Last Updated on Jul 21, 2023 by Vyshakh

Stock markets are risky but also rewarding for patient and diligent investors. As such, the success stories of celebrity investors like Rakesh Jhunjhunwala can be quite inspiring. Popularly known as ‘The Big Bull of India’, Jhunjhunwala was one of India’s well-known investors and traders. At the time of his demise, he had ~$4 bn worth of stocks. After his death, his wife, Rekha Jhunjhunwala, inherited the valuable portfolio. In this article, let’s look at his inspiring journey, struggles, and failures. Additionally, we’ll also scan Rakesh Jhunjhunwala and Associates’ portfolio in 2023.

Table of Contents

Who was Rakesh Jhunjhunwala?

Rakesh Jhunjhunwala was born in Mumbai to a Marwari family. He completed his Bachelor of Commerce from Sydenham College, University of Mumbai and later became a qualified Chartered Accountant. His is not a typical story of rags to riches but that of persistence and self-belief. Because of his acumen and success in the stock market, Jhunjhunwala is often called ‘India’s Warren Buffett’ and ‘Investor with the Midas Touch’.

The bull has sadly left the world before his time, very much at the peak of his prowess. His estate, including shares and property, will be bequeathed to his wife and three children. The famed investor was among the most influential market voices in Asia’s third-biggest economy. The ace investor has also given back to society via the Rakesh Jhunjhunwala Foundation, which backs causes like education and healthcare.

Rakesh Jhunjhunwala’s investment journey

Rakesh Jhunjhunwala started his journey in the stock market with only Rs. 5,000 in 1985 when the SENSEX, the Bombay Stock Exchange Index, was at 150; it now trades at ~52,863. He earned his first big profit back in 1986. He invested in 5,000 shares of Tata Tea, which, at that time, was trading at the price of Rs 43 per share. In 3 months, the share price rose to Rs. 143, giving him a profit of Rs. 5,00,000. Over the next 3 yrs, he earned a profit of over Rs. 20 lakh by trading in the stock market.

Jhunjhunwala’s investment company

Jhunjhunwala established his own stock trading firm – RARE Enterprises. The name is a combination of the initials of Rakesh Jhunjhunwala’s wife and his’.

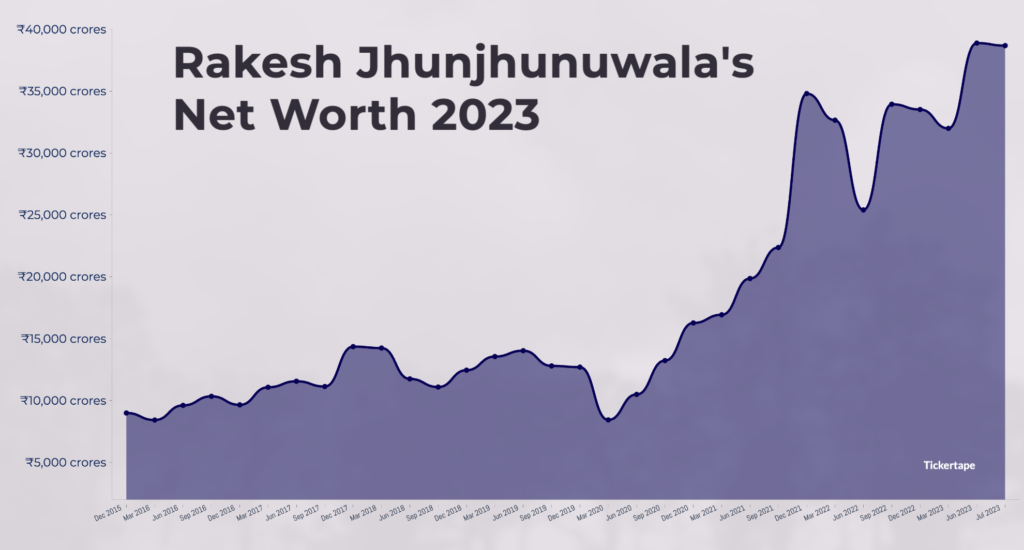

Rakesh Jhunjhunwala and Associates’ net worth trend

Rakesh Jhunjhunwala and Associates’ net worth is Rs. 38,687.90 cr. as of 20th July 2023. Following is the trend of their net worth over the last 5 yrs.

