Last Updated on Jan 15, 2024 by Harshit Singh

World Wide Waiter pioneered the world’s first-ever online food delivery service in northern California in 1995. When did it start in India? Astoundingly, we never had an online food delivery infrastructure till 2015. Next, when was the first smartphone built? IBM built the world’s first smartphone in 1992 and made it commercially available in 1994. When did the smartphone frenzy arrive in India? We got our first smartphone in 2009 from HTC. Lastly, when was the internet invented? 1983! And when did we get our access? 1995!

Let’s draw parallels between developments in the Unlisted Shares market at a global level and its growth in India.

Private capital in the US, primarily focused on startups, existed in the pre-1950s. In 1958, the Small Business Act marked the start of private buyouts, aided by government loans to venture capital firms.

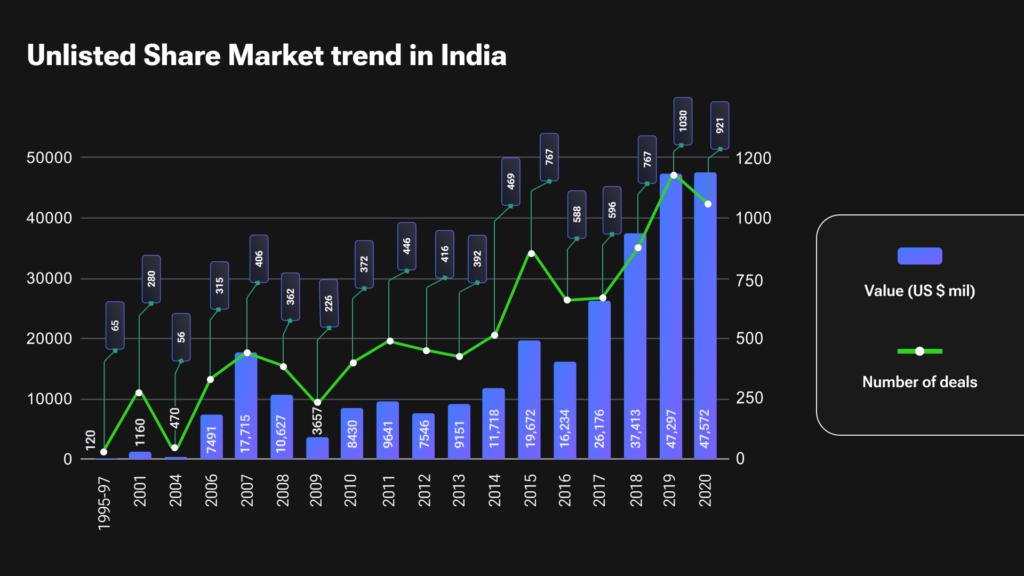

Meanwhile, India’s private equity began with foreign investments in the 1990s. Investments were made by foreign investors who were attracted by the country’s large market and low labour costs. Local participation grew in the early 2000s, reaching a peak in 2007-08. As the Indian economy grew and domestic companies became more successful, domestic investors also started to invest in private equity.

An article published by Paulina Likos, a former risk manager on the U.S. News & World Report, dated September 29, 2021, says that “For the past 15 years, Private equity markets posted stronger annualized returns at 14%, than public equity metrics such as the S&P 500, Russell 3000, and MSCI World, which posted 9.3%, 10%, and 7.2% returns, respectively”.

Similar is the Indian Unlisted Share market scenario, as the Unlisted Share capital has crossed the mark of $232.4 billion in 2020, as per a report published by E&Y.

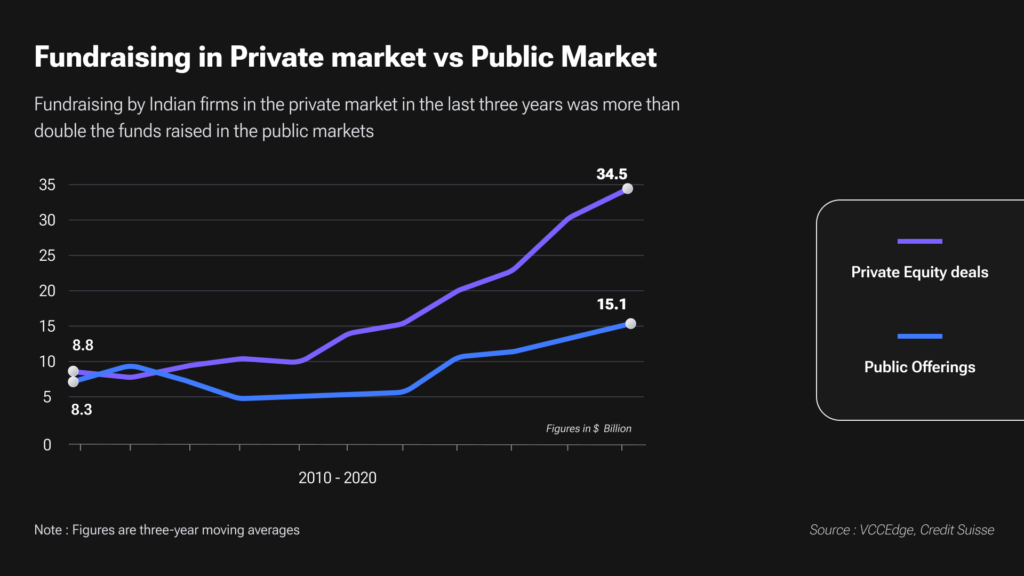

In addition, according to an article published by Livemint on March 30, 2021, “In the past three years, fundraising by Indian firms in the Unlisted Share market averaged $34.5 bn, more than double the $15.1 bn raised on average in the public markets.”

