Last Updated on Dec 4, 2024 by Anjali Chourasiya

Wouldn’t it be great if you had an indicator of how risky a stock can be? It would simplify choosing a stock that best suits your risk appetite, right? Well, you do have such an indicator, and it is called ‘beta’. Does ‘high beta stocks’ ring a bell? If not, we’ll talk about it in a bit.

If you have the itch to learn more about this risk indicator and what are high beta stocks, jump right in. We have also drawn up a list of high beta stocks in Nifty 50 in the article.

Table of Contents

Risk: the Premise For High Beta Stocks

Stock investing is a risky business. But what comes without risk? Let us get this straight. Money only grows when invested. There’s no alternative to it. When you entrust your money to someone else to grow it, a risk factor is associated with it. You may run into losses and have to accept lower-than-expected returns; if the losses run too deep, you may not get your funds back at all.

So, does this stop you from investing? Mostly, no. You still invest in relatively low-risk instruments, or you may diversify thoughtfully. The same goes for stocks. While some are highly volatile, others may not be as much. Higher the volatility, the more risky the stock is, and vice versa. So, how do you ascertain the volatility of stocks?

Using ‘beta’.

What is Beta in Stock Market?

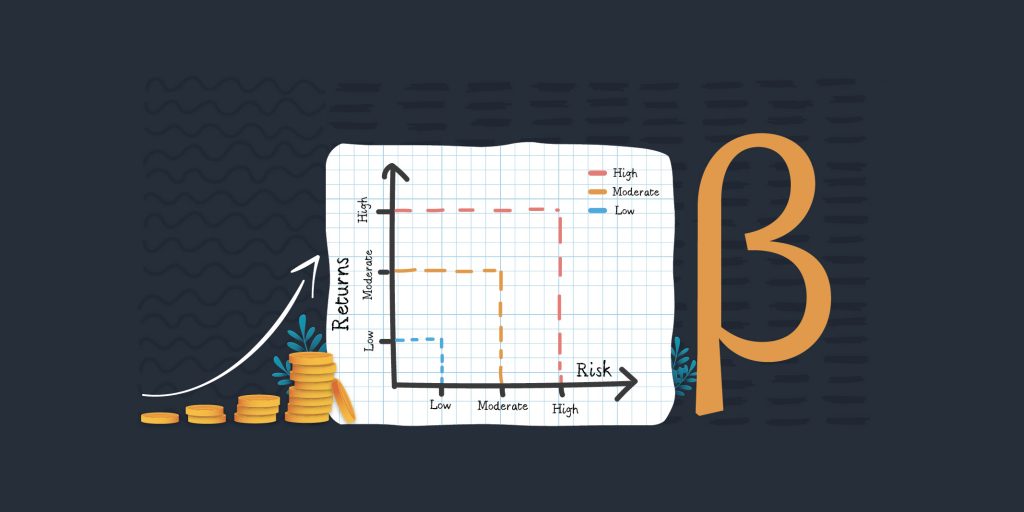

Beta in stocks is a statistical measure of a stock’s volatility compared to the broader market or a benchmark index. It is calculated using regression analysis, a statistical method used to find the relationship between a dependent variable with one or more independent variables. In the context of stock beta, the volatility in the broader market is the independent variable, and the risk associated with the stock is the dependent variable.

Features of the Top High Beta Stocks in NSE

High beta stocks in NSE have distinct characteristics that set them apart from low or average beta stocks. Below are the key features that define these stocks:

- Sensitivity to Market Movements: High beta stocks in NSE are more sensitive to the market’s ups and downs. They tend to rise higher in bull markets and drop more in bear markets compared to the broader market. This is a core aspect of what is beta in stocks.

- High Volatility: One of the main features of high beta stocks is their increased price volatility. These stocks often experience more frequent and larger price swings, making them high fluctuating stocks in the market.

- Aggressive Growth Potential: Companies associated with high beta stocks often have rapid growth prospects. Investors looking for high returns may be attracted to these stocks due to their potential for higher performance during market rallies.

- Cyclical Industry Presence: Many high beta stocks are found in cyclical industries like technology, biotechnology, and commodities. These industries are more prone to economic cycles, making the beta value of stocks in these sectors more volatile.

