Last Updated on Apr 26, 2023 by

Companies need ample funds to meet working capital needs and expansion/growth. Besides issuing stocks, a company can raise funds by borrowing money from the market, called debt. However, debt is borrowed money and adds to a company’s liability. So too much of it is not a good thing. Therefore, when searching for stocks to invest in, you can look for debt-free companies or those with a low level of borrowing.

In this article, we discuss the significance of debt in an entity and how to find debt-free stocks using the Tickertape Stock Screener.

Table of Contents

Debt-free companies in India

Here, we’ve listed the debt-free company stocks in India according to their market cap: large-cap, mid-cap and small-cap.

Debt-free/low-debt stocks: Large-cap category

List of debt-free companies and those with low-debt levels based on large-cap category.

| Name | Sub-Sector | Market Cap (Rs. in cr.) | PE Ratio | Total Debt (Rs. in cr.) | Debt to Equity (%) | Fundamental Score |

| SBI Life Insurance Company Ltd | Insurance | 1,10,668.93 | 73.49 | 0 | 0 | – |

| Siemens Ltd | Conglomerates | 1,16,401.47 | 75.44 | 0 | 0 | 6.09 |

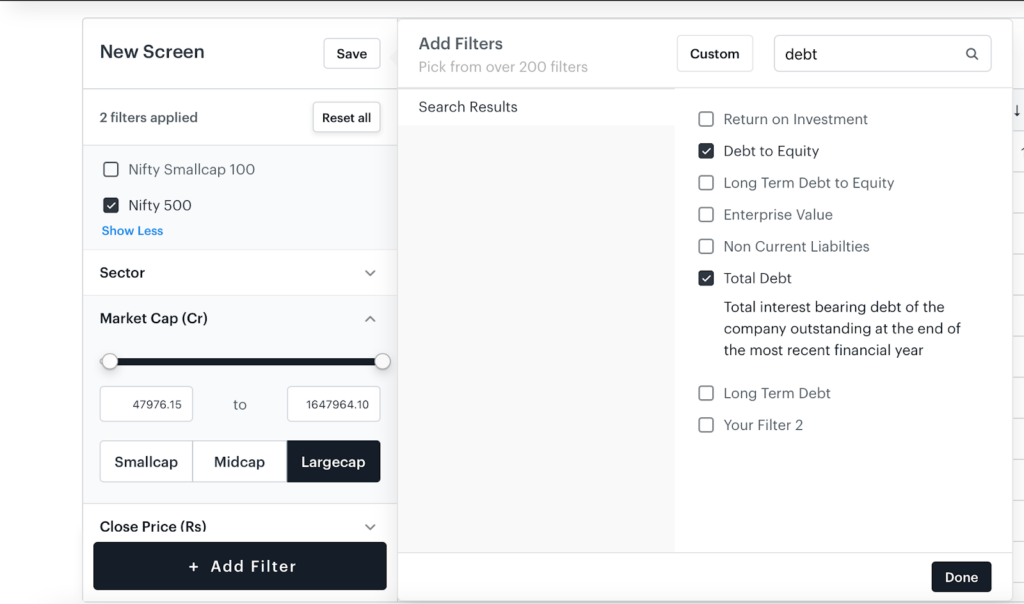

Note: The above list of low-debt/debt-free stocks is derived from Tickertape’s Stock Screener. The data is as of 25th April 2023. The following parameters were used for the purpose:

