Evaluating stocks

All the ratios & metrics you need

ROCE

Return on capital employed (ROCE) is a financial ratio that measures a company’s profitability and the efficiency with which it uses capital. Return on capital employed is calculated by dividing net operating profit, or earnings before interest and taxes (EBIT), by employed capital (ie total assets minus total current liabilities for the most recent financial year). A good ROCE signals that the company is healthy and its resources are properly managed.

1Y Max Loss

Indicates the maximum fall in the value of the investment over the previous 1 year; In simple terms, it is the % return an investor would have made if they would have bought a stock at the highest price point and sold and the lowest price point in the past year. It gives investors an idea of the worst-case return if they decide to invest in a particular stock. Also known as maximum drawdown, the calculation of this metric is not as straightforward as the % difference between the 52 week high and low. Since the low could be before the high, that might not necessarily be your worst return, rather the % difference between 52 week high and the lowest point occurring after it would be your max loss.

Simple Moving Average

A simple moving average (SMA) is just what it sounds like, simply an average of the closing prices in a particular date range. For instance, a 10D SMA means the average of all closing prices from today to 10 days ago. It is primarily a technical indicator more relevant for traders. Comparing average closing prices of different stocks doesn’t tell much, since the absolute stock price can be anything, and irrelevant to how good the company is at its core. However, since closing prices change daily, it can cause unnecessary noise in price-specific ratios like P/E, P/S, etc. To avoid this, users can implement smoothened out ratios like (50D SMA)/E rather than just P/E as custom filters.

We have added 10, 50, 100, and 200 day SMAs as screener filters

Exponential Moving Average

An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period.

The following formula is used to calculate the current EMA:

EMA = Closing price x multiplier + EMA (previous day) x (1-multiplier)

The multiplier is added for smoothing (weighting) the EMA, which typically follows the formula: [2 ÷ (number of observations + 1)]. For a 20-day moving average, the multiplier would be [2/(20+1)]= 0.0952.

We have added 10, 50, 100, and 200 day EMAs as screener filters

Cost of Goods Sold

Cost of Goods Sold refers to the direct cost of producing goods sold by the company. This usually includes raw material and labour costs expended to produce the good. An important point to note is that COGS is mostly relevant for inventory heavy businesses. For example, NBFCs like Bajaj Finance don’t have relevant COGS values.

Cash Flow Margin

Cash Flow Margin is the Cash from operations divided by total revenue for the most recent financial year.

Operating cash flow margin measures how efficiently a company converts sales into cash. It is a good indicator of earnings quality because it only includes transactions that involve the actual transfer of money. This ratio uses operating cash flow, which adds back non-cash expenses.

5Y Avg Cash Flow Margin

5Y Avg Cash Flow Margin is the Average of annual cash flow margin for the 5 most recent financial years

5Y CAGR

Compound annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each year of the investment’s lifespan. The CAGR isn’t a true return rate, but rather a representational figure. It is essentially a number that describes the rate at which an investment would have grown if it had grown the same rate every year and the profits were reinvested at the end of each year. In reality, this sort of performance is unlikely. However, CAGR can be used to smooth returns so that they may be more easily understood when compared to alternative investments. For example, if a stock’s 5Y CAGR is 20%, it implies if one had invested 100 Rs in the stock 5 years back and never withdrawn any amount of gains or losses, they would have made 100*(1 + 20/100)^5 = 248.832

Face value

Face value is a financial term used to describe the nominal value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate.

The cumulative face value of the entirety of a company’s stock shares designates the legal capital a corporation is obligated to maintain. Only the above-and-beyond capital may be released to investors, in the form of dividends. In essence, the funds that cover the face value, function as a type of default reserve.

The face value of a stock does not denote the actual market value, which is determined based on principles of supply and demand, often governed by the figure at which investors are willing to buy and sell a particular security, at a specific point in time. In fact, depending on market conditions, the face value and market value usually have no correlation.

