Last Updated on Mar 24, 2021 by Manonmayi

On 1st Jun 2020, Moody’s Investors Services, a global credit rating company downgraded India’s sovereign rating to Baa3. Previously, Moody’s had upgraded the rating in Nov 2017 from Baa3 to “Baa2” with “stable” outlook. What do these terms mean? Here’s all you need to know about Moody’s credit rating.

The article covers

How does Moody’s rating help investors?

Why the downgrade in Moody’s India’s rating?

Reasons for downgrade in Moody’s India rating

What does negative outlook tell about India?

Is an upgrade in Moody’s India rating likely soon?

Introduction to Moody’s

When a lender offers a loan, they expect it back, in full and on time. So, before approving a loan, they check the borrowers’ credit score and report to gauge their willingness and ability to repay the loan. If the individual has a good credit score and clean credit history, the lender happily sanctions a loan. If not, they reject it or may offer unfavourable terms of the loan.

You see how credit score helps lenders dodge the risk of default on a loan? Similarly, governments and corporates also get credit ratings from rating agencies such as Moody’s.

Moody’s Investors Service and its ratings

Moody’s aka Moody’s Investors Service is one of the global Big Three credit rating agencies, Standard & Poor’s and Fitch Group being the other two. As a credit rating agency, Moody’s ranks the creditworthiness or credit health of the issuers of financial instruments or borrowers.

Creditworthiness suggests the ability of an organisation or individual to repay the funds that it borrows. It is ascertained based on the borrower’s credit behaviour in the past. Moody’s ranks borrowers based on a standardised rating scale that measures the extent to which the borrower may default on repayment and so the investor or lender or subscriber to the instrument may lose their capital in such cases.

Additionally, Moody’s also monitors the activities of the concerned party regularly so as to change its rating if viable. In a way, Moody’s offers investors financial research on the securities issued by government and commercial entities.

What does Moody’s Investors Service rate?

1. Debt securities issued by government, municipal, and corporates

2. Money market funds

3. Fixed income funds

4. Banks and NBFCs

Moody’s credit ratings

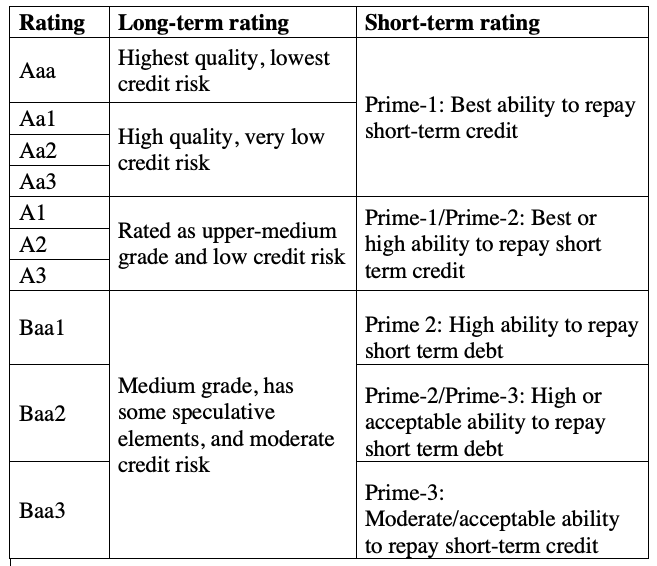

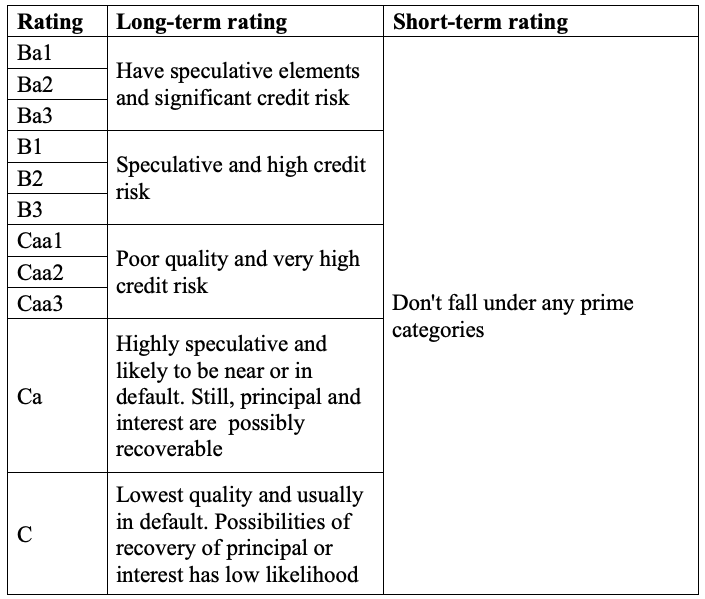

As mentioned before, Moody’s rates securities based on a standardised rating scale that ranges from Aaa to C. While Aaa is the highest rating, C is the lowest.

Investment grade

Speculative grade

How does Moody’s rating help investors?

Since Moody’s rating is based on comprehensive financial analysis of the concerned party, it helps investors and market participants to assess the risk involved in investing in securities.

Why the downgrade in Moody’s India rating?

Though Moody’s downgraded India’s rating during the coronavirus pandemic, the move itself was not triggered by the impact of COVID-19. In contrast, Moody’s downgraded India’s rating mainly because of the prolonged low growth of the economy compared to the country’s debt affordability.

In addition to India’s debt security, Moody’s has also downgraded:

- The country’s local-currency senior unsecured rating to Baa3

- The country’s short-term local-currency rating from to P-3

What does Moody’s India rating Baa3 signify?

‘Baa3’ is a level above ‘junk’, meaning India’s debt securities are still investment-worthy. The rating reflects Moody’s opinion that India’s chances of non-repayment of funds that it has borrowed have increased. The risk of non-repayment discourages foreign investors from investing in India and thus drive away funds we could use for development purposes. Besides, a higher risk also means that Indian governments and corporates would now have to pay a higher rate of interest to acquire funds.

Reasons for downgrade in Moody’s India rating

Moody’s Investors Service cited the following factors for the downgrade in India’s rating:

- Ineffective implementation of economic reforms since 2017

- Prolonged economic slowdown

- Significant deterioration in state and central governments’ fiscal position

- Stress in the financial sector and high debt burden

Notably, India’s fiscal deficit for FY 19-20 widened to 4.59% of GDP from the targeted 3.8%, meaning our debt burden actually surpassed the projection. To add to it, loans offered as part of the Rs 20 lakh crore economic package can also pose a threat to the financial sector if they turn bad.

What does negative outlook tell about India?

Moody’s had changed its India outlook from “stable” to “negative” in Nov 2019 for the same reasons for downgrade in rating, which are discussed later. Since Moody’s didn’t see significant developments, it maintained India outlook of “negative”. A “negative” outlook reflects Moody’s opinion that the current risks in the economy and financial system could get worse in the coming days. It also tells that there may be another downgrade on the cards.

Is an upgrade in Moody’s India rating likely soon?

Well, Moody’s Investors Service revealed that an upgrade back to stable is unlikely, and only it will only be considered if effective policy implementation pushes the GDP rate higher than projected.