Last Updated on May 24, 2022 by Anjali Chourasiya

It is natural to wonder why the market is thronged with IPOs even as the pandemic continues to impact the economy. It may seem unreal but there are justifications to this paradox. Collectively, companies raised ~$4.6 bn. via initial public offerings in 2020. With more initial share sales expected to hit the market later this year, experts suggest that 2021 is sprinting towards breaking the previous records!

Let’s look at what is driving the IPO craze in 2020-2021.

Full-fledged efforts are being put by policymakers to aid the economic revival. Some of these are the infusion of liquidity in the system and prioritising various sectors. But the markets? They have been on one jolly ride. And one reason for such behaviour could be that the markets are forward-looking. Let’s dig deeper.

Table of Contents

Excellent performance in the secondary market

The secondary market has been bullish, witnessing overwhelming activity amid the pandemic. Stocks have been hitting 52-week and all-time highs, major indices–Nifty and Sensex–have also been breaking records! This conducive environment in the secondary markets has had a rub-off effect on the primary markets as well. That is why many companies went public this year and more are looking to make a debut in the market.

Novice investors at the forefront

Given the pandemic and the resultant lockdowns, many citizens were forced to stay at home. With no other distraction and entertainment, many novice investors ventured into the market. A report by the State Bank of India (SBI) revealed that there was an influx of over 14.2 mn. new individual investors in 2020-21.

The reason? Back-to-back cuts in the repo rate have reduced the interest rate on fixed deposits (FD) and investors have been diverting their funds to equity.

High liquidity garnering increased fund inflow

With economies across the globe suffering due to the pandemic, policymakers loosened their credit policies to aid business growth. Back home, the government has assured several times that it would maintain an easy money policy till the economy recovers. This has resulted in high liquidity, which has encouraged investors both big and small to bet on IPOs.

Companies looking to tidy balance sheets

Multiple lockdowns and curfews at national, state, and regional levels either halted or slowed down commercial activities. Owing to this, many businesses incurred huge losses, which reflected badly on their financial statements. Encouraged by the increasing retail investor participation, companies are looking to raise funds via IPO to shore up their balance sheets.

Promoters and big investors diluting their stakes

If you have been actively analysing IPOs, you may have noticed that the share sale of several companies was purely offer for sale (OFS). If you are not familiar, OFS is a way through which promoters of a company sell their shares to the public. In addition to the promoters, private equity players of many companies also took the opportunity of a thriving market to monetise their investments.

Performance of IPOs so far

Of all the IPOs issued so far, many companies including MTAR Technologies, Mrs. Bector’s, and Nazara Technologies were oversubscribed by more than 150 times. Such commendable success of the recent initial public offerings boosted the sentiment in the primary market.

While most IPOs listed at a premium to their issue price, a few companies including CarTrade Tech, Macrotech Developers, and Nuvoco Vistas listed at discount.

Talking of the post-issue performance, many IPOs have generated handsome returns for investors. However, a few of them are trading below their issue price. Below are two examples.