No. of Shareholders

This is the number of unique DEMAT accounts that hold at least one share of a particular stock. This can be an indicator of the breadth of a company’s investor base. Its value might not be very helpful in comparison standalone but can have interesting use cases in custom filters.

Retail Investor Holding

A retail investor is an individual who purchases securities for his or her own personal account rather than for an organization.

Retail investors typically trade in much smaller amounts compared to institutional investors such as mutual funds, pensions, or university endowments.

This filter tells what percentage of a company’s outstanding shares are held by retail investors.

Insurance Firms Holding

Percentage of company’s common stock held by insurance firms. Insurance companies invest in many areas, but most of all they invest in bonds. This makes sense because bonds are perhaps the safest of all investment categories. Hence, an Insurance firm’s holding in a particular stock may suggest a lower risk profile for that stock as well.

Bulk Deals – Cumulative

These data items tell us the cumulative number of shares traded under bulk deals over a given time period as a % of total shares outstanding. We’ve added Bulk Trades – 1M, 3M, 6M cumulative as screener filters. For example, Bulk Deals – 3M Cumulative is calculated by summing up the number of shares traded in all the Bulk deals that have occurred in the past 3 months, then dividing it by the total number of shares outstanding and finally multiplying it by 100 to arrive at a percentage value

A bulk deal is a deal where the total quantity of shares bought or sold is greater than 0.5% of the share capital of the company. A bulk deal is transacted through the normal trading window and SEBI mandates the broker to report these high-value transactions. This can be looked at as a signal of building interest in a particular stock. Normally, bulk deals tend to be indicative of a sudden spurt in interest from informed investors. These basically give an indication of what stocks, big institutions, and asset management firms are buying.

Insider Trades – Cumulative

These data items tell us the cumulative number of shares traded by insiders of the company over a given time period as a % of total shares outstanding. We’ve added Insider Trades – 1M, 3M, 6M cumulative as screener filters. For example, Insider Trades – 3M Cumulative is calculated by summing up the number of shares traded in all the insider trades that have occurred in the past 3 months, then dividing it by the total number of shares outstanding and finally multiplying it by 100 to arrive at a percentage value

An insider is someone with either access to valuable non-public information about a corporation or ownership of stock equaling more than 10% of a firm’s equity. The kind of information found in filings is extremely valuable to individual investors. For example, if insiders are buying shares in their own companies, they might know something that normal investors do not. The insider might buy because they see great potential, the possibility for merger or acquisition in the future, or simply because they think their stock is undervalued. While the data are important, just remember that large companies might have hundreds of insiders, which means that trying to determine a pattern can be difficult.

Working Capital Turnover Ratio

Working Capital Turnover Ratio is the Total revenue of a company divided by average working capital over the past 2 financial years. It measures how efficiently a company is using its working capital to support sales and growth. Also known as net sales to working capital, working capital turnover measures the relationship between the funds used to finance a company’s operations and the revenues a company generates to continue operations and turn a profit.

A higher working capital turnover ratio is better and indicates that a company is able to generate a larger amount of sales. However, if working capital turnover rises too high, it could suggest that a company needs to raise additional capital to support future growth.

Net Income / Liabilities

Net income divided by total liabilities for the most recent financial year. It is a measure to see if a company has enough cash flow to pay off long-term debts while also meeting other short-term obligations. Also, know as the solvency ratio, it can determine if a company’s finances are healthy enough to pay off long-term debts and still operate.

Days Payable Outstanding

Average number of days a company takes to make payments to its trade creditors.

A company with a higher value of DPO takes longer to pay its bills, which means that it can retain available funds for a longer duration, allowing the company an opportunity to utilize those funds in a better way to maximize the benefits. A high DPO, however, may also be a red flag indicating an inability to pay its bills on time.

Days of Sales Outstanding

Days of Sales Outstanding is the average number of days a company takes to collect payment of a sale.

A high DSO number suggests that a company is experiencing delays in receiving payments. That can cause a cash flow problem. A low DSO indicates that the company is getting its payments quickly. That money can be put back into the business to good effect.

