The interest coverage ratio is a useful measure that indicates a company’s ability to pay its interest expenses. This straightforward calculation compares a company’s Earnings Before Interest and Tax (EBIT) to its interest expenses. A high ratio is generally considered favourable, indicating that the company makes enough to comfortably cover its interest payments. Different versions of the ratio can be used, involving different types of earnings. Analysts, investors, and creditors often refer to this ratio when evaluating a company’s short-term financial health and its overall capability to manage debt.

In this article, let’s dive into the details of the interest coverage ratio, its types, calculations, uses, and more!

You will Learn About:

What is the interest coverage ratio?

The interest coverage ratio is an accounting ratio that measures the ease of interest payment. The ratio checks a company’s ability to pay its interest liability.

You can also take the ratio as the number of times a company can cover its interest liability for a given level of earnings. A high ratio is better since it shows that the company has sufficient funds to pay the interest expenses.

Interest Coverage Ratio – Main Highlights

- The interest coverage ratio shows the ability of a company to pay the interest expense on its debts.

- It is calculated by dividing the EBIT by the interest expense.

- You can use EBITDA or EBIAT instead of EBIT for calculating the ratio.

- A higher ratio is a favourable indicator.

How to calculate the interest coverage ratio?

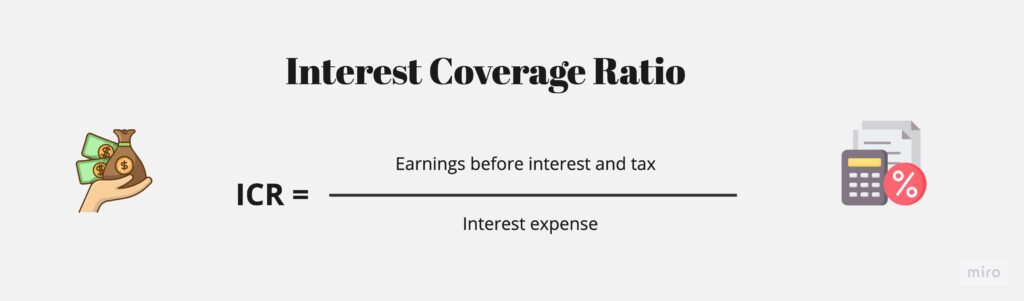

The interest coverage ratio can be calculated using two main inputs – the earnings before interest and tax and the interest payable on debt. The ratio is calculated for a specific time period, usually a financial year, and is expressed in an absolute number.

What is the formula for the interest coverage ratio?

The interest coverage ratio formula is as follows –

Interest Coverage Ratio or ICR = Earnings Before Interest and Tax (EBIT) / Interest expense

Interest coverage ratio example

Here’s a simple example to understand how the interest coverage ratio is calculated –

Say a company reports earnings before interest and tax of Rs. 20 lakh. The interest payable during the financial year amounts to Rs. 5 lakh. In this case, the interest coverage ratio would be calculated as follows –

Interest coverage ratio = Rs. 20 lakh / Rs. 5 lakh = 4 times

One of the quick and easy ways to find the interest coverage ratio of a stock is by using the Tickertape Stock Screener. There are over 200 filters on Tickertape’s Stock Screener, and the interest coverage ratio is one of those that helps you analyse a stock better.

Types of interest coverage ratios

Usually, the interest coverage ratio can be divided into different types based on the earnings used. While the standard ratio includes the earnings before interest, other ratios can modify the numerator to calculate the ratio.

The interest coverage ratio can be of three types based on the numerator considered. These are as follows –

- Ratio using EBIT as the numerator

This is the most popular ratio wherein the Earnings Before Interest and Tax (EBIT) are considered to calculate the interest coverage ratio.

- Ratio using the EBITDA as the numerator

This method uses the Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) to calculate the ratio. Since depreciation and amortisation are included in the earnings, the numerator is higher compared to EBIT.

As such, under this method, the interest coverage ratio is higher compared to the previous method.

