Last Updated on Nov 11, 2022 by Anjali Chourasiya

Top 10 stocks for long-term investment, most undervalued stocks in India, top green energy stock in India – You may want to discover stocks based on themes like this. But how can you screen the list of top stocks amongst 5,000+ stocks available in the Indian stock market? The answer is – with the help of a ‘Stock Screener’. But what is it? How to use it? And what’s so special about Tickertape Stock Screener?

In this article, let’s dive deep into various features of Tickertape Stock Screener with examples. So, let’s get started.

Table of Contents

What is a stock screener?

Over 5000 stocks are listed on the Indian stock market. Hence, selecting and tracking a few good stocks among them is a difficult task. In such a case, a stock screener is an investor/trader’s best friend. It is a tool that allows them to filter and list their preferred stocks among thousands of others available in the market.

What’s special about Tickertape Stock Screener?

To smoothen your process of filtering stocks, Tickertape presents an intuitive Stock Screener loaded with various features such as –

- Over 200 filters

- Custom filters

- Custom Stock Universe

- Pre-Built Screens

- Take data offline

Let’s dive into each of them in detail.

Over 200 filters to screen stocks based on your preferences

Tickertape Stock Screener is built with over 200 filters to help you screen stocks based on different themes or preferences.

- There are basic filters such as Volatility, 1Y Historical Revenue Growth, and more. You can use the ‘Volatility’ filter to screen and list stocks based on their volatility in combination with other filters.

- There are premium filters like 1Y Forward EPS Growth, Analysts Ratings, Fundamental Score, and more. For instance, you can use ‘No. of analysts with buy reco’ to see the sum of analysts having a strong buy/buy rating for the stock.

To access premium filters, you can get Tickertape Pro Plan for only Rs. 336 for 3 months. You can also avail 14-day FREE trial. HURRY NOW!

With Tickertape Stock Screener, you can filter stocks based on your preference in under 2 minutes. Yes! You read it right (we beat the Maggi ;))

How to filter stocks using Tickertape Stock Screener?

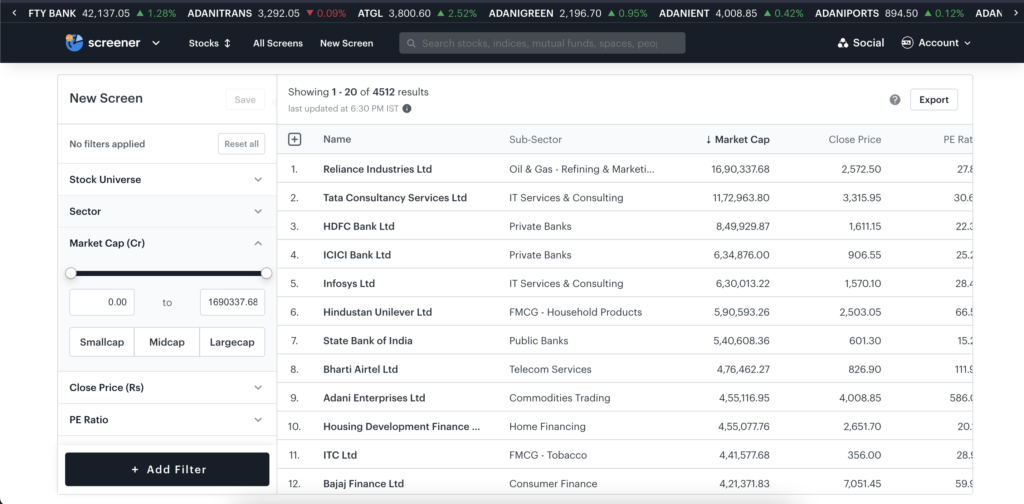

You can filter your preferred stocks using over 200 filters in less than 2 minutes. For instance, let’s filter Fast Moving Consumer Goods (FMCG) stocks. To churn out the list of the best FMCG stocks, follow these steps-

Step 1: Go to https://www.tickertape.in

Step 2: Hover over the ‘tickertape’ and click on ‘Stock Screener’ under ‘Tools of the trade’.

