Last Updated on Oct 11, 2022 by Aradhana Gotur

This year’s Muhurat Trading session was rewarding for investors. The Indian investor community sentiment around this session was packed with zeal and enthusiasm. But how did their collective transactions turn out for the market? Let’s take a look at the key statistics of the day.

Many investors rely on numbers before shortlisting stocks. Hence, we present to you the key statistics during Muhurat Trading. Read how the Nifty50 index performed on Muhurat Trading along with the post Muhurat Trading market reaction. Please be informed that this is a comparison of a one-hour trade session against a normal day trade session.

Table of Contents

Nifty and Sensex closing

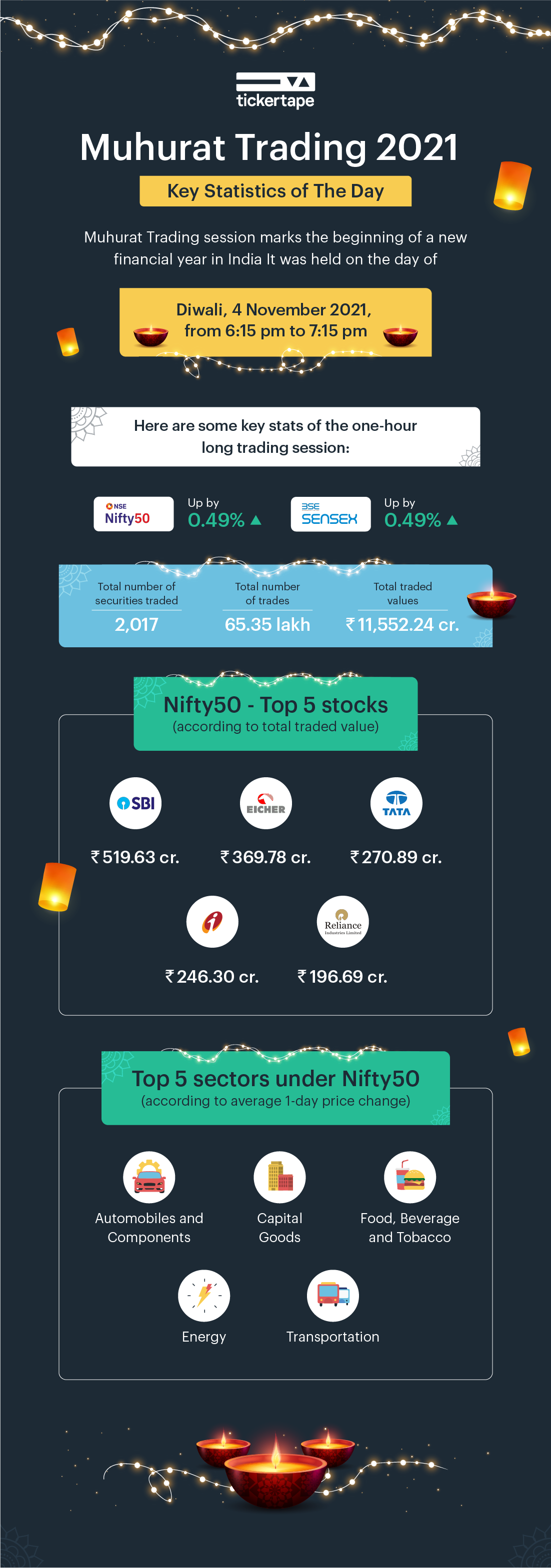

During Muhurat Trading, the stock market was engulfed with festive vibes as investors chose to be bullish. This can be confirmed by looking at the number of securities traded during this one-hour trading session; a staggering 2,017. There were 65.35 lakh trades that happened during Muhurat Trading, and this amounted to Rs. 11,552.24 cr. The benchmark index, NSE Nifty ended 0.49% higher than the previous day. And, the BSE Sensex advanced by 0.49% as well.

Highest Traded Nifty50 stocks (according to total traded value)

- The Nifty50 index performed well, with State Bank of India topping the list. It traded for a total value of Rs. 519.63 cr.

- Eicher Motors Ltd. which traded for a total value of Rs. 369.78 cr. performed the second best.

- Tata Motors Ltd. traded for a total value of Rs. 270.89 cr. making it the third in line, with ICICI Bank Ltd. in the 4th position which traded for a value of Rs. 246.30 cr.

- The 5th rank goes to Reliance Industries Ltd. with a total traded value of Rs. 196.69 cr.

