Businesses engage in a lot of financial transactions on a daily basis. They keep records of every transaction in their accounts. Moreover, businesses maintain accounts and records of their assets and liabilities, which help them assess the efficiency of their operations.

There are different types of businesses, and each business might use different accounting rules to maintain its books. As such, accounting standards have been specified that dictate the rules of recording accounting entries. Let’s read further to understand accounting standards in detail.

You will Learn About:

What is an accounting standard?

In general terms, an accounting standard is a set of rules, standards, and principles based on which financial transactions are recorded in books of accounts. The accounting standard determines the basis of financial reporting for most companies. They dictate how each transaction and accounting entry should be identified, measured, recorded, and published in financial reports and statements.

The accounting standards in India are issued by the Accounting Standards Board (ASB). The ASB was established by the Institute of Chartered Accountants in India (ICAI) in 1977.

Accounting Standards – Points to Note!

- Accounting standards are a set of rules which help companies record and report their financial statements.

- Companies in India are required to follow accounting standards as prescribed.

- Accounting standards make for uniform and comparable financial reports and are beneficial.

Indian Accounting Standards (Ind AS) list

The ASB has issued a list of accounting standards that are to be used by all companies. The standards are as follows –

| Accounting standard | Use |

| Ind AS 101 | First-Time Adopting of Indian Accounting Standards |

| Ind AS 102 | Share-Based Payment |

| Ind AS 103 | Business Combinations |

| Ind AS 104 | Insurance Contracts |

| Ind AS 105 | Non-Current Assets Held For Sale and Discontinued Operations |

| Ind AS 106 | Exploration for and Evaluation of Mineral Resources |

| Ind AS 107 | Financial Instruments and Disclosure |

| Ind AS 108 | Operating Segments |

| Ind AS 109 | Financial Instruments |

| Ind AS 110 | Consolidated Financial Statements |

| Ind AS 111 | Joint Arrangements |

| Ind AS 112 | Disclosure of Interests in Other Entities |

| Ind AS 113 | Fair Value Measurement |

| Ind AS 114 | Regulatory Deferral Accounts |

| Ind AS 115 | Revenue from Contracts with Customers (Applicable from April 2018) |

| Ind AS 116 | Leases – Applicable from April 2019 |

| Ind AS 1 | Presentation of Financial Statements |

| Ind AS 2 | Inventories |

| Ind AS 7 | Statement of Cash Flows |

| Ind AS 8 | Accounting Policies, Changes in Accounting Estimates and Errors |

| Ind AS 10 | Events After the Reporting Period |

| Ind AS 12 | Income Taxes |

| Ind AS 16 | Property Plant and Equipment |

| Ind AS 19 | Employee Benefits |

| Ind AS 20 | Accounting for Government Grants and Disclosure of Government Assistance |

| Ind AS 21 | The Effects of Changes in Foreign Exchange Rates |

| Ind AS 23 | Borrowing Costs |

| Ind AS 24 | Related Party Disclosures |

| Ind AS 27 | Consolidated and Separate Financial Statements |

| Ind AS 28 | Investments in Associates and Joint Ventures |

| Ind AS 29 | Financial Reporting in Hyperinflationary Economies |

| Ind AS 32 | Financial Instruments: Presentation |

| Ind AS 33 | Earnings Per Share |

| Ind AS 34 | Interim Financial Reporting |

| Ind AS 36 | Impairment of Assets |

| Ind AS 37 | Provisions, Contingent Liabilities and Contingent Assets |

| Ind AS 38 | Intangible Assets |

| Ind AS 40 | Investment Property |

| Ind AS 41 | Agriculture |

of the revaluation of assets and written back depreciation cannot be included.

Objectives of accounting standards

The objectives of accounting standards are as follows –

- To make accounting principles used in India at par with internationally recognised standards.

- To adopt a uniform set of accounting principles for financial reporting.

- To create a single recognised framework of the accounting system.

- To make international companies understand Indian accounting practices.

- To ensure transparency in the financial statements of companies.

- To expand the scope of doing business globally.

Importance of accounting standards

Accounting standards are important because they bring uniformity in accounting practices irrespective of the company or the industry. This makes financial statements comparable.

Moreover, the standards are developed on the basis of internationally recognized standards bringing parity with global companies. This makes it easier for companies to expand into international markets and grow their business.

Lastly, uniform accounting standards can help eliminate the possibility of fraud or incorrect accounting.