- Beta Coefficient Above 1: The beta of a stock measures its volatility in comparison to the broader market or a benchmark index. High beta stocks typically have a beta coefficient greater than 1, indicating higher volatility than the market average.

- Higher Return Potential: Because of their volatility, high beta stocks may offer greater return potential, especially during bullish markets. However, this potential for higher returns also comes with increased risk.

- Increased Risk Levels: High beta stocks are often considered riskier investments due to their larger price fluctuations. Investors must be prepared for the potential of greater losses as well as gains.

- Speculative Nature: High beta stocks are sometimes seen as speculative, as their price movements can be driven by market sentiment, news, or rumours, making them unpredictable.

- Interest Rate Sensitivity: These stocks can be more sensitive to changes in interest rates. For example, high beta stocks may be negatively impacted when interest rates rise, while falling rates could positively influence them.

- Impact of Investor Sentiment: Investor sentiment plays a significant role in the price movements of stocks with high beta value. Market rumours, news, and speculative trading can greatly impact their prices.

- Less Stable Dividend Payments: Companies with high beta stocks tend to focus on reinvesting profits for growth, which may result in less stable or less predictable dividend payments compared to low beta stocks.

High Beta Stocks Meaning

Shares with a beta value higher than 1 are high beta stocks. To simply put high beta stock meaning, these are relatively volatile and risky. And going by the risk-reward relationship, this stock can potentially give higher returns (but remember, high risk never guarantees high returns). That’s why investors looking to create significant wealth through shares go for stocks with high beta.

High Beta 50 Stocks List – 2024

Here’s a list of high beta stocks – NSE 2024

| Name | Sub-Category | Market Cap (Rs. in cr.) | Close Price (Rs.) | PE Ratio | Beta |

| Indusind Bank Ltd | Private Banks | 77,814.80 | 998.85 | 8.67 | 2.38 |

| Bajaj Finserv Ltd | Insurance | 259,599.38 | 1,628.10 | 31.86 | 1.94 |

| Bajaj Finance Ltd | Consumer Finance | 416,980.19 | 6,740.00 | 28.85 | 1.87 |

| Hindalco Industries Ltd | Metals – Aluminium | 148,256.52 | 663.05 | 14.60 | 1.84 |

| Tata Motors Ltd | Four Wheelers | 290,098.96 | 788.10 | 9.24 | 1.71 |

| Axis Bank Ltd | Private Banks | 358,793.02 | 1,159.45 | 13.60 | 1.49 |

| Tata Steel Ltd | Iron & Steel | 182,072.31 | 145.85 | -41.03 | 1.46 |

| Shriram Finance Ltd | Consumer Finance | 117,784.89 | 3,132.30 | 15.99 | 1.45 |

| Adani Enterprises Ltd | Commodities Trading | 287,939.24 | 2,494.75 | 88.88 | 1.38 |

| Mahindra and Mahindra Ltd | Four Wheelers | 363,411.35 | 3,031.75 | 32.25 | 1.29 |

| State Bank of India | Public Banks | 767,249.58 | 859.70 | 11.44 | 1.28 |

| JSW Steel Ltd | Iron & Steel | 242,701.25 | 994.85 | 27.54 | 1.27 |

| ICICI Bank Ltd | Private Banks | 928,724.43 | 1,316.05 | 20.99 | 1.26 |

| Adani Ports and Special Economic Zone Ltd | Ports | 274,240.44 | 1,269.55 | 33.81 | 1.18 |

| Bharat Petroleum Corporation Ltd | Oil & Gas – Refining & Marketing | 127,400.21 | 293.65 | 4.74 | 1.14 |

| Larsen and Toubro Ltd | Construction & Engineering | 521,160.76 | 3,789.90 | 39.91 | 1.11 |

| Bajaj Auto Ltd | Two Wheelers | 251,308.11 | 8,999.15 | 32.60 | 1.10 |

| HDFC Bank Ltd | Private Banks | 1,422,020.18 | 1,860.10 | 22.20 | 1.10 |

| Trent Ltd | Retail – Apparel | 242,577.53 | 6,841.35 | 163.15 | 1.06 |

| Titan Company Ltd | Precious Metals, Jewellery & Watches | 298,441.94 | 3,332.75 | 85.37 | 1.05 |

| Oil and Natural Gas Corporation Ltd | Oil & Gas – Exploration & Production | 327,967.88 | 260.70 | 6.66 | 1.03 |