Sectoral aggregation

Talking about sectors that performed the best under Nifty50, Automobiles and Components topped the list while the materials sector was one of the sectors that failed to perform well.

The NSE Nifty50 sector-wise ranking can be found in the table below along with the 1-day price change (compared with the previous day session):

| GICS Industry group name | No. of companies | 1-day price change | Performance rank |

| Automobiles and Components | 6 | 2.09% | 1 |

| Capital Goods | 1 | 1.03% | 2 |

| Food, Beverage and Tobacco | 4 | 0.84% | 3 |

| Energy | 5 | 0.79% | 4 |

| Transportation | 1 | 0.63% | 5 |

| Consumer Durables and Apparel | 1 | 0.57% | 6 |

| Pharmaceuticals, Biotechnology and Life Sciences | 4 | 0.49% | 7 |

| Household and Personal Products | 1 | 0.48% | 8 |

| Banks | 7 | 0.45% | 9 |

| Utilities | 2 | 0.45% | 10 |

| Insurance | 2 | 0.42% | 11 |

| Software and Services | 5 | 0.42% | 12 |

| Diversified Financials | 2 | 0.30% | 13 |

| Telecommunication Services | 1 | 0.29% | 14 |

| Materials | 8 | -0.15% | 15 |

Let us have a look at the performance of the stocks under the top sectors of Nifty50.

Automobiles and Components

This sector covers 6 stocks in Nifty50.

- Eicher Motors was the top gainer with a 1-day price change of 5.54% under Nifty50.

- Maruti Suzuki India Ltd., on the other hand, did not perform very well with a 1-day price change of just 0.17%.

The table below shows the 6 companies belonging to this sector along with their 1-day price change(%) and the traded value.

| Name | 3 November 2021 – Price Close (Rs.) | 4 November 2021 – Price Close (Rs.) | 1-day price change. | Traded value (Rs. in cr.) |

| Bajaj Auto Ltd. | 3,698.40 | 3,759.35 | 1.65% | 24.69 |

| Eicher Motors Ltd. | 2,521.85 | 2,661.60 | 5.54% | 369.78 |

| Hero MotoCorp Ltd. | 2,641.45 | 2,677.50 | 1.36% | 24.98 |

| Mahindra and Mahindra Ltd. | 849.00 | 872.85 | 2.81% | 84.95 |

| Maruti Suzuki India Ltd. | 7,734.25 | 7,747.40 | 0.17% | 41.34 |

| Tata Motors Ltd. | 484.90 | 489.70 | 0.99% | 270.89 |

Food, Beverage and Tobacco

- Under this sector, among the 4 companies that it covers in Nifty50, ITC Ltd. was the star with a one day price change of 1.84% and a total traded value of Rs. 159.14 cr.

- Tata Consumer Products Ltd. ranked last in this sector with a 1-day price change of just 0.06%.

The table below shows the 4 companies belonging to this sector along with their 1-day price change(%) and the traded value.

| Name | 3 November 2021 – Price Close (Rs.) | 4 November 2021 – Price Close (Rs.) | 1-day price change | Traded value (Rs. in cr.) |

| Britannia Industries Ltd. | 3,629.85 | 3,652.60 | 0.63% | 8.63 |

| ITC Ltd. | 222.45 | 226.55 | 1.84% | 159.14 |

| Nestle India Ltd. | 18,737.15 | 18,889.25 | 0.81% | 13.04 |

| Tata Consumer Products Ltd. | 826.90 | 827.40 | 0.06% | 14.54 |

Energy

- This sector comprises 5 stocks, among which Indian Oil Corporation Ltd. shined brightest during the one-hour trade session. The 1-day price change was recorded at 1.58% and the total traded value stood at Rs. 44.75 cr.

- On the other hand, Oil and Natural Gas Corporation Ltd. ranks last in this sector with a 1-day price change of just 0.03% and trading for a total value of Rs. 16.94 cr.

The table below shows the 5 companies belonging to this sector along with their 1-day price change(%) and the traded value.

| Name | 3 November 2021 – Price Close (Rs.) | 4 November 2021 – Price Close (Rs.) | 1-day price change | Traded value (Rs. in cr.) |

| Bharat Petroleum Corporation Ltd. | 414.90 | 419.75 | 1.17% | 41.45 |

| Coal India Ltd. | 169.75 | 170.70 | 0.56% | 16.61 |

| Indian Oil Corporation Ltd. | 132.55 | 134.65 | 1.58% | 44.75 |

| Oil and Natural Gas Corporation Ltd. | 152.00 | 152.05 | 0.03% | 16.94 |

| Reliance Industries Ltd. | 2,483.60 | 2,498.85 | 0.61% | 196.69 |

Pharmaceuticals, Biotechnology

- Under this sector, the top gainer was Divi’s Laboratories Ltd. with a 1-day price change of 1.32% and a total traded value of Rs. 18.96 cr.

