi Cap Fund | 31,892.77 | 0.99 | 15.08 | Allowed | 100 | HDFC Asset Management Company Limited |

| JM Flexicap Fund | 284.69 | 1.4 | 14.80 | Allowed | 1,000 | JM Financial Asset Management Private Limited |

| Canara Rob Flexi Cap Fund | 8,712.83 | 0.49 | 14.61 | Allowed | 5,000 | Canara Robeco Asset Management Company Limited |

| Union Flexi Cap Fund | 1,404.98 | 1.01 | 14.35 | Allowed | 1,000 | Union Asset Management Company Pvt. Ltd. |

| DSP Flexi Cap Fund | 7,847.24 | 0.73 | 13.49 | Allowed | 100 | DSP Investment Managers Private Limited |

| Edelweiss Flexi Cap Fund | 1,117.87 | 0.55 | 13.44 | Allowed | 5,000 | Edelweiss Asset Management Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the best Flexi-cap equity funds.

- Category > Equity > Flexi-cap fund

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Best small cap fund with high ROI

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Quant Small Cap Fund | 3,578.84 | 0.62 | 25.62 | Allowed | 5,000 | Quant Money Managers Limited |

| Nippon India Small Cap Fund | 26,293.50 | 0.82 | 19.22 | Allowed | 5,000 | Nippon Life India Asset Management Limited |

| Kotak Small Cap Fund | 8,672.23 | 0.55 | 18.50 | Allowed | 500 | Kotak Mahindra Asset Management Company Limited |

| Axis Small Cap Fund | 11,390.24 | 0.51 | 18.34 | Allowed | 500 | Axis Asset Management Company Ltd. |

| ICICI Pru Smallcap Fund | 4,761.83 | 0.86 | 17.20 | Allowed | 5,000 | ICICI Prudential Asset Management Company Limited |

| SBI Small Cap Fund | 15,590.43 | 0.73 | 17.18 | Allowed | 0 | SBI Funds Management Limited |

| Union Small Cap Fund | 708.31 | 1.32 | 15.38 | Allowed | 1,000 | Union Asset Management Company Pvt. Ltd. |

| HDFC Small Cap Fund | 14,962.63 | 0.79 | 15.24 | Allowed | 100 | HDFC Asset Management Company Limited |

| HSBC Small Cap Fund | 8,718.44 | 0.74 | 15.00 | Allowed | 5,000 | HSBC Global Asset Management (India) Private Limited |

| DSP Small Cap Fund | 9,408.99 | 0.94 | 14.98 | Allowed | 100 | DSP Investment Managers Private Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the best small-cap equity funds.

- Category > Equity > Small-cap fund

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Value funds with high return

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| ICICI Pru Value Discovery Fund | 27,677.26 | 1.21 | 16.04 | Allowed | 1,000 | ICICI Prudential Asset Management Company Limited |

| JM Value Fund | 167.93 | 1.75 | 14.03 | Allowed | 1,000 | JM Financial Asset Management Private Limited |

| Templeton India Value Fund | 954.05 | 0.92 | 13.81 | Allowed | 5,000 | Franklin Templeton Asset Management (India) Private Limited |

| Bandhan Sterling Value Fund | 5,430.33 | 0.83 | 13.41 | Allowed | 1,000 | Bandhan AMC Limited |

| Nippon India Value Fund | 4,634.11 | 1.24 | 13.35 | Allowed | 500 | Nippon Life India Asset Management Limited |

| UTI Value Opp Fund | 6,815.09 | 1.15 | 13.15 | Allowed | 5,000 | UTI Asset Management Company Private Limited |

| HSBC Value Fund | 8,087.74 | 0.83 | 12.90 | Allowed | 5,000 | HSBC Global Asset Management (India) Private Limited |

| Tata Equity P/E Fund | 5,359.60 | 0.9 | 11.30 | Allowed | 5,000 | Tata Asset Management Private Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the best-value equity funds.

