Last Updated on May 5, 2023 by Anjali Chourasiya

They say – don’t put all your eggs in one basket when it comes to investing. Whether you’re a seasoned investor or just starting out, the key to minimising risk and maximising returns is diversification. By spreading your investments across different sectors or market caps, you can reduce the dependency on a single stock/sector/market cap to generate returns.

Although diversification may mean sacrificing some potential returns, it also reduces volatility and the risk of a bad outcome. In this article, we’ll dive into how to properly diversify your portfolio, how to identify red flags, how Tickertape can be your partner in mitigating risks and maximising returns effectively, and most importantly, how to strike a balance between diversification and concentration.

Additionally, we’ll explore five strategies for portfolio diversification and how to obtain perfect portfolio diversification using Tickertape’s flagship Diversification Score. So, whether you’re a seasoned investor or just starting out, we will learn how to invest confidently and minimise the impact of market fluctuations. But first, what is diversification, and why should we take this concept seriously while investing?

Table of Contents

So, what is portfolio diversification?

In simple terms, portfolio diversification is the practice of investing in various asset classes to reduce the overall risk of your portfolio. It is often regarded as an important concept to understand by marquee investors like Warren Buffet and Mohnish Pobrai. Proper diversification of your portfolio can help you harvest better risk-adjusted returns. By spreading investments across different sectors and geographies, investors can benefit from the growth potential of different regions and industries and are not impacted by sudden market movements and/or crashes of one company or even a sector.

As the old adage goes, never put all your eggs in one basket! The translation to that in Wall Street Language is portfolio diversification. But why should one bother?

Benefits of portfolio diversification

Diversification has a major role in protecting against market volatility by balancing risk across different asset classes. If one asset class experiences a downturn, the losses can be offset by the performance of other asset classes. They say the only constant is change, but in finance, the only constant is that markets are volatile. To combat this volatility, diversification is a good first choice employed by investors.

Now this can also translate into better gains as you have exposure towards several different market players in an industry or even several different asset classes in varying industries. This also encourages investors to get access to varying asset classes that might not have been in their purview and thus help conduct better research!

While diversification can bring a host of benefits to your investment portfolio, there is also such a thing as over-diversification. So what is over-diversification, and how can one strike a balance between diversification and concentration?

How diversified is too diversified?

The level of diversification needed for a portfolio can vary based on your investment goals, risk tolerance, and market conditions. While diversification can be beneficial, over-diversification can be counterproductive. Wondering how you can spot such a portfolio? Well…

Over-diversification occurs when an investor spreads their portfolio across too many different investments to the point where the potential benefits of diversification are outweighed by the drawbacks.

In simple terms, it’s like trying to juggle too many balls at once. When you start, juggling a few balls can be challenging, but it gets easier with practice. However, if you try to juggle too many balls, you may lose control and drop them all. Similarly, if you have too many investments in your portfolio, it can be challenging to manage, research and monitor all of them simultaneously while looking at other macro-economic factors of the market itself!

But how can you measure the over-diversification of your portfolio? How diversified is too diversified? You can simply use the Tickertape Diversification Score to not only check for that, but also compare your own portfolio to several other portfolios on the market. With this exclusive feature, you can quickly get a score from 1-100 on how well-diversified your portfolio is. A higher score indicates that your portfolio is less risky and more diversified, giving you peace of mind and confidence in your investment strategy. If your score falls below the community average, don’t worry – you can easily diversify further by adding stocks from other sectors or market caps.

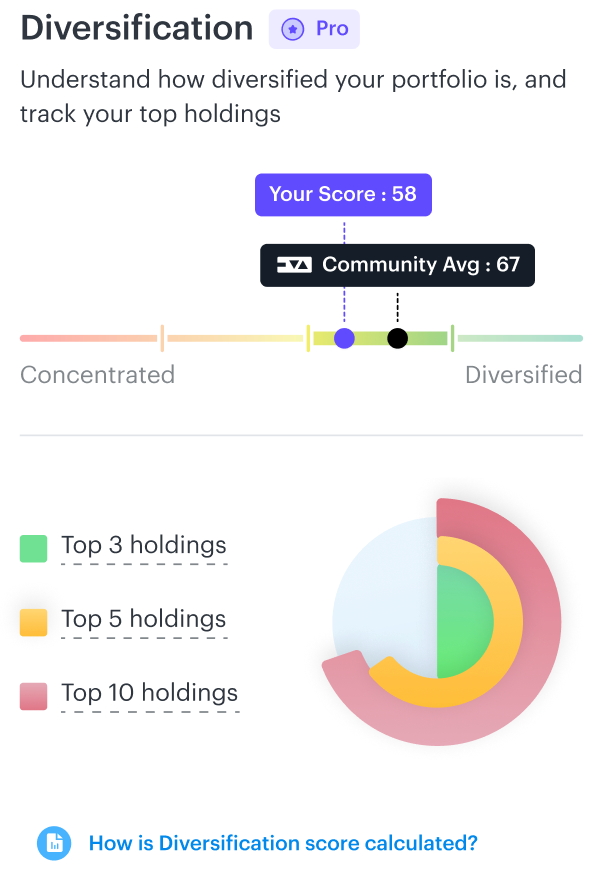

Ranging from 1 to 100, the higher the score, the closer you get to a perfectly diversified and less volatile portfolio. This is what it looks like on the Tickertape App.

The above image shows that the portfolio Diversification Score is 58, whereas the community average is 67. This indicates that there is scope to further diversify your portfolio by adding stocks of other sectors or market cap or letting go of stocks that are hampering the performance of your portfolio. So a lower score would warrant you to take some actions to diversify your portfolio more while a very high portfolio score might very well be an indication of being close to over-diversification.

