smallcase is a portfolio of up to 20 stocks affected by a theme. A theme could be a new government initiative like Digital India or Smart Cities Project; long term trends like rising middle class consumption or increasing demand for leisure products; or simply an investment strategy based on fundamental criteria like earnings growth or dividends. Stocks included in a smallcase are expected to perform well as the theme plays out.

Rising Rural Demand is a smallcase representing prospects of increased rural demand due to policies and initiatives proposed by the government in the union budget 2016. Stocks included in the smallcase have high exposure to rural economy and will benefit if the proposed plans and policies boost rural demand.

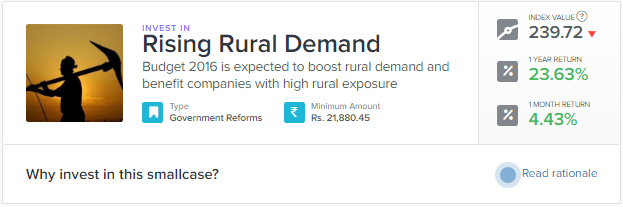

Index Value: Every smallcase index starts from 100 and represents the return generated by the smallcase since its inception. For Rising Rural Demand, an index value of 239.72 tells that it has generated a return of 139.72% (239.72-100) since its inception.

Returns: 1 year/1 month return shows returns generated by smallcase in the respective time period. The above image shows that Rising Rural Demand has generated a return of 23.63% in last one year.

Minimum Amount: It tells the minimum amount required to achieve prescribed weighting scheme of the smallcase. If a stock has a weight of 20%, it means Rs 200 will be allocated to this stock if you invest Rs 1000 in the smallcase. To maintain prescribed weighting scheme of Rising Rural Demand smallcase, a minimum of Rs 21,880.45 needs to be invested.

Type: smallcases are categorized under different types like government reforms, long term themes, current trends etc. A Government Reforms type represents a collection of smallcases built around proposed reforms and initiatives taken by the government. Similarly, a Long Term type would be a collection of smallcases representing long term changes like urbanization or rising middle class income. Types help in easy discovery of smallcases on the discover page.

To read about benefits of smallcase over Mutual funds and ETFs click here

Add a comment