Last Updated on Jan 18, 2023 by Anjali Chourasiya

As the pandemic subsides, the Indian economy is expected to bounce back with resilience. With easing inflation, several industries are poised to thrive, particularly those related to domestic consumption, travel, and hospitality. Additionally, the banking sector has demonstrated strength, with rising credit growth and much more robust balance sheets.

To get a sneak peek into the banking sector, how it performed in 2022, and what to expect in 2023, we asked some questions to our banking experts Sonam Srivastava from Wright Research and Anmol Das from Teji Mandi. Let’s dive into it.

Table of Contents

Banking performance in 2022

When asked about the banking sector performance in 2022, analyst Anmol Das said, “Banking is my favourite sector, and I maintain a tight watch on it. The banking sector outperformed all sectors in 2022, especially the PSU banking space, which has rallied somewhere between 65 and 75% on a year-on-year level, with many smaller PSU banks giving more than 100% returns over the last year.”

Sonam Srivastava mentioned that PSU Bank is going through a cycle of good loan growth, NII growth, NIM growth, and balance sheet cleanup, giving investors confidence. She also said that PSU’s banking stocks had outperformed their private sector peers as asset quality, corporate loan portfolios, and earnings have improved. Higher margins will support PSB’s strong performance, continued credit growth and improved trade debt over the next few years. Credit growth is sustainable and credit costs for these banks will remain low.

Outperformed/underperformed banking stocks of 2022

Talking about stocks, Anmol Das mentioned that the PSU banks have outperformed like anything, with the likes of Bank of Baroda, Union Bank of India, Bank of India and Indian Bank among the larger banks outperforming more than 100% returns. Among the smaller PSU banks, Punjab & Sind Bank, J&K Bank, and UCO Bank have outperformed.

He mentioned Kotak Mahindra Bank, Bandhan Bank and RBL Bank in his underperformers list. He stated that the higher valuations for the last several years could be a reason for their underperformance. Several other private small finance banks could have fared better against larger peers.

What to expect in 2023?

Most of the PSU banks will keep performing well depending on the asset quality improvement of the undervalued banks, with higher conviction on the banks with business of more than Rs. 10 lakh cr., i.e., smaller than State Bank of India but larger than Central Bank of India, said Anmol Das.

He also mentioned that the six large PSU banks are valued slightly below P/B of 1.0x and have RoA below 1.0x. Still, how they have improved their asset quality after each quarter makes us confident of higher valuations backed by better performance and higher returns. At the same time, the larger size makes them more stable than smaller banks.

Sonam Srivastava believed that the banking sector would flourish in a rising interest rate environment. Along with the PSU banking sector, she said with the budget in view, they are excited about the infrastructure segment, especially stocks linked to defence and railways. There are other industries like sugar, fertilisers, textiles, and paper which are flourishing due to subsidy-linked announcements.

Apart from these, capital goods space and private investment remain strong in India despite the global volatility. The government is incentivising domestic manufacturing and defence indigenisation, and the private sector is seeing capex in the energy transformation, emerging tech and warehousing. Based on these themes, Sonam Srivastava and the team have picked some stocks, including Schneider Electric Infrastructure, Triveni Engineering and Industries, Bank of Baroda, Deepak Fertilisers and Petrochemicals Corp.

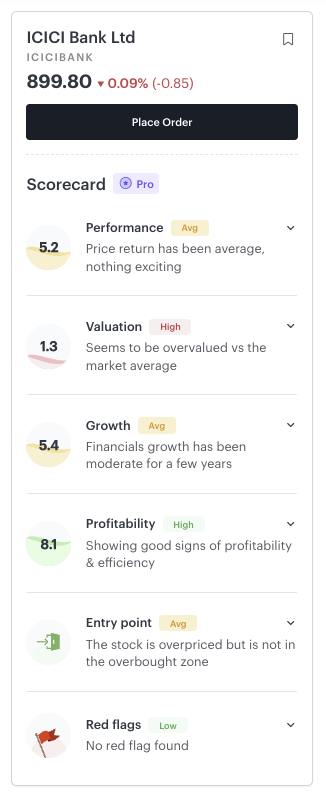

Use Scorecards to analyse stocks quicker

Before investing, it is always wise to perform thorough research on investment avenues. For this purpose, #TickertapeHaiNa! Tickertape’s Asset Pages have a handy Scorecard, which helps in quick analysis of the viability of an investment. You can get qualitative and quantitative data about any asset on this page.

You can check Performance, Valuation, Growth, Profitability scores, and entry points based on fundamentals and technicals. You can also analyse the red flags on a stock, which is a combination of promoter pledged holding, Additional Surveillance Measures (ASM) and Graded Surveillance Measures (GSM) lists, probability of default, and unsolicited messages.

Secure your investments with thorough research beforehand and/or consult a financial advisor for guidance.