For a business, liability is something that it owes to a third party, i.e., an individual, vendor or company. Current liabilities are the short-term commitments of the business that are due and payable within a short period of time. They usually generate a future cash outflow.

Current liabilities arise due to the operating activities of a business. For example, accounts payables, bank overdrafts, dividends payable, etc. Let’s understand current liabilities in detail.

You will Learn About:

What are current liabilities?

The short-term obligations of the business that are due within a year or within the operating cycle of the business are called current liabilities. For instance, accounts payable to a supplier or outstanding rent, etc., fall under current liabilities.

It can be calculated using the below formula-

Current Liabilities = Accounts Payable + Notes payable + Accrued expenses + Unearned revenue + Other short-term debt

The amount of current liabilities also helps in determining a company’s liquidity and solvency. Excess of current assets over current liabilities is a good sign, depicting that the company can meet its obligations easily.

You can also calculate a company’s working capital through its current liabilities.

Working capital = Current assets – Current liabilities

Return on equity: Highlights

- Current liabilities are the short-term commitments of a company that need to be paid within the operating cycle of the business.

- Current liabilities are recorded on the balance sheet.

- Some examples of current liabilities are- accounts payable, short-term debt, outstanding rent, etc.

Accounting for current liabilities

Current liabilities are credited in the books of accounts with the appropriate expense or asset account being debited. For example, assume Company X has an outstanding rent due after three months. So, the accounting entry for this transaction would be – Rent A/C debited to outstanding Rent A/C.

The outstanding rent is then shown in the balance sheet as the current liabilities of the company.

Let’s take another example. Assume Company Y is a trading business and has an inventory worth Rs. 5,00,000. However, the company has not paid its supplier Z. So, the entry for this transaction would be Inventory A/C debited to Accounts Payable A/C.

Examples of current liabilities

Some examples of current liabilities include accounts payable to suppliers, bank overdrafts, unpaid expenses, unearned revenue, short-term loans, etc.

What are some current liabilities listed on a balance sheet?

Some current liabilities that are listed on the balance sheet are-

- Short-term debt

These are basically short-term loans taken by the business to meet its immediate requirements. This includes bank overdrafts etc.,

- Outstanding expense

These are expenses that have been incurred/accrued but have not been paid off—for example, outstanding rent, interest payable, unpaid bills, etc.

- Unearned revenue

It is the money a business receives even though the goods have not yet been provided.

- Accounts payable

It is the money payable to the suppliers or vendors of a business. These arise strictly from the operating activities of the business.

- Dividends payable

Dividends are a portion of the profits distributed to stakeholders. Dividends payable are those that are due to be paid but are unpaid.

What is a current ratio?

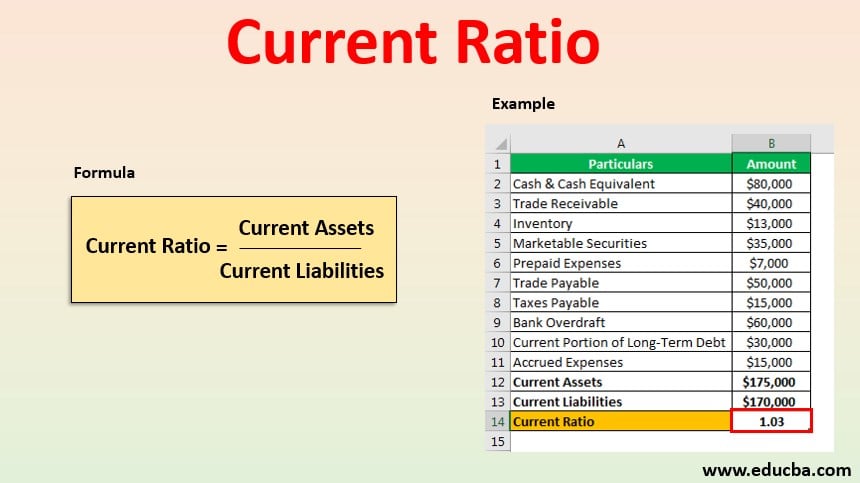

The current ratio measures a company’s short-term liquidity. It defines a company’s ability to pay off its short-term obligations. The current ratio can also be termed the working capital ratio. This ratio can be calculated in the following way-

Current ratio = Current assets / Current liabilities

Different industries have different current ratio values. A high current ratio depicts that the management is efficiently utilising the current assets and resources are not lying unused. A comparatively lower current ratio shows that the company is risky and has a high likelihood of default.

However, the current ratio does not fully represent a company’s short-term solvency. For instance, a company may have high accounts receivable, which shows that the company is not efficient in collecting the debt. Also, higher inventory levels may sometimes contribute to a high current ratio. In the same light, a low current ratio may be due to the company’s goodwill, thus its ability to have longer accounts payable cycle as compared to the accounts receivable cycle.

What are current assets?

Current assets are short-term assets of a company that can be converted into cash in the short run. Some examples of current assets are-

- Cash and cash equivalents

- Accounts receivables

- Prepaid expenses

- Inventory

- Short term investments

Current assets are debited in the journal entry and shown under assets on the balance sheet of a company.

Relationship between current liabilities and current assets

The relationship between current assets and current liabilities is that both help in assessing the liquidity and solvency position of the company. They help in determining the short-term future requirements of cash for a company.

Also, current liabilities are mostly paid off using the current assets, i.e., short-term assets of the company. For instance, accounts payable are paid off using cash. Additionally, the current ratio, quick ratio and cash ratio are some of the ratios that define the relationship between current assets and current liabilities.

Conclusion

Current liabilities depict a company’s short-term obligations. Accounts payables, bank overdrafts, etc., are some examples of current liabilities. Current liabilities are used along with current assets to determine the solvency of a company. The current ratio is obtained by dividing current assets by liabilities. The higher the ratio, the higher the company’s ability to clear its liabilities. The quick ratio and cash ratio also depict the relationship between current assets and liabilities.

FAQs

Did you Like the Explanation?

Authored By:

I am a finance enthusiast who loves exploring the world of money through my lens. I’ve been dedicated to building systems that work and curating content that helps people learn.

As an insatiable reader and learner, I’ve spent the last two years exploring the world of finance. With my creative mind and curious spirit, I love making complex finance topics easy and fun for everyone to understand. Join me on my journey as we navigate the world of finance together!