Most companies have their capital raised by their promoters. Usually, the capital is raised through the issuance of shares, which forms the company’s share capital. In some cases, one entity or individual might own a majority of shares, making the person a majority shareholder. The remaining shareholders, then, collectively represent the minority interest in the company. Let’s elaborate.

You will Learn About:

What is minority interest?

Minority interest represents a stake in a company where more than 50% of the share capital is owned and controlled by one individual/ entity. In other words, if a company’s majority shares are held by another company or individual, the remaining stake in such a company forms the minority interest.

The relevance of minority interest is usually seen in subsidiary companies wherein a parent company owns more than 50% of the subsidiary stake. As such, the remaining stakeholders of the subsidiary company form the minority interest. Note that the parent company has no control over the stake of such stakeholders who form the minority interest.

Minority Interest – Main Highlights

- Minority interest represents less than 50% ownership in a company wherein an individual or entity owns 50% or more of the company.

- Minority interest can be passive or active depending on the percentage of the stake owned by minority stakeholders.

- There are different ways to value minority interest.

- Minority interest can be calculated by multiplying the minority percentage with the company’s book value and attributing the proportional net income to minority stakeholders.

Passive vs active minority interest

There are two types of minority interest – active and passive. Let’s understand what they are and how they differ from one another.

- Passive minority interest

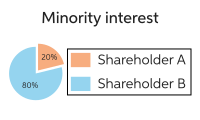

In the case of a passive minority interest, the minority stakeholders usually hold less than 20% of the company’s stock. As such, the majority stakeholder makes the major decisions for the company, with the minority shareholders not having much say on the same.

- Active minority interest

Under active minority interest, the minority shareholders hold between 21% and 49% of the company’s ownership. Therefore, they have voting rights, allowing them to participate in the company’s managerial decisions and influence them.

Valuation of minority interest

There are three ways to calculate the valuation of minority interest. These are as follows –

- Constant growth

Under this method, it is assumed that the subsidiary company does not register any growth or decline over the years.

- Numerical growth

Under this method, the growth or decline of a subsidiary is measured based on past data. The historical data helps analysts compute a uniform rate at which the subsidiary grows or declines. The future trends are calculated using statistical calculations like moving averages, time-series analysis, regression-based analysis, etc.

- Modelling subsidiaries independently

Under this method, the valuation of minority interest is done independently for each subsidiary company that a parent company owns. The values are then aggregated to calculate the consolidated value of minority interest.

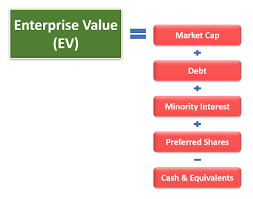

Minority interest in the computation of enterprise value

The enterprise value means the overall value of a company. If the company has a majority stakeholding in a subsidiary, the inclusion of the minority interest is taken into consideration when calculating the enterprise value.

It gives a clearer picture of the overall enterprise value of the business.

Is minority interest an asset or a liability?

A liability is an obligation a company has to pay. Since minority interest does not involve any cash outflow, it cannot be called a liability.

On the other hand, an asset is something that generates returns for the company and over which the company has control. Since minority interest cannot be controlled and does not generate cash inflow, it cannot be called an asset. Thus, minority interest is neither classified as a liability nor an asset.

How to calculate minority interest?

There are two steps for minority interest calculation. The first step involves calculating the book value of the minority interest. The book value is calculated as follows –

Book value = Total assets – Intangible assets – Liabilities.

This book value, when multiplied by the percentage of stakeholding (by minority stakeholders), would give you the value of the minority interest. For instance, if a company has a share capital of Rs. 1 crore and 30% of the company is owned by minority shareholders, then the minority interest would be Rs.30 lakhs.

Once the minority interest share capital is valued, the next step is to value the proportion of income attributable to the minority stakeholders. Here you multiply the company’s net income by the proportion of minority stakeholding. For instance, in the above example, if the company posts a net income of Rs. 12 lakh, Rs. 3.6 lakh would be the share of minority stakeholders.

How to calculate minority interest in a holding company?

The holding company also calculates the value of the minority interest in the same format. The share capital attributable to the minority interest is calculated by multiplying the percentage of minority shareholding with the book value of the overall share capital.

The income attributable to the minority interest is also calculated by multiplying the percentage of minority shareholding with the net income.

Use Tickertape Stock Screener to find the minority interest in a company. You can also use other key parameters on the Stock Screener to analyse stocks.

Conclusion

The concept of minority interest is applicable in the case of holding companies and their subsidiaries. If you invest in a subsidiary, you would be the company’s minority shareholder representing its overall minority interest. However, being a minority shareholder does not mean that you are on the losing side. You can still make profits on your investment if the subsidiary company is profitable and delivers attractive dividends. Do understand what minority interest is all about so that when you find it listed on a company’s financial statements, you will understand exactly what it means.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.

Pranay is a BMS Graduate from KC College who has cleared all 3 levels of the CFA exam and is currently working as an Equity Research Associate at Alpha Invesco.