- Category > Equity > Value fund

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Best Multi-cap equity funds with high return

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Quant Active Fund | 4,061.77 | 0.58 | 21.62 | Allowed | 5,000 | Quant Money Managers Limited |

| Kotak India Growth Fund-Sr 4 | 90.64 | 0.34 | 17.69 | Not allowed | 0 | Kotak Mahindra Asset Management Company Limited |

| Mahindra Manulife Multi Cap Fund | 1,633.38 | 0.49 | 17.30 | Allowed | 1,000 | Mahindra Manulife Investment Management Private Limited |

| Nippon India Multi Cap Fund | 15,087.68 | 1.07 | 15.19 | Allowed | 100 | Nippon Life India Asset Management Limited |

| Baroda BNP Paribas Multi Cap Fund | 1,610.32 | 1.13 | 13.82 | Allowed | 5,000 | Baroda BNP Paribas Asset Management India Pvt. Ltd. |

| ICICI Pru Multicap Fund | 6,963.42 | 1.06 | 13.53 | Allowed | 5,000 | ICICI Prudential Asset Management Company Limited |

| Sundaram Multi Cap Fund | 1,784.63 | 0.97 | 12.34 | Allowed | 100 | Sundaram Asset Management Company Limited |

| Invesco India Multicap Fund | 2,458.69 | 0.65 | 11.93 | Allowed | 1,000 | Invesco Asset Management Company Pvt Ltd. |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the best multi-cap equity funds.

- Category > Equity > Multi-cap

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Highest dividend yield mutual funds with high ROI

| Name | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Templeton India Equity Income Fund | 1,410.93 | 1.20 | 14.61 | Allowed | 5,000 | Franklin Templeton Asset Management (India) Private Limited |

| ICICI Pru Dividend Yield Equity Fund | 1,302.53 | 0.63 | 13.34 | Allowed | 5,000 | ICICI Prudential Asset Management Company Limited |

| Sundaram Dividend Yield Fund | 420.07 | 1.48 | 12.41 | Allowed | 5,000 | Sundaram Asset Management Company Limited |

| UTI Dividend Yield Fund | 2,810.26 | 1.45 | 12.20 | Allowed | 5,000 | UTI Asset Management Company Private Limited |

| Aditya Birla SL Dividend Yield Fund | 882.97 | 1.70 | 11.63 | Allowed | 1,000 | Aditya Birla Sun Life AMC Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the highest dividend yield mutual funds.

- Category > Equity > Dividend Yield Fund

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Best hybrid mutual funds

| Name | Sub Category | AUM (Rs. in cr.) | Expense Ratio (%) | CAGR 5Y (%) | SIP Investment | Minimum Lumpsum (Rs.) | AMC |

| Quant Multi Asset Fund | Multi Asset Allocation Fund | 749.48 | 0.56 | 21.70 | Allowed | 5,000 | Quant Money Managers Limited |

| Quant Absolute Fund | Aggressive Hybrid Fund | 1,073.76 | 0.56 | 20.06 | Allowed | 5,000 | Quant Money Managers Limited |

| ICICI Pru Equity & Debt Fund | Aggressive Hybrid Fund | 21,435.78 | 1.2 | 15.59 | Allowed | 5,000 | ICICI Prudential Asset Management Company Limited |

| ICICI Pru Multi-Asset Fund | Multi Asset Allocation Fund | 17,044.38 | 1.14 | 15.27 | Allowed | 5,000 | ICICI Prudential Asset Management Company Limited |

| Baroda BNP Paribas Aggressive Hybrid Fund | Aggressive Hybrid Fund | 780.81 | 0.62 | 14.15 | Allowed | 5,000 | Baroda BNP Paribas Asset Management India Pvt. Ltd. |

| HDFC Balanced Advantage Fund | Balanced Advantage Fund | 54,412.64 | 0.86 | 14.14 | Allowed | 100 | HDFC Asset Management Company Limited |

| Edelweiss Aggressive Hybrid Fund | Aggressive Hybrid Fund | 496.26 | 0.57 | 13.87 | Allowed | 5,000 | Edelweiss Asset Management Limited |

| Kotak Equity Hybrid Fund | Aggressive Hybrid Fund | 3,326.97 | 0.54 | 13.70 | Allowed | 5,000 | Kotak Mahindra Asset Management Company Limited |

| Mirae Asset Hybrid Equity Fund | Aggressive Hybrid Fund | 6,949.27 | 0.36 | 13.22 | Allowed | 5,000 | Mirae Asset Investment Managers (India) Private Limited |

| Canara Rob Equity Hybrid Fund | Aggressive Hybrid Fund | 8,445.43 | 0.58 | 13.00 | Allowed | 5,000 | Canara Robeco Asset Management Company Limited |

Note: The funds are sorted using the Tickertape Mutual Fund Screener on 25th May 2023. Below-listed parameters are used to sort the list of the highest dividend yield mutual funds.