| SBI Life Insurance Company Ltd | Insurance | 145,557.06 | 1,452.60 | 76.86 | 1.03 |

| Hero MotoCorp Ltd | Two Wheelers | 92,716.78 | 4,635.85 | 24.76 | 1.02 |

| Apollo Hospitals Enterprise Ltd | Hospitals & Diagnostic Centres | 103,990.10 | 7,232.35 | 115.72 | 1.01 |

| Reliance Industries Ltd | Oil & Gas – Refining & Marketing | 1,771,319.95 | 1,308.95 | 25.44 | 1.00 |

| Tata Consumer Products Ltd | Tea & Coffee | 95,106.76 | 961.20 | 82.68 | 0.96 |

| Grasim Industries Ltd | Cement | 182,285.03 | 2,717.30 | 32.41 | 0.96 |

| Kotak Mahindra Bank Ltd | Private Banks | 349,419.85 | 1,757.50 | 19.18 | 0.95 |

| Maruti Suzuki India Ltd | Four Wheelers | 349,925.35 | 11,129.85 | 25.94 | 0.92 |

| Tech Mahindra Ltd | IT Services & Consulting | 172,211.68 | 1,749.50 | 73.04 | 0.92 |

| HCL Technologies Ltd | IT Services & Consulting | 513,529.38 | 1,897.65 | 32.70 | 0.91 |

| UltraTech Cement Ltd | Cement | 339,124.48 | 11,852.35 | 48.41 | 0.91 |

| NTPC Ltd | Power Generation | 361,443.23 | 372.75 | 17.37 | 0.88 |

| HDFC Life Insurance Company Ltd | Insurance | 139,933.93 | 650.25 | 88.90 | 0.85 |

| Eicher Motors Ltd | Trucks & Buses | 131,502.71 | 4,797.05 | 32.87 | 0.83 |

| Infosys Ltd | IT Services & Consulting | 782,529.17 | 1,889.25 | 29.83 | 0.81 |

| Coal India Ltd | Mining – Coal | 256,770.08 | 416.65 | 6.87 | 0.81 |

| Sun Pharmaceutical Industries Ltd | Pharmaceuticals | 431,928.28 | 1,800.20 | 45.10 | 0.78 |

| Asian Paints Ltd | Paints | 235,788.02 | 2,459.45 | 43.18 | 0.72 |

| Bharat Electronics Ltd | Electronic Equipments | 228,686.43 | 312.85 | 57.39 | 0.68 |

| ITC Ltd | FMCG – Tobacco | 584,380.02 | 467.10 | 28.56 | 0.65 |

| Britannia Industries Ltd | FMCG – Foods | 116,858.46 | 4,851.55 | 54.61 | 0.63 |

| Power Grid Corporation of India Ltd | Power Transmission & Distribution | 302,316.13 | 325.05 | 19.41 | 0.62 |

| Wipro Ltd | IT Services & Consulting | 307,297.13 | 291.65 | 27.82 | 0.62 |

| Tata Consultancy Services Ltd | IT Services & Consulting | 1,575,460.03 | 4,302.75 | 34.32 | 0.60 |

| Bharti Airtel Ltd | Telecom Services | 948,115.53 | 1,584.10 | 126.97 | 0.60 |

| Cipla Ltd | Pharmaceuticals | 121,210.52 | 1,500.85 | 29.41 | 0.45 |

| Nestle India Ltd | FMCG – Foods | 217,687.40 | 2,257.80 | 55.35 | 0.38 |

| Dr Reddy’s Laboratories Ltd | Pharmaceuticals | 101,264.10 | 1,215.55 | 18.15 | 0.28 |

| Hindustan Unilever Ltd | FMCG – Household Products | 579,056.77 | 2,464.50 | 56.34 | 0.25 |

Note: The list of top 50 high beta stocks in NSE as of 4th December 2024 and derived using Tickertape Stock Screener using the following parameters.

- Stock Universe: Nifty 50

- Beta: Sorted from highest to lowest

🚀 Pro Tip: Explore Tickertape’s Financial Statements for detailed company financial reports to make informed investment decisions.

Did You Know You Can Invest in Stocks with smallcase?

Discover the convenience of investing in stocks through ready-made portfolios curated by SEBI-registered experts.

