Last Updated on Feb 7, 2024 by Harshit Singh

Amidst the COVID-19 pandemic, several sectors encountered economic challenges, leading to a downturn, while specific industries experienced a surge in growth. As reported by the National Center for Biotechnology Information in their analysis of the impact of COVID-19 on the energy sector, the global oil market experienced a nearly 5% decline attributed to travel restrictions and shifts in work patterns. On a global scale, there was a decrease in nuclear energy output, and the demand for natural gas dropped by approximately 2%. In contrast, the market for renewable energy witnessed a 1.5% growth in the first quarter of 2020.

Investing solely in one sector can impact your portfolio if that specific industry experiences a downturn. Therefore, diversifying your investments can contribute to a more stable portfolio.

When we talk about diversification of portfolios, does that only mean diversification across different industries? Absolutely not!!

Diversifying your portfolio is about more than just spreading investments across different industries. It’s a smart strategy to minimize risk by investing in various types of assets and financial instruments.

When investors consider diversification, they often think of the traditional asset classes. This is because, historically, the unlisted share market was limited to institutional investors due to investment caps. However, this is no longer the case, as Precize has made investments in unlisted shares accessible to everyone.

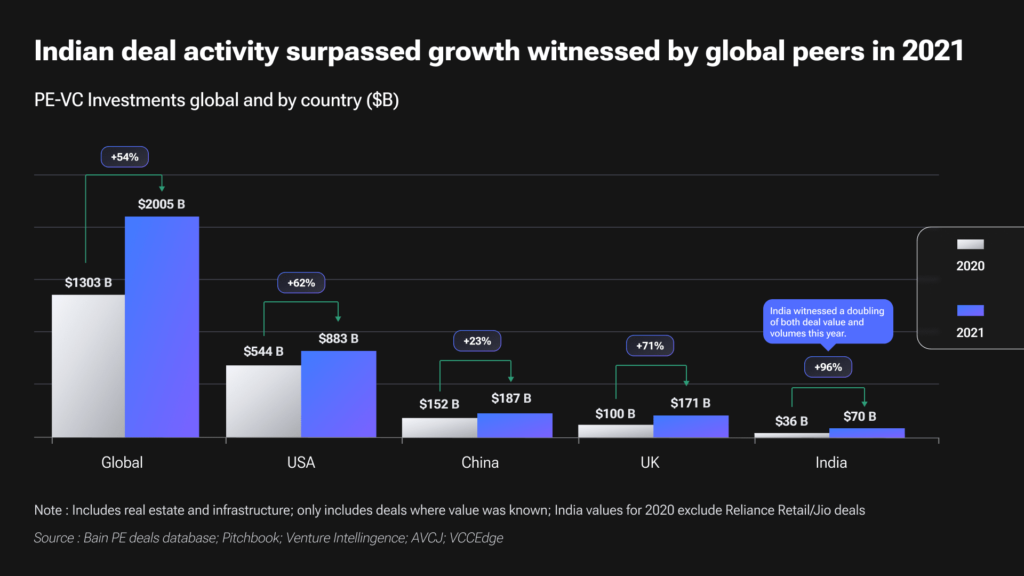

When we talk about diversification through unlisted shares, According to a report published by Bain & Company, investments in unlisted shares have shown growth over the year 2021.

In 2021, India witnessed significant private equity and venture capital investment growth, surpassing major economies such as China. Indian unlisted shares investments grew by an impressive 96% compared to 2020.

The year 2021 marked numerous achievements, including a notable increase in deal velocity, a fourfold rise in exit momentum totaling $36 billion, a substantial uptick in venture capital and growth equity reaching $38.5 billion, a fivefold expansion in buyouts deal value exceeding $16 billion, and successful IPO listings of emerging businesses like Zomato, Nykaa and Tata Technologies.

What diverted attention towards unlisted shares?

The success of unlisted company’s listings has drawn investors to the unlisted share market. Investing in pre-IPO shares offers the potential for a 100% IPO allotment, making it an attractive strategy for gaining early access to promising companies before they go public.

Talking about successful recent IPOs: Numerous companies, highlighted in the Listed vs Unlisted Shares blog, have effectively initiated IPOs.

But Is it the End of the Era? Definitely not!!

If you see the list below, multiple companies plan to launch their IPOs in the upcoming years.

Among these upcoming IPOs, the focal point of discussion revolves around the NSE.

According to an Article Published by the Times of India, there was a 20% surge in the unlisted share price of NSE.

The unlisted shares of the National Stock Exchange (NSE) surged over 20% in off-market transactions in the initial weeks of January, breaking a two-year sideways trend. Increased demand from wealthy and retail investors and a limited supply of shares contributed to the rise.NSE’s shares, trading at Rs 4449/share, rose from

3,232 in 2023. The surge is attributed to solid demand, unfulfilled selling commitments, and favorable market dynamics. Despite IPO uncertainties, NSE’s stock remained stable at around Rs 3,000 after a surge from Rs 1,700 to Rs 3,500 in 2023. Institutional investors have divested holdings, with Rs 1,860 crore worth of NSE shares exchanged at an average price of Rs 2,939 in the September quarter.

You can check the current share price of NSE unlisted share at Precize.in.

When discussing unlisted shares, it’s not just institutional investors; retail investors also prefer them, aiming for 100% IPO allotment and aligning their investments with long-term growth.

In conversation with a representative of Precize, they stated, “’We have streamlined investing into a simple 3-step procedure. Once you place your order, shares are swiftly transferred to your depository account within 24-48 business hours. Additionally, we boast a pool of buyers, facilitating easy liquidation at the current market price. Investing in unlisted companies presents challenges such as limited transparency and a longer timeframe for returns. Precize tackles these issues by raising awareness, ensuring universal access, and user privacy in unlisted share investments.”

Have you invested in your preferred unlisted shares, though?

Disclaimer: The material presented in this advertisement is for informational purposes only and should not be construed as investment advice or investment availability. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular unlisted share, security, strategy, or investment product. Investing in the private market and securities involves risks, including the potential loss of money, and past performance does not guarantee future results. Market trends, data interpretations, graph projections are provided for informational and illustrative purposes and may not reflect actual future performance. Nothing on this website should be construed as personalized investment advice or should not be treated as legal, financial, or any other form of advice. Precize is not liable for financial or any other form of loss incurred by the user or any affiliated party based on information provided herein.