- Category > Hybrid

- 5-yr CAGR – Set to High

- AUM

- Expense Ratio

- SIP Investment

- Minimum Lumpsum

- AMC

Build a high-quality debt portfolio with Tickertape

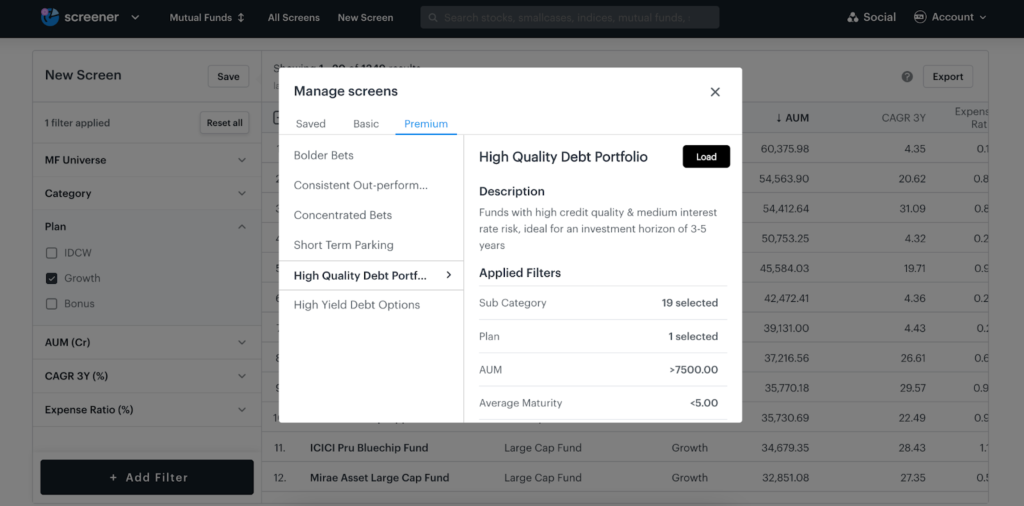

High-quality debt mutual funds refer to funds with high credit quality and medium interest rate risk. These mutual funds are considered ideal for an investment horizon of 3-5 yrs. With Tickertape, it is possible to get high-quality debt mutual funds. Follow the below-mentioned steps.

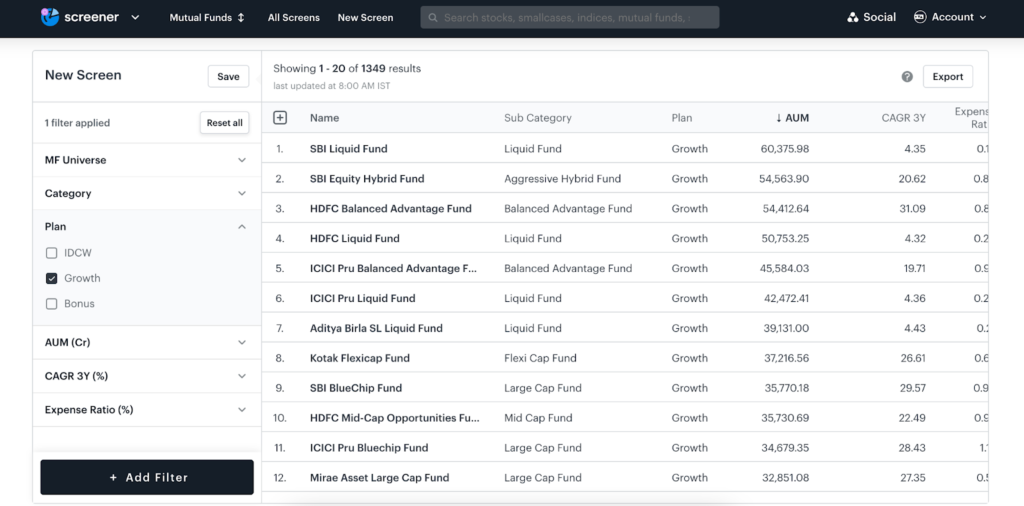

Step 1: Go to Tickertape Mutual Fund Screener.

Step 2: Click on ‘All Screens’. And under ‘Premium’, click on ‘High Quality Debt Portfolio’.

