Last Updated on Oct 11, 2022 by

What is the correct percentage of your capital that you should allocate to a particular asset class? Is there a foolproof formula to decide this? Or it depends on personal choice? As a beginner, how should you decide how much to allocate to a particular asset class? A portfolio of how many stocks is an ideal portfolio? These are the few questions we generally encounter while constructing an investment portfolio. This article tries to answer all these questions.

Let’s start by understanding what exactly an asset is.

Table of Contents

What is an asset?

As described by Robert Kiyosaki in his book Rich Dad Poor Dad, an asset is something that generates income or puts money into your pocket. An asset can be in various forms like investment in shares of listed/unlisted companies, fixed income securities, real estate, precious metals like gold etc.

Importance of asset allocation

Now that you know the meaning of asset, you might be wondering how you should decide how much to put in which asset class, i.e., asset selection and its allocation or position sizing.

Have you ever heard about any company which is dependent on a single supplier or a single customer? No, right. They always have a backup option or have more than one supplier for each and every part of their value chain. Have you ever wondered why?

Recently everyone started talking about the China Plus One strategy. Every country is looking for an alternative to Chinese suppliers. Many companies who were majorly dependent on China have either started working with other suppliers or are doing backward integration to remove their dependence thereon.

By doing so, they are diversifying themselves from any potential risk that could come across in future.

Similarly, you should never invest everything in one asset class, be it business – listed/unlisted, gold, real estate, fixed-income securities etc. You should diversify among asset classes by keeping your risk profile, income, lifestyle, financial goals and time horizon, etc., in mind. A young person usually has more risk-taking capability than someone going to retire soon so they can invest a higher percentage of their income in risky assets like equity than the others. However, a young person who is saving for their education and wants to use that cash after a year or in the near future should invest in less risky assets like fixed-income securities instead of risky or volatile assets like equity.

Risk and return of assets

Risk return profile of various asset classes –

Note – This is an indicative risk-return profile of various asset classes.

Cash is also one of the most important asset classes. Having cash at the right time can become your biggest asset. However, cash lying in your locker will significantly decrease your purchasing power over time.

Now that you know the risk and return profile of various asset classes, if you have an option to pick any asset class of your choice, which one would you prefer and why?

Continuing with the above example, you must have also seen that every company gives the highest order to the supplier with whom they have a long-standing relationship (due to reliability, quality, proximity, cost, timely delivery etc.) and fewer orders to a new supplier. This is exactly what needs to be done while allocating your capital, i.e., giving higher weight to your most conviction bet and less weight to those bets where you are not fully convinced yet. However, the percentage allocation to a particular asset class should neither be very large nor small enough that it becomes too risky or doesn’t move the needle.

Impact of asset allocation on a portfolio

Let’s take a simple example to understand how too small or too large an allocation to a particular asset class can impact the overall portfolio.

Suppose an investor has free cash of Rs. 100 with them.

| Particulars | Asset allocation |

| Scenario 1 | Buys 35 random companies in same proportion (investing based on tips) |

| Scenario 2 | Invests free cash in Nifty 50 ETFs, Gold ETF and REITS |

| Scenario 3 | Buys Reliance Industries/HDFC Cos shares/gold/real estate/REITS(any one from this) from the entire free cash |

| Scenario 4 | Buys shares of Cos belonging to a particular sector say Chemical/ IT and gold in same proportion |

| Scenario 5 | Buys a few companies based on their research, some gold and some fixed-income securities keeping the risk profile, time horizon, income, financial goals etc., in mind. |

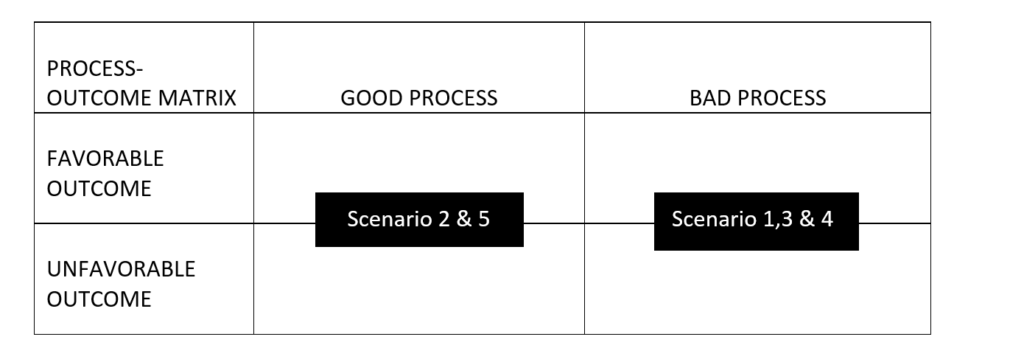

| Scenario | Problem | Risk-return profile |

| 1 | 100% allocation to a single asset class and over-diversification therein | Asset-class-specific risk and mediocre return |

