You must have come across the term ‘asset management company’ when investing in pooled avenues like mutual funds, hedge funds, etc. Asset management companies, or AMCs as they are popularly called, manage assets on behalf of investors.

Let’s understand what asset management companies are all about.

You will Learn About:

What is an asset management company?

In a pooled investment avenue, like mutual funds, multiple investors invest towards the same investment objective. This investment is handled by the entity that creates the pooled corpus. The investment is made as per the fund’s pre-decided objective. This is exactly what an asset management company (AMC) does.

An AMC is a company that pools the investment of multiple investors and then, through professional guidance, invests the corpus into different securities depending on the fund’s investment strategy. The asset management company manages the investment, its risks and returns.

Asset Management Company – Key Highlights

- An asset management company is a company that manages pooled investments like mutual funds.

- AMCs manage the funds on the investors’ behalf and try to maximise the portfolio returns.

- SEBI, RBI and AMFI regulates AMCs in India.

How does an AMC manage funds?

Asset management companies usually appoint experienced fund managers and professionals to manage investors’ assets and portfolios. Under the direction of these fund managers, the AMC takes investment decisions on behalf of the investors.

These managers allocate the pooled corpus into different securities to create a diversified portfolio. AMCs also buy and sell securities to generate investors’ returns or meet the redemption demand.

Asset management company functions

An AMC functions as an independent legal entity. While managing investors’ assets, the asset management company usually carries out the following functions –

- Review of the market

The asset management company carries out a broad review of the capital market to assess the investment opportunities that can generate the maximum possible profits.

- Asset allocation

Once investment opportunities are identified, the AMC uses the pooled corpus and invests it into different asset classes depending on the fund’s investment objective. The asset allocation is done to create a diversified portfolio that helps mitigate risks while enhancing returns.

- Portfolio creation

The allocated corpus and the bought assets create a diversified portfolio which is then managed by the asset management company, actively or passively, to generate returns for investors.

- Regular reviews

The portfolio is also reviewed regularly to weed out non-performing securities and substitute them with profitable ones.

Points to consider before you choose an AMC

There are multiple asset management companies in India. And thus, it is essential to choose the right AMC to manage your investments as per your needs and requirements. So, when selecting an AMC, here are a few points that you should consider –

- The reputation of the AMC

- Costs of services

- Reviews of the existing investors

- Educational and professional qualifications of the fund managers that the AMC has hired

- The consistency of past returns

- Proper registration, licensing, and authorisation received from regulatory bodies and

- Services offered

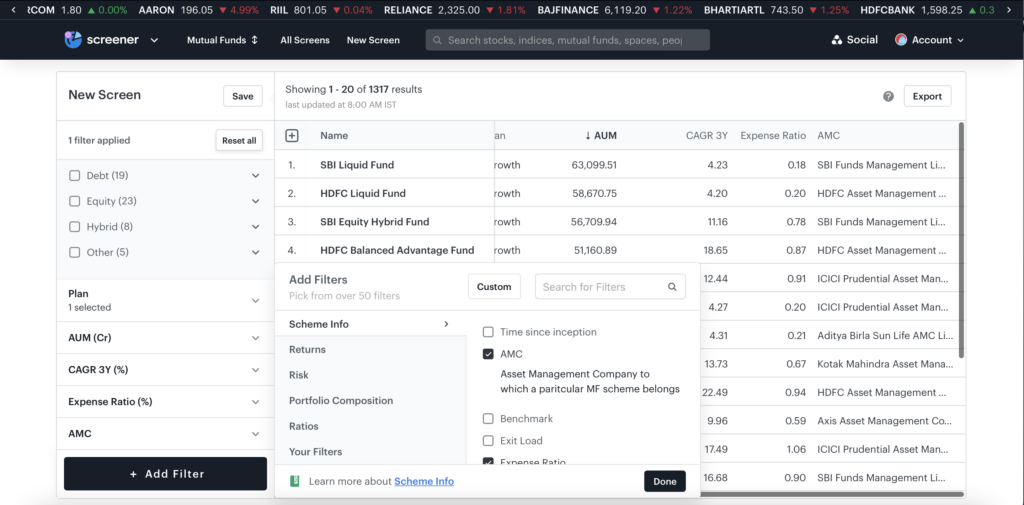

Use Tickertape Mutual Fund Screener to filter mutual funds based on your preferred AMC.

Guidelines laid by SEBI, AMFI and RBI for AMC

AMCs are supervised by a Board of Trustees and must follow the rules and regulations set forth by the Securities and Exchange Board of India (SEBI). Moreover, when it comes to mutual funds, the Association of Mutual Funds in India (AMFI) also safeguards investors’ interests and governs the working of AMCs. Overall, the country’s central regulatory body, RBI (Reserve Bank of India), regulates the working of AMCs.

AMCs, thus, have to follow the guidelines set forth by SEBI, AMFI and the RBI. These guidelines are as follows –

- An asset management company cannot act as a trustee of a mutual fund scheme.

- The AMCs cannot invest in their own company. However, an investment is allowed only after the company fully discloses the investment intention in the offer document.

- The asset management company should submit quarterly reports to the Board of Trustees. The reports should highlight the AMC’s activities during the quarter and compliance with all the necessary rules and regulations.

- The key personnel managing the asset management company should have a clean record without any offence.

- An AMC’s Chairman cannot be a trustee of a mutual fund scheme.

- The net worth of the asset management company should be within Rs. 10 crores.

- AMCs should submit their compliance certificates to the Board of Trustees every six months.

Pros and cons of an AMC

The pros of an asset management company are as follows –

- AMCs manage a large portfolio of investments. These allow them to invest in diversified assets for risk mitigation and profit maximisation.

- By hiring experienced fund managers to manage their portfolios, AMCs help you access professionally managed funds.

- AMCs have access to various assets that retail investors might not be able to buy on their own.

- AMCs are regulated entities that promote investor confidence and trust.

On the other hand, the cons of an asset management company are as follows –

- A small charge is levied as a fund management fee to manage your investments.

- There is a possibility of reduced returns if the fund manager does not manage the portfolio appropriately.

- You do not control your investment. The AMC manages your investment at its discretion.

Reliability of AMC compared to banks

It is often misunderstood that an AMC is not as safe as a bank (which is regulated and governed by the RBI). However, this is a myth.

The AMC is incorporated under the provisions of the Companies Act 1956. The asset management company, as such, has to abide by the regulations stated in the Act. Moreover, the Board of Trustees is regulated by the SEBI and, in the case of mutual funds, by AMFI too. Both these governing bodies ensure that the investors’ interests are taken into consideration. So, like banks, AMCs are also reliable and do not mishandle or misuse investors’ money.

Conclusion

As investors, it is important to understand what AMCs are all about, how they function and whether they are regulated entities or not. If you invest in pooled investment funds, like mutual funds, your money will be handled by the AMCs. So, knowledge of the different aspects of an asset management company is vital for investors before they entrust their money to it.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.

Pranay is a BMS Graduate from KC College who has cleared all 3 levels of the CFA exam and is currently working as an Equity Research Associate at Alpha Invesco.