By default, the screener loads “New Screen” that returns stocks based on a set of filters. Note that you can either retain these default filters or remove them.

Step 3: Click on ‘Sector’ in the ‘Filters’ section on the left side. Select all categories for ‘FMCG’.

Step 4: Now, you can select multiple filters based on your criteria. For instance, if you want large-cap FMCG stocks, you can apply the filter ‘Marketcap’ and set it to high i.e. Largecap. You can also select other filters such as ‘Return on Capital Employed’, ‘Return on Equity’, ‘Volatility’ etc. from the ‘Filters’ section, and sort the list based on your preference.

There you go!! Your FMCG stocks are in front of you.

For now, we have screened FMCG stocks based on the following parameters:

- Sector: Consumer Staples (FMCG Foods, FMCG – Household Products, FMCG – Personal Products, FMCG – Tobacco)

- Market Cap: Set to high, i.e. Largecap

- Return on Capital Employed (ROCE): Set from highest to lowest

Note: The data is as of 11th November 2022.

| Name | Sub-Sector | Market Cap (Rs. in cr.) | ROCE (%) |

| Britannia Industries Ltd | FMCG – Foods | 99590.61 | 66.17 |

| Nestle India Ltd | FMCG – Foods | 194521.60 | 55.02 |

| Marico Ltd | FMCG – Personal Products | 65098.91 | 46.54 |

| ITC Ltd | FMCG – Tobacco | 441577.68 | 31.98 |

| Dabur India Ltd | FMCG – Personal Products | 98137.98 | 25.75 |

| Hindustan Unilever Ltd | FMCG – Household Products | 590593.26 | 20.24 |

| Adani Wilmar Ltd | FMCG – Foods | 88345.65 | 18.81 |

| Godrej Consumer Products Ltd | FMCG – Personal Products | 83876.52 | 18.81 |

Easy, isn’t it? Now, let’s look at one more example.

How to look at the shares traded by the promoters of the company?

Now, let’s understand how to look at the cumulative number of shares traded by promoters of the company over the previous 1 month/3 month/6 month.

Step 1: Go to Tickertape Stock Screener.

Step 2: Go to ‘Add Filter’. Click on ‘Ownership’.

Step 3: Under ‘Ownership’, there is an option for ‘Insider Trades’ with 1M, 3M, and 6M variants.

You can select based on your preference and sort the result from highest to lowest to get the top companies whose promoters are repurchasing the shares. There can be various reasons for a promoter of a company to buy back the shares.

Now that you have understood how to filter stocks, let’s explore how you can use other features to make the best use of Tickertape Stock Screener.