- Stock Universe: Nifty 500

- Market Cap: Largecap

- Total Debt – set to low

- Debt to equity ratio

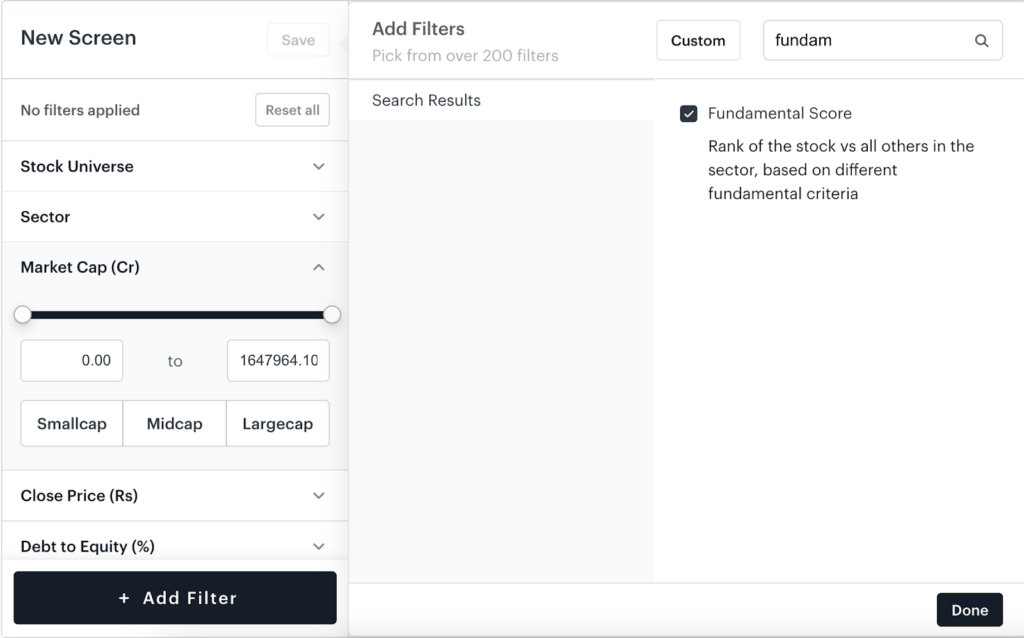

- Fundamental Score

Debt-free/Low-debt companies – Mid-cap category

List of debt-free Indian companies or those with low-debt levels based on the mid-cap category.

| Name | Sub-Sector | Market Cap (Rs. in cr.) | PE Ratio | Total Debt (Rs. in cr.) | Debt to Equity (%) | Fundamental Score |

| General Insurance Corporation of India | Insurance | 26,508.98 | 11.11 | 0 | 0 | – |

| HDFC Asset Management Company Ltd | Asset Management | 38,008.81 | 27.28 | 0 | 0 | – |

| New India Assurance Company Ltd | Insurance | 16,966.16 | 87.20 | 0 | 0 | – |

| ZF Commercial Vehicle Control Systems India Ltd | Auto Parts | 19,484.74 | 137.14 | 0 | 0 | 4.93 |

Note: The above list of low debt/debt-free stocks is derived from Tickertape’s Stock Screener. The data is as of 25th April 2023. The following parameters were used for the purpose:

- Stock Universe: Nifty 500

- Market Cap: Midcap

- Total Debt – set to low

- Debt to equity ratio

- Fundamental Score

Debt-free/low-debt stocks: Small-cap category

List of low-debt or debt-free small-cap stocks.

| Name | Sub-Sector | Market Cap (Rs. in cr.) | PE Ratio | Total Debt (Rs. in cr.) | Debt to Equity (%) | Fundamental Score |

| Brightcom Group Ltd | Advertising | 2,310.52 | 2.53 | 0 | 0 | – |

| IDFC Ltd | Diversified Financials | 13,359.87 | 208.65 | 0 | 0 | 2.57 |

| Kennametal India Ltd | Industrial Machinery | 4,783.34 | 41.92 | 0 | 0 | 5.83 |

| Lakshmi Machine Works Ltd | Industrial Machinery | 11,246.80 | 62.12 | 0 | 0 | 3.55 |

| Nippon Life India Asset Management Ltd | Asset Management | 14,616.88 | 19.64 | 0 | 0 | 4.06 |

| Tata Investment Corporation Ltd | Asset Management | 10,961.98 | 51.16 | 0 | 0 | – |

| UTI Asset Management Company Ltd | Asset Management | 8,524.42 | 15.95 | 0 | 0 | 4.28 |

| BSE Ltd | Stock Exchanges & Ratings | 6,203.52 | 24.39 | 0.02 | 0.00071 | 6.13 |

| Infibeam Avenues Ltd | IT Services & Consulting | 3,571.73 | 41.28 | 0.21 | 0.00710 | 4.67 |

| Central Depository Services (India) Ltd | Stock Exchanges & Ratings | 10,314.15 | 33.15 | 0.29 | 0.03 | 5.67 |

Note: The above list of low-debt/debt-free stocks is derived from Tickertape’s Stock Screener. The data is as of 25th April 2023. The following parameters were used for the purpose:

- Stock Universe: Nifty 500

- Market Cap: Smallcap

- Total Debt – set to low

- Debt to equity ratio

- Fundamental Score

What are debt-free companies?

An organisation with zero debt is considered to be a debt-free company. In other words, when a company has repaid all its borrowings, it becomes debt-free.

How to find debt-free companies?

