Last Updated on Dec 29, 2021 by Aradhana Gotur

In just 2 months of 2021, 8 IPOs have made it to the Indian stock markets. On 3rd Mar 2021, MTAR Technologies Ltd is set to join the pack. In this article, we analyse the company and its IPO to equip you with vital information needed to make informed investment decisions.

The article covers:

Timeline of MTAR Technologies Limited’s growth

Products of MTAR Technologies Ltd

Sectors serviced by MTAR Technologies

Clientele of MTAR Technologies Ltd

About MTAR Technologies Ltd IPO

Constituents and subscription of MTAR Technologies’ IPO

Book running lead managers and registrar of MTAR IPO

Purpose of MTAR Technologies Ltd IPO

Valuation of MTAR Technologies’ Ltd

Promoter holding of MTAR Technologies

Financials of MTAR Technologies Ltd

Strengths of MTAR Technologies Limited

Risks of MTAR Technologies Ltd

Table of Contents

About MTAR Technologies Ltd

Backed by Mathew Cyriac, the former co-head of private equity Blackstone, MTAR Technologies is a Hyderabad-based precision engineering solutions company. It manufactures nuclear, defence, and aerospace equipment, which are used in projects of high national importance.

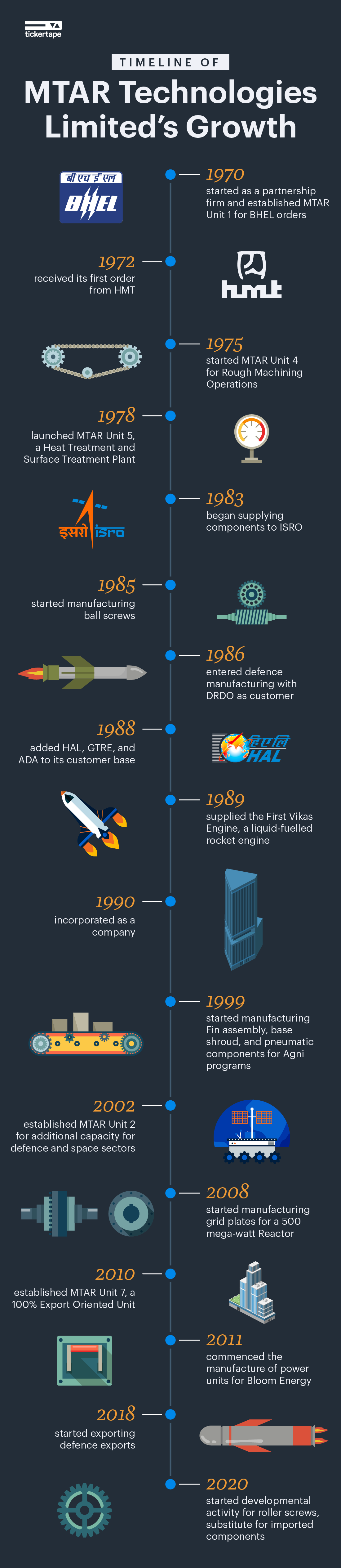

Timeline of MTAR Technologies Limited’s growth

Here’s a snapshot of the various milestones achieved by the company:

1970: started as a partnership firm and established MTAR Unit 1 for BHEL orders

1972: received its first order from HMT

1975: started MTAR Unit 4 for Rough Machining Operations

1978: launched MTAR Unit 5, a Heat Treatment and Surface Treatment Plant

1983: began supplying components to ISRO

1985: started manufacturing ball screws

1986: entered manufacturing with DRDO as customer

1988: added HAL, GTRE, and ADA to its customer base

1989: supplied the First Vikas Engine, a liquid-fuelled rocket engine

1990: incorporated as a company

1999: started manufacturing Fin assembly, base shroud, and pneumatic components for Agni programs

2002: established MTAR Unit 2 for additional capacity for defence and space sectors

2008: started manufacturing grid plates for a 500 mega-watt Reactor

2010: established MTAR Unit 7, a 100% Export Oriented Unit

2011: commenced the manufacture of power units for Bloom Energy

2018: started exporting defence exports

2020: started developmental activity for roller screws, substitute for imported components

Products of MTAR Technologies Ltd

MTAR Technologies is involved in building critical components and assemblies including:

- Missile systems

- Aerospace engines

- Aircraft components

- Nuclear and pressurized water reactors

Sectors serviced by MTAR Technologies

- Clean Energy

- Nuclear

- Space

- Defence

MTAR Technologies also develops import substitutes such as ball screws and water-lubricated bearings used in the above sectors. The company has 3 products in the clean energy sector, 14 products in the nuclear sector, and 6 products in the space and defence sectors.

Clientele of MTRA Technologies Ltd

The company’s clients include:

- Bharat Dynamics

- Hindustan Aeronautics

- US-based Bloom Energy Corp

- Nuclear Power Corporation of India

- Indian Space Research Organization

- Research and Development Organisation

About MTAR Technologies Ltd IPO

MTAR Technologies is the 9th one to offer IPO so far in 2021. It has already raised Rs 100 cr via a pre-IPO placement. Here are the details of the MTAR Technologies IPO.