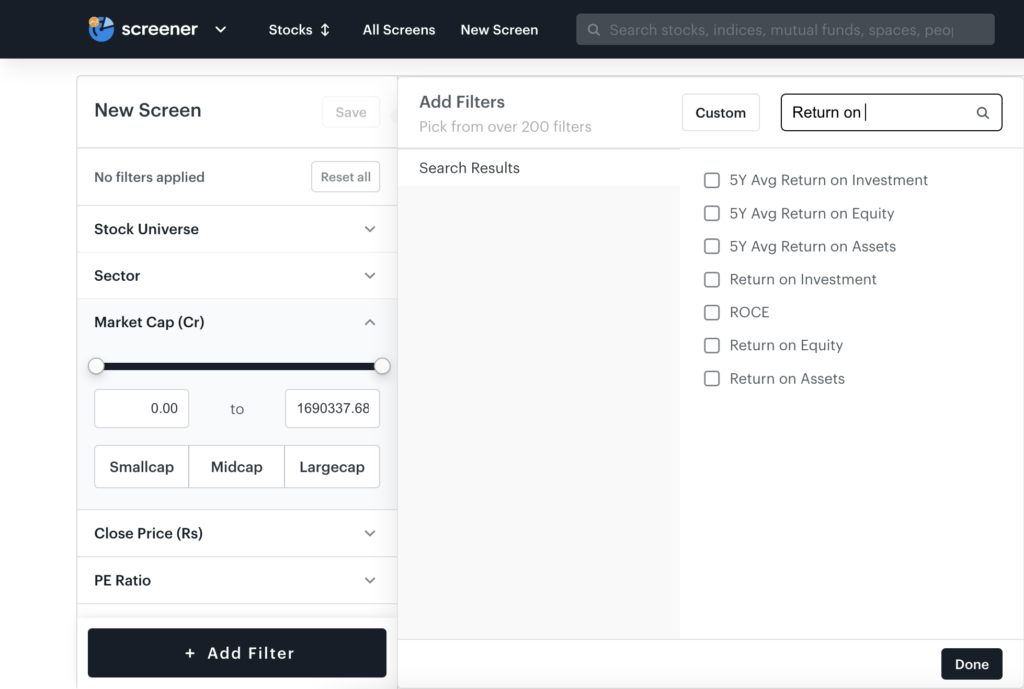

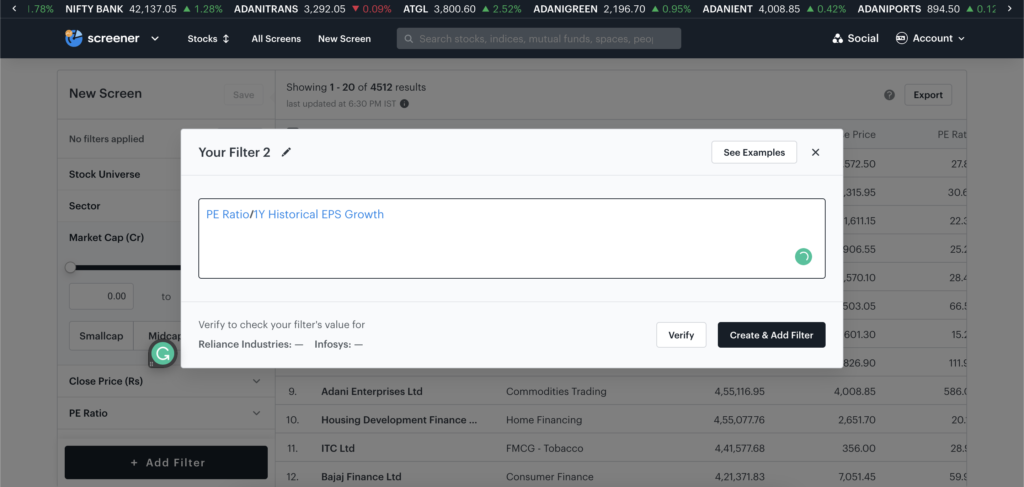

Custom filter to ease your stock screening experience

While you are filtering stocks, in case you didn’t find the filters you are looking for, you can create one. You can do this by using existing filters. Let’s create a filter for the PEG ratio.

The PEG ratio is a company’s price-to-earnings ratio divided by the growth rate of its earnings for a specific period, i.e.

PEG ratio = (PE ratio)/(EPS Growth)

To create a filter for the PEG ratio in the Stock Screener, follow the below-mentioned steps:

Step 1: Go to Tickertape Stock Screener.

Step 2: Click on ‘Add Filters’, and select ‘Custom’ at the top.

Step 3: In the pop-up, put the formula as –

PE Ratio/1Y Historical EPS Growth

These metrics are available on the Tickertape Stock Screener.

Step 4: Click on ‘Verify’. If the formula is correct, it will be approved, and sample values will appear. If there is an error, it will state the exact error. You can rectify it.

Step 5: Click on ‘Create and Add Filter’. You can rename the filter according to your preference.

Your new PEG ratio filter is added successfully.