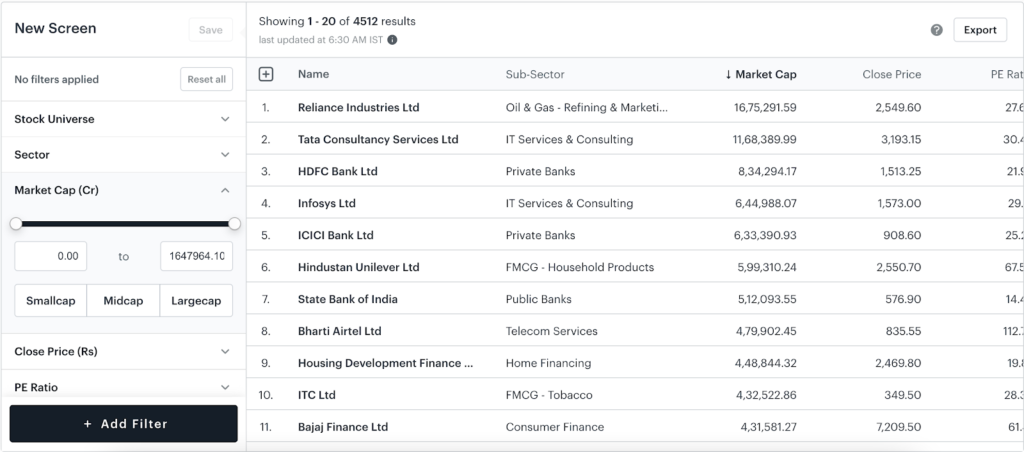

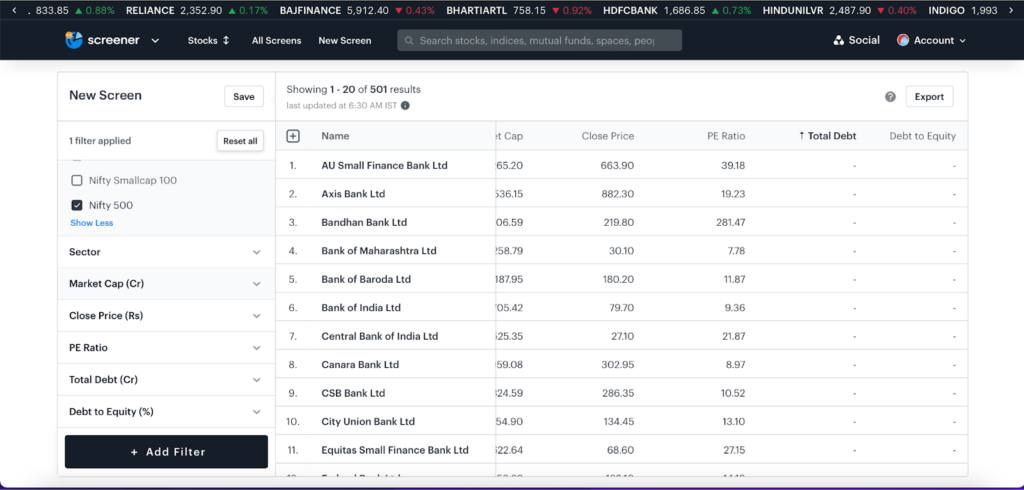

One of the easiest and quickest ways to discover debt-free stocks is by using a stock screener. Tickertape offers a smart Stock Screener built using 200+ filters to help you discover stocks based on your preferred metrics. Here’s how you can get a list of the top debt-free companies using Tickertape’s Screener.

Step 1: Launch Tickertape’s Stock Screener

Step 2: Add ‘Total Debt’ and other filters

Launch the filter panel and add ‘Total Debt’ parameter to find stocks with zero to low debt. Add other filters like debt to equity ratio as per your preference.

For instance, you may narrow your choices to large-cap, mid-cap, or small-cap stocks by applying the relevant filter. Additionally, you can also use other filters like sector, index, P/E ratio, and closing price.

Step 3: Check out the fundamental score

As an additional step, you can apply a Tickertape Special called ‘fundamental score’. This parameter ranks a stock compared to its peers in the sector based on different fundamental criteria.

Step 4: Get a list of debt-free stocks and those with low debt levels

You can now see a list of debt-free companies based on the specified parameters. The entire process takes just minutes using Tickertape’s Stock Screener.

Significance of debt in a company

Debt comes at a cost. When a company’s interest payouts get high, its profit reduces. In the worst-case scenario, high debt can push the company into bankruptcy due to its inability to meet repayments timely. Whereas debt-free companies typically meet their funding needs through their reserves or cash flow, and they have better control over their finances. As such, many investors look for debt-free stocks when investing in stocks.

