Last Updated on Apr 12, 2023 by

There are numerous categories of stocks, such as large-caps, mid-caps, and small-caps, each offering its own benefits and risks. An Indian company whose market capitalization is less than Rs. 5,000 cr. is known as a small-cap company. According to SEBI norms, companies ranked from the 251st position onwards in terms of market capitalization are called small-cap companies.

Unfortunately, small-cap companies have a bad reputation for being too risky, prone to fraudulent activity, and illiquid. However, history has shown that small-cap stocks have delivered phenomenal returns to investors. Thus, allocating to small caps can offer a significant upside.

Table of Contents

What are the advantages of investing in small-cap stocks?

1. Huge growth potential

“Everything big starts small.” Similarly, every mid-cap or large-cap company once started as a small business. Due to their smaller size, the potential for growth is immense. Adding new products or services, expanding distribution channels, sourcing capital, and reaching scale is easier for small companies.

Small-caps are only at the beginning of their journey, and the potential upside for undertaking risks in small-cap companies is huge.

2. Not fit for institutions

Large domestic and foreign institutions are bound by regulations restricting them from investing in small-cap companies. These institutions manage huge amounts of funds, and even a small 1-2% allocation of this large amount of funds could result in a complete takeover of the small companies. Hence, small-cap companies remain unidentified and un-researched, giving an early-mover advantage to people who identify and invest in such stocks early.

This also provides an opportunity to avail small-cap companies at a cheap valuation, which institutions do not influence. Later, when the growth potential is executed and the scale of operations becomes large, these institutions allocate funds, pushing the prices upwards, which in turn makes such small-cap companies multi-bagger stocks.

3. Attractive valuation

Small-cap companies are far more volatile than large-cap companies. During market lows, many good quality small-cap companies trade at attractive valuations due to illiquidity. During the COVID-19 pandemic and the Russia-Ukraine war, many small-cap stocks were available at attractive valuations. Small caps are typically more immune to global economic turbulence compared to large caps.

How to take advantage of small-cap stocks to make good profits?

Identifying the right businesses with quality management

Small caps tend to perform best and have indeed outperformed large caps when the economic cycle enters a recovery phase. Hence, identifying the right company beforehand helps generate good profits when the odds are in favor.

One needs to continuously research and identify the growth opportunities in small companies due to economic cycle revival, any sectorial tailwind, product developments at the company level, undervalued stocks, and more.

The risks involved with small-cap companies are huge, leaving no room for error. Even a small management error can spell doom. Hence, one should conduct a thorough background check of the company’s promoters and management before investing.

Valuation

“Quality comes at a price.” Hence, everything that looks reasonable might need to be of better quality. For superior returns, quality small caps are necessary.

In investing, the price at which you buy becomes more important than what you buy. Hence, one needs to ensure not to overpay for stocks despite their strong business model and growth potential.

Allocation

Since small-cap companies are risky, one must include small-caps and large-caps based on their risk appetite and balance the overall portfolio. Even among small-caps, one can choose multiple companies and diversify the portfolio to reduce risk.

Is it the right time to invest?

There is no way to predict good entry and exit times in the stock market with absolute accuracy, but history suggests there cannot be any better time than now to invest in small-cap companies.

Tickertape’s Market Mood Index (MMI) feature also helps you time your investments better. It is rigorously tested and has an accuracy of 88.6%. You can download the historical data of MMI using Tickertape Pro.

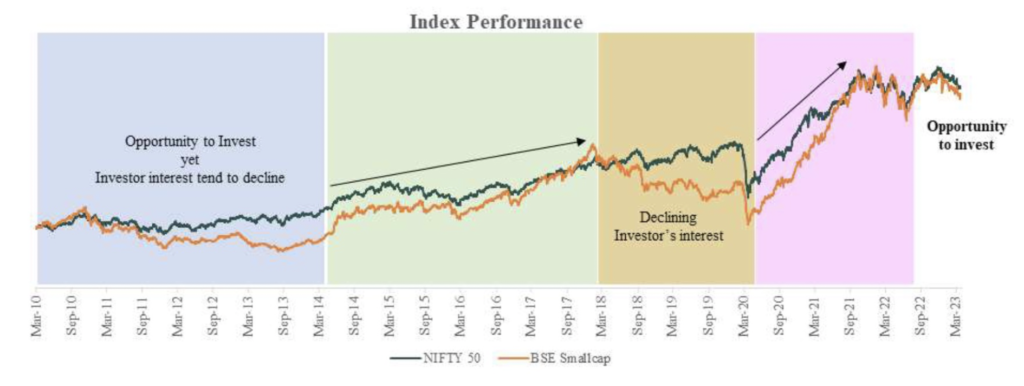

In the last 500 days, both the BSE Small Cap and NIFTY 50 indices experienced negative returns of -4.92% and -4.63%, respectively, indicating a challenging period of 1.5 yrs for the market, with a significant number of fund managers underperforming.

Technical analysis also suggests that the market indices have remained relatively stagnant over the past 18 months, indicating a high probability of an upward move in the near future.

Tickertape provides Stock Screener where you can filter “small-cap” companies with additional filters of Sector and PE ratio. This feature provides a big help in identifying the right businesses at the right valuation. Thus, identifying the right small-cap company and allocating it at reasonable prices before institutions enter will result in good profits.

This article was written by Arvind Kothari. He has been practising Equity Research and Investment Advisory for the last 12 yrs and has previously worked with ICICI Bank as an Industry Research Analyst. He then founded Niveshaay Investment Advisors, a SEBI Registered Investment Advisory Firm.

- Government Policy’s Role in Energy and Transportation Opportunities - Nov 6, 2023

- How To Take Advantage of Small-Cap Stocks To Make Good Profits - Apr 12, 2023

- What To Expect From Green Energy Sector in 2023? - Jan 19, 2023