Last Updated on Aug 25, 2022 by

Harsh Vora is a proprietary investor and day trader with more than 10 yrs of experience in financial markets and is interviewed on ET NOW.

With the sharp increase in volatility in the global markets of late, it may help to re-evaluate your investments across various asset classes.

Should you continue your systematic investment plans in existing schemes? Which sectors could the markets favour this year? Finally, how do we screen and select the best mutual funds across categories?

But, before we get into these questions, let’s take a look at what has recently changed in the global macros.

For one, the Federal Reserve is on track to raising interest rates this year. The United States is grappling with record-high inflation. In December 2021, the US inflation hit a 39-yr high (last seen in 1982) at 7% and was further expected to hit 7.2% in January. In the Eurozone, inflation hit a record-high of 5.1% in January. The Bank of England has already made consecutive rate hikes for the first time since 2004. Back home in India, retail inflation hit a 5-mth high of 5.59% in December. If the US Fed does increase rates starting March this year, then the Reserve Bank of India (RBI) will face increased pressure to tighten its monetary policy to bound the foreign fund outflow and the resultant pressure on the rupee.

Which categories are the most likely to underperform?

For long duration debt funds, an increase in interest rates spells bad news. Remember that interest rates and bond prices move in the opposite direction. This is especially true for longer duration bonds. Higher interest rates may therefore translate into underperformance of these schemes and it may help to limit your exposure to them.

For equity schemes, higher interest rates may hurt growth stocks, especially those that flew high during the low-interest rate regime of the previous 2 yrs. This includes smallcaps and midcaps that fail to meet the market’s expectations on the growth front.

Moving forward, therefore, it is likely that small and midcaps may not perform as well as they did previously. They may also witness high volatility and drawdown. As such, an investor in small and midcaps must keep a long-term horizon, say, of at least 5 yrs.

Which categories have the potential to outperform others?

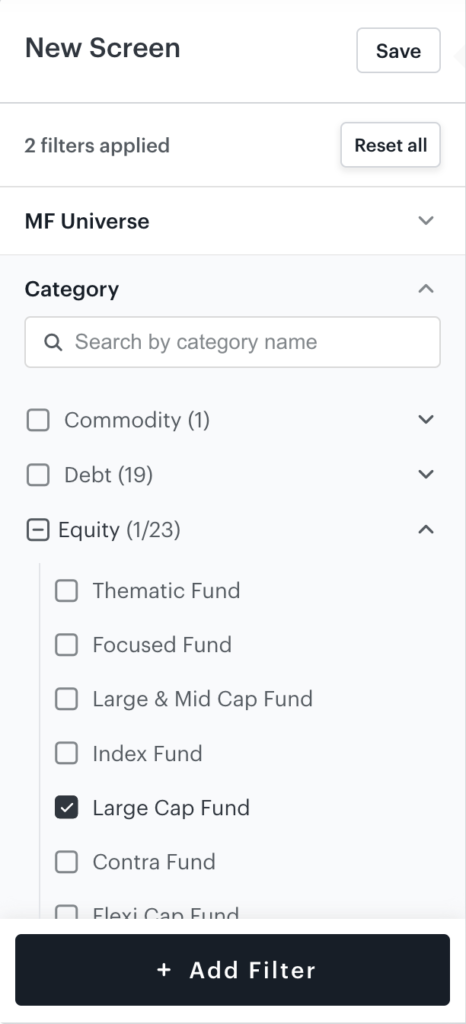

High market volatility can be managed by increasing exposure in large-cap or flexi cap equity schemes for a risk-averse investor. By definition, large-cap companies exhibit lower volatility than small or mid-cap companies. To find which mutual funds within the large-cap category fare better on the volatility front, simply go to Tickertape’s newly launched Mutual Fund Screener.

Step 1. On the left-handside of the Mutual Fund Screener, click on “Category” section and select “Large Cap Fund” under the “Equity” head.