- The IPO, which is worth ~Rs 600 cr, is set to open on 3rd Mar and close on 5th Mar

- The face value of the shares will be Rs 10 apiece and the price band for the IPO is fixed at Rs 574 to Rs 575 per share. The lot size is 26 and multiples thereof

- Stocks would be listed on both NSE and BSE and the tentative date is 16th Mar 2021

- Implied market cap post issue is expected to be between Rs 1,766 cr and Rs 1,769 cr

Constituents and subscription of MTAR Technologies’ IPO

The issue size of the IPO is up to 1,03,72,419 equity shares consisting of:

- Fresh issue of up to 21,48,149 shares

- Offer for sale of up to 82,24,270 shares

The IPO is reserved for subscription as follows:

- 50% for Qualified Institutional Buyers (QIB)

- 15% for non-institutional investors

- 35% for retail investors

Book running lead managers and registrar of MTAR IPO

JM Financial and IIFL Securities are the running lead managers of the IPO and KFin Technologies Private Ltd is the registrar.

Purpose of MTAR Technologies Ltd IPO

The company looks to use the proceeds of the IPO for:

- Debt repayment

- Long-term working capital requirements

- General corporate purpose

Valuation of MTAR Technologies’ Ltd

At the higher price band of Rs 575, the stock is valued at 20x the earnings of Rs 28.3—FY 2020 earnings

Promoter holding of MTAR Technologies

Financials of MTAR Technologies Ltd

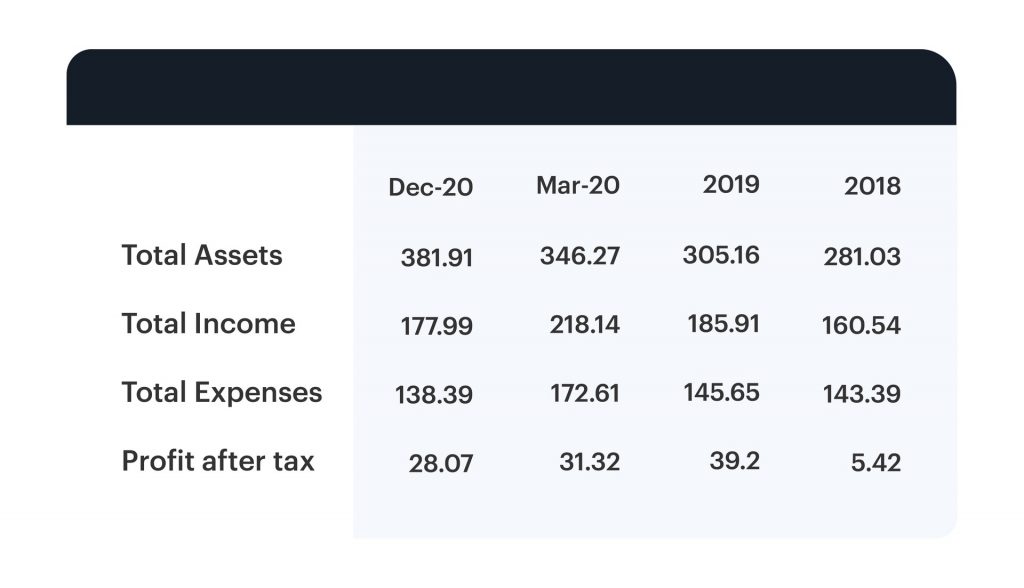

Despite the government slashing the defence budget, MTAR has earned consistent profits. The company has the lowest gearing ratio in the industry and a significant interest coverage ratio. Here are the other details:

- It has grown at a CAGR of 16.5% over the last 3 yrs

- For FY 2020, its EBITDA margins were 28.5% and net margin was 14%

Here’s the snapshot of MTAR Technologies Ltd’s financial performance over the last 3 yrs (amounts is Rs cr)

The total income of MTAR grew at a CAGR of 16.57%, profit after tax at a CAGR of 14.39%, and total assets at a CAGR of 11%.

Sector-wise breakdown of MTAR Technologies’ order book

The aggregate order book of MTAR Technologies as on 31st Dec 2020 was Rs 336 cr. Following is the sector-wise breakdown of the same:

Peer analysis

MTAR Technologies has no listed peers.

Strengths of MTAR Technologies Limited

- The Indian Precision Engineering Industry is worth Rs 409.8 cr and is expected to grow at a CAGR of 6% to 7% between 2020 and 2025. MTAR, being a leading player in the sector can capitalise on such a scope

- MTAR boasts a worldwide clientele, attractive return ratios, and sound R&D base and technological progress. Coupled with a healthy order book, competitive edge, and superior profitability compared to its peers, MTAR Technologies commands a premium

- MTAR Technologies Limited is equipped with precision engineering expertise that it employs in manufacturing, testing, and quality control of products

- MTAR started as a partnership firm but is now a renowned company in its industry. Over the years, it has developed a wide product portfolio and caters to diverse segments

- It has 7 manufacturing facilities. One of them is an export-oriented unit that is located in Hyderabad. The unit has been rendering its services to the clean energy, aerospace, and defence sectors for over 4 decades now

- Make in India, aim to exporter defence goods, and increasing budgetary allocations to defence and space sectors offer the company potential to grow

Risks of MTAR Technologies Ltd

- A disruption in the supply chain can have a huge impact on MTAR’s revenue

- Because of the critical nature and high national importance of its products, any error in quality requirements and failure to adhere to them can cost MTAR dearly

- As of 31st Dec 2020, the top 3 clients of 39 contributed 83.55% of MTAR Technologies Ltd’s revenue. Any loss of these clients will douse the demand for its products and impact the company’s revenue

- MTAR has a heavy dependency on government entities such as ISRO, NPCIL, and DRDO. A reduction of the budget in the respective sectors can adversely impact the company

- Liberalization of the defence and space sectors would lead to stiff- competition to MTAR’s business

That’s about it folks. We hope these points, in addition to your research, helps you make meaningful investing decisions.