Compound interest is a very important concept in the world of accounting. For investors and lenders, compound interest and its functioning are crucial. It is often compared to simple interest but is more complicated.

So what is compound interest? Are the values of compound interest and simple interest the same? As an investor, should I employ compound interest? All these questions are answered below! Read further to know more about compound interest.

What is compound interest?

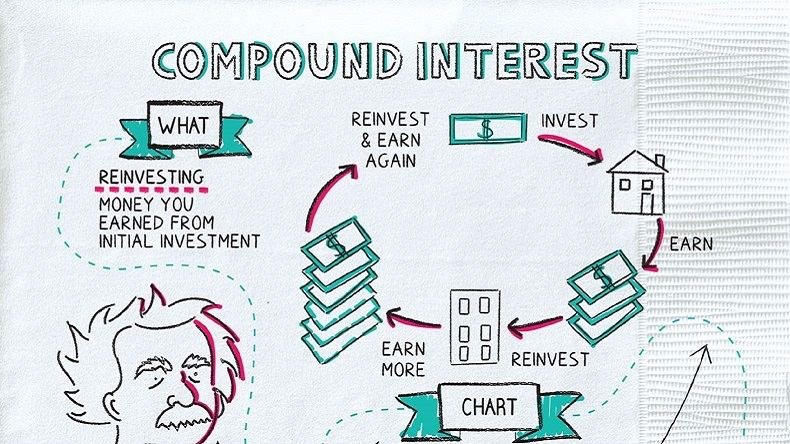

When an amount is invested, the interest earned on it is invested along with the original principal and earns interest. This interest on interest is termed compound interest. When the original principal is left untouched and the interest earned for each period is reinvested along with the principal, the resultant amount is significantly higher (It can be compared to a snowball that accumulates more snow and grows in size as it rolls).

The frequency of compounding determines the rate at which compound interest is accrued. The value of compound interest is directly proportional to the number of compounding periods. For instance, if a principal of Rs. 1,000 is compounded at 10% annually, it will accrue Rs. 210 as compound interest at the end of 2 yrs. However, if the same Rs. 1,000 is compounded at 5% semi-annually; it will accrue a total of Rs. 215.50 as interest at the end of 2 yrs.

Compounding is often referred to as the 8th wonder of the world. It enables investors to grow their investments exponentially, and this effect has often been termed the power of compounding or the miracle of compound interest.

Important points to note

- The compound interest concept involves reinvesting the interest from the previous period along with the principal, so both the interest and principal earn interest.

- The original principal, investment duration and the rate of interest are used to calculate compound interest.

- It is calculated as CI = P×(1+r)t−P.

- Compound interest enables investors to grow their wealth significantly if they invest it for a long time.

Simple interest vs compound interest

There are two types of interest that an investor can earn – simple interest and compound interest. The difference between simple interest and compound interest is the sum on which the interest is calculated.

Simple interest is calculated only on the original principal, whereas compound interest is calculated based on the original principal and accumulated interest from the previous period. Simple interest calculation is easier as compared to compound interest calculation.

Simple interest is calculated using the following formula:

S.I = P*R*T

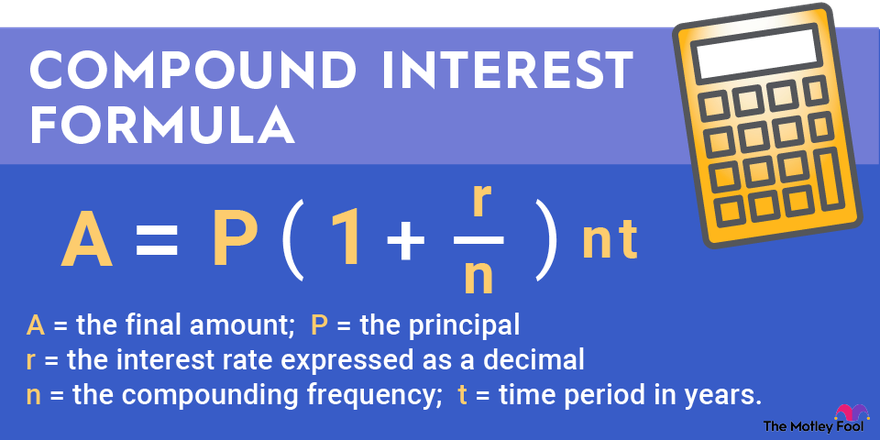

The formula for Compound Interest (CI) is below:

CI = P×(1+r)t−P

Here,

S.I= Simple interest

C.I= Compound interest

P= Principal

R= Rate

T= Time period

Investments like SIP mutual funds work on the basis on compounding. Visit Tickertape Mutual Fund Screener to get the list of SIP funds in India. Open the Mutual Fund Screener and search for ‘SIP Investment’ in ‘Add Filters’. Sort the list according to your preferred parameter like AUM, NAV, 5-yr CAGR, etc.

How does compound interest work?

Read the below-presented example to understand in detail how compound interest works.

Consider an investment of Rs. 1,000 in a financial instrument with a 10% interest rate that compounds annually. At the end of the first year, the instrument will yield Rs. 1,100, including interest of Rs. 100. This is simple interest because it is based only on the amount invested.

Now, Rs. 1,100 will be the principal for next year and the amount at the end of the second year will be Rs. 1,210 ( This will include Rs. 110 interest).

The Rs. 110 interest at the end of the second year is thus compound interest, as it has been calculated on interest. Consequently, at the end of 10 yrs, the resultant amount will be Rs. 2,594, which is more than double the initial principal.

This translates to a 100% return on the initial investment. This is how compound interest works.

How does compound interest grow?

Compound interest grows at an increasing rate, as long as the principal is untouched.

The table below illustrates how the Rs. 1,000, invested at 10% per annum compounded annually, grows through the tenure:

| Principal (Rs.) | Compound interest earned (Rs.) | Resultant amount (Rs.) | |

| Year 1 | 1,000 | 100 | 1,100 |

| Year 2 | 1,100 | 110 | 1,210 |

| Year 3 | 1,210 | 121 | 1,331 |

| Year 4 | 1,331 | 133.1 | 1,464.1 |

| Year 5 | 1,464.1 | 146.41 | 1,610.51 |

| Year 6 | 1,610.51 | 161.051 | 1,771.561 |

| Year 7 | 1,771.561 | 177.1561 | 1,948.7171 |

| Year 8 | 1,948.717 | 194.87171 | 2,143.58881 |

| Year 9 | 2,143.589 | 214.358881 | 2,357.947691 |

| Year 10 | 2,357.948 | 235.7947691 | 2,593.74246 |

Thus, over the long term, compound interest can significantly increase the return on investment.

Pros and cons of compounding

Compounding plays a vital role in wealth creation and can also help to offset the impact of inflation. As more compound interest accumulates over the tenure of investment, the investment grows exponentially in value.

But compounding is associated with negatives as well. For instance, A credit card debt of Rs. 10,000 with a compound interest rate of 13% monthly will attract a cumulative interest of Rs. 33,345 at the end of the year! Now, that will have a catastrophic impact on the finances of the credit card holder.

Also, the income from compound interest is taxable unless the money is saved in a tax-free account. This can lead to a decrease in the balance if the portfolio loses value due to market factors.

Conclusion

Compound interest is a fundamental accounting concept. Through compound interest, the value of an investment can be significantly increased. This can also apply to most investment instruments (for example, mutual funds). However, it can be both a boon and a bane, depending on the situation where it is applied. Compounding is a great reason to begin investing in the early stages of life.

FAQs

Did you Like the Explanation?

Harsh Paul