| 2 | Over-diversification within single asset class i.e. Nifty 50 ETF (Good for a beginner or someone who doesn’t have much knowledge) | Low risk and Mediocre return |

| 3 | 100% allocation to a single asset class and over-concentration therein | Asset class-specific risk Return can be either too high or too low |

| 4 | Over-concentration within asset class and among asset class | Sector-specific and asset-class-specific risk. Return can be either too high or too low |

| 5 (Solution) | – | A portfolio of assets where correlation among assets is either very low or negative is a good portfolio.Usually, a mix of equity, debt, or gold is preferred for someone with limited capital. In equity, a portfolio of 15-20 stocks with weightage depending on conviction on that stock is considered as a good portfolio. As a part of risk management, there should be a cap (i.e. upper limit) on a particular stock, sector and group companies and asset class. |

In scenarios 1 and 2, even if a stock turns out to be a multi-bagger, it might not significantly impact the overall portfolio as the amount allocated to each and every stock is much less.

Note – Never act based on tips. A 10% fall in stock bought based on tips will make you question your decision to follow that person, and you might exit that stock at a loss. However, if you have done your research and have a conviction on that stock, you can hold or add it during drawdowns if your thesis still holds, or you can exit if it is not playing out as imagined.

Scenarios 3 and 4 are examples of putting all the eggs in one basket. In scenario 3, the majority amount is invested in a single sector and in scenario 4, the entire amount is invested in a single stock/group/asset class none of which is good for someone with medium risk-taking capability.

Source – TradingView and LiveMint

Note – This is the data from two random periods and hence should not be considered as the approximate return of any asset class.

It is quite evident from the above chart that every asset class/sector/company has a cycle due to some tailwind or headwind, which is why it becomes important to diversify. For some, it might be shorter while for others it might be a bit longer. However, in the end, everything reverts to its meaning. Therefore, scenarios 3 and 4 are examples of favourable or unfavourable outcomes of a bad process.

So, the best way for portfolio construction is to have a mix of various asset classes with a cap within and among asset classes keeping in mind your risk profile, income, goals, time horizon etc. You can start by investing a small percentage of the portfolio in a particular stock and keep building on it as you develop conviction in that idea instead of taking a full position in one go.

Now let’s understand the same thing through numbers. Suppose you have Rs. 100, which you want to allocate to one of your most convincing bets. Let’s see how different allocations will affect your portfolio.

| Stock weight in portfolio (in %) | Returns generated by that stock | Impact on the overall portfolio (in %) |

| 2 | 10x | +18 |

| 10 | 3x | +20 |

| 5 | 10x | +45 |

| 2 | 46x | +90 |

| 10 | 10x | +90 |

| 2 | 500x | +998 |

| 10 | 500x | +4990 |

| 15 | 10x | +135 |

Let us assume that the investor has invested in only one stock and the remaining amount has been kept in cash.

If you have allocated only 2% of your capital in a particular stock, your stock needs to be 46 baggers in order to earn the same return as a position in your portfolio with 10% weight and has become 10 baggers. You can see how the difference of 8% in initial investment could end up becoming a difference of 72% if the stock increases 10x. And for this reason, you need to allocate a higher percentage of your capital to your high-conviction bets to experience compounding and wealth creation in the true sense.

Just holding the right stock with the right allocation is not enough. The time of entry and exit should also be fairly correct. Imagine what if Rakesh Jhunjhunwala had sold his shares of Titan when the stock price doubled? He invested in Titan at the right time, kept on increasing his position over time as his conviction got stronger and kept riding the rally with patience.

To summarise

- There is no foolproof formula to succeed while investing in any asset class. Neither over-diversify nor over-concentrate within and among asset classes. Start with a small allocation and keep building on it as your conviction increases.

- Everyone has a different style of investing, but what makes them successful is following the right process and holding on to the right assets with patience if the thesis is playing out while considering their risk profile.

- You should regularly review your portfolio, accept that you can go wrong and take corrective actions thereupon.

- Research Framework 1O1 – Part 1 - Apr 19, 2023

- How To Prioritise Company or Industry Research Post Shortlisting? - Dec 1, 2022

- How To Shortlist Good Companies Out of 5000+ Listed Companies? - Oct 28, 2022