Advantages of debt-free companies

- Limited impact of interest rate fluctuations on stock prices: Since a debt-free company doesn’t have interest repayments, fluctuations in the macroeconomic interest rates do not impact them. Hence, their stock price does not fluctuate due to interest rate changes.

- They are cost-effective businesses: Debt-free companies don’t have to pay interest on loans. This reduces business expenses and makes the business cost-effective.

- Economic slowdowns or recessions do not severely impact them: Although an economic slowdown impacts most companies, those with zero debt may not be severely impacted. Ample cash flow helps meet the company’s requirements without borrowing from the market, which provides stability in the face of market volatility.

- Higher dividend yield and return on equity: Given no interest payments, debt-free companies boast higher profits. This improves the company’s key performance indicators like return on equity and dividend yield. In fact, stockholders are likely to earn higher dividends should the company decide to distribute its profits to them. The return on equity also works out to be a higher ratio.

- Lower debt-to-equity ratio: The debt-to-equity ratio is an important financial ratio that investors use to analyse a stock. It indicates a company’s debt position—how much debt it has against equity.

- Lower risk to shareholders: A zero-debt company is relatively less risky as there are no borrowers who have a claim over the company’s assets. If the company does borrow in case of emergencies, it will not become an additional burden as there is no existing debt.

Disadvantages of a debt-free company

Not all debt is bad for a company. If not debt, a company may have to raise funds via equity. Interest on debt is an allowable expense when calculating tax liabilities. Hence, a company without debt can face higher taxation. However, if they have some debt on the books, it reduces the tax outflow to an extent.

Conclusion

Debt-free companies have benefits, and their stocks are relatively low-risk choices. However, considering only a company’s debt position is a myopic view. Besides the total debt and debt-to-equity ratio, you should consider other parameters to filter stocks. Moreover, you should check the fundamental and technical aspects of the debt-free company you choose to invest in. Choose profitable companies that can yield a good return on your investment. Just being debt-free should not be the primary deciding factor.

While debt-free companies with strong fundamentals and good investment options, debt should not be the sole deciding factor. Fundamentally strong companies managing debt well can also be good investments. A company with good growth potential is better than those with low or zero debt but limited growth potential.

Use Tickertape’s Scorecard to analyse the company’s qualitative and quantitative performance and potential. Then invest in it if it has a stable outlook and can offer capital appreciation.

Frequently asked questions (FAQs)

What is a debt-free company?

A company whose balance sheet has zero debt is called a debt-free company. Debt increases the company’s expenses and reduces its profitability. However, a manageable level of debt can help the company fund its growth plans.

How do I know if a company is debt free?

One of the quickest ways to find a debt-free company is by using Tickertape Stock Screener. Use the debt-to-equity or total filter to know the level of debt in companies.

Are debt-free stocks good?

Companies with debt are more likely to be impacted by market downturns and other turbulent times. If they are not able to make repayments, they stand the risk of becoming bankrupt. Hence debt-free companies that are fundamentally strong are considered to be relatively safer.

How to calculate the total debt of a company?

The total debt of a company is calculated by adding short-term (current) and long-term liabilities. You can find it on the left-hand side of the balance sheet.

What is the debt-to-equity ratio?

The debt-to-equity ratio is a financial ratio that indicates the relative proportion of equity and debt used to fund a company. It measures the contribution of lenders (creditors) and shareholders or owners in the company’s capital.

How to calculate the debt-to-equity ratio?

Debt-to-equity ratio = Total liabilities of a company / Total shareholders’ equity

How to get the list of debt-free companies in NSE?

You can get the list of debt-free companies on the NSE on Tickertape by following the steps below:

– Log in to Tickertape

– Go to the Stock Screener

– Add the‘ Debt to Equity’ filter and set it to max 0.

You’ll get the list of debt-free companies on the NSE. You can also add other parameters like market cap or sector to narrow your search.

How to find debt-free chemical stocks in India?

Use Tickertape to find debt-free chemical stocks in India easily.

– Launch Tickertape Stock Screener

– Select ‘Commodity Chemicals’, ‘Diversified Chemicals’, ‘Fertilisers & Agro Chemicals’ and ‘Speciality Chemicals’ under ‘Sector’

– Click on ‘Add Filters’

– Search and select ‘Total Debt’

– Set ‘Total Debt’ to low

You can add other filters as well to narrow down your search and find the best chemical stocks according to your preferred parameters.

- Best Mutual Funds for Passive Investors (2025) - Dec 9, 2024

- List of Stocks With RSI Below 30 in India - Dec 9, 2024

- 10 Highest Dividend Paying Stocks in Nifty 50 NSE India - Dec 9, 2024