The profitability of businesses needs to be measured regularly to keep lenders and investors assured about financial progress. Keeping track of financial well-being also helps to come up with strategies for the future. Net income is among the most efficient ways to monitor the growth and performance of a business.

But what is net income? Is it the same as EBITDA or net profit? Let’s find out!

You will Learn About:

What is net income?

Net income is the total amount remaining with a company or an individual after deducting all taxes, interest, and expenses. It is also known as net earnings and measures the company’s profitability. It is mentioned in the income statement of the company.

Net income calculation subtracts depreciation, amortisation, taxes, interest expenses, COGS and other expenses from sales revenue. While it is a widely-used metric for businesses, net income can also be used to describe an individual’s income after deductions and taxes.

Historically, accountants have included it at the bottom of income statements, and thus, it has also been nicknamed “bottom line.”

Net Income – Quick Highlights

- Net income refers to the total amount a company has for its shareholders or is the amount left after all taxes, interests, and expenses.

- The net income formula subtracts all expenses and the cost of goods sold from the total revenue.

- Net profit margin expresses the net income as a percentage of the revenue.

- Conceptually, net income differs from gross income, net profit, and EBITDA.

Net income formula

Net income is the amount of money a business has left to invest in new equipment and projects, pay shareholders, clear debts or save for a future contingency.

Here is the net income formula:

Net income= Sales revenue – Cost of goods sold – Expenses

Or,

Net income = Gross income – Expenses

Another simplistic way to calculate net income is below:

Net income = Total revenues – Total expenses

The value of net income can be both positive and negative. A positive net income indicates that revenues are higher than expenses, and thus the company is profitable. A negative net income, also referred to as net loss, means expenses are higher than revenues. It means the company is registering losses.

The formulae above can help calculate a company’s net income for any period, such as monthly, quarterly, or annually.

Here is an example to illustrate how net income is calculated

Assume a business needs to calculate its annual net income based on the following information:

Total revenues: Rs. 6,00,00,000

Cost of goods sold (COGS): Rs. 2,00,00,000

Rent: Rs. 40,00,000

Utilities: Rs. 20,00,000

Salaries: Rs. 1,00,00,000

Marketing: Rs. 10,00,000

Interest payable: Rs. 10,00,000

The first step would be to calculate gross income:

Gross income = Total revenues- COGS

Gross income for the business above = Rs. 4,00,00,000

Total expenses for the year = Rs. 1,80,00,000

Net income = Rs. 4,00,00,000 – Rs. 1,80,00,000 = Rs. 2,20,00,000

The annual net income for the business is Rs. 2,20,00,000

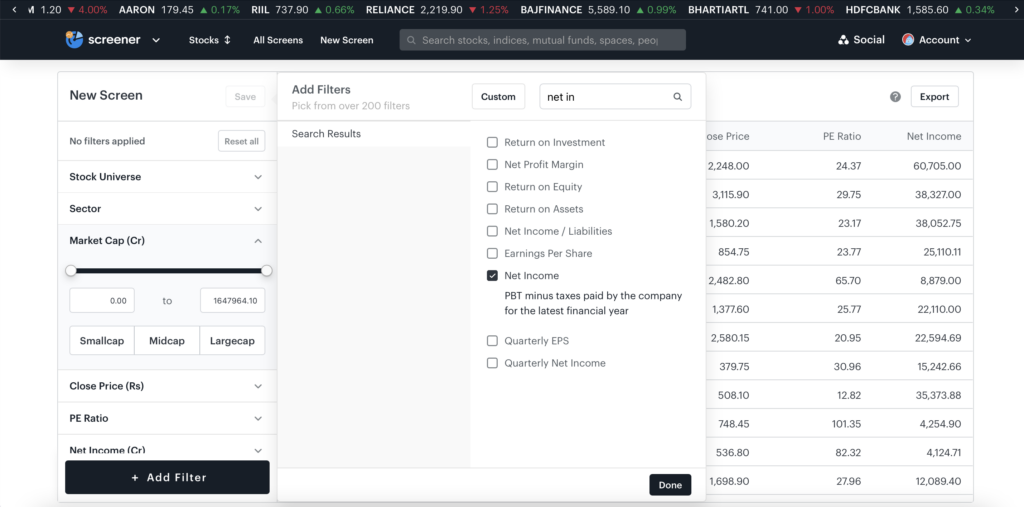

Use Tickertape Stock Screener to find the net income of a company. Open the Stock Screener, click ‘Add Filter’ and select ‘Net Income’. Along with the net income, you can use other parameters to analyse a company better.

Net profit margin

Net profit margin expresses the net income of a business as a percentage of its revenue. It is the ratio of net income to the total revenues of a company, individual, or business segment.

Net profit margin helps investors assess whether enough profit is being generated from the sales of a company and if the costs of operation and overheads are in control. It thus helps to analyse the financial well-being of a company.

Since net profit margin is a percentage and not a rupee value, it can be used to compare the financial health of two companies, irrespective of their scale and size. However, the comparison must be made for companies from the same industry.

Net profit margin = [Net income/ Total revenue] * 100

In the example above,

Net profit margin = [2,20,00,000/6,00,00,000] * 100 = 36.66%

Hence,

The net profit margin of the company is 36.66% of its revenue.

Gross income vs net income

Both gross income and net income are important aspects of personal and organisational finance. They both are crucial for decision-making and help to strategise for the future. Using these metrics, businesses can make important decisions such as increasing the prices of products, reducing expenses and determining the types of projects the company should be focusing on.

However, gross and net income offer different perspectives regarding the success of a business.

Gross income is the income that remains after subtracting the cost of production from total revenues. In other words, it is the difference between revenue and the cost of goods sold.

Net income, however, is the income after subtracting all expenses and taxes. This includes administrative, operational and all other expenses. Net income is a more efficient metric that helps determine a company’s profitability and efficiency.

Net income vs net profit

Net profit and net income are line items on the income statement of a business.

They are similar as they show how much money has been earned after reducing expenses and COGS. Both of them enable businesses to make financial forecasts. However, they are different in their use and calculation.

Net income measures the amount of money available to shareholders. However, not all businesses have shareholders. These businesses calculate only net profit.

On the other hand, public entities calculate both net profit and net income. They use the NI figure to calculate earnings per share. On the contrary, all businesses use the net profit to determine their profitability over a specific period.

EBITDA vs net income

EBITDA is an abbreviation for ‘earnings before interests, taxes, depreciation and amortisation’. Net income is the opposite of EBITDA as it calculates the earnings after deducting all the expenses, including interests, taxes, depreciation and amortisation.

While EBITDA is used to determine the company’s earning potential, net income is used to calculate the actual earnings of a company, and when concerning stocks, the earnings per share.

Conclusion

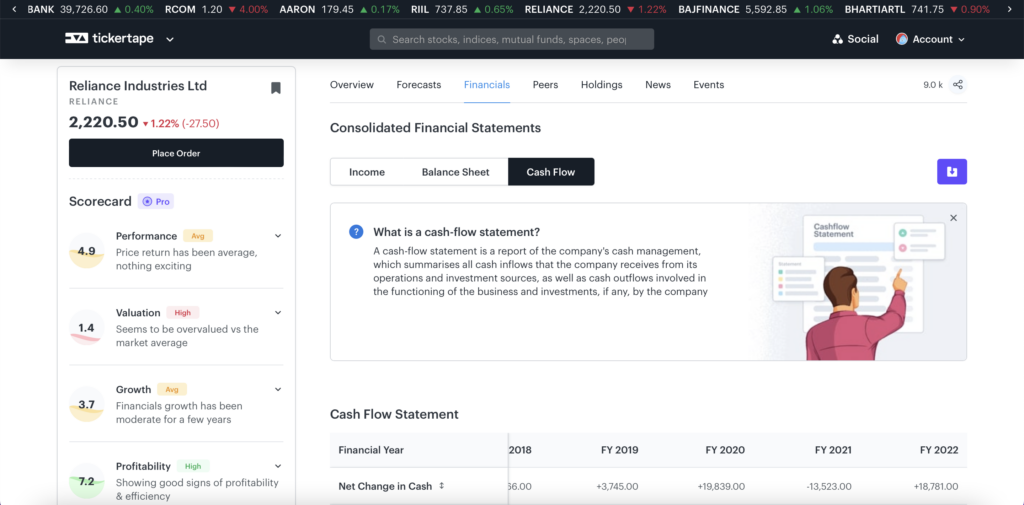

Net income is one of the most important and widely used metrics of profitability of a business. It is the revenue recorded after subtracting expenses, interest and taxes. Additionally, it is referred to as the ‘bottom line’ and helps businesses to determine their future strategies. Study all components of a company’s financial statements to determine its net income. On Tickertape, you can visit the ‘Financials‘ tab of your preferred stock and get their financial details easily.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.