It is important to note that DSO can vary from business to business. In the financial industry, relatively long payment terms are common. In the agriculture and fuel industries, fast payment can be crucial. In general, small businesses rely more heavily on steady cash flow than large, diversified companies.

Days of Inventory Outstanding

Days of Inventory Outstanding is the average number of days a company holds inventory before turning it into sales.

Indicating the liquidity of the inventory, the figure represents how many days a company’s current stock of inventory will last. Generally, a lower DIO is preferred as it indicates a shorter duration to clear off the inventory, though the average DSI varies from one industry to another.

DIO is a metric that analysts use to determine the efficiency of sales. A smaller number indicates that a company is more efficiently and frequently selling off its inventory, which means rapid turnover leading to the potential for higher profits (assuming that sales are being made in profit). However, this number should be looked upon cautiously as it often lacks context. DIO tends to vary greatly among industries depending on various factors like product type and business model. Therefore, it is important to compare the value among the same sector peer companies. Companies in the technology, automobile, and furniture sectors can afford to hold on to their inventories for long, but those in the business of perishable or fast-moving consumer goods (FMCG) cannot. Therefore, sector-specific comparisons should be made for DIO values.

Asset Turnover Ratio

Asset Turnover Ratio is calculated as the total revenue of a company divided by average total assets over the past 2 financial years.

The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets.

This metric helps investors understand how effectively companies are using their assets to generate sales. The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales.

Inventory Turnover Ratio

The inventory turnover ratio is calculated as the Cost of goods sold of a company divided by average inventory over the past 2 financial years. Inventory turnover measures how many times in a given period a company is able to replace the inventories that it has sold.

A slow turnover implies weak sales and possibly excess inventory, while a faster ratio implies either strong sales or insufficient inventory. High volume, low margin industries such as retailers and supermarkets tend to have the highest inventory turnover.

Earning Power

Earning power is a company’s ability to generate profit. Specifically, its ability to generate profit from its operations. Investors and analysts calculate earning power to determine whether a company is worth investing in.

It is calculated by dividing EBIT with total assets for the most recent financial year. (EBIT can be calculated as revenue minus expenses excluding tax and interest. EBIT is also referred to as operating earnings, operating profit, and profit before interest and taxes.)

Number of analysts with buy recommendations

It is the number of analysts suggesting to buy a particular stock out of the total analysts who have researched the stock.

It gives a general idea on a stock’s performance as well as future value. We have other similar filters like: % of analysts giving buy and sell recommendations but this absolute value additionally gives an idea of how many analysts are covering the stock

Book Value

In theory, Book Value is the sum that shareholders would receive in the event that the firm was liquidated, all of the tangible assets were sold and all of the liabilities were paid.

Book value can be used by investors to gauge whether a stock price is undervalued by comparing it to the firm’s market capitalisation. If a company’s book value is higher than its market cap, then the stock can be considered undervalued and if it’s lesser, the company can be considered overvalued. However, this basic check usually holds true for inventory/asset-intensive businesses. Book Value of IT services companies for instance is mostly on the lower side, because they generate capital out of human resources rather than physical assets, but that doesn’t imply every IT company is forever undervalued.

Dividend Yield vs Sub-sector

It is the percentage difference between the dividend yield of a company and the average dividend paid by all companies within that sub-sector

PS Premium vs Sub-sector

Stock PS ratio divided by the corresponding sub-sector PS ratio minus one. Similar use cases to PE and PB premiums vs sub-sector

PB Premium vs Sub-sector

Similar to Premium vs Sector, we have PB Premium vs Sub-sector as well. It is basically the stock PB ratio divided by the corresponding sub-sector PB ratio minus one. The interpretation is also similar to the premiums vs sector, but sometimes a sector is a very broad universe to compare. For instance, You can’t compare a 2 wheeler company’s PB with an Airline’s PB, but both are in the same sector. Hence, for users looking to find stock-specific investing opportunities in niche industries, this metric might be more helpful. However since stocks in a sub-sector are obviously less than a sector, this metric is susceptible to bias, where one or two companies could grossly affect the sub-sector’s average, but affecting the sector’s average might be tough since there are many more companies and more business varieties which won’t necessarily have correlated earning cycles

