Last Updated on Jan 12, 2022 by Aradhana Gotur

When the British left us, or rather, when we asked them to pack their bags and leave, India was primarily an agrarian society. The industry was poor, the manpower was incapable of producing quality output, and the economy was essentially concentrated in the hands of a select few. It wasn’t ideal. The Indian economy as a whole needed intervention. There were also multiple strategic and social problems for India to improve as a developing nation.

As with any problem, you can invest in something that offers a solution. To try and solve these economic issues and provide support to key sectors like the railways, energy, nuclear power, defence, and so on, the government invested in the public sector. They set up the Central Public Sector Enterprises (CPSEs), a series of companies across multiple industries like steel manufacturing, coal mining, crude oil extraction, and more.

Over time, the number of CPSEs has grown to over 339, with assets worth Rs 10,45,953 cr as of Dec 2020. It didn’t quite go according to plan. Under the rationale that the CPSEs were not functioning well and citing problems of labour, manpower and lack of autonomy, the government set up the CPSE ETF fund in a bid to disinvest.

Disinvestment or divestment is when a company sells its assets, usually in a bid to raise more funds or as a strategic move to offload. It is mostly used in the context of governments. This unlocks the use of capital for development like energy sectors and public infrastructures such as railways, sewage systems, and roads. The Indian government set up the CPSE ETF funds in Mar 2014 in a bid to divest and raise funds.

This article covers:

- What is CPSE ETF?

- Government’s divestment efforts and asset monetisation

- How are divestment efforts impacting stocks and, in turn, CPSE ETF

- What to expect?

Table of Contents

What is CPSE ETF?

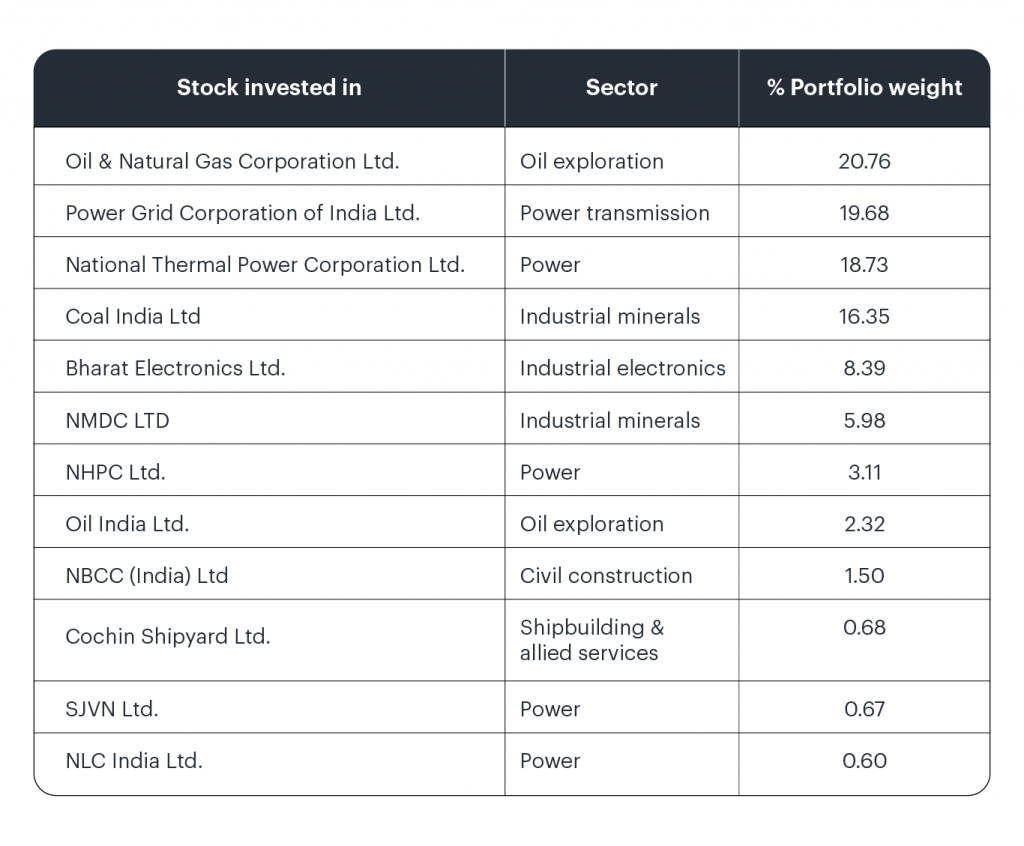

The CPSE ETF is a highly concentrated mutual fund consisting of 12 stocks. The ETF or the Exchange Traded Fund is a type of investment fund that is traded on the stock exchange. It is unique in the sense that, even though it is a mutual fund, you can still buy/sell stocks by setting up a trading account.

CPSE ETF stocks as of 28th Feb 2021 are as follows:

Government’s divestment efforts and asset monetisation

Divestment of CPSE ETF raised Rs 38,500 cr for the government and attracted 8.76 lakh investors as of Mar 2019, while the most recent divestment drive raised Rs 20,571 cr. The government had set its 2019-2020 disinvestment target as Rs 1.05 tn. The reasons include financing the increasing fiscal deficit, large-scale infra development, and reducing debt.

To achieve this target, the government released its stakes in these companies in tranches. These stakes are offered at a discount to encourage more investors and are usually offered at a time when the market conditions are right. If the market conditions were generally seen as volatile, COVID accentuated that reputation showing us that human health is tightly linked to the economy.

The CPSE ETF’s health has been on the decline, especially over the past two years, with the Nifty CPSE showing losses of 42% in FY 2020 and 6% in FY 2019. The Nifty Index, comprising the top 50 best-performing stocks, only showed losses of 26% in FY 2020 and a gain of 15% in FY 2019. The underlying divestment measures of the government are understandable given the impact COVID has had on the economy.

But the CPSE ETF stocks have over 75% belonging to the utilities and energy sectors that have performed poorly over the past few years. Oil and power stocks rank in the bottom half of India’s sector performance this year, dragging the CPSE ETFs performance. The energy sector is also cyclical, leading to fluctuations in share prices.

The Prime Minister recently admitted that there were too many CPSEs (more than 300) and the government could not remain the owner of so many of them. He also announced asset monetisation of 100 CPSEs, suggesting that the government will be looking to privatise them and generate better revenue through improving their performances. While the CPSEs are entirely government-owned, privatising them would turn them into PSUs where the government owns more than 51%.

How are divestment efforts impacting stocks and, in turn, CPSE ETF

Privatised CPSEs attract lots of investors leading to increased investment in PSU stocks. This led many investors into believing that they could find value by investing in them.

This increased investment in PSUs pushed the Nifty CPSE higher, as it includes companies that the government has over 51% ownership in. The rise in these stocks also impacted the CPSE ETFs, which are directly tied to the Nifty CPSE Index.

What to expect?

As a result, from last Oct, NIFTY CPSE beat the Nifty index by over 14% and is expected to rise higher. While the CPSE ETF has fluctuated, the CPSE ETF price is discounted and has huge investment potential, with more stocks expected to be bought over the next quarter.

Many stock experts believe that the concentration of stocks in the CPSE ETF is detrimental, while the value found in PSUs is best realised by investing in specific stocks.

Conclusion

Going forward, maximising divestment and asset monetisation depends on integrating them with focused use of revenue generated, competency of regulatory agencies, and wider political economy compulsions.

The ideal result would be empowered investors and providing a revenue influx to the government, so they achieve their divestment goals without sacrificing the CPSE ETF performance. Tickertape’s News and Events section can help you stay up to date with the latest impact divestment has on stocks and more.