- Cipla Ltd. was the loser with a 1-day price change of -0.21% and a total traded value of just Rs. 8.77 cr.

The table below shows the 4 companies belonging to this sector along with their 1-day price change(%) and the traded value.

| Name | 3 November 2021 – Price Close (Rs.) | 4 November 2021 – Price Close (Rs.) | 1-day price change | Traded value (Rs. in cr.) |

| Cipla Ltd. | 912.65 | 910.70 | -0.21% | 8.77 |

| Divi’s Laboratories Ltd. | 5,140.15 | 5,208.05 | 1.32% | 18.96 |

| Dr.Reddy’s Laboratories Ltd. | 4,771.65 | 4,766.15 | -0.12% | 9.93 |

| Sun Pharmaceutical Industries Ltd. | 787.95 | 795.45 | 0.95% | 38.64 |

Banks

- Talking about the banking sector, SBI topped the list with the highest total traded value. Meanwhile, considering the 1-day price change, Kotak Mahindra Bank Ltd. shared the podium with Indusind Bank Ltd. with a 0.95% change.

- ICICI Bank Ltd. ranked the lowest in this sector with a 1-day price change of -0.49%.

The table below shows the 6 companies belonging to this sector along with their 1-day price change(%) and the traded value.

| Name | 3 November 2021 – Price Close (Rs.) | 4 November 2021 – Price Close (Rs.) | 1-day price change | Traded value (Rs. in cr.) |

| Axis Bank Ltd. | 750.60 | 752.95 | 0.31% | 59.74 |

| HDFC Bank Ltd. | 1,581.45 | 1,593.95 | 0.79% | 87.41 |

| Housing Development Finance Corporation Ltd. | 2,895.90 | 2,899.70 | 0.13% | 37.43 |

| ICICI Bank Ltd. | 785.95 | 782.10 | -0.49% | 246.30 |

| Indusind Bank Ltd. | 1,177.95 | 1,189.10 | 0.95% | 33.11 |

| Kotak Mahindra Bank Ltd. | 2,037.55 | 2,057.00 | 0.95% | 42.20 |

| State Bank of India | 527.65 | 530.45 | 0.53% | 519.63 |

Top 5 stocks of the overall session

Let’s look at the top 5 stocks of Nifty50 (considering the 1-day price change) during the Muhurat Trading session.

- We already know that Eicher Motors Ltd. is the topper.

- The second in line is Mahindra and Mahindra Ltd. from the same sector with a 2.81% change.

- The third is ITC Ltd. from the Food, Beverage and Tobacco sector with a 1.84% change.

- The fourth is Bajaj Auto Ltd., once again from the Automobiles and Components sector with a 1.65% change.

- The fifth stock is Indian Oil Corporation Ltd. from the Energy sector with a 1.58% change in price.

Gold ETF – Nippon India ETF Gold BeES

- Gold being the inflationary hedge has always been the Indian investors’ favourite.

- During the Muhurat Trading session, people placed their bets on Nippon India ETF Gold BeES; The trade volume on 4 November 2021 stood at 31.04 lakh.

- The 1-day price change rose by 0.63%. The total traded value for the day amounted to Rs. 12.83 cr.

Market reaction post Muhurat Trading

After the Muhurat trading session, the bullish trend still persisted. This reflects in the closing price of the benchmark indexes. On 8 November 2021, NSE Nifty advanced by 0.85% and BSE Sensex moved up by 0.80%. The number of securities traded is also a stunning 2,175 which is higher than the securities traded daily for the first 3 days of November, and the traded value was significantly higher.

Summary

The Muhurat Trading session is over, but it’s always #DimaagLaganeKaMuhurat. Hoping that you cashed on this shubh opportunity. But if you failed to place orders, it’s okay because every day can be your lucky day if your research is strong and your strategies are backtested. To help you solidify your investment game, we’ve got a special surprise for you! On account of Diwali 2021, we are gifting you a free Tickertape PRO upgrade! Just sign up on Tickertape and avail the offer.

Go on, claim your free account now!

*All the data in this article is sourced from “Refinitiv Eikon”.