With over 10 IPOs issued in Indian stock markets within just 3 months of 2021, it looks like the markets have got no chill. Today, we analyse Anupam Rasayan India Limited IPO. A well-known name in the specialty chemicals market, Anupam Rasayan holds great potential, thanks to its significant exports, increasing demand for its products, and an eco-friendly business approach.

If you aren’t familiar with an IPO and how to apply for one, consider reading All you need to know about IPOs and All you need to know about applying for IPOs to get a fair understanding.

This article covers

About Anupam Rasayan India Limited

Business verticals of Anupam Rasayan Ltd

Manufacturing and R&D facilities of Anupam Rasayan

Raw materials of Anupam Rasayan Ltd

Products of Anupam Rasayan India Limited

About Anupam Rasayan Ltd IPO

Subscription eligibility

Utilisation of the IPO proceeds

Book running lead managers and registrar to the IPO

Valuation of Anupam Rasayan Ltd

Peers of Anupam Rasayan India Ltd

Financials of Anupam Rasayan Limited

Prospects of Anupam Rasayan India Ltd

Table of Contents

About Anupam Rasayan India Limited

Established in 1984, Anupam Rasayan Ltd is a leading specialty chemicals company, which manufactures products while focusing on sustainability. It is engaged in custom synthesis and the manufacturing of specialty chemicals involving complex chemistries and multi-step synthesis. Anupam Rasayan has a wide geographic reach across Europe, Japan, and the US, thanks to its long-term relationships with Sumitomo Chemical, Syngenta Asia Pacific, and UPL.

Business verticals of Anupam Rasayan India Ltd

Anupam Rasayan has 2 business verticals:

- Life science-related specialty chemicals

- Other specialty chemicals

Life science-related specialty chemicals vertical

Under this vertical, Anupam Rasayan manufactures intermediates and ingredients for fungicides, insecticides, and herbicides consumed by agrochemical players. In addition, Anupam Rasayan is also involved in manufacturing ultraviolet protection and anti-bacterial ingredients for pharma and FMCG companies. Its portfolio of chemical intermediates has expanded from 25 to 41, thus increasing its product offerings.

Other speciality chemicals vertical

The products belonging to this vertical of Anupam Rasayan are used in pigments, polymer additives, and dyes. Despite contributing a mere 10% to the overall revenue of the company, this segment holds great potential to grow in the coming years, thanks to the increasing demand for pigments and dyes in the paint and textile industries.

90% of Anupam Rasayan’s revenue comes from the Life sciences specialty segment and the rest 10% comes from the Other specialty segment.

Manufacturing and R&D facilities of Anupam Rasayan

As of 31st Dec 2020, Anupam Rasayan operated via 6 multi-purpose manufacturing facilities in:

- 4 at Sachin, Surat

- 2 at Jhagadia, Bharuch

The company has a dedicated in-house R&D facility recognized by The Department of Scientific & Industrial Research.

Raw materials of Anupam Rasayan

20% to 25% of Anupam Rasayan’s key raw materials: benzene derivatives and phenol, are imported.

Products of Anupam Rasayan India Limited

- Personal care

- Agrochemicals

- Pharmaceuticals

- Polymer additives

- Specialty pigments

About Anupam Rasayan IPO

- The Rs 760 cr-worth Anupam Rasayan IPO opens on 12th Mar and closes on 16th Mar

- The price band of the IPO is set at Rs 553 – Rs 555 per share

- The issue comprises entirely of fresh issuance of shares

- The post-issue implied market capital of Anupam Rasayan is expected to be Rs 5,527 – Rs 5,544 cr

- The bid lot size is 27 shares and multiples thereof

- Shares reserved for employees would be offered a discount of Rs 55 apiece

- Anupam Rasayan will list its shares on BSE and NSE

Subscription eligibility

- Up to 50% of the IPO is reserved for qualified institutional buyers (QIBs)

- 35% of the IPO is set aside for retail investors

- 15% of the issue is reserved for non-institutional investors

- Up to 2,20,000 shares worth Rs 11 cr are reserved for eligible employees

Utilisation of IPO proceeds

The funds raised via Anupam Rasayan IPO would be utilised to:

- Make repayment or prepayment of debts

- For general corporate purposes

Book running lead managers and registrar to the IPO

While the book running lead managers to the issue are Ambit, Axis Capital, JM Financial, and IIFL Securities, KFin Technologies Private Ltd. is the registrar to the IPO.