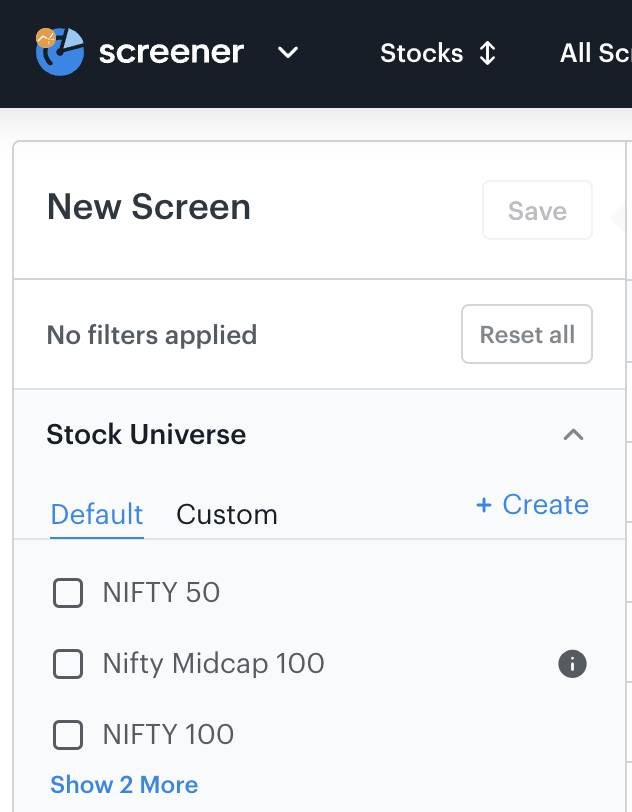

Custom Stock Universe to get all your stocks based on a theme in one place

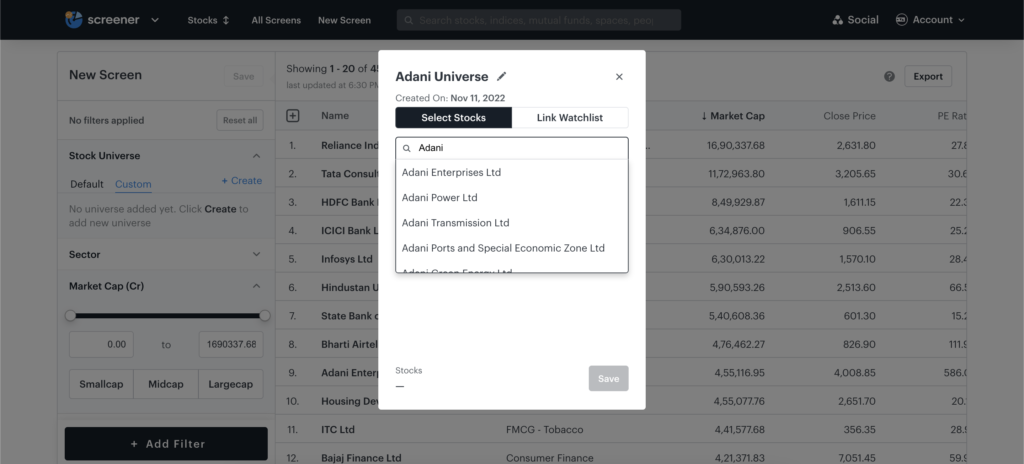

To make your research process even smoother, we have a feature called ‘Custom Stock Universe’, where you can add your favourite stocks in one place without needing to apply any filters in no time. For example, let’s create a universe for all the Adani stocks.

Step 1: On the Tickertape Stock Screener, click on ‘Stock Universe’ in the ‘Filters’ Section.

Step 2: Click on ‘Custom’, then click on ‘+Create’.

Step 3: Type the name of the stock i.e. Adani Enterprises. Click on it and add it to your new Universe.

Step 4: Similarly, type the name of other stocks such as Adani Wilmar, Adani Green Energy, Adani Power, and more. When done, name your Universe by clicking on ‘?’ near ‘My Universe’.

Step 5: Click on ‘Save’.

Boom! Your new Universe (or should say Adani Universe) is ready to use. Now, you can keep a track of all Adani stocks in one place with a single click.

But if you have a long list of stocks in your portfolio and searching for every stock seems like too much work, then fret not! You can directly link your watchlist by clicking on the ‘Link Watchlist’ while creating a new Universe. You can select from your different watchlists and click on ‘Save’.

Your Custom Universe is a few fingertips away! Build one now!