Thus, the Diversification Score also helps investors identify areas of their portfolio that need improvement and determine which stocks to add to diversify further. Overall, the Diversification Score is a powerful community-requested tool that provides investors with valuable insights into their portfolios and helps them make informed and profitable investment decisions. You asked, and we delivered and are all ears on how we can improve this feature.

However, if you like to improve your portfolio manually, you should consider a tedious process involving but not limited to the following steps:

5 Strategies for portfolio diversification

- Determine the correlation between stocks

Simply owning various stocks doesn’t replicate portfolio diversification, especially if they all trend up and down together. Therefore, assess the correlation between different stocks and sectors and diversify accordingly.

- Diversify across the asset classes

Each asset class comes with its levels of risks and returns. Therefore, according to your risk appetite, you can invest across – stocks, mutual funds, ETFs, etc.

- Diversify within the sector

Suppose you’re interested in investing in green energy. In that case, you can diversify your portfolio by including stocks of IT companies that support the green energy revolution, as well as auto stocks in the EV sector and other relevant options.

- Regularly rebalance your portfolio

Every smallcase manager balances the smallcase portfolio to minimise risks and maximise returns. Similarly, you should rebalance your portfolio as it is essential to create a well-diversified portfolio. Rebalancing involves balancing the risks and rewards to maintain portfolio performance in fluctuating markets.

- Know your risk tolerance

The extent of diversification you need may vary based on your risk tolerance as it dictates the portfolio allocation. Aggressive investors allocate 90% to stocks and 10% to bonds, moderate investors 70% to stocks and 30% to bonds, while conservative investors may have a 50/50 balance between the two.

An additional way to guarantee a good risk-adjusted portfolio is to check for bad actors that might pull your returns down. These are called red-flags in a portfolio, and let’s look at how to identify these as well.

Secure your portfolio from red-flags

Now that you have understood the stocks you need to add/remove from your portfolio, how will you identify any potential red flags? Red flags can be early indicators of potential problems in a company, and by avoiding or selling the stocks with red flags, you can exponentially reduce your investment risk. But manually doing this for all stocks in a portfolio might be time-consuming and incomprehensive. But don’t fret, as this is now a feature that investors like you can use via Tickertape!

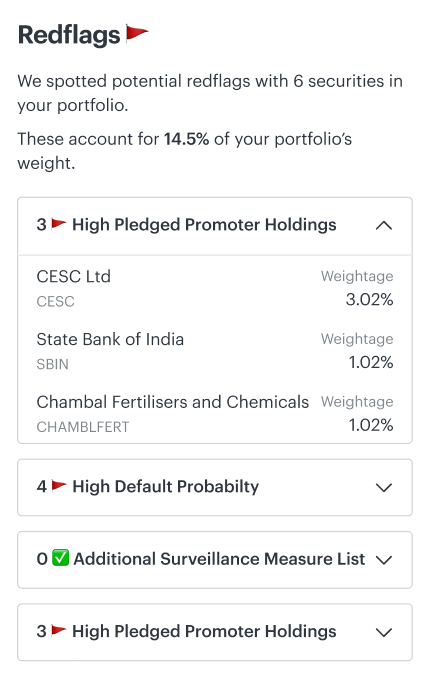

Tickertape Portfolio offers a comprehensive ‘Redflags’ section where you can easily check for stocks with red flags and make informed selling decisions. By collating all the red flags in one place, you can quickly identify and analyse the red flags in your portfolio, saving you time and helping you to make better investment decisions.

One of the red flags we have on Tickertape is whether a stock is included in the ASM and GSM list, which can give you an idea of the company’s financial health. Along with these two, there are two more red flags, all in one place in the Portfolio section, allowing you to do a comprehensive analysis easily.

Apart from ASM and GSM list red flags, you can also check for other potential issues, such as stocks with high promoter pledged holdings and a high probability of default. These are important red flags that you should pay attention to. Under the Redflags section, you can see individual stocks with exposure to these red flags and get their cumulative weightage in your portfolio. This way, you can easily identify the stocks that pose the most risk to your portfolio.

Let’s look at an example.

In the above image, you can see that 6 stocks, accounting for 14.5% of the portfolio, have red flags. By clicking on each red flag, you can see the individual stocks that have issues and make informed selling decisions.

Once you invest and have a vibrant portfolio ready, monitoring its performance becomes key to earning good returns. However, portfolio analysis is more than just a function of tracking the performance of investments but continually analysing them to take the right buying/selling decision.

Investing doesn’t have to be boring. And we are here to make sure to give you the industry-best services that not only make investing a fruitful experience but also fun! Take a step towards diversifying your portfolio with zero red flags. Explore the Tickertape Portfolio now!

In summary, portfolio diversification is a strategy that aims to reduce risk by investing in various asset classes. By spreading investments across different sectors and geographies, investors can benefit from the growth potential of different regions and industries and are not impacted by sudden market movements and crashes of a single company or sector. While diversification can bring a host of benefits to your investment portfolio, there is also such a thing as over-diversification, where the potential benefits of diversification are outweighed by the drawbacks.

To strike a balance between diversification and concentration, investors can use Tickertape’s Diversification Score, a powerful tool that provides insights into their portfolios and helps them make informed and profitable investment decisions. The Diversification Score ranges from 1 to 100, and the higher the score, the closer the portfolio is to being perfectly diversified and less volatile. If the score is too low, investors can further diversify their portfolios by adding stocks from other sectors or market caps. Overall, proper diversification can help investors achieve better risk-adjusted returns and protect against market volatility. It sure helps to mitigate red flags too!

- How To Withdraw Mutual Funds? - Jun 6, 2025

- Top Maternity Insurance With Low Waiting Periods - Jun 5, 2025

- ROE vs ROCE – What are the Differences? - Jun 5, 2025