Simple interest is a vital concept for individuals borrowing or investing money and can simply be defined as the cost of borrowing. It derives its name from the simplicity of its formula and usage and is an important metric in the financial world.

But what exactly is simple interest? How does it differ from compound interest? Let’s read simple interest and its formula in detail below.

You will Learn About:

What is simple interest?

Simple interest is a basic way of calculating the interest value of a loan. It is calculated by multiplying the principal amount by time and interest rate. The value obtained is then added to the principal to determine the total amount payable or receivable.

If a loan is based on simple interest, it means that the interest is always calculated on the basis of the initial principal. This is in contrast to compound interest, where the interest amount from each period is added to the principal, and the new interest is calculated on the inflated principal amount.

In other words, for loans based on simple interest, there is no interest on interest, and the interest amount to be paid is the same for each cycle. The same is not true for compound interest.

Simple Interest – Main Highlights

- Simple interest can be calculated by multiplying the principal amount by the interest rate and time. It is expressed as I = P*T*R

- Simple interest is typically used for small-duration and personal loans.

- Simple interest is not the same as compound interest. In simple interest, the interest is calculated on the principal and remains the same throughout, whereas compound interest adds interest from each period, and the value is then calculated on the inflated principal.

- Simple interest may be lower than compound interest. But it is important to metric to understand and quickly quantify the amount payable or receivable on a loan.

How to calculate simple interest?

Calculating simple interest is quite easy. Assuming that the interest is calculated annually, all you need to do is multiply the annual interest rate by the duration of the loan (expressed in years) and the initial principal.

If a borrower pays a monthly instalment for a loan based on a simple interest rate, the amount paid is first used to cover the interest for that month, and the remainder is used to cover a part of the principal.

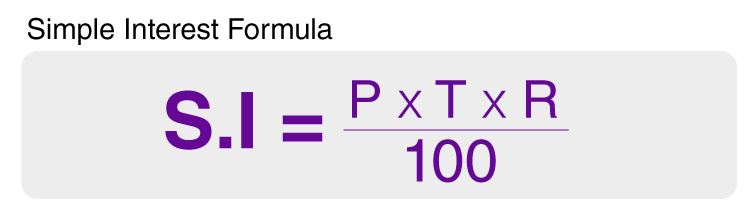

Simple interest formula

The formula for simple interest is:

SI = P x R x T

Here, SI stands for simple interest,

P stands for the principal,

R is the interest rate, and

T is the time period

The following formula is used to compute the total amount owed:

A = P + I

Where A denotes the entire amount of money repaid at the conclusion of the time period, P is the principal, and I is the interest. In the case of simple interest, the above formula can also be stated as:

A = P(1 + RT)

A = Total amount to be repaid at the end of the loan duration

P = Principal

R = Interest rate (per annum)

T = Time (in years)

Simple interest formula example

Here’s an example to understand how simple interest works.

Suppose Mr X takes a loan of Rs. 20,000 from a bank for 1 yr. The rate of interest is 10% per annum. Let’s calculate the simple interest in this situation.

Principal (P) = Rs. 20,000,

Annual interest rate (R) = 10%, and

Loan duration (T) = 1 yr.

Then the simple interest for one year is:

Simple interest = P x R x T / 100

Thus, SI = 20000 × 10 × 1 / 100 = Rs. 2,000

Hence, the total amount that Mr X has to pay back to the bank at the end of the year

= Principal + Interest = Rs. 10,000 + Rs. 2,000 = Rs. 12,000

Simple interest vs compound interest

As mentioned above, there are two main types of interest: simple interest and compound interest.

Let’s discuss the differences between simple and compound interest. With simple interest, the interest amount owed is the same over every period. The interest rate is always applied to the initial principal amount.

With compound interest, on the other hand, the interest earned is added to the principal for every period. Then interest is calculated on this higher principal value for each period, causing an exponential growth of the amount payable.

Naturally, compound interest grows faster than simple interest.

Limitations of simple interest

Simple interest is merely a tool for general interest calculation comprehension and has very limited use. Some limitations of simple interest are as follows:

- Simple interest has low utility; most banks use compound interest.

- Credit card companies and other financial institutions use compound interest to evaluate their costs. This greatly limits the usage of simple interest in the real world.

Conclusion

Simple interest is an easy-to-calculate kind of interest that may be associated with an investment or loan. It is calculated using interest rate, time period and the principal amount or the sum borrowed. Simple interest may not produce high interest as compared to compound interest but yet is important to assess loan terms better.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.