Before diving in, let’s understand what smallcase is.

smallcases are modern investment products that help investors build low-cost, long-term & diversified portfolios with ease. A smallcase is a basket or portfolio of stocks/ETFs representing an idea – an objective, theme, or strategy. They are created and managed by SEBI-registered experts.

Among 500+ smallcases, here’s the top smallcases you can check out:

Disclosure on Wright 🌱 Smallcaps

Disclosure for Trends Trilogy

Note: The smallcases are mentioned only for educational purposes and are not meant to be recommendatory. Investors must conduct their own research and consult a financial expert before making any investment decisions.

How to Find the Beta of Indian Stocks?

You can find the beta of Indian stocks in 2 ways:

- Using the formula

- Using Tickertape’s Stock Screener

Finding the beta of a stock using formula

- Get the historical prices for the desired stock.

- Get the historical prices for the comparison benchmark index.

- Calculate % change for the same period for both the stock and the benchmark index. Here, the period can be daily, weekly, and so on.

- Calculate the Variance of the stock.

- Find the covariance of the stock to the benchmark.

Now, Beta = Covariance/Variance

Finding beta of shares using Tickertape’s Stock Screener

Since manually calculating the beta of a stock is prone to errors, you can easily view the beta coefficient of stocks on Tickertape’s Stock Screener.

Follow these steps:

- Open Tickertape

2. Click on the screener and select “Start Screening”

3. Click on “Add Filter”

4. In the “Search for Filters” box, type ‘beta’ and click on done.

5. The screener now returns stocks along with their beta value.

You can change the value of beta according to your preference. Add from over 200 filters to narrow down your search. Explore different sectors, universe, and create custom filters. Try it now!

High-Beta Stocks Are Usually Issued by High-Risk Companies

Generally, small and midcap companies have a higher beta and are thus perceived to be risky. This is because companies having smaller balance sheets or fewer physical assets are more prone to economic disruptions than those with larger balance sheets. As such, the risk associated with a high beta stock can accelerate in times of economic turmoil and eat into your returns.

Let’s understand this with an example. To flourish, small and midcap companies need cheap credit and high demand, both of which can be scarce in times of economic turmoil. Once the economy shows signs of recovery—credit conditions get better, and demand picks up—these companies’ performance can also improve. (Note that this is not a prediction; nothing in the stock market is predictable. So, always do your due diligence before relying on market-related information from any source).

A note on small and midcap companies

Small and mid-cap companies are sensitive to macroeconomic factors. Therefore, any ongoing problem in the economy can almost immediately impact these stocks. Typically, such companies are risky businesses. They offer products that are in high demand and generate high turnover. Though their balance sheets are not large, the efficiency of their operations and internal management aid their growth and attract investors.

How to Interpret the Beta Value of a Stock?

Assign the benchmark index representing the overall stock market beta of 1. So if the beta value of a particular stock is higher than 1, it is more volatile than the overall market, which means that its price moves too frequently. And so it is considered relatively riskier. In contrast, a stock beta value lower than 1 is considered less volatile versus the market. Since such a stock is more stable, it is less risky. Here are three points that will help you make sense of beta in a better way.

Suppose Nifty 50 has a beta of 1. Here’s how to use a particular stock’s beta can be interpreted:

- Beta of less than 1: The stock is less volatile than the index. For example, if the Nifty moves down by 2.5%, the stock price falls at a lower rate.

- Beta equal to 1: The stock is as volatile as the Nifty 50. If the index increases, the stock is also likely to increase at a similar pace, and vice versa.

- Beta of more than 1: The stock is more volatile compared to the index. For example, if the Nifty moves up by 2.5%, the stock price increases at a higher rate.

Beta Can Also Be Negative!

A high negative beta means more volatility in the price movement. For example, if the Nifty moves up by 1.5%, the stock price falls by -1.25%.

Note that beta indicates a stock’s volatility and riskiness, not its price movement or the company’s relative strength.

Advantages of Investing in High Beta Stocks

Help in wealth creation

Stocks with high beta carry higher risks and can generate high returns. Thus, investing in such stocks after careful evaluation and continual monitoring can help you create wealth.

Give high returns amid a market upswing

Since a high beta stock is sensitive to economic conditions, it tends to perform well when the market is swelling.

Returns higher than inflation

Since stocks with high beta generate high returns, the figure may surpass the inflation rate in the country.