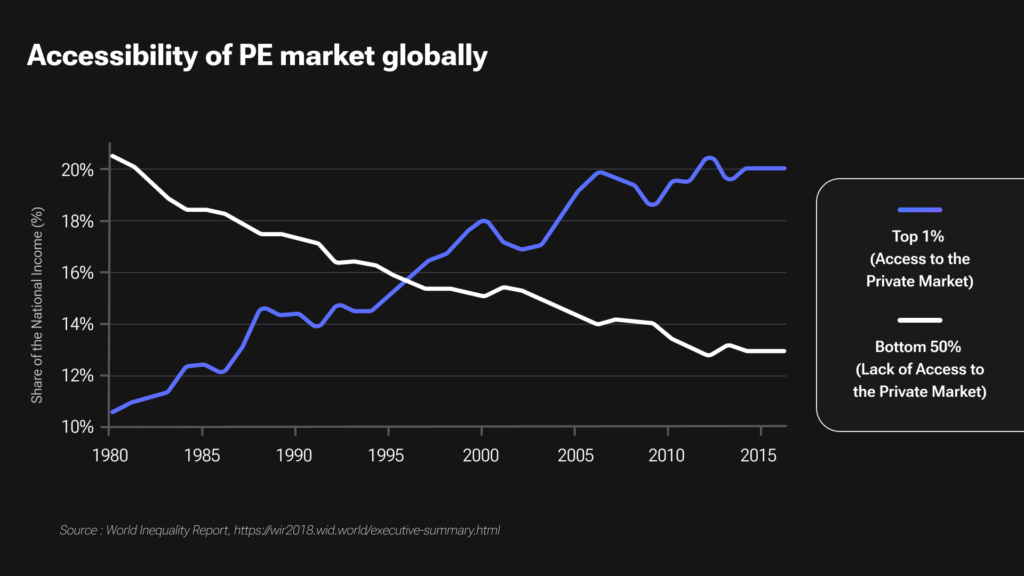

However, unlisted shares markets or private equity markets were explored less by retail clients; now, why is that?

There were entry barriers irrespective of being staged globally or domestically!

- Lack of avenue.

- Lack of information on the strategy of investing in Unlisted Shares.

- Lack of liquidity.

- High entry minimum investment amount. The minimum investable amount in any alternative fund in India is INR 1 Crore. At the global level, it ranges from $25 million to as low as $250,000.

In the past, private equity was reserved for institutional investors due to investment caps. However, Precize has revolutionised the market, making it accessible to retail investors with an entry point of just Rs.10,000. Talking about the recent success stories, Tata Tech stands out in the unlisted shares market. The IPO launch of Tata Technologies showcased a remarkable shift in share values, jumping from Rs.172.5/share (post-bonus and split) in 2021 to an impressive Rs.1,400/share on the first day of trading.

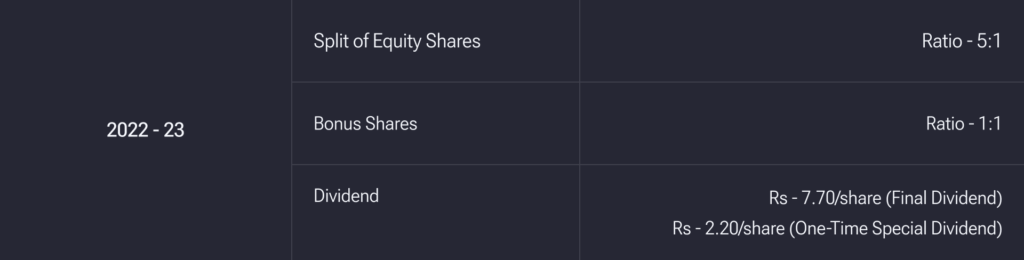

For those who invested in 2021, the returns amounted to a staggering 711%, highlighting the potential gains in this dynamic market. Additionally, Tata Technologies implemented strategic corporate actions, including bonuses, splits, and a substantial dividend (495% on face value), offering retail investors further opportunities for growth.

Investing in the pre-IPO phase entails early-stage commitments, holding them for years until the company goes public. This is vital as aligning with the company’s growth story directly impacts your portfolio growth. Typically, investors enter the pre-IPO space about 2-3 months before a company goes public. SEBI’s norms also mandate specific revenue and growth metrics for IPOs, making pre-IPO shares less prudent, especially if a company has already undergone substantial growth. However, this may not be advisable as the returns are significantly lower than long-term investments.

Linking back to ‘Precize,’ they have made investing and liquidity of unlisted shares within just 24 business hours, making it as easy as investing in the Listed Market. Investing in unlisted companies poses challenges like limited transparency and a lengthier time horizon for returns. Precize addresses these by raising awareness, ensuring universal access, and prioritising user privacy in pre-IPO share investments.

Explore more with Precize. It’s time to mark our profiles with a leader’s tag in the Unlisted Share market ecosystem.

Disclaimer: This information is for educational purposes only; it does not constitute financial advice. Readers are urged to conduct their due diligence before making any investment decisions.