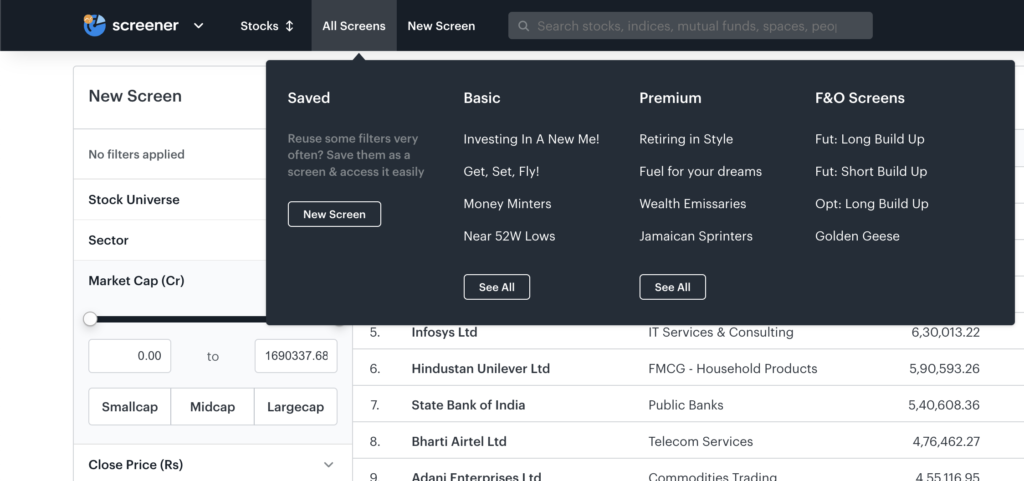

Pre-built Screens for various investment strategies

When you have pre-built screens, why put efforts into screening stocks separately? At Tickertape, we have 18 pre-built screens with different themes to make your life easier. Planning for your retirement? We have a screen for you – Retire in Style. Planning a trip for next year? – Get, Set, Fly! screen is for you. Looking for stocks with strong price momentum? – the Jamaican Sprinters screen is there to help you. Let’s learn about each of them in brief –

Basic screens

- Investing in New Me! – This screen filters stocks with low expense ratios and gold ETFs. You can use this screen while you are planning to get a degree or a new lifestyle.

- Get, Set, Fly! – It lists low-expense ETFs for short to medium-term investments to fund your trips.

- Money Minters – This screen list out companies which are good at quickly turning around cash to generate profits due to low/negative cash conversion cycles.

- Near 52W Low – This screen helps you filter fundamentally stocks which are near their 52-week low.

- Low-debt Midcaps – You get growing mid-cap companies with less to zero debt using this screen.

- Cash-Rich Smallcaps – This screen list profitable small-cap companies with growing cash flow and earnings.

- Limited Variability – You can use this screen to filter low-risk, large-cap stocks to achieve market-beating returns.

- Cash-Rich Largecaps – It lists profitable large-cap companies with growing cash flow and earnings.

- Quality Drifters – This screen shows you high-growth quality companies that are exhibiting price momentum.

Premium screens

- Retiring in Style – This screen displays stocks of long-term growth companies to help you plan your golden years.

- Fuel for Your Dreams – You can list stocks with a high market cap and 1-yr returns that can help you plan for your dreams using this screen.

- Wealth Emissaries – This screen lists asset management companies, investment banks and stock exchanges which are expected to benefit from bull runs in the stock market.

- Jamaican Sprinters – This is a technical screen to select stocks which are experiencing strong price momentum.

- Cash & Carry Candidates – This screen lists potential stocks where profitable cash and carry arbitrage trade can be executed.

Premium Futures & Options screens

- Fut: Long Build Up – This screen lists stocks which are experiencing long build-ups in future contracts. It is considered a bullish indicator.

- Fut: Short Build Up – This screen sorts out stocks which are experiencing short build-up in future contracts. It is considered a bearish indicator.

- Opt: Long Build Up – You can sort stocks which are experiencing long build-up in option contracts using this screen. It is considered a bullish indicator.

