Last Updated on Jul 27, 2023 by Vyshakh

Mohnish Pabrai is a well-known personality in the world of the stock market. He is not just famous for his profitable investment portfolio and high net worth but also for spending US$ 6,50,000 to have lunch with his mentor Warren Buffett. Read below to learn more about Mohnish Pabrai’s portfolio, net worth, and more.

Table of Contents

About Mohnish Pabrai

Mohnish Pabrai was born in India in 1964. Later he moved to the USA to study software engineering but later shifted to international marketing as a part of his uncharted career. This benefitted him as he started learning about how business works globally. Since then Mohnish started converting every experience into learning.

In 1991, Mohnish Pabrai launched his IT consulting firm TransTech Inc., which eventually was sold to Kurt Salmon Associates in 2000 for US$ 20 mn. In 1999, he launched Pabrai Investment Funds to invest in undervalued stocks. The company comes under the hedge funds category, which is along the lines of the Buffett Partnership. Pabrai Investment Funds quickly grew to earn him serious profits and made him popular in the stock market.

During the dot com development era, he realised that some non-tech stocks were priced relatively cheap and that some firms offered quite low valuations compared to their sales or prospects. He predicted these companies to have quite a bright future. All of his experience and this knowledge helped him make smart calls in the stock market actively.

Mohnish Pabrai portfolio 2023

As of June 2023, Mohnish Pabrai’s portfolio consists of three stocks. His portfolio is as follows:

| Stock name | Holding Value (Rs. in cr.) | June 2023 holdings in % | March 2023 holdings in % | December 2022 holdings in % |

| Edelweiss Financial Services Ltd | 344.10 | 7.60 | 7.00 | 6.70 |

| Rain Industries Ltd | 489.70 | 8.80 | 8.80 | 8.80 |

| Sunteck Realty Ltd | 368.80 | 6.70 | 6.70 | 6.70 |

Mohnish Pabrai’s India portfolio holdings analysis

Edelweiss Financial Services Ltd

It is one of the well-known investment and financial services companies in India. Mohnish Pabrai has increased his stake in this company by 0.60% in the quarter ending June 2023. The investment is worth Rs. 344.10 cr.

Rain Industries Ltd

It is one of the world’s largest coal tar pitch and petroleum coke producing companies. Rain Industries is the first-largest stock investment in Mohnish Pabrai’s India portfolio. In Q1 FY 2024, Pabrai neither bought the stock nor sold it. His total investment in Rain Industries Ltd is worth Rs. 482.70 cr., the largest investment in his portfolio.

Sunteck Realty Ltd

This has been one of the significant investments of Pabrai to date. In Q1 FY 2023, Pabrai maintained his at 6.70% in Sunteck Realty Ltd. The investment is now worth Rs. 368.80 cr. Currently, Sunteck Realty happens to be the second-largest equity investment in his portfolio.

Note: The details on Mohnish Pabrai’s portfolio holdings here, are, as per the information provided by the exchanges. For the latest quarter, results might not be available for some companies as they may file them later on.