Step 3: Click on ‘Load’. It will give you funds with high credit quality and medium interest rate risk.

Easy, right? Get all the top mutual funds and diversify your portfolio with debt mutual funds using Tickertape. Become a pro member now!

Factors to consider before investing in the best-performing mutual funds in the last 5 yrs

Below listed are some of the factors that can help you identify the best mutual funds to invest in India.

- Risk assessment

Every mutual fund category comes with a different set of risk factors. For instance, equity mutual funds are prone to volatility and liquidity risk, whereas debt mutual funds are prone to interest, credit, rebalancing, currency, and more such types of risks. It’s important to strike a balance between potential returns and the level of risk you are comfortable with. Hence, it is worthwhile to consider a financial advisor before investing in order to avoid investing against your risk appetite.

- Performance consistency

Consistency in performance is a crucial factor to consider when investing in mutual funds for higher returns. Look beyond just the top performers and evaluate the consistency of their performance over the last 5 yrs. Assess how they have performed during different market conditions and if they have been able to generate returns consistently.

- Fund objectives and strategy

Understand the investment objectives and strategy of the mutual funds. Check whether their investment approach aligns with your own investment goals and risk tolerance.

- Fund management

Evaluate the experience and track record of the fund manager or management team., and assess if the fund’s management has remained stable over the last 5 yrs or if there have been frequent changes.

- Expense ratio

A fee charged by the fund to cover operating expenses is referred to as the expense ratio. Consider the expense ratio of the mutual funds, as it can impact your overall returns. Lower expense ratios are generally preferable, as they leave more of the fund’s returns for the investor.

Diversified funds spread their investments across various asset classes, sectors, and regions, which can help mitigate risks. Consider whether the funds you’re evaluating provide adequate diversification or if they are heavily concentrated in specific areas.

- Fund size and liquidity

Take into account the size of the mutual funds and their liquidity. Larger funds may need help in deploying capital effectively, and smaller funds may be more nimble but could face liquidity issues. Consider the fund’s asset size in relation to its investment strategy and objectives.

- Fund expenses and charges

In addition to the expense ratio, consider any additional charges or fees associated with the mutual funds, such as front-end or back-end loads, redemption fees, or transaction costs. These expenses can impact your overall returns and should be carefully evaluated.

- Peer comparison and benchmarking

Compare the performance of the mutual funds not only against their peers but also against relevant benchmarks. Assess whether the funds have outperformed their benchmarks consistently or if their performance has been primarily driven by exposure to a specific asset class or sector.

Conclusion

Finding the right investment can be a tedious process. It involves researching, analysing, tracking and investing at the right time. With Tickertape, you can reduce this process to a few minutes. Using Tickertape Mutual Fund Screener, you can filter mutual funds based on 50+ filters. Moreover, you can create a custom filter as well. And like a cherry on top, there are 11 pre-built screens built for you to save you time and effort. So, what are you waiting for? Become a pro member now!

FAQs

How do you select the right mutual fund to invest in?

There are various factors that can influence your decision to invest in any mutual fund, such as risk appetite, the fund’s performance, expense ratio, diversification, competitive advantage, and more. You can use Tickertape Mutual Fund Screener, which is loaded with over 50 filters to get a list of the best mutual fund for your portfolio based on your criteria. In case you can’t find the filter you need, create a custom filter and save it for later use. Explore Tickertape Mutual Fund Screener now!

How to get mutual funds which are out-performers and have low volatility?

With Tickertape, you can get a list of mutual funds which are out-performers and have low volatility in just a few clicks. Follow the below-mentioned steps to get your desired result.

Step 1: Go to Tickertape Mutual Fund Screener.

Step 2: Click on ‘All Screens’ and select ‘Consistent Out-performers’ in ‘Premium’ screens.

Step 3: Click on ‘Load’. Now, all the mutual funds which have been consistent outperformers and display low volatility appear on the screen. Click on ‘Load’. Now, all the mutual funds which have been consistent outperformers and display low volatility appear on the screen.

Easy, right? Maximise your returns by consistently outperforming mutual funds using Tickertape. Become a pro member now!

- Best Mutual Funds for Passive Investors (2025) - Dec 9, 2024

- List of Stocks With RSI Below 30 in India - Dec 9, 2024

- 10 Highest Dividend Paying Stocks in Nifty 50 NSE India - Dec 9, 2024