Last Updated on Jun 8, 2023 by Anjali Chourasiya

Investing in the stock market can give you two types of returns. The first is the capital appreciation that you get when the value of the stock rises. The second is the dividend income that many companies issue as a kind of reward to shareholders from the profits the company makes during the financial year. Dividends can create an additional source of income and give you liquid funds if you don’t want to redeem your stockholding. But how do you identify dividend-yielding stocks? How can you establish an alternate source of income from dividends? Let’s find out!

Table of Contents

What are dividends?

When a listed company makes a profit in a financial year, they’re most likely to:

- Retain the entire profit and use it for business expansion, growth, or for meeting the cash flow requirements.

- Distribute the entire profit among its shareholders.

- Retain a certain portion of the profit for business use and the rest distributed among its shareholders.

In the second and third cases, the profit is distributed by the company, fully or partly, in the form of dividends.

So, dividends are part of the profit that shareholders earn on their shares for being part owners of the company. Dividends can be paid in cash, stock, or other forms. Companies declare dividends at their board meetings, and the shareholders’ approval is a must for dividend declaration.

How to earn dividends?

When you invest in the stock, you automatically become eligible to receive the dividends announced by the company. The amount you get is generally pegged to the number of shares you hold.

The dividend yield is a commonly used parameter by investors to identify profitable and dividend-yielding companies in the stock market. Let’s explore the concept of dividend yield in detail –

Dividend yield – the concept and its calculation

The dividend yield is a ratio that measures the dividend that a company pays vis-à-vis its share price. The formula is expressed in percentages.

Dividend yield = (Dividend per share/market price per share) * 100

For example, say, a stock valued at Rs. 150 per unit pays a dividend of Rs. 10. Then, the dividend yield of the company would be:

(Rs. 10/Rs. 150) * 100 = 6.67%

A higher dividend yield percentage reflects the company’s ability to pay high dividends to its shareholders.

Identify high dividend-yielding stocks on Tickertape

If you want to get regular dividend income from your investments besides capital appreciation, you should look to invest in stocks with a high dividend yield.

But how do you find such stocks?

Through Tickertape’s Stock Screener, how else!

Tickertape offers an online Stock Screener where you can find the stocks using 200+ filters. If you want dividend-yielding stocks, you can select the relevant filters on Tickertape’s Stock Screener and get a list of the best dividend stocks in India. The process is quick, simple, and gives you accurate results. Let us show you how you can get high dividend yield stocks in under 1 minute.

How to use Tickertape’s Stock Screener to find high dividend-yield stocks?

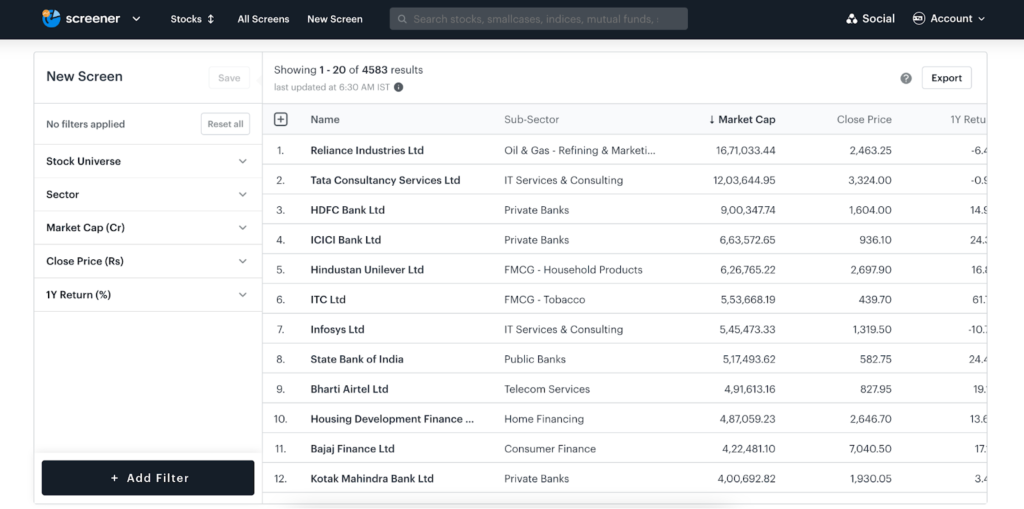

Step 1: Go to the screener.