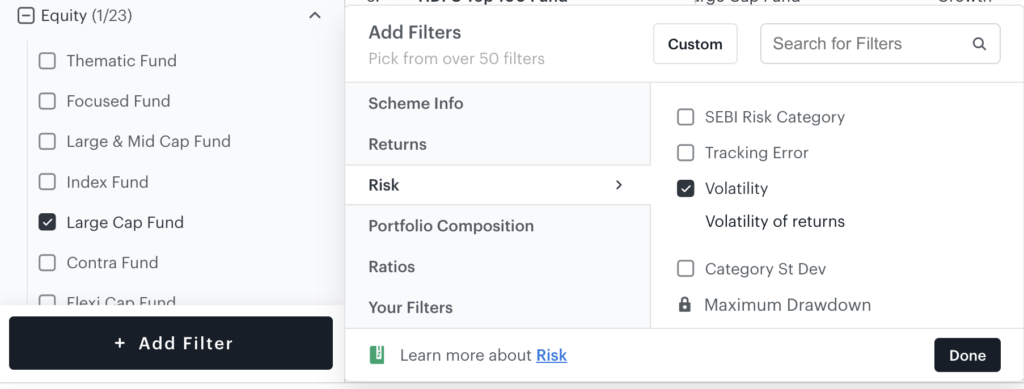

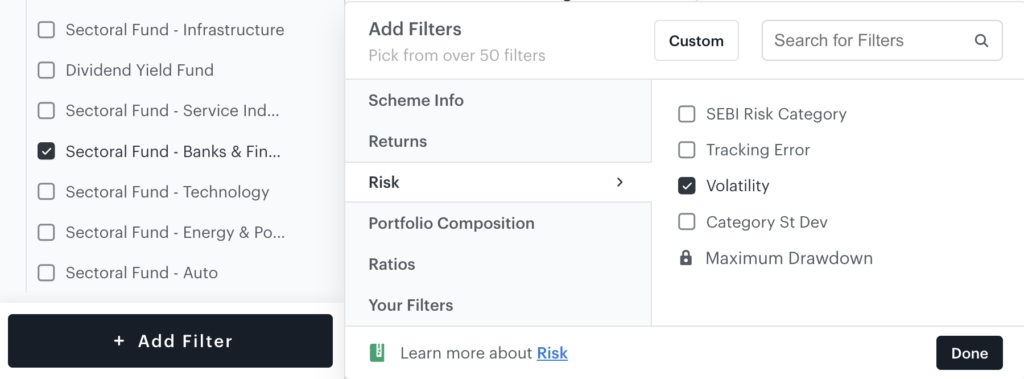

Step 2. Further, add a filter for “Volatility” under the “Risk” category.

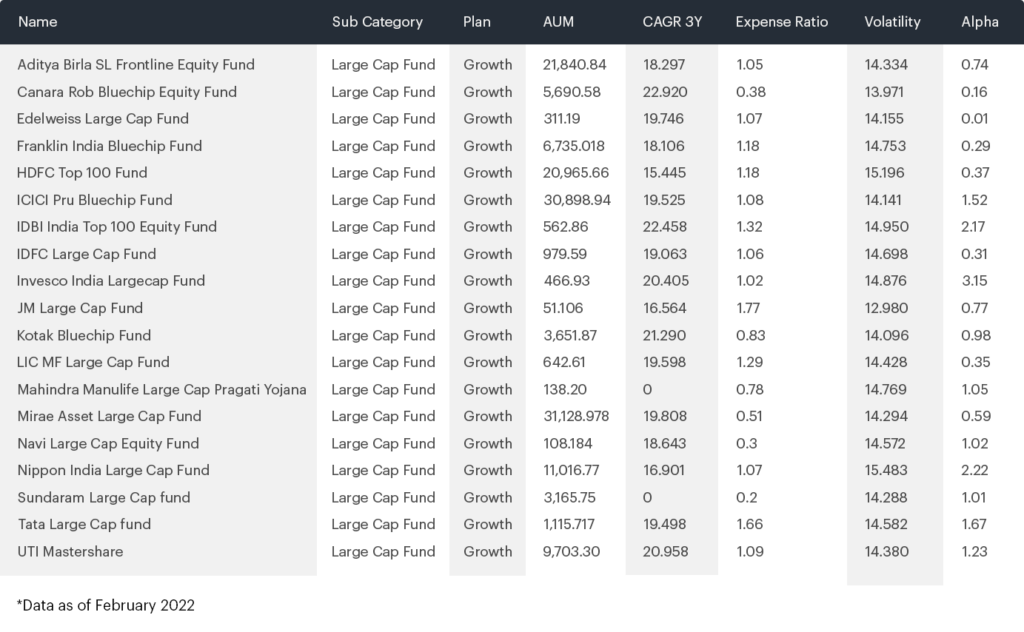

This will give you a list of 32 large-cap schemes with varying volatility degrees, ranging from 13 to 15.5. However, keep in mind that lower volatility also implies a relatively lower CAGR – though not always. To further narrow down the options, I like to add another filter to these, which is “Alpha”. Remember that alpha is simply the fund’s outperformance compared to its benchmark.