Demerits of high beta stocks

Though the beta of a stock signifies the volatility and risk associated with it, relying solely on it would not be a wise move. Here’s why.

Are relatively riskier

Stocks with a beta value of more than 1 are riskier as they are sensitive to market volatility. Ergo, a downturn in the stock market can impact such stocks leading to huge losses.

Have other associated risks

The beta coefficient is the rate at which the price of a stock moves when compared to the broader market index. While this is an important indicator of the volatility with respect to the stock, there can be other associated risks as well. Ergo, if you simply rely on the beta value of a stock to invest in it, you may be ignoring other red flags, such as inefficient management or operations.

Reliance on past data

The beta coefficient is calculated based on past data of stock. So it is a good indicator of the stock’s past performance but doesn’t guarantee future performance. Here’s why.

Assume that a well-established company has a beta of less than 1. The beta will not have accounted for this in the company’s risk profile if it avails a massive debt for expansion.

The debt changes the company’s risk profile. What if the proportion of debt is higher than equity? Then the company’s debt-to-equity ratio will be higher than before. And if the company is unable to repay its debt on time, the creditors will have a higher stake in the company’s assets than its shareholders.

So, as a shareholder, you will be at more risk when a company avails debt. See how the story changes?

That is why relying on beta information alone may not be a good investment decision when evaluating a stock.

Factors to Consider Before Investing in High Beta Stocks

Before investing in high beta stocks, consider the following factors:

Risk Tolerance

As high beta stocks in India are more volatile and can experience more significant price swings, it is astute to assess your risk tolerance. Ensure that you are comfortable with the potential for increased risk and market fluctuations before making any investment decision.

Investment Goals

Clearly define your investment goals. Determine whether seeking higher returns aligns with your objectives and if the potential for increased volatility matches your risk-return preferences.

Market Conditions

Evaluate the current market conditions. Nifty 50 high beta stocks may perform well in bullish markets but can be more vulnerable during market downturns. Consider the overall economic environment and market trends before investing.

Company Performance

Conduct thorough research on companies with highest beta value stocks. Analyse their financial health, growth prospects, and recent performance.

Industry Trends

Consider the industry in which the high beta stocks operate. Some industries are inherently more volatile and cyclical than others. Hence, being aware of industry trends and potential external factors that may impact the stocks can be wise.

Valuation

Evaluate the valuation of high beta stocks for intraday nse. Ensure that the stocks are not overvalued and their current prices are justified based on the companies’ fundamentals and growth potential. For this purpose, you can check the list of high beta stocks nse or the fno stocks list. Learn more about it here.

Diversification

As high beta f&o stocks are associated with high risk, it is worthwhile to consider maintaining a diversified portfolio to spread risk. While stocks with high beta value can offer opportunities for higher returns, it’s essential not to concentrate your entire investment in this category. Diversification helps mitigate the impact of poor-performing stocks.

Investment Horizon

Define your investment horizon. Beta less than 1 stocks may require a longer-term perspective to reduce short-term market volatility. Consider whether your investment timeline aligns with the potential volatility of these stocks. It may be worthwhile to consult an expert for this before investing.

Interest Rate Environment

Assess the prevailing interest rate environment as the changes in interest rates can impact the performance of beta shares and negative beta stocks. Understand how rising or falling interest rates may influence the specific stocks you are considering.

Research and Due Diligence

Engage in thorough research and due diligence. Understand the factors driving the meaning of high beta stocks and stay informed about upcoming events/announcements that could impact their prices.

Exit Strategy

It is crucial to have a clear exit strategy in place. It is essential so you don’t ride the wave of volatility and end up losing. Determine under what conditions you would consider selling your very good beta stocks. This proactive approach helps manage risks and may prepare you for various market scenarios.

Should You Invest in High Beta Stocks?

Now that you know the beta meaning in finance and how to get the list of high volatile stocks, you may be wondering if you should invest in these stocks. Well, the answer solely depends on two factors:

- Your Experience in Stock Markets

Seasoned investors have a better understanding of stock markets. They know to analyse market swings and use their observations to predict the market. They know when to enter and exit a particular stock and the extent of exposure to take on. Moreover, they analyse domestic and global market conditions when studying a stock. This makes seasoned investors better equipped to invest in a high beta stock list. If you are a beginner and wish to invest in such stocks, it is highly important to study the markets first and only then venture out.