Rakesh Jhunjhunwala and Associates’ portfolio 2023

Below is the list of Rakesh Jhunjhunwala’s holdings as of the quarter ending June 2023.

| Stock name | Holding Value (Rs. in cr.) | June 2023 holdings in % | March 2023 holdings in % |

| Titan Company Ltd | 14,181.50 | 5.40% | 5.30% |

| Tata Communications Ltd | 840.1 | 1.80% | 1.80% |

| Canara Bank Ltd | 1,276.40 | 2.10% | 2.10% |

| Crisil Ltd | 1,561.70 | 5.50% | 5.50% |

| Fortis Healthcare Ltd | 1,123.00 | 4.50% | 4.50% |

| NCC Ltd | 1,142.70 | 13.10% | 13.10% |

| Tata Motors Ltd | 3,247.70 | 1.60% | 1.60% |

| Va Tech Wabag Ltd | 256.7 | 8.00% | 8.00% |

| Federal Bank Ltd | 993.3 | 3.50% | 3.50% |

| Star Health and Allied Insurance Company Ltd | 6,498.60 | 17.30% | 17.30% |

| Jubilant Ingrevia Ltd | 204.2 | 3.10% | 3.20% |

| Agro Tech Foods Ltd | 165.1 | 8.10% | 8.20% |

| Raghav Productivity Enhancers Ltd | 60.8 | 5.10% | 5.20% |

| Autoline Industries Ltd | 7.1 | 2.50% | 4.00% |

| Rallis India Ltd | 332.2 | 7.80% | 10.30% |

| Metro Brands Ltd | 2,759.30 | 9.60% | 14.40% |

| Prozone Intu Properties Ltd | – | – | 2.10% |

Of the above, there is no recent addition to Rakesh Jhunjhunwala and Associates’ portfolio June 2023. Further, the sell activities in Jhunjhunwala’s portfolio were seen in stocks of Jubilant Ingrevia Ltd, Agro Tech Foods Ltd, Raghav Productivity Enhancers Ltd, Autoline Industries Ltd, Rallis India Ltd, and Metro Brands Ltd.

In the quarter under review, Rakesh Jhunjhunwala and Associates sold Prozone Intu Properties Ltd.

Note: The data above may have minor discrepancies as not all companies may have reported their shareholding data.

Rakesh Jhunjhunwala and Associates’ Bulk and Block Deals in 2023

Bulk and block deals provide transparency and explain why stock volumes have increased or decreased. The disclosure of bulk and block sales can help evaluate which sectors are gaining traction and losing interest to buyers. It also directs individual investors’ future investment decisions.

For the quarter under review, no Bulk and Block deals can be seen for Rakesh Jhunjhunwala and Associates. You can use Tickertape’s Stock Deals tool to analyse Jhunjhunwala’s Bulk and Block Deals for a different time period.

Conclusion

Rakesh Jhunjhunwala has always been a passionate investor. He recognised the Indian economy’s potential for growth and did not hold back while taking risks. He has always been a source of inspiration for many investors. There are many bulls on Dalal Street, but Jhunjhunwala might turn out to be India’s last ‘Big Bull’.

Be it an old player or a new entrant, everyone is a fan and keen observer of Rakesh Jhunjhunwala’s trade strategies. However, it may be prudent to conduct your own research and find stocks that suit your risk capability rather than simply copying Rakesh Jhunjhunwala’s holdings. Speak to a financial advisor before investing.

- How To Withdraw Mutual Funds? - Jun 6, 2025

- Top Maternity Insurance With Low Waiting Periods - Jun 5, 2025

- ROE vs ROCE – What are the Differences? - Jun 5, 2025