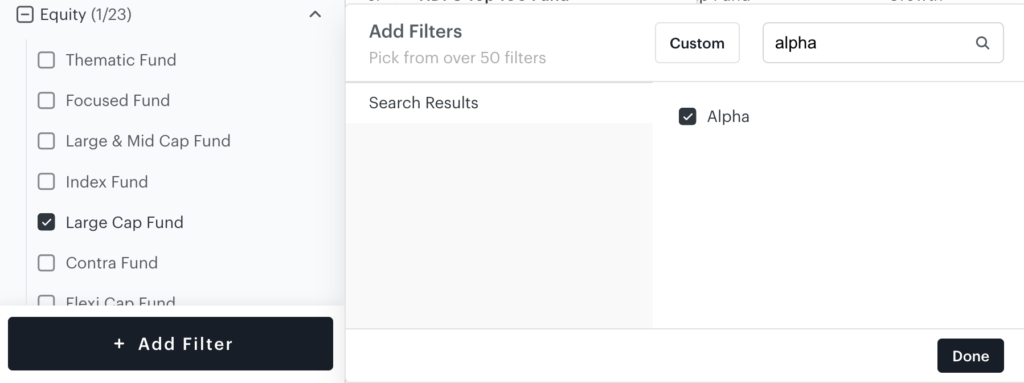

Step 3. Additionally, add the filter “Alpha” under the “Equity” head.

For most large-cap schemes, this benchmark is the Nifty50. Once added, this filter shows the funds that have outperformed their respective benchmarks. Look for schemes with an alpha of greater than zero. This gives a list of 19 schemes that have beaten their benchmarks as of February 2022.

The large-cap scheme with the highest alpha is Invesco India Large Cap Fund. Note that it also has an average level of volatility of 14.7 amongst peers. In case you’re wondering why would its alpha be so high? Notice that its assets under management (AUM) are only about Rs 467 cr. When the AUM is lower, it is easier for the fund manager to deploy funds across a wide range of companies in the market.The universe of stocks becomes smaller for high AUM schemes, including ICICI Prudential Bluechip Fund with an AUM of about Rs 31,000 cr. So, smaller AUM schemes have an advantage over their larger AUM peers.

Another category that may potentially perform better this year is banking. Higher interest rates are favourable for banks in the short to medium term as they can reprice their assets faster than their liabilities. In other words, banks can increase the interest rates on loans given out sooner than they have to raise rates on the deposits taken. This increases their net interest margin. This, coupled with the fact that asset quality issues for most private banks are now passe and credit growth is expected to pick up, the banking sector is likely to be in a sweet spot.

Let’s look at how to screen sectoral funds on Tickertape:

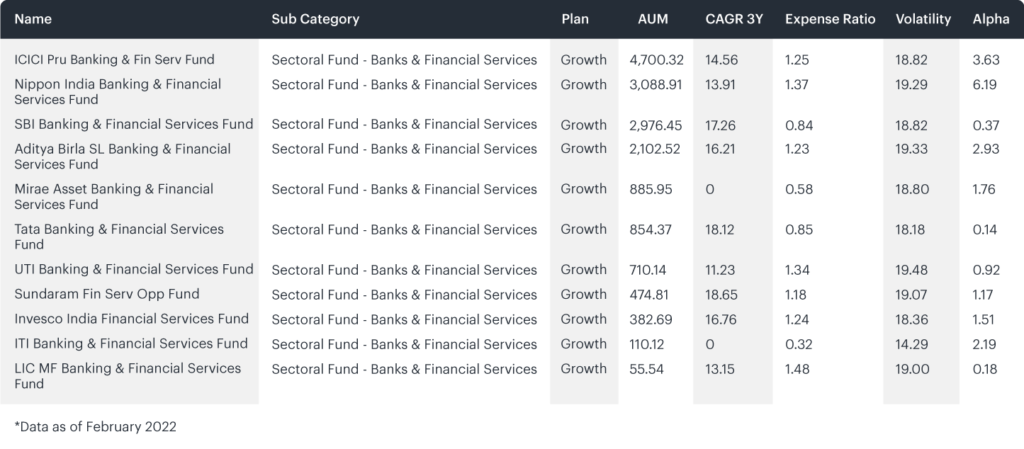

Step 4. Keeping the “Volatility” and “Alpha” filters intact, select “Sectoral Fund – Banks & Finance” under the Equity drop-down list in the Category section.