- Your Risk Tolerance and Return Expectation

Being a seasoned investor is not a prerequisite to investing in alpha stocks. As mentioned earlier, high alpha stocks are risky but can potentially generate high returns. Ergo, you should also be comfortable with taking a high risk. Moreover, you shouldn’t be demotivated when the market faces a crisis. Because, generally, when the market suffers, such stocks can fall hard. So you must be prepared to bear losses until the market recovers. It is even better to hold stocks for the long term.

If both these boxes are ticked, you can consider investing in nse high beta stocks.

What are high alpha and low beta stocks?

High alpha low beta stocks are characterised by superior returns relative to their risk, measured by a beta coefficient below 1. These stocks exhibit lower volatility than the broader market, making them less prone to significant price fluctuations. Despite their stability, high alpha low beta stocks consistently outperform the market, as indicated by a positive alpha coefficient.

Investors are drawn to this category for its attractive balance of lower risk and the potential for above-average returns, offering a more conservative investment approach with the prospect of outpacing overall market performance. Thorough research is advisable before including these stocks in a portfolio due to varying market conditions and individual stock characteristics.

Conclusion

There you go! By now, you may have understood what a high beta stock is, its merits and demerits, and whether you should invest in it or not. You also know how to get the list of high-volatility stocks using Tickertape Stock Screener.

Be mindful of not basing your investment decisions on a stock’s beta alone. Ensure to look at more than just the beta value. Evaluating the company’s internal management and conducting fundamental and technical analysis of the stock is equally important.

FAQs About High Beta Stocks

What is the beta of a stock?

The beta of stocks is a statistical measure of their volatility versus the market. The higher the volatility, the more risky the stock is, and vice versa.

What is the best beta for a stock?

There is no ideal or best beta for a stock. Since beta represents the stock’s volatility and riskiness, you should invest in stocks in line with your risk tolerance. If you are an aggressive investor, you can consider stocks with a beta higher than 1. If you are a conservative investor, stocks with a beta lower than 1 may be suitable. But if you can take a moderate risk, you can consider a stock with a beta equal to 1.

Where can I find the top 10 high beta stocks of NSE?

You can find NSE high volatile stocks using Tickertape’s Stock Screener. Simply launch the Stock Screener and apply the ‘beta’ filter to the screener. Add other metrics as you wish. You can see a list of high beta stocks listed on the NSE.

If you want a list of highly volatile stocks in Nifty 50, select the universe as Nifty 50.

Are low-beta stocks risky?

Low beta stocks are less-volatile, and so lend stability to a portfolio of stocks by compensating for losses of high volatility stocks. However, be mindful that stocks, by nature, are risky.

How to find high alpha, low beta stocks?

Follow the steps below to find high alpha, low beta stock using Tickertape:

– Open Stock Screener

– Click on ‘Add Filters’

– Search and select ‘Alpha’. Set it to high

– Again, click on ‘Add Filters’ and select ‘Beta’. Set ‘Beta’ to low

You can use other filters as well to narrow the search and find the best stocks according to your preferred parameters.

What are high beta value stocks?

High beta value stocks are characterised by their elevated sensitivity to market movements. A beta value greater than 1 suggests these stocks are more volatile than the overall market, making them favoured by risk-tolerant investors seeking the potential for higher returns. Their prices tend to fluctuate more significantly in response to market fluctuations, presenting opportunities for profit during bullish trends but also posing increased risk during market downturns.

Investors considering high beta value stocks should carefully assess their risk tolerance, investment objectives, and market conditions, as these stocks are known for their potential for both substantial gains and heightened volatility.

How to calculate beta of a stock?

You can typically find the beta value of stocks through Tickertape Stock Screener. This beta value helps gauge a stock’s volatility and whether it aligns with high beta stocks NSE for intraday or long-term investment strategies.

What is Nifty High Beta 50?

The Nifty High Beta 50 is an index of the top 50 stocks on the NSE with high beta values, indicating greater volatility. High beta stocks mean those with a beta ratio above 1, appealing to beta investors seeking high-risk, high-reward opportunities in the Indian stock market.

Explore other popular stock collections on Tickertape –

Here’s are some of the popular stock collections across different sectors in India: