Every bank or financial institution has interest-bearing assets and interest-bearing liabilities. Interest-bearing assets include mortgages, securities, and loans that help the bank earn interest. Interest-bearing liabilities include customer deposits for which the bank needs to pay out interest to the customers. The difference between the interest earned over assets and the interest paid out on deposits is termed net interest income. It is a measure of financial performance.

To get a deeper understanding of net interest income, in this blog we have explained the term in detail along with net interest income formula. Let’s begin

You will Learn About:

What is Net Interest Income (NII)?

A major aspect of the functioning of banks is to earn interest on the loans and securities they offer and pay interest on the money that customers deposit. In accounting terms, the products that help financial institutions earn interest are termed assets, and those that require paying interest are termed liabilities. The difference between the total interest earned from assets and the total interest payable on liabilities is termed net interest income.

Banks with variable interest rates on assets and liabilities are more sensitive to interest rate changes than banks with fixed-rate holdings.

There are varied interest-earning assets ranging from mortgages to personal, automobile and real estate loans. The risk factor varies from loan to loan; thus, the bank charges different interest rates for each loan. For instance, personal loans are not backed by collateral and have some of the highest interest rates among all loan types.

Thus, the net interest income depends on the proportion of holding types. Also, the same type of loan can either have fixed or variable interest rates depending on the borrower. Net interest income can also be low because of a weak economy or job losses that cause borrowers to lag on their loan payments.

Net Interest Income – Main Highlights

- The net interest income of a financial institution is the difference between the total interest it earns from the loans it offers and the interest it needs to pay on customer deposits.

- The net interest income formula subtracts the total amount paid as interest from the total amount earned as interest.

- Net interest income depends on the proportion of loans offered and customer deposits and the economy’s condition.

- Net interest margin is used for comparing historical data concerning net interest income and is calculated by dividing net interest income by average earning assets.

Assets that generate interest income for investors

Below are the asset types that help investors to earn interest income:

- Treasury bills

Treasury bills (money market instruments) are short-term obligations issued by the Government, which guarantee repayment at a pre-decided period. If the economic conditions cause the interest rates to drop and treasury bills need to be sold (before they mature), it can help generate a capital gain.

- Indexed securities

Inflation-indexed securities may guarantee returns higher than the inflation rate if the investor holds on to them until maturity. The capital appreciation or coupon payments of these securities are linked to inflation rates. They are ideal investment options for investors with negligible risk appetite. The interest rate they offer is discounted to the prevalent market rate, and the balance is adjusted for inflation at maturity. Positive adjustments are added to interest income at the time of maturity.

- Hybrid financial Instruments

These instruments combine two or more different securities to obtain the characteristics of both debt and equity. They offer guaranteed returns on a pre-decided date, depending on the movement of a market index, specified in advance. These products often have agreements on maximum and minimum interest and exercise periods.

Types of assets generate interest income for a bank

Many financial institutions rely on net interest income as a primary source of income. This income is the amount they earn for acting as middle agents between depositors and borrowers. It is the difference between the interest they earn (on the loans they offer) and the interest they pay on the deposits their customers make with them.

The following asset types help banks to earn interest income:

- Personal and commercial loans

- Investment instruments

- Mortgages

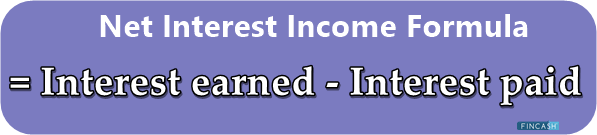

Net interest income formula

Below is the formula for net interest income:

Net interest income = Interest revenues – Interest expenses

Let’s see how each component is calculated –

Interest revenue = Effective interest rate * Gross carrying amount of financial assets

Note: This calculation doesn’t consider credit-impaired financial assets or those that were credit-impaired at the time of purchase.

Interest expenses calculation: Interest expenses are the interest payable by the financial institution on outstanding liabilities. It is given by –

Interest expense = Effective interest rate * Gross carrying amount of financial liabilities

Net interest income example

Here is an example to illustrate how net interest income is calculated.

Assume a bank has a loan portfolio of Rs. 20 cr. and earns an average interest rate of 5%. Thus, using the interest revenue formula, the bank’s interest revenue is Rs. 1 cr.

The bank also has outstanding customer deposits amounting to Rs. 25 cr. with an average interest rate of 2%.

Using the interest expenses formula, interest expense is Rs. 50 lakh.

Using both these values for interest revenue and interest expense in the net interest income formula, the net interest income the bank generates is Rs. 50 lakh.

Net interest margin

If banks wish to compare their past performance or profitability with other banks, net interest income is insufficient. Net interest margin has been historically used for these comparisons. It is derived by dividing NII by the average income earned from interest-generating assets.

Below is the formula to calculate the net interest margin:

Net interest margin = Net interest income/ Average earning assets

Conclusion

Net interest income is an important metric of profitability used by banks and other financial institutions. But it is not the sole indicator. This is because banks have other expenses such as salaries, rent, utilities, and training costs apart from interest payable. Similarly, it may have other sources of income, such as advisory fees, trading fees, etc. Thus, these expenses and earnings need to be accounted for to determine true profitability.