Furthermore, in the image below, I have selected only those schemes that have an alpha of greater than zero.

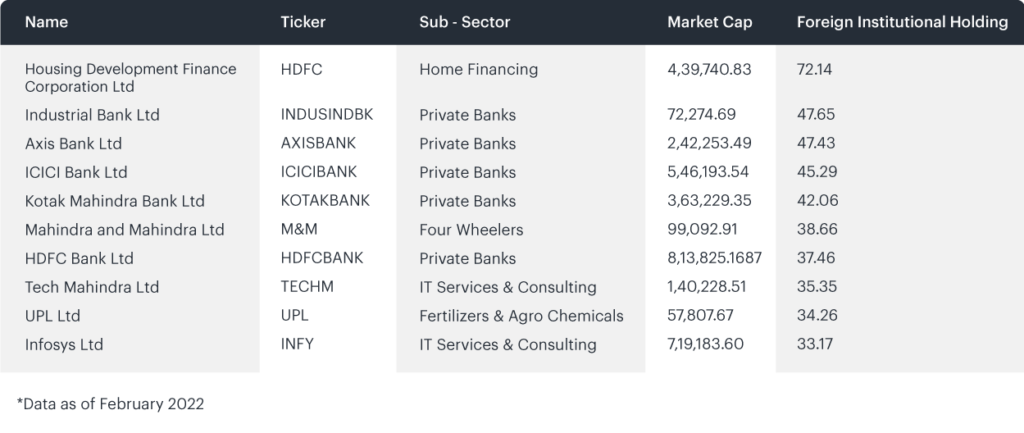

As you may notice, all schemes under banking have much greater volatility than the large-cap schemes discussed above. This is expected as foreign investors have a disproportionate exposure to banking stocks in India. Note in the image below that six out of the top 10 companies in the Nifty50 index in which foreign institutional investors hold the most stake are banks and financial companies. Therefore, when things go bad, these banks and financial companies tend to see a much sharper drawdown.

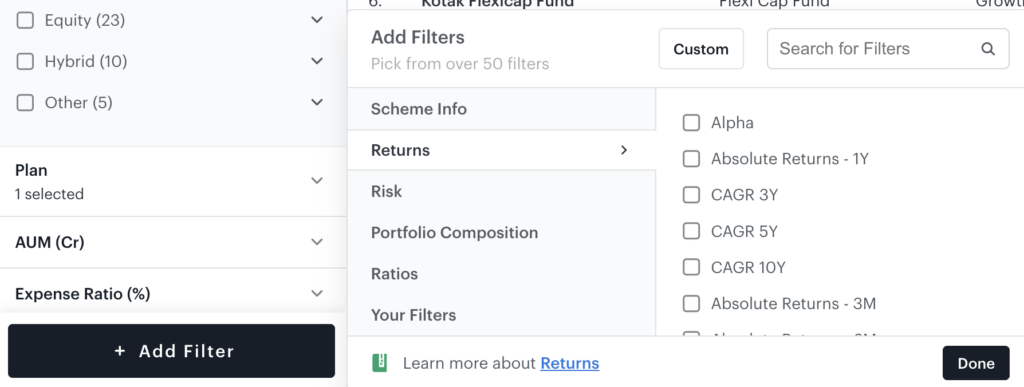

So an investor choosing to deploy a portion of their capital into banking must keep in mind the higher volatility vis-à-vis non-financial large-cap companies. Similarly, you may use Tickertape’s Mutual Fund Screener to filter out fund categories and schemes within those categories, that you believe may outperform the broader indices or other asset classes this year. Use the “Add Filter” option to add filters such as alpha, expense ratios, valuation, including say, PE or PB of the mutual funds, and more to your search.

Step 5. Select the “Add Filter” option and filter as per your preference.

So, with Ticketape, all you have to do is tick and filter your mutual funds – all at one place!