Applicability of Ind AS in India

The Ministry of Corporation Affairs (MCA) notified the Companies (Indian Accounting Standards) Rules, 2015 were introduced to align with the converged form of IFRS. This was done to ensure consistency and harmonization in Financial Statements and Reports.

Voluntary applicability

A company has the option to adopt Ind AS even if it doesn’t meet the mandatory requirement under the law (for financial years beginning on or after April 01, 2015). However, once a company chooses to use Ind AS for reporting financial statements, it must continue to do so for all subsequent financial statements.

Phase-wise mandatory adoption of Ind AS

The MCA has made it mandatory for the companies to follow the list of Ind AS in a phase-wise manner as follows:

Phase -1

Mandatory applicability of Ind AS to all the companies with effect from 2016-2017 if:

- It is an unlisted or listed company having a net worth of more than or equal to Rs. 500 cr.

- Holding company, subsidiary, a joint venture or associate companies of companies fulfilling the above condition.

Phase – 2

Made effective from the financial year 2017-2018 by

- Companies not listed under any stock exchange but having a net worth of at least Rs. 250 cr.

- Companies which are listed or in the process of getting listed its equity or debt listed in any stock exchanges in or outside India.

- Holding company, subsidiary, a joint venture or associate companies of companies fulfilling the above condition.

Phase -3

To be implemented with effect from the financial year 2018-2019 by

- Bank, insurance companies, and Non-Banking Financial Corporations (NBFCs) have a net worth equal to or more than Rs. 500 cr.

- Holding company, subsidiary, a joint venture or associate companies of companies fulfilling the above condition.

Note: The regulatory authorities for Banks and Insurance Companies postponed the implementation date. Now, RBI has deferred the implementation of Ind AS for Banks by one year, starting from 1st April 2019. Insurance Companies have a two-year deferment commencing from 1st April 2020.

Phase – 4

The adoption of phase 4 needs to be made with effect from the financial year 2019-2020 by the following:

- Listed NBFCs or the ones which are in the process of getting its equity or debt listed in any stock exchange in or outside India. They all have a net worth of more than Rs. 500 cr.

- Unlisted NBFCs with a net worth of more than Rs. 250 cr.

- Holding company, subsidiary, a joint venture or associate companies of companies fulfilling the above condition.

Net worth calculation

Net worth should be calculated as provided under section 2(57) of the Companies Act, 2013. It states that the net worth is found based on the standalone financial statements that should be audited.

Net worth should be calculated as the sum total of paid-up share capital and all reserves made out of profit and securities premium account, and then subtract the value of deferred expenditure, accumulated losses and miscellaneous expenditures that are not written off. Mathematically we can write this as,

Net Worth = Total paid-up share capital + all reserves (made out of profit and including securities premium account) – deferred expenditure – miscellaneous expenditure (should not be written off) – accumulates losses.

Only include capital Reserve arising out of promoters contribution, and government grants received. Reserves created out

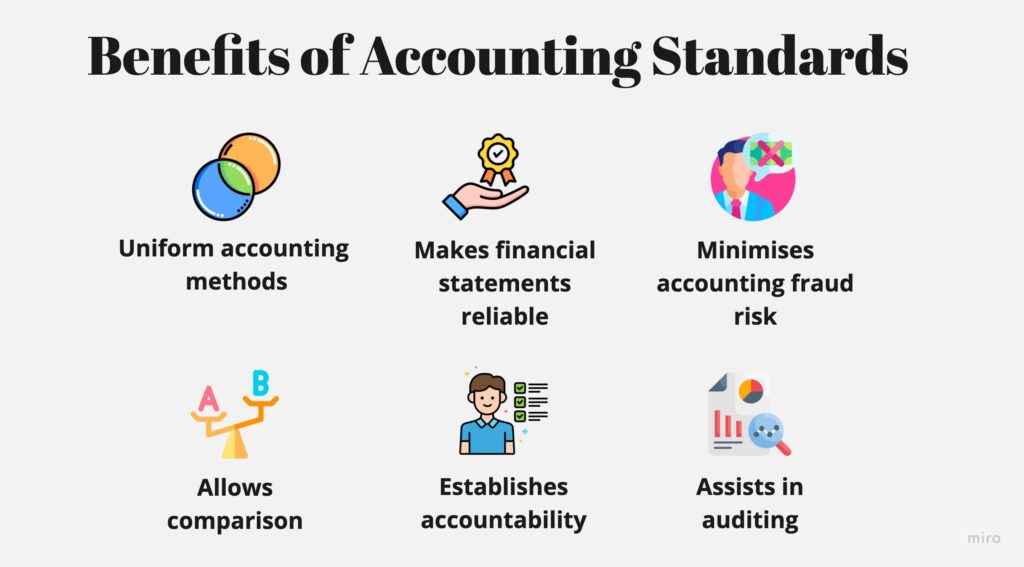

Benefits of accounting standards

- Uniform accounting methods

Accounting standards make financial reporting uniform across entities. This makes it easier to maintain accounts (since a standard format is used).