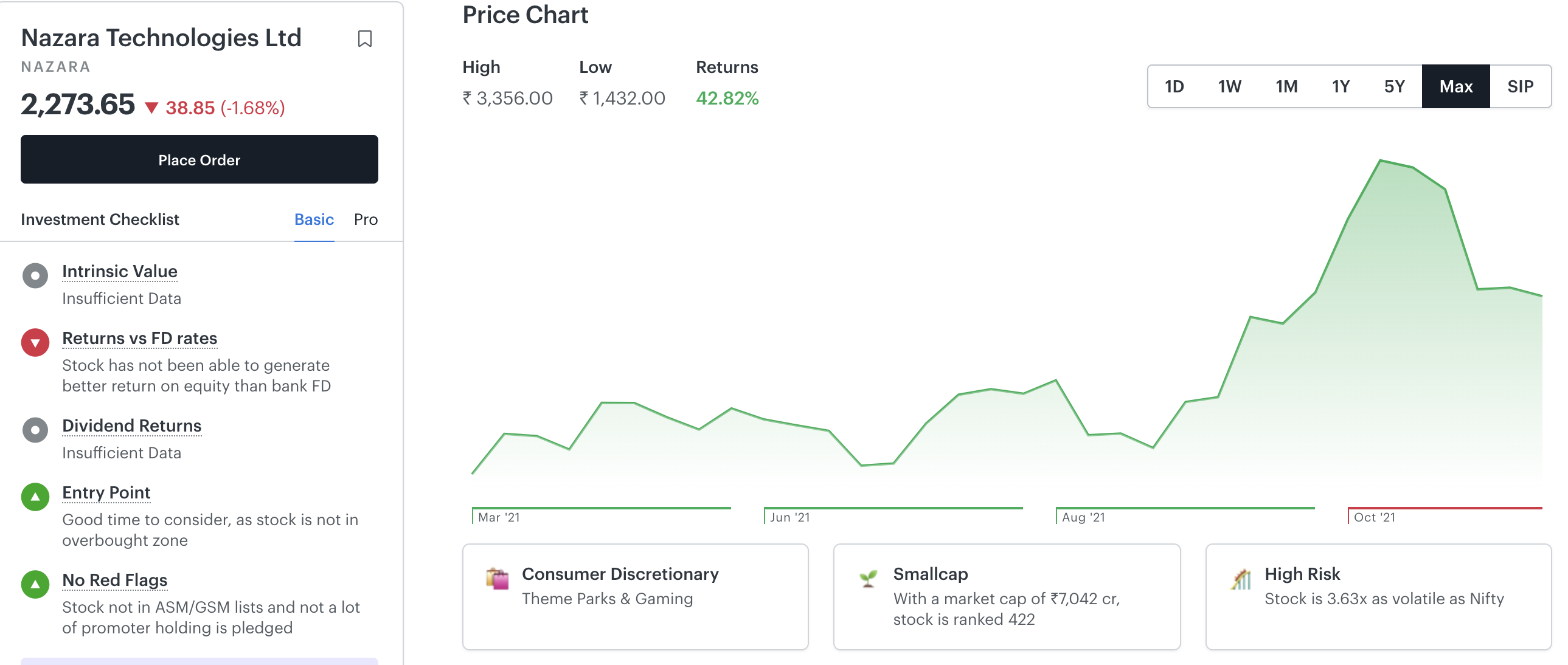

Nazara Technologies

Issued in March this year, Nazara Tech is trading at 15.50% higher than the issue price.

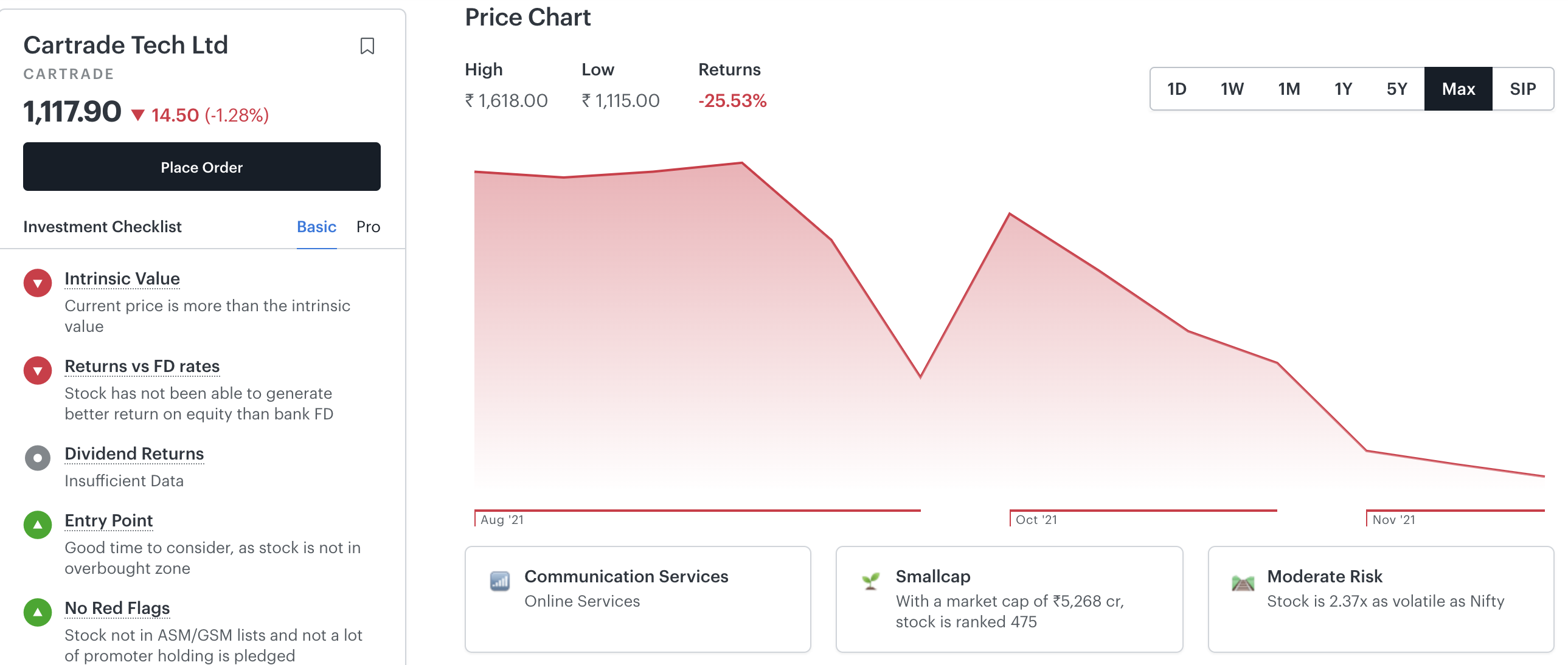

CarTrade Tech Ltd

Issued in August this year, CarTrade is trading at -2.11% lower than the issue price.

Finally, investors are also enthusiastic about the mix of sector-specific companies such as specialty chemicals, manufacturing, fintech, and e-commerce eyeing IPOs. In the next 2 yrs, around 18 unicorns including Byju’s, Flipkart, Paytm, and Ola are set to hit the market with total initial public offerings worth $11-12 bn.

Here’s an article that talks about the lesser-known parameters that you should look at when evaluating an IPO.

Before ending this article, we’ve got a special surprise for you! On account of Diwali 2021, we are gifting you a free Tickertape PRO upgrade! Just sign up on Tickertape and avail the offer.

Go on, claim your free account now!

- Best Performing Index Funds in India (2025) - Jun 5, 2025

- Issue of Shares – Meaning, Types, Examples and Steps - Jun 4, 2025

- Banking Mergers in India – List of Merged PSU Banks, Advantages, and Challenges - Jun 3, 2025