EV/ EBITDA, also known as Enterprise Multiple, is a popular ratio used by financial analysts and investors to ascertain a company’s value. The metric gives the potential acquirer an overview of the company’s debts. Different industries have different standards for enterprise value.

Read on to understand what EV/EBITDA is and how the financial metric is calculated.

What is EV?

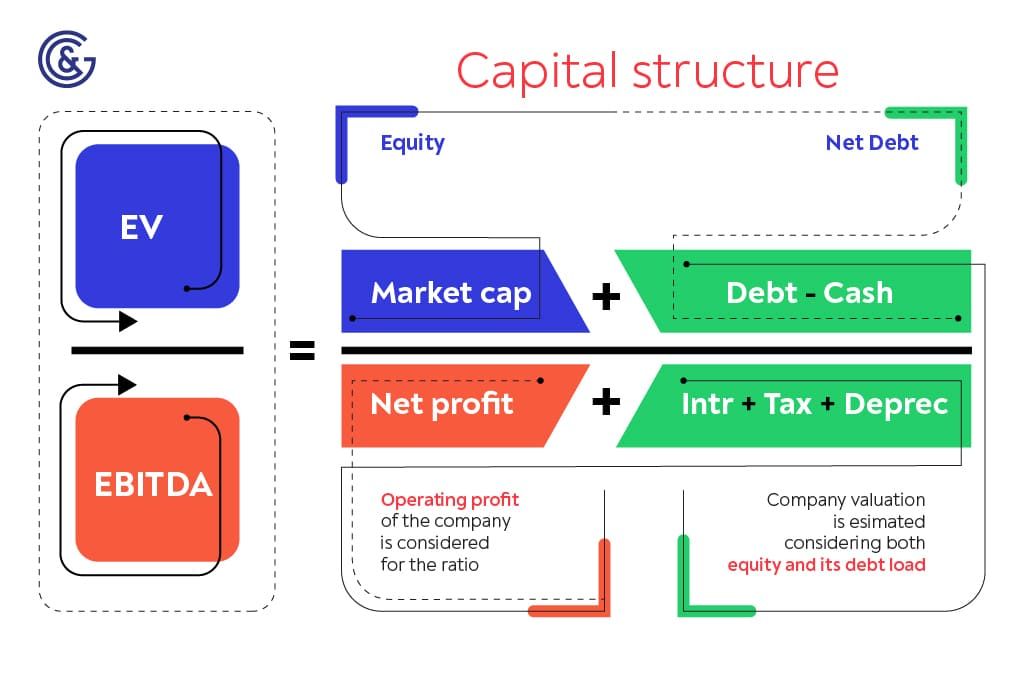

Now that you know what EV/EBITDA is, you must understand the concept of EV. It is the abbreviated form of Enterprise Value and is the total of the equity value and the company’s net debts. The net debts are calculated by subtracting the cash in hand from the company’s total debts.

EV tells an investor about the company’s market capitalisation and the prior financial commitments that a company might have. It is also an important figure used for calculating the enterprise multiple.

Enterprise value is also called firm value and asset value, as it gives the total value of the company’s assets. The formula for calculating the enterprise value is:

EV= (Share price X Number of shares) + The total debts of the company – Cash in hand

Once you have the EV, you can calculate the enterprise multiple to evaluate a company.

Return on equity: Highlights

- EV/EBITDA helps investors understand the value of the company and the money they will need to acquire the company.

- You will require information on Enterprise Value and the EBITDA to calculate the enterprise multiple of a company.

- EV/EBITDA is a widely used metric to compare the valuation of two or more companies.

- The enterprise multiple considers the company’s debt along with the level of cash to ascertain the profitability of the company.

What is EBITDA?

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortisation. EBITDA defines a company’s total earnings before taxes, and other relevant deductions are made.

EBITDA is used to measure the operating performance of a company. The formula for calculating EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Or

EBITDA = Operating Profit + Depreciation + Amortisation

You can use either of the two formulas based on the readily available figures.

What is EV/EBITDA?

EV/EBITDA is a financial ratio that shows the relationship between the enterprise value of the company and its operating profit.

Investors use EV/EBITDA to compare the relative value of two or more businesses operating in the same or different industries. There are several pros and cons of EV/EBITDA. However, most companies use EV/EBITDA as it is easy to calculate and give a fair estimate of the company’s current value.

If you are wondering what a good EV EBITDA ratio is, there are no such standard values. There are multiple applications of this ratio. Primarily, it is used by investors to estimate the multiple of EBITDA or value that they will have to pay if they want to acquire a particular company.

Also, EV/EBITDA helps investors understand if a company is under or overvalued. A low EV/EBITDA ratio suggests the company is undervalued compared to the other companies in the same industry. However, high-growth sectors like fintech have a higher EV/EBITDA ratio compared to slow-growth industries.

EV/EBITDA formula

The EV/EBITDA formula is quite straightforward. You need to calculate the enterprise value and operating profit to determine the enterprise multiple or the EV/EBITDA ratio.

The EV EBITDA ratio formula is:

Enterprise multiple = EV / EBITDA

Where EV is the Enterprise Value; EV = Market Capitalisation + Total Debts – Cash in hand,

EBITDA is the Earnings Before Interest, Taxes, Depreciation, and Amortisation.

Pros and cons of EV/EBITDA

Before you use the EV/EBITDA ratio to calculate the value of a company, you must try to understand the pros and cons of EV/EBITDA. Let’s have a look at some of the benefits and drawbacks of using this financial metric:

Before you use the EV/EBITDA ratio to calculate the value of a company, you must try to understand the pros and cons of EV/EBITDA. Let’s have a look at some of the benefits and drawbacks of using this financial metric:

| Pros | Cons |

| Investors can easily calculate the EV/EBITDA ratio using the information available on publicly released financial statements. | The metric does not account for capital expenditures. |

| The metric is widely accepted in most industries, and many investors use it to understand the company’s valuation. | It may not be possible to define debt finely, as a company can deal with different types of obligations. |

| The metric is ideal for calculating the value of large or mature organisations. | The adjustment of growth rates of different companies is almost impossible when you use an enterprise multiple. |

| It calculates the relative value of the business. Hence, you can compare different businesses based on the EV/EBITDA ratio. |

Why use EV/EBITDA?

It would help if you used the EV/EBITDA ratio to calculate the company’s value, as the metric does not consider taxes and other capital expenses. Hence, it gives an accurate picture of the company’s operating profits. The ratio can also be used to compare valuations with peers and others in the industry.

Now, several investors use the Price-to-Earnings ratio (P/E ratio) to value the company. However, the EV/EBITDA ratio also includes the company’s debt component and gives a clear understanding of the company’s current valuation, and hence is preferred over the P/E ratio.

Why EV/EBITDA is better than EV/EBIT?

When you use the EV/EBITDA ratio to calculate the company’s value, you do not consider capital expenses like depreciation and amortisation. The metric gives a multiple of the operating profit that the investor must pay to acquire the company. Hence, the company is valued fairly.

When an investor uses EV/EBIT ratio, they also include the depreciation and amortisation cost, which reduces the company’s operating profit. Hence, the investor might end up undervaluing the company.

Conclusion

EV/EBITDA is a valuation metric used to ascertain a company’s value. Basically, it depicts the price required to acquire a company. It takes into account the EBITDA of the company along with enterprise value. The ratio must be compared to only companies in the same industry. Understand EV/EBITDA to better evaluate a company and its worth.