Companies constantly borrow funds to meet their business requirements. Many metrics and financial ratios can help determine how a company repays them. One of the most popular ratios to assess a company’s ability to repay liabilities is the quick ratio.

This ratio is used to measure a company’s ability to pay off its current liabilities in a given year by converting its liquid assets into cash. Let’s read more about the quick ratio below.

You will Learn About:

What is a quick ratio?

The quick ratio, also known as the liquidity ratio/ acid-test ratio, measures the ability of a company to pay off its short-term obligations or liabilities. The term ‘acid-test’ ratio implies that you can use the ratio to instantly determine the position of a company. It is an important measure of a company’s health as it depicts how a business can cover its financial obligations without obtaining additional funds or needing to sell inventory.

Simply put, the quick ratio helps determine the solvency of a company. Investors and lenders often use the quick ratio or acid-test ratio to evaluate whether a business would be a profitable bet in terms of investment or loan.

Importantly, the quick ratio only takes liquid assets, such as marketable securities, cash, accounts receivable, etc., into account. Those current assets which are not readily convertible such as inventory or prepaid expenses, are not included.

The higher the quick ratio, the better the financial health and liquidity of a company, and vice versa. Generally, if a company has a quick ratio of 1 and above, it can easily cover all its debts and liabilities.

Quick Ratio – Main Highlights!

- The quick ratio measures the ability of a company to pay off its current liabilities by converting liquid assets into cash.

- As compared to the current ratio, the quick ratio is a more conservative method since it does not consider inventory and prepaid assets, as they cannot be readily converted into cash or cash equivalents.

- This ratio may turn out to be inaccurate for companies having high inventory.

- A high quick ratio may be considered a good sign, indicating a company can fulfil its obligations quickly and vice versa.

Quick ratio interpretation

Typically, 1:1 is considered the ideal quick ratio. You can analyse a quick ratio as follows – suppose a company has a quick ratio of 2; it means that a company has twice the liquid assets to pay its short-term obligation. Now, if a company has a ratio of less than 1, it will most likely not be able to fully pay off its short-term liabilities for the given period.

In this sense, a quick ratio can throw light on the solvency of a company

Limitation of the quick ratio

Several factors influence the quick ratio of a company, including the industry a company operates in, the type of business, the market segment it caters to, its creditworthiness, the debtor and creditor cycles, and more. And for the same reason, this ratio has certain limitations. Take a look at a few below.

- Does not factor in inventory

For a comprehensive and accurate analysis of a company’s liquidity, the quick ratio should be considered along with the current and cash flow ratios. In fact, arguably, the biggest drawback of the ratio is that it excludes inventory a company has on hand. The method is often counterproductive for companies holding inventory in high quantities.

For example, supermarkets usually have high inventory, which can easily be valued at the market price. In such situations, the results would be inaccurate if the quick ratio only considers highly liquid assets or cash or cash equivalents.

- Can mislead investors when concerning a company’s liquidity

Contrary to popular belief, an extremely high quick ratio isn’t particularly a good sign. It could indicate that a company is holding too many liquid assets. Now the company could have invested this extra liquidity at hand in other projects or investment schemes to generate extra revenue.

- Can be challenging to compare

Companies with high creditworthiness are likely to survive turbulence in the market. This can be attributed to better relationships with debtors, creditors, and lenders, leading to better negotiation of payment terms. The same cannot be said for a new, small business with low creditworthiness. Small businesses often have to struggle to maintain a steady cash flow. Now, the quick ratio of such companies can dwindle, misguiding investors that it’s a bad investment.

All said, a company should focus on maintaining the quick ratio to reduce liquidity risk.

How to calculate the quick ratio?

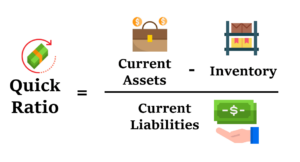

You can use the formula given below to calculate the quick ratio:

Quick ratio = Accounts receivable + Cash & cash equivalents + Marketable securities / Total current liabilities

However, if the balance sheet of a company does not break up the current assets, you can use the formula given below instead:

Quick ratio = Total Current assets – Inventory – Prepaid expenses / Total current liabilities

As it can be concluded from the above formulas, the quick ratio considers only those current assets a company can easily convert into cash.

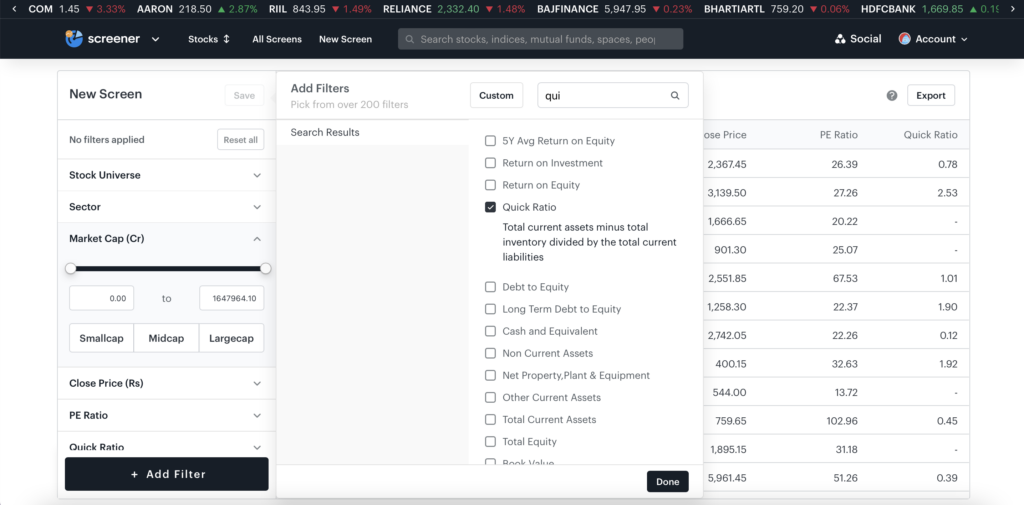

Alternatively, use Tickertape Stock Screener to find the quick ratio of a company. There are over 200 filters on the Stock Screener that can help you analyse a stock quickly and hassle-free.

Difference between the current ratio and the quick ratio

The current ratio and quick ratio both assess the financial health of a company. However, there are certain aspects in which both ratios starkly differ from each other. Let’s read them below.

| Current ratio | Quick ratio |

| The current ratio measures the ability of a company to pay off its short-term liabilities through its short-term assets, including cash, inventory, and receivables. | The quick ratio also measures the company’s ability to cover its short-term liabilities, but it does not consider inventory. |

| The current ratio of a company is calculated by dividing current assets by the current liabilities of a company, i.e. Current ratio = Current assets / Current liabilities | The quick ratio of a company is calculated by totalling the amount of cash, accounts receivable, and marketable securities and then dividing the sum by the total current liabilities, i.e. Quick ratio = Accounts receivable + Cash & cash equivalents + Marketable securities / Total current liabilities |

Conclusion

The quick ratio measures a company’s ability to pay off its current liabilities by converting its liquid assets into cash. The ratio excludes inventory as it is not easily convertible into cash. A quick ratio of 1:1 and above is a positive sign in terms of a company’s ability to pay off its current liabilities. However, a negative or a quick ratio below 1 can be a red flag. While the quick ratio measures liquidity, the assessment depends on multiple factors and might not always be accurate.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.