- Makes financial statements reliable

Since all financial statements are drafted based on accepted standards, they become reliable. There is no ambiguity, and one can assess a company’s financial statements without worrying about their authenticity.

- Reduces the possibility of accounting malpractices

Since accountants have to follow the accounting rules outlined in the accounting standards, the possibility of fraud and malpractice is reduced.

- Assists auditing

Auditors find it easy to audit entries and statements using the prescribed standards. It helps them check the authenticity of transactions and calculate the correct income and expenses of the business.

- Allows comparison

With uniformity, stakeholders can compare the statements across companies. This is especially relevant for investors who want to compare financial data across companies to gauge the profitability of potential investments.

- Establishes accountability

Stakeholders can fairly assess how the company’s management has performed by looking at their financial statements. This further helps establish accountability.

Limitations of accounting standards

There are a couple of limitations that accounting standards have. These are as follows –

- Legal restrictions

Though accounting standards establish accounting rules, they are limited by the legal rules and practices prevalent in India. The standards must comply with the laws and Acts governing companies, like the Companies Act 1953. This may restrict the scope of accounting standards.

- Availability of alternatives

Different accounting standards allow alternative modes of accounting and recording a particular financial entry. For instance, in the valuation of stocks, companies can use the FIFO (First In, First Out), LIFO (Last In, First Out), and other methods to value stocks.

This, thus, brings in an element of difference when checking the stocks of different companies following different practices.

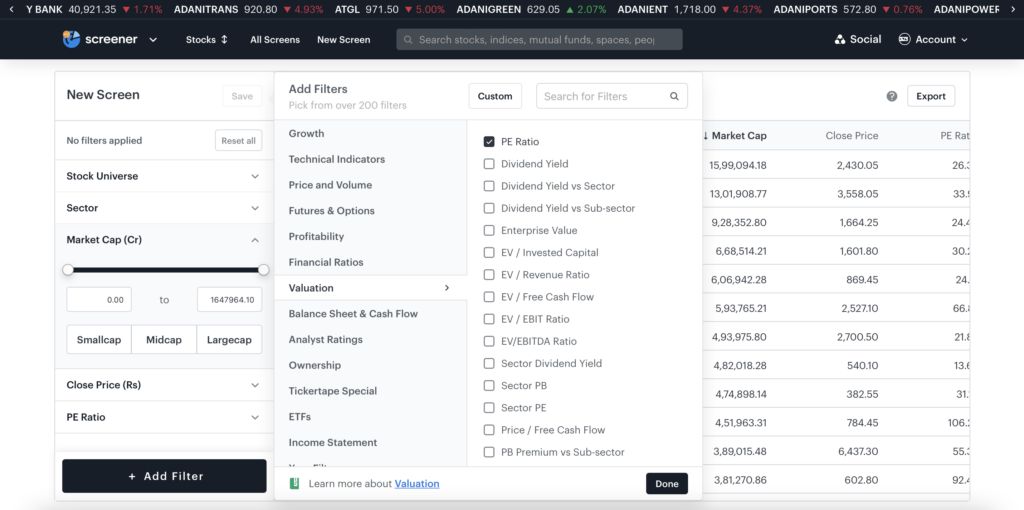

For a better valuation of stocks with key parameters, use Tickertape Stock Screener. You can use several valuation parameters like dividend yield, PE ratio, etc.

- Restricts companies

Companies might face unique financial transactions in the course of their business. Moreover, a few companies may have unique accounting needs. However, companies are restricted from exploring other accounting possibilities as they have to fit their transactions into the rules specified by the accounting standards.

Lastly, despite their limitations, accounting standards are widely accepted accounting rules.

How is Ind AS helpful for businesses?

In simple terms, Ind AS helps businesses with acceptability and readability, making them appealing to foreign investors. Additionally, the standardised norms help businesses carry out necessary changes in case adverse economic conditions arise.

Ind AS has streamlined methodologies, which avoids situations of monetary fraud. It helps ensure that the management of the companies does not manipulate or give a false account of the essential financial details of the company.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.