- Ratio using the EBIAT as the numerator

Under this method, the Earnings Before Interest but After Taxes (EBIAT) is considered in the numerator. Since taxes are deducted from the earnings, the numerator is lower than both the EBIT and EBITDA methods. The denominator remains the same, yielding a lower ratio compared to EBIT and EBITDA methods.

This method gives a better picture of a company’s ability to pay the interest expenses because the taxes payable, which are a must, are deducted from the earnings. This method, thus, shows how affordably a company can pay the interest expense even after paying its tax liability.

Interpretation of interest coverage ratio

The interest coverage ratio depicts the number of times a company can pay its interest expenses within a financial year or quarter using its current earnings. If the ratio is high, the business has sufficient profits to pay off the interest expense without hurting its finances. If the ratio is low, it shows that the company is burdened with its debt expenses.

Thus, the ratio is an important metric used by analysts, investors, shareholders and other company stakeholders.

- Higher interest coverage ratio

A high-interest coverage ratio paints a favourable picture of the company. It shows that the company has sufficient earnings to cover the interest expenses.

A ratio of 1 shows that the earnings are sufficient to cover the interest expense, while a ratio of 1.5 or higher shows that the earnings are more than sufficient to meet the interest requirements.

- Lower interest coverage ratio

A low interest coverage ratio is a negative sign. It shows that the company is not able to manage its debt effectively. It might struggle to keep the interest payments or may have low earnings. It can also show that the company has enormous debt and that paying off the interest is taxing its gains.

A consistently low ratio means the company is not stable enough with its debt repayments which can be a red flag.

Uses of interest coverage ratio

The interest coverage ratio can be used to assess important financial metrics of a company. Here are the primary uses of the ratio –

- The ratio primarily assesses the company’s ability to pay its debt interest expenses.

- Before lending money to a company, lenders and investors use the interest coverage ratio to determine the inherent risk of offering debt. If the ratio is low, they might not issue debt to the company since the chances of getting interest payments are low.

- The solvency and stability of a company can be checked using the ICR.

- Analysts use the interest coverage ratio to assess the short-term financial health of a company.

- Consistent low ratios can mean mounting debt and reduced earrings.

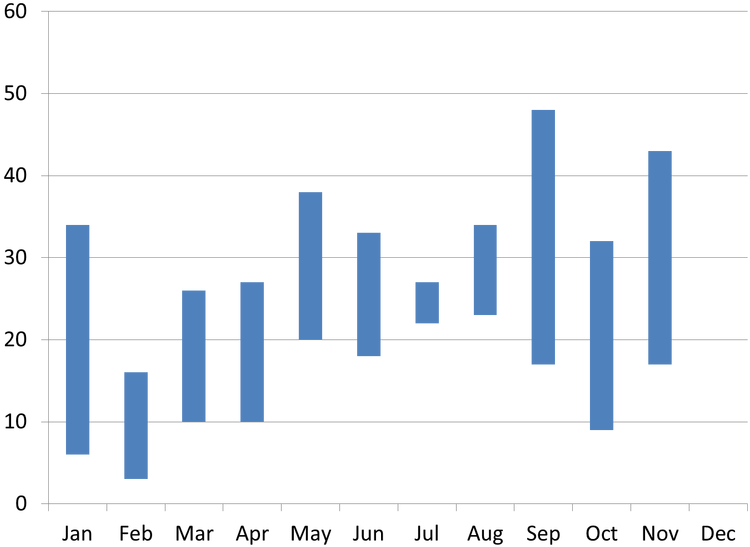

- The interest coverage ratio of the last few years can be used to create a trend analysis to understand the company’s ability to repay interest.

Conclusion

The interest coverage ratio is an important metric that depicts how a company manages its debts. The company can be viewed in a favourable light if the ratio is high. However, if the ratio is low, you must check whether the company is profitable enough to service its debts. Moreover, you should also check the overall debt position, i.e., whether the company has availed of very high debts or not. High debts and low capacity of interest payments can result in liquidation.