All companies need to track what is selling and the rate at which it is selling. This understanding helps to strategise further and increase production. The inventory turnover ratio is one ratio that helps investors analyse the overall inventory picture of a company.

But what does this ratio exactly depict? Let’s read more about the inventory turnover ratio, its formula and its interpretation.

You will Learn About:

What is the inventory turnover ratio?

The inventory turnover ratio measures the frequency at which a company replaces its inventory relative to the cost of goods sold. The rate at which a company can turn over its inventory is an important indicator of its business performance.

Furthermore, the inventory turnover ratio reflects a company’s inventory management, forecasting, and marketing expertise. Inventory turnover calculation also helps to understand the product lifecycle and the effectiveness of the pricing and marketing strategy, and supplier relationships.

Inventory Turnover Ratio – Main Highlights

- The inventory turnover ratio of a company helps to determine the rate at which it converts its inventory to cash.

- The inventory turnover ratio divides the cost of goods sold by the average value of inventory.

- A high inventory turnover ratio indicates good business performance, proper inventory management, and efficient marketing

- A low inventory turnover ratio indicates ineffective inventory management, low demand, or outdated products

- An ideal inventory turnover ratio for most industries ranges between 5-10.

Inventory turnover formula and calculation

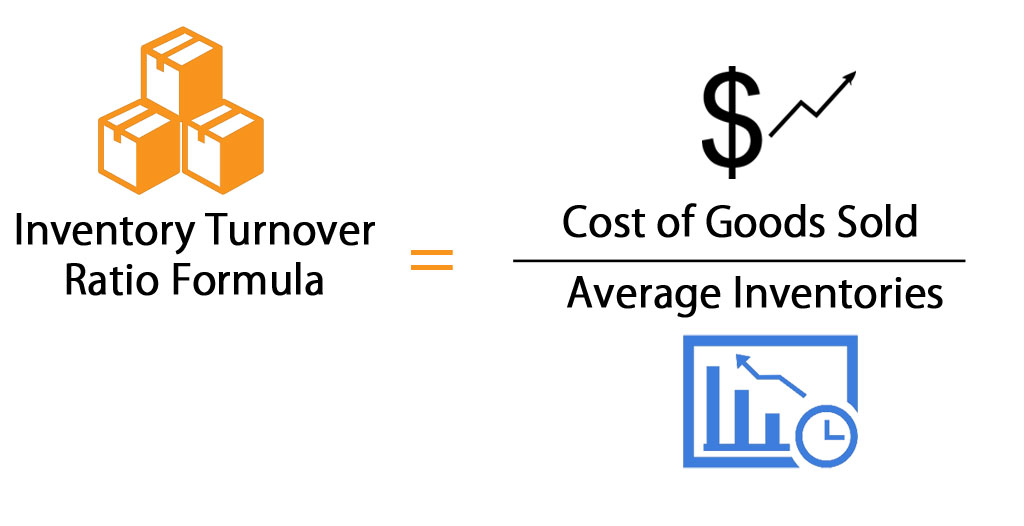

The inventory turnover ratio formula calculates the time a company would take to sell its current inventory.

A company needs to know how much stock it has on hand to calculate the turnover ratio effectively. The mathematical calculation of the inventory turnover ratio involves dividing the cost of goods sold by the average inventory across a timeframe.

Inventory turnover ratio = Cost of goods sold / Average value of inventory

The average value of inventory = [value of inventory at the end of period + value of inventory at the end of the previous period] /2

Note: Here, the average inventory value is used because many businesses are seasonal. Using average value helps to offset the effects of seasonality.

The inventory turnover ratio uses the cost of goods sold instead of sales. This is because the inventory value is based on its cost, whereas the sales price includes the company’s profit. Using the sales figure instead of COGS can lead to an inflated ratio.

Use Tickertape Stock Screener to find the inventory turnover ratio of a company. This takes the data for the past 2 financial years.

Importance of inventory turnover ratio

The inventory turnover ratio is critical for assessing how fast a company sells its inventory. This information is used to compare the company’s efficiency against industry standards.

However, the ratio depends on the complexity of the business environment and the type of products. For example, retail organisations have considerably higher inventory rates than airline manufacturing companies.

Inventory turnover ratio analysis helps assess if a company has cleared inventories faster than its competitors. This allows investors to decide if the company is a good investment.

The importance of the inventory turnover ratio can also be attributed to its ability to measure a company’s liquidity. A high inventory turnover ratio means that the company receives cash more frequently and thus can maintain sufficient liquidity. Hence, organisations always try to maintain a higher ratio to stay financially fit.

What inventory turnover tells you?

In general, a higher ratio is considered better. This is because higher inventory turnover rates often mean a higher chance of outperforming competitors.

However, when inflation is high or disruptions in the supply chain, a low inventory turnover rate is advantageous, as it indicates that the inventory has increased before the price hike. For instance, most supply chains took a major hit in the early stages of the pandemic, and many retailers didn’t have enough inventory to meet consumer demands. Such situations can cause high inventory turnover ratios but aren’t preferable.

Furthermore, an inventory item that remains in stock for a very long time poses a high holding cost. The likelihood of it getting sold also goes down with time. Thus, most businesses try to maintain their inventory turnover ratio by replacing slow-selling items.

Interpretation of inventory turnover ratio

The inventory turnover ratio varies from industry to industry. Generally, companies dealing with widely affordable products have higher inventory turnovers, whereas those with more expensive products have low inventory turnover ratios.

Here is how different inventory turnover ratios can be interpreted:

- High inventory turnover ratio

High ratios indicate that the company can effectively turn inventory into sales. This suggests that inventory management is good and the sales strategy is effective. High ratios thus indirectly indicate good financial performance and better liquidity. However, a high ratio may also be caused due to insufficient inventory, which isn’t a good sign.

- Low inventory turnover ratios

Negative or low inventory turnover ratios can mean a lack of demand, obsolete products, or poor inventory management. This can increase the maintenance and handling costs for the company and put the products at risk of becoming obsolete or suffering degradation because of long-term storage. A low ratio is a red flag for potential investors and stakeholders.

What is the ideal inventory turnover ratio?

The ideal inventory turnover ratio lies between 5 and 10 for most industries.

This means the company can sell and restock inventory approximately every 1-2 months. The ideal inventory ratio for industries dealing with perishable goods is higher to avoid spoilage.

How to optimise the inventory turnover ratio?

Inventory stored in a warehouse is constantly at risk of becoming obsolete, getting spoiled in storage or being affected by price fluctuations. It also blocks a significant portion of the working capital of the business. Businesses reap more benefits if the inventory is quickly converted to cash. So here is how companies can optimise their inventory turnover ratio:

- Better forecast the customer demands by using surveys and observing trends

- Research of market data

- Employ better marketing strategies to improve sales

- Reduce inventory price by renegotiating with vendors

- Use the discount strategy to improve sales

- Restock top-selling products and reduce the underperformers

Conclusion

The inventory turnover ratio helps determine how fast the company is replacing its inventory. Higher the ratio, the better the inventory movement. Low ratios can be a potential red flag, depicting the sales failing or the inventory being stocked for too long. Analyse the ratio to understand the inventory movement of a company and its liquidity.