Valuation of Anupam Rasayan Ltd

Anupam Rasayan’s PE based on 9 mth-ended FY 2021 EPS is 69, making the issue fully priced. On the other hand, the company is valued at 36.1X FY 2023 earnings at the higher price band of Rs 555 apiece.

Peers of Anupam Rasayan India Ltd

Anupam Rasayan has listed peers such as:

- SRF with a P/E of 30.58x

- PI Industries with a P/E of 695.72x

- Astec Lifesciences with a P/E of 462.73x

- Navin Fluorine International with a P/E of 32.20x

Financials of Anupam Rasayan Limited

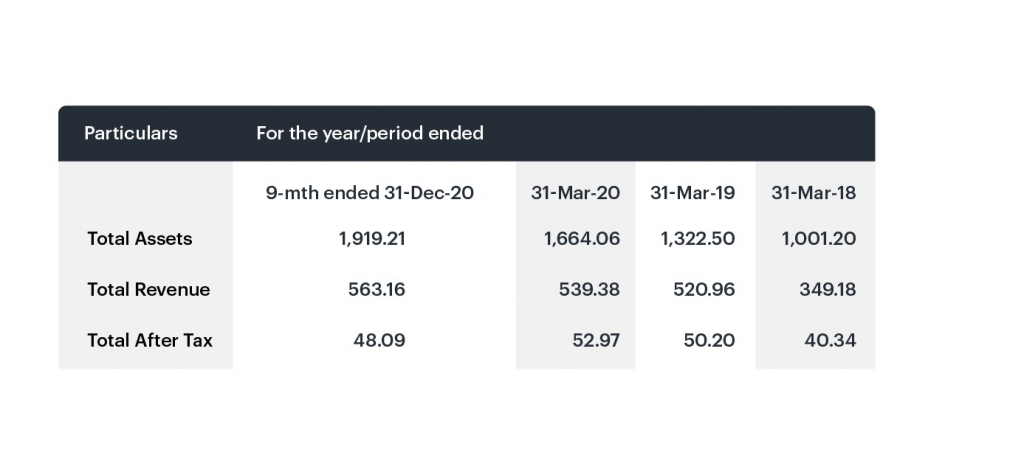

Despite the lingering impact of the pandemic, Anupam Rasayan reported attractive growth numbers on the revenue, EBITDA, and operational margins fronts.

- From FY 2018 to FY 2020, the company’s total revenue zoomed 24.29% annually

- The company’s EBITDA for FY 2020 was Rs 134.89 cr

- Despite the impact of coronavirus, Anupam Rasayan’s revenue from operations grew 45.03% at Rs 539.22 cr during the 9-mth ended 31st Dec 2020

- Total revenue grew at a CAGR of 24.29% from FY 2018 to FY 2020. During the same period, the export segment recorded an impressive growth of 32.94% CAGR

- Over 60% of Anupam Rasayan Ltd’s revenue comes from its exports

- From FY 2018 – FY 2020, the company’s revenue from its Life sciences vertical zoomed at 26.3% CAGR to Rs 504 cr. During the 9-mth ended FY 2021, the segment’s revenue increased 40.7% y-o-y to clock Rs 506 cr

- During FY 2018 – FY 2020, the revenue from the other chemical speciality segment zoomed at 1.4% CAGR clocking Rs 25 cr. However, the revenue has galloped to Rs 34 cr, growing at 171.8% y-oy in the 9-mth ended FY 2021

Prospects of Anupam Rasayan India Ltd

- The adoption of the China+1 strategy is likely to fuel Anupam Rasayan’s exports and growth

- Further, the increasing focus on health and hygiene in India and food demand globally also opens up new doors of opportunities for Anupam Rasayan Ltd

- Thanks to the company’s Green manufacturing and Green growth values, Anupam Rasayan Ltd has developed safer, eco-friendly, and novel routes for various products. With the future of businesses skewed towards sustainability, Anupam Rasayan is better-equipped for the coming years

Here you go. You have all the information needed to make an informed investment decision. Still, we urge you to do your homework before subscribing to Anupam Rasayan India Limited IPO.