Last Updated on Apr 27, 2021 by Manonmayi

You will not find any shares listed as “multibagger” in the stock market. Multibagger stocks are equity (usually smallcap stocks) that entail returns that are far higher than the amount invested in them. Peter Lynch, in his book, ‘One Up on Wall Street’ coined the term.

Companies issue these shares with high potential and a stringent management team overlooking their performance. But stocks often become multibaggers because of investors’ huge expectations, even when they lack such potential.

“When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever.” – Warren Buffett.

This article covers:

- Myths around multibagger investing

- Will all the penny stocks become ‘multibagger’ in the future?

- Mistakes investors make while picking multibagger stocks

Table of Contents

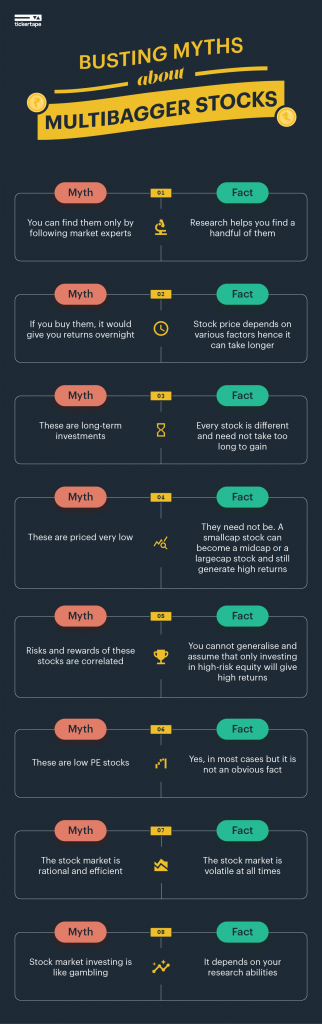

Myths around multibagger investing

Because of their high returns, people often associate a bunch of myths around them. Remember how everyone believed the new Rs 2,000 notes had tracking chips implanted? Multibagger stocks, too, suffer from a list of such absurdities. Here are some myths surrounding multibagger stocks.

- Myth – You can only find them by following market experts

Fact – If you can research, you can find a handful of them - Myth – If you buy a stock, it would give you returns overnight

Fact – The stock price depends on a lot of factors. It is not that simple - Myth – These are long-term investments

Fact – Not every stock takes time to gain - Myth – These are priced very low

Fact – A mediocre company can revamp and turn itself into a largecap stock too - Myth – Risks and rewards of such stocks are correlated

Fact – As mentioned earlier, stock pricing depends on a lot of factors. You cannot generalize and assume that you will get high returns only when you invest in a high-risk equity - Myth – These are low PE stocks

Fact – In most cases, yes. But it is not the writing on the wall - Myth – The stock market is rational and efficient

Fact – The stock market is volatile throughout - Myth – People say that stock market investing is like gambling

Fact – Not at all. It depends on your research abilities

Most multibagger stocks are just launched in the market and are from companies with a strong base and the ability to scale with ease. But it is not by chance. The presence of a trained and dedicated management team, an abundance of resources, and coordination between production and supply chain has helped them achieve the tag of being a ‘multibagger.’

Will all the penny stocks become ‘multibagger’ in the future?

You saw Sachin Ramesh Tendulkar making it to the Indian team at the age of 16. Every cricket fanatic knows him by the name ‘Master Blaster’ and is fondly called the ‘God of Cricket.’ There was another contemporary that rose the ranks with him – Vinod Kambli. But how many people remember him? It answers the question you have about multibagger stocks.

If you look in the past, you will come across several big honchos of today, such as Titan, JSW Steel, and more, who started small and have made a name for themselves. But the chance of smallcap stocks making it big is minute, and you should be very careful before taking the plunge. We have seen hundreds and hundreds of penny stocks that sank as quickly as they rose.

Mistakes investors make while picking multibagger stocks

Every investor invests for returns, but it is imperative to be cautious while undertaking your endeavours. Unfortunately, many investors, in a bid to pick up multibagger stocks, end up picking an array of equities that bear minimal returns and get discouraged.

Here are some common mistakes that people commit while picking multibagger stocks –

1. Succumbing to herd mentality

There would always be people who think of themselves as stock market experts but are far from it. Given their soaring confidence levels, many investors tend to fall victim to their recommendations and end up losing money. You can instead use Tickertape’s screener to filter the most relevant stocks and conduct an in-depth analysis on them after that.

2. Investing at high PE multiples

A high PE ratio is an indicator of overvalued stock. If you are pocketing equity at 50 times PE, it means you are paying 50 times what the company earned in the preceding 12 months. It means that it would take over 50 years for you to get back whatever you invest today. Not many stocks can justify such an exorbitant price.

3. Discontinuing monitoring of key indicators

It is often familiar with rookie investors. If you want to earn in the stock market and especially want to make big money, you need to monitor the stock and gauge if it behaves the way you anticipated. It includes looking into the investment thesis and other vital indicators.

4. Holding for too long or holding on to losers

Sometimes, equities behave like bitcoins and other cryptocurrencies. If it is trading low, it means that it has lost customer trust. If it performs poorly over time, it is imperative to liquidate your investment and invest in a better option. But most investors, in a bid to make it big, prefer holding on to stocks as they are unwilling to lose some money.

5. Making risky bets without enough research backing them

Investors often indulge in massive speculative bids to earn cash quickly. Such transactions carry high risk and are not suggested for those unwilling to research. We often come across stocks that people get excited over for no reason, and investors end up piling their losses because of them.

Finding a multibagger stock is no easy job. It requires a lot of research and the ability to resist the urge to sell. If you want to earn big, you should be willing to wait till the time is right. At Tickertape, we understand how difficult it can be for you. To make things more effortless, we have a plethora of smart tools, such as Stock Screener, Asset Pages for various investments such as Stocks, Mutual Funds, and ETFs. You can use them to grab critical insights and make more informed investment decisions. Explore Tickertape.