Last Updated on May 2, 2022 by Aradhana Gotur

Kushank is an avid investor and SEBI-registered investment advisor. He is an alumnus of IIT KGP and has worked with JP Morgan, Ambit capital. He runs a smallcase called – Value and Momentum Picks consisting of a mix of undervalued stocks and ones that have a good price momentum going for them.

I like to keep an eye on ups and downs of the markets and see “value” investment opportunities as they arise. One such opportunity that is looking good to me after careful analysis at the moment is HPCL (Hindustan Petroleum Corporation Limited).

In this article, I will share the rationale behind this view.

Table of Contents

Everyone hates HPCL – I get it

When you think about it, HPCL doesn’t look like a great business because of the following three reasons –

- Disruption – Electric vehicles (EV) are the future and will completely disrupt petrol and diesel demand.

- Government involvement – Indian government drives the company’s decision-making, which may not be good for minority shareholders.

- Commodity Industry – Refining crude and selling petrol is a commodity business with no pricing power and long-term compounding.

Given these reasons, HPCL doesn’t show up on investors’ stock screeners and watchlists. When I recommended this stock in my smallcase as a value pick, the subscribers were sceptical and asked if I was doing the right thing.

But there are big positives in the story

The points that HPCL is a commodity business and is also prone to government involvement are fair. However, I see some factors that support the underlying story, which the market doesn’t appreciate.

The macro story – India needs petroleum

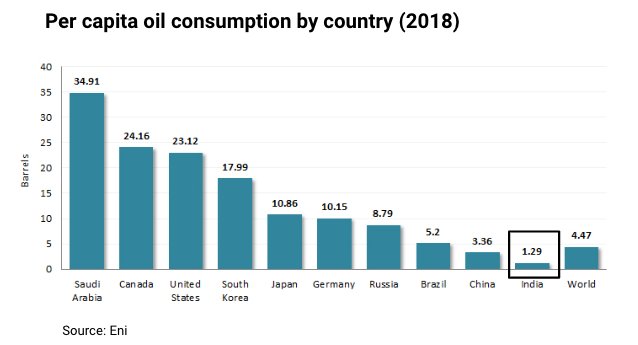

Unlike the western countries, India is a growing country. As the economy grows, more people will have vehicles, they will drive longer distances and will need more fuel. India’s petroleum demand has been a secular growth story. In July 2021, the country’s overall petrol consumption had grown by 5% compared to July 2019 (despite travel restrictions at that time).

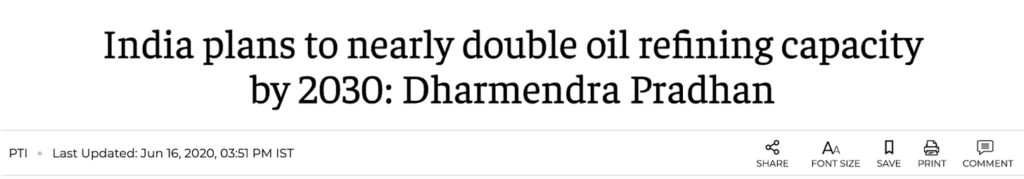

India’s need for petrol is so much that the Ministry of Petroleum is planning to double the country’s refining capacity by 2030.

EV adoption’s trajectory may not be that fast

If we look at some of the markets where EVs have gained a higher share – like Norway and China – it is because of an active government push through heavy subsidies and other regulations. If we look at the US, only 4% of new vehicles sold in 2021 were EV. India cannot afford heavy subsidies. And experience from the US suggests that the shift to EV will take time.

HPCL will survive even in 100% EV world

Also, full EV adoption does not mean companies like HPCL will go out of business. Firstly, HPCL is already working on providing charging infrastructure at its petrol pumps. Also I believe oil marketing companies are well positioned to benefit from EV charging because they already have real-estate at key locations – which will be an important driver for success.

Secondly, petrol and diesel are not the only products you get from oil refining. The refining process also produces jet fuel, asphalt and a wide range of petrochemicals. So even if no one is using petrol or diesel, we would still need to refine raw crude oil and get jet fuel and petrochemicals for which there is no other alternative.

HPCL’s business is in an upward trajectory

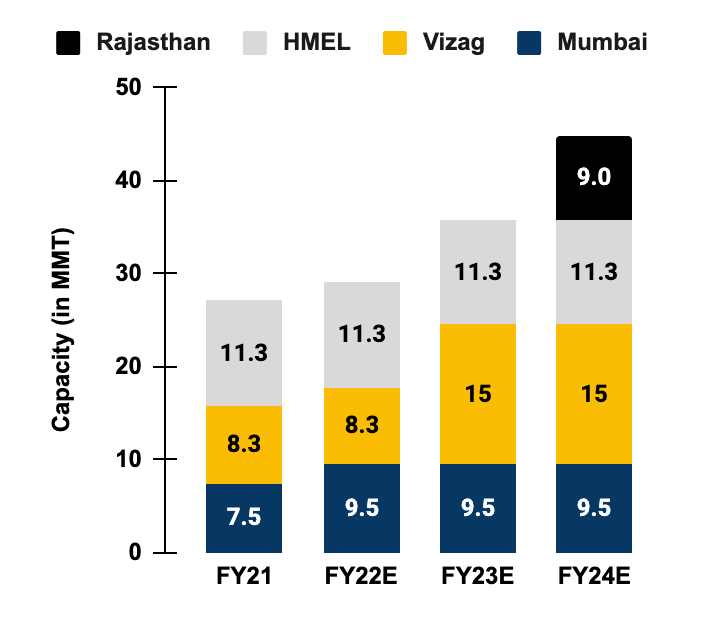

Over the past few years, the company has been investing a lot of money towards increasing its capacity. In the coming years, this capacity will come into operation as seen in the chart below.