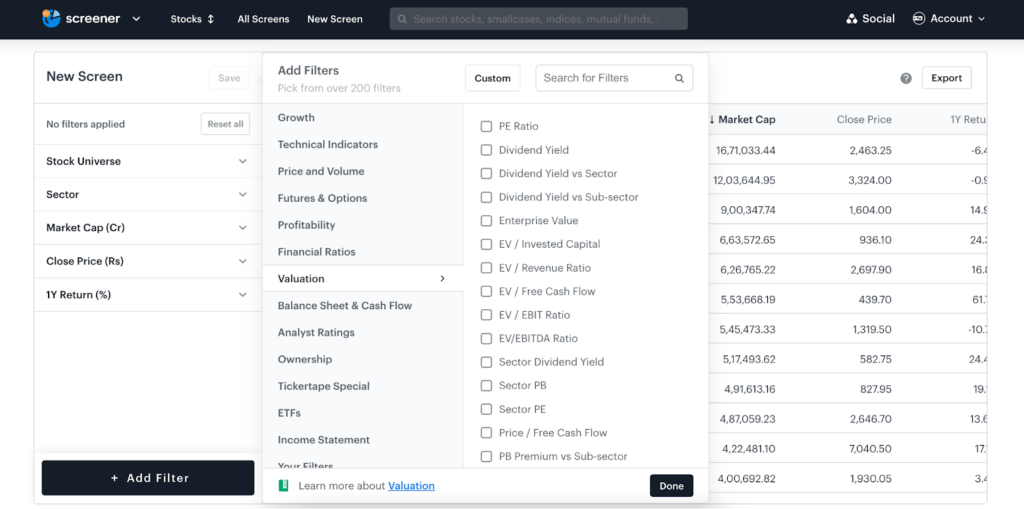

Step 2: In the filters panel on the left-hand side of the screen, choose ‘+ Add Filter‘ and go to ‘Valuation.’

Step 3: In the ‘Valuation’ filter, you would find different options. Choose ‘Dividend Yield’ and click on ‘Done.’

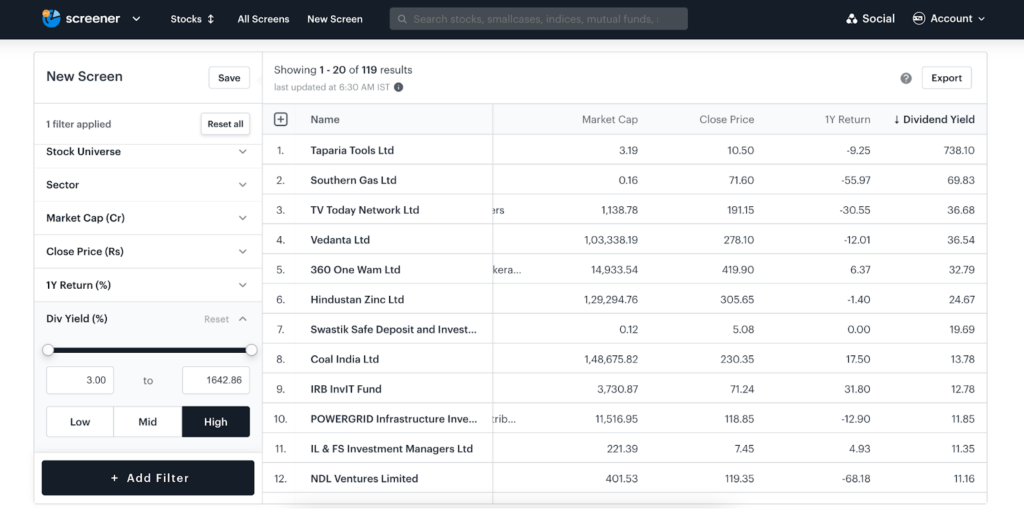

Step 4: Then, set the dividend yield filter to ‘High,’ and you would get a list of stocks with the highest dividend yield.

Let’s look at the top 10 best dividend-paying stocks in India as of 1st June 2023.