- Golden Geese – This screen lists high Return on Equity (ROE) companies with growing cash and earnings, available at a discount.

When you click on any of the screens, you can check the applied filters that make the screen.

How to use Pre-Built Screens to find stocks with strong price momentum?

Let’s look at how you can access these screens. For instance, let’s look for stocks that are experiencing strong price momentum using the pre-built screen.

Step 1: On the Tickertape website, at the Stock Screener Page, click on ‘All Screens’ at the top.

Step 2: There are four different sections. Under the premium section, click on ‘See all’.

Step 3: Click on ‘Jamaican Sprinters’ – You can see all the filters that are used to build this screen on the right-hand side.

Step 4: When you click on ‘Load’, a screen appears with all the stocks which are experiencing strong price momentum.

Easy-peasy! Right? Now, a surprise – you can create your own screens and save them for future reference. When you filter stocks based on your preferences, you can save the screen by clicking on the ‘Save’ button near the New Screen heading and renaming it according to your preferences.

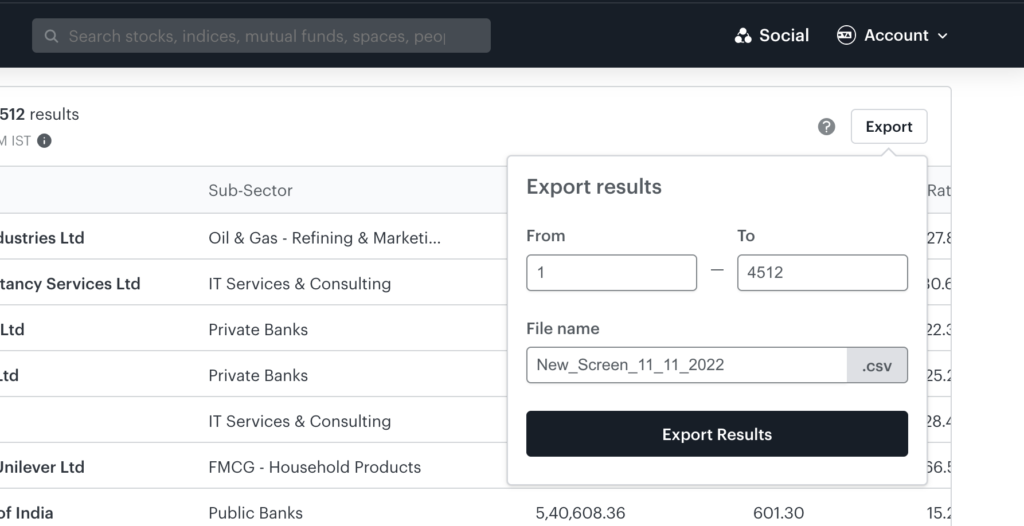

Take it offline

Tickertape allows you to export your shortlisted stocks in CSV format. To do so, click on ‘Export’ at the top right corner after you filter stocks based on your preference. Then, rename your file, select how many rows you want to export, and click on ‘Export Results’. Your CSV file is exported and saved to your device.

The way forward

Now that you are aware of how Tickertape empowers you as an investor, it’s time you utilise this knowledge by starting your research with the tools and features. You can also link your broker account and invest directly in your shortlisted stocks. Before you begin your research, make sure you read about the market and its terminology. For that purpose, you can check Blog by Tickertape, where we educate, inform, and help you grow with the right knowledge. Happy investing!

FAQs

1. What is a stock screener?

A stock screener is a tool that allows investors/traders to select stocks based on their preferred criteria. It contains several filters and features for investors to select.

2. What are the benefits of a stock screener?

Stock screeners are investors/traders’ all-time companions. They make the process easy and save time. All the information an investor/trader needs is available with a few clicks and all in one place. They also help eliminate emotional biases and assist investors in making rational decisions.

- How To Withdraw Mutual Funds? - Jun 6, 2025

- Top Maternity Insurance With Low Waiting Periods - Jun 5, 2025

- ROE vs ROCE – What are the Differences? - Jun 5, 2025