Mohnish Pabrai’s net worth

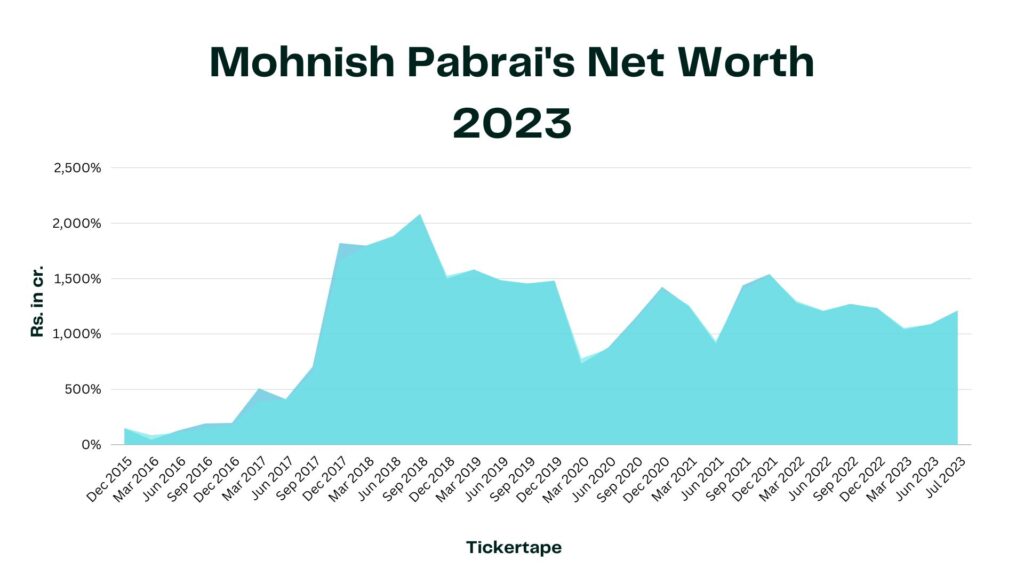

As of June 2023, the net worth of Mohnish Pabrai is Rs. 1,202.7 cr. From the above chart, you can see that there have been several ups and downs in Pabrai’s net worth since 2016. The first major dip was 86% in 2016 after which his net worth moved north. Pabrai’s portfolio declined again in 2020 by 47% and by 25% in 2021.

What does the portfolio reveal about the investment strategy?

Though Mohnish Pabrai’s portfolio in India includes only three stocks, they are well-established companies with sound management that are performing well in the market. He has either maintained or increased his stake in these companies. Mohnish’s investment portfolio reveals that he makes wise decisions only after analysing the company’s data.

He gives an investment tip in his book, The Dhandho Investor, that low-risk stocks have the potential to provide high returns even if there is uncertainty involved.

Mohnish Pabrai’s Bulk and Block Deals in 2023

As of Q1 FY 2024, there are no bulk and block deals in Mohnish Pabrai’s portfolio. To keep a track of bulk and block deals, you can use Tickertape’s Stock Deals. The tool allows you to analyse big investors’ bulk and block deals for a time period, reflecting their outlook on a particular stock.

Mohnish Pabrai books

The Dhandho Investor by Mohnish Pabrai

Mohnish Pabrai is inspired by Warren Buffett’s style of investments. He wrote a book on his investment style: “The Dhandho Investor”. Here are a few key investment learnings from his book.

- Make sure to invest in existing established businesses.

- Try acquiring shares from simple businesses, i.e., where the flow of change is very low.

- Find shares in companies or industries with durable moats.

- Buy businesses with a helpful margin of safety.

- Understand when to sell and by what margin.

Mosaic – Perspectives on Investing

Mosaic – Perspectives on Investing is a collection of 26 essays published by Mohnish Pabrai between 2001 and 2004. The essays simplify the art of value investing look.

Conclusion

Investing in the stock market is not a piece of cake. A deep understanding of the subject is required. Successful investors like Mohnish Pabrai can teach several things through their investment portfolios. You can use Blog by Tickertape to expand your knowledge horizon about investing and utilise Tickertape’s Stock Screener tool to screen top stocks based on your requirements.

FAQs

1. How many books did Mohnish Pabrai write?

Mohnish Pabrai wrote two books. One is The Dhandho Investor: The Low-Risk Value Method to High Returns and the other one is Mosaic: Perspectives on Investing.

2. Are there any philanthropic activities done by Mohnish Pabrai?

Mohnish Pabrai established the Dakshana Foundation in 2005. Though the initial goal of this foundation was to reduce poverty in India, later they started offering tutoring services to the less-privileged students in India and help them attend elite institutions for higher education.

3. Is Mohnish Pabrai involved in any philanthropic activities?

Mohnish Pabrai established the Dakshana Foundation in 2005. Though the initial goal of this foundation was to reduce poverty in India, later they started offering tutoring services to the less-privileged students in India and helping them attend elite institutions for higher education.

4. What stocks does Mohnish Pabrai own?

As of June 2023, Mohnish Pabrai owns stocks in three companies. They are – Rain Industries Ltd, Sunteck Realty Ltd and Edelweiss Financial Services Ltd

- How To Withdraw Mutual Funds? - Jun 6, 2025

- Top Maternity Insurance With Low Waiting Periods - Jun 5, 2025

- ROE vs ROCE – What are the Differences? - Jun 5, 2025