| Name | Sub-Sector | Market Cap (Rs. in cr.) | Close Price (Rs.) | Dividend Yield (%) | 1Y Return (%) |

| Taparia Tools Ltd | Industrial Machinery | 3.19 | 10.50 | 738.10 | -9.25 |

| Southern Gas Ltd | Gas Distribution | 0.16 | 71.60 | 69.83 | -55.97 |

| TV Today Network Ltd | TV Channels & Broadcasters | 1,138.78 | 190.85 | 36.68 | -29.26 |

| Vedanta Ltd | Metals – Diversified | 1,03,338.19 | 278.30 | 36.54 | -13.28 |

| 360 One Wam Ltd | Investment Banking & Brokerage | 14,933.54 | 418.50 | 32.79 | 6.87 |

| Hindustan Zinc Ltd | Mining – Diversified | 1,29,294.76 | 306.00 | 24.67 | 1.68 |

| Swastik Safe Deposit and Investments Ltd | Diversified Financials | 0.12 | 5.08 | 19.69 | 0.00 |

| Coal India Ltd | Mining – Coal | 1,48,675.82 | 241.25 | 13.78 | 25.06 |

| IRB InvIT Fund | Roads | 3,730.87 | 71.49 | 12.78 | 31.90 |

| POWERGRID Infrastructure Investment Trust | Power Transmission & Distribution | 11,516.95 | 117.09 | 11.85 | -13.05 |

But wait, there’s more! You can customise your search with several filters. Let’s look at how.

Customising your search for dividend stocks

If you want to further narrow down dividend stocks based on other parameters such as market capitalisation, the index they belong to, sector, and more, simply choose relevant filters from those available in the panel, and you are all set. For instance, if you need to find large-cap or mid-cap companies with a high dividend yield, you can change the market capitalisation and find relevant stocks. Some of the common filters include:

- Market capitalisation – large-cap, midcap, and small-cap stocks

- Index – Nifty 50, Nifty 100, and the like

- Sectors – pharma, banking, energy, healthcare, and the like

- P/E ratio

- Debt to equity ratio

- Profitability of the stocks

- Technical indicators

Benefits and risks of high dividend-yielding stocks

Dividend-yielding stocks have both pros and cons. Have a look:

Benefits of stocks yielding high dividends:

- It is a good indication of a company’s financial stability. A company with a soundtrack of dividend payments has sufficient profitability. It also shows that the company is sustainable and its stock can give good returns over time.

- Dividend-paying companies usually enjoy goodwill in the market and are established. As such, their stocks have lower short-term volatilities compared to companies with limited profitability.

- Dividend income creates a source of supplemental income for investors, which can be used to enhance the stock portfolio.

Risks in stocks yielding high dividends:

- The dividend amount and yield are not guaranteed. It depends on the profitability and the dividend policy of the company. The company might cut down its dividends in the future. As such, a high dividend yield in the past does not guarantee the same in the future.

- In case the company cuts down on dividends, it might lose investor confidence. This might make the stock prices depreciate, which is a double whammy for investors.

- Dividend income is taxable in the hands of investors. As such, even if you earn a dividend, you have to pay tax on the same at your tax slab rates.

- The dividend yield of different sectors varies. One sector can give very high dividends while the other might not despite having profitable companies.

Should you invest in high dividend-yielding stocks?

While investing in dividend-yielding stocks is a good idea, you should expand your search. Don’t only look at the dividend history of a stock. Delve into other factors like the EBITDA, debt-to-equity ratio, and market capitalisation, and then make an informed choice. Even if you want attractive dividends, the dividend yield should not be the only deciding parameter when selecting stocks. Do broader research and check the company’s financial and technical stability to make your choice.

A little research and you can build yourself a profitable portfolio!

FAQs

What are good dividend-paying stocks?

Dividend-paying stocks refer to the companies that pay dividends to their shareholders. To identify good dividend-paying stocks, use the filter ‘Dividend Yield’ on Tickertape Stock Screener, and set its value to high. You will get your list of high dividend-paying stocks in under 1 minute.

Is it mandatory for a company to pay dividends?

No, it is never mandatory for any company to pay dividends. It is a voluntary choice made by the company and its board of directors to pay dividends.

What are the top high dividend yield stocks in India?

Based on dividend yield, the below-mentioned are the top dividend yield stocks in India. –

1. Taparia Tools Ltd

2. Southern Gas Ltd

3. TV Today Network Ltd

4. Vedanta Ltd

5. 360 One Wam Ltd

6. Hindustan Zinc Ltd

7. Swastik Safe Deposit and Investments Ltd

8. Coal India Ltd

9. IRB InvIT Fund

10. POWERGRID Infrastructure Investment Trust

To get your customised list of high dividend-paying stocks, choose from the 200+ filters available on Tickertape Stock Screener.

- Best Mutual Funds for Passive Investors (2025) - Dec 9, 2024

- List of Stocks With RSI Below 30 in India - Dec 9, 2024

- 10 Highest Dividend Paying Stocks in Nifty 50 NSE India - Dec 9, 2024