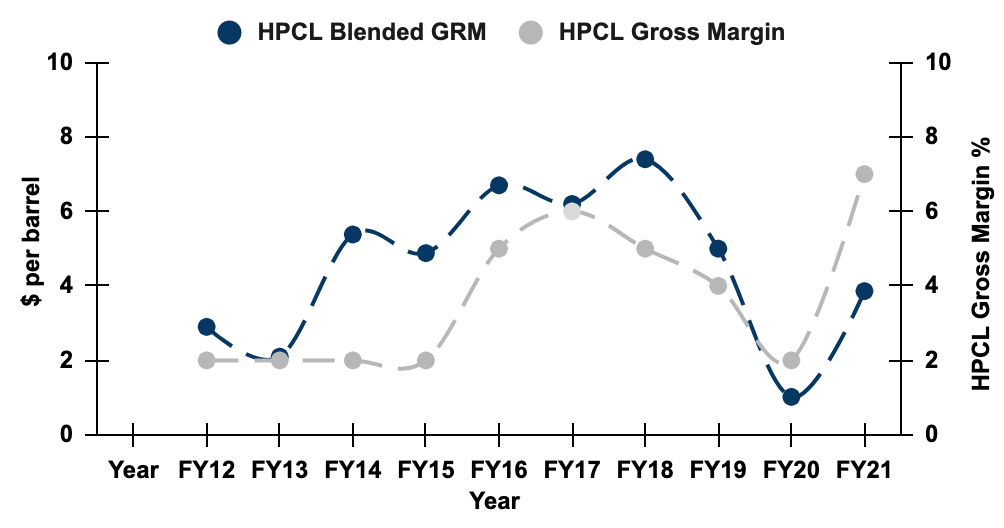

Also the global refining margins have been depressed over the past years, but like all commodities this is expected to reverse in the future. This is because of closure of unprofitable refineries due to COVID losses, increased demand as economies reopen and slower addition of capacity due to depressed refining margins of the past. And refining margins are the biggest drivers of profitability for HPCL as can be seen from the chart below.

The company is expected to grow from a period of increasing debt and low margins to that of decreasing debt and high margins.

Valuation makes HPCL attractive – despite all negatives

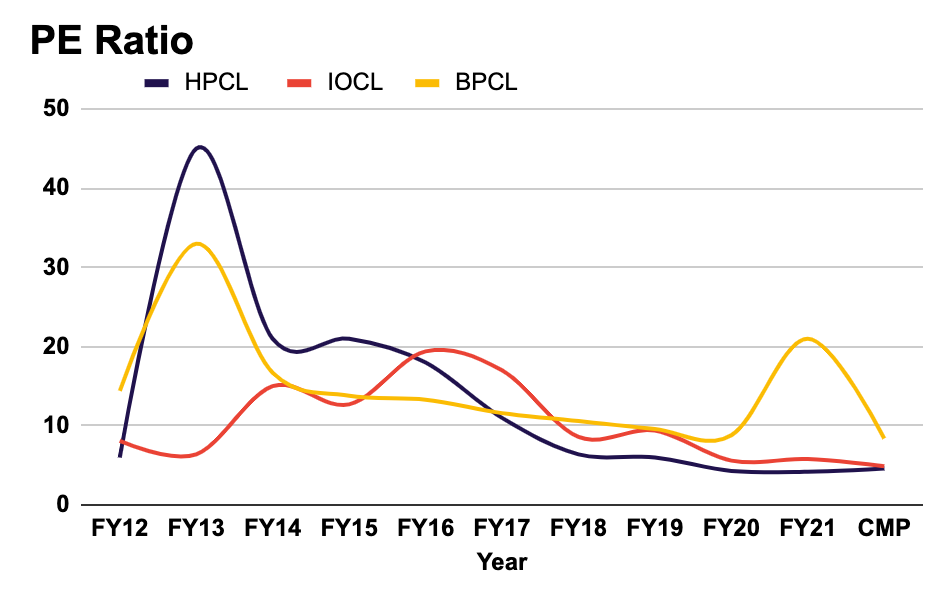

The stock trades at a normalised PE of 4x, which is quite cheap when compared with peers and its own history.

Even on the DCF, the stock looks undervalued despite putting in conservative assumptions due to EV adoption.

Timing looks good

The key part of the thesis – improvement in refining margin – has played out as expected. However, the stock has come under pressure recently because of government intervention. Following the Ukraine crisis, the oil prices have shot up. But the government hasn’t allowed oil marketing companies to increase fuel prices considering the UP elections. During this period, HPCL incurred losses on fuel sales, which did not go well with the markets.

But now the situation is reversing. Oil prices have come down from $130/bbl to $100/bbl currently. At the same time the government has announced a hike in fuel prices and reduced its share of taxes. I expect that in the long term the oil marketing companies will be allowed to recoup the losses made recently – which will help with investor confidence in the stock.

To conclude, don’t write off PSUs like HPCL because of narratives around EV destruction, commodity business, government business and other factors. It’s usually in these ignored areas where you get the best value. Since I added HPCL, it has outperformed Sensex by 10% (excluding dividends). I believe there is more juice left here. These are my views on HPCL, but don’t treat this as an investment recommendation – please do your own research.

- Expert View on HPCL – Unfolding Opportunity in Crisis - Apr 13, 2022