PE Premium vs Sub-sector

Similar to Premium vs Sector, we have PE Premium vs Sub-sector as well. It is basically the stock PE ratio divided by the corresponding sub-sector PE ratio minus one. The interpretation is also similar to the premiums vs sector, but sometimes a sector is a very broad universe to compare. For instance, You can’t compare a bank’s PE with an NBFC’s PE, but both are financials. You can’t compare agriculture machinery with a stationary company but both are in the industrial sector. Hence, for users looking to find stock-specific investing opportunities in niche industries, this metric might be more helpful. However since stocks in a sub-sector are obviously less than a sector, this metric is susceptible to bias, where one or two companies could grossly affect the sub-sector’s average, but affecting the sector’s average might be tough since there are many more companies and more business varieties which won’t necessarily have correlated earning cycles

Price / CFO

Price / CFO is the Market capitalisation of the company divided by cashflow from operations for the most recent financial year. It is a stock valuation indicator or multiple that measures the value of a stock’s price relative to its operating cash flow per share. It’s different from price / free cash flow since it gives an indication of how cash-rich is the company’s core business. This ratio could be misleading if analysed standalone. It’s best to analyse it with other cash-based valuation metrics. For instance, a low Price / CFO but a high Price / FCF might indicate the company’s core business is functioning well but the company is aggressively reinvesting its profits

EV / Free Cash Flow

EV / Free Cash Flow compares the total valuation of the company with it’s ability to generate free cash flow.

Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cashflow. The lower the ratio of enterprise value to the free cash flow figures, the faster a company can pay back the cost of its acquisition or generate cash to reinvest in its business.

EV / Invested Capital

EV / Invested Capital is Enterprise Value divided by invested capital of the last financial year.

It measures the Enterprise Value against capital invested by shareholders and lenders. The invested capital is especially useful when capital assets are a key driver of revenue and earnings. Stocks trading at high multiples of invested capital may also be more susceptible to competition, since investing in similar assets will be attractive to investors.

EV / Revenue Ratio

Current Enterprise Value divided by the total revenue at the end of the most recent financial year.

It is one of several fundamental indicators that investors use to determine whether a stock is priced fairly. The EV/Revenue ratio is also often used to determine a company’s valuation in the case of a potential acquisition. The lower the better, in that, a lower EV/R multiple signals a company is undervalued.

EV / EBIT Ratio

Current Enterprise Value divided by the EBIT at the end of the most recent financial year.

This metric is used as a valuation tool to compare the value of a company (debt included), to the company’s cash earnings less non-cash expenses. It’s ideal for analysts and investors looking to compare companies within the same industry.

Enterprise Value

Enterprise Value is the sum of a company’s latest market cap, total debt, and minority interest less cash short term investment at the end of the most recent financial year. Enterprise value (EV) is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

Enterprise value (EV) could be thought of like the theoretical takeover price if a company were to be bought. EV differs significantly from simple market capitalization in several ways, and many consider it to be a more accurate representation of a firm’s value. The value of a firm’s debt, for example, would need to be paid off by the buyer when taking over a company. As a result, enterprise value provides a much more accurate takeover valuation because it includes debt in its value calculation. It is used as the basis for many financial ratios that measure the performance of a company.

Price / Free Cash Flow

Price / Free Cash Flow is the Market capitalization of the company divided by free cash flow for the most recent financial year. It is an equity valuation metric that indicates a company’s ability to generate additional revenues. A lower value for price to free cash flow could indicate that the company is cash-rich but the market isn’t betting on its ability to use this cash for further growth. A higher ratio might suggest that the company is valued by the market based on intangibles like brand recall, future prospects but the company isn’t generating a lot of cash

Insider Trades

Insider trading is a term subject to many definitions and connotations and it encompasses both legal and prohibited activity.

Insider trading is the buying, selling, or dealing in securities of a listed company by a director, member of management, employee of the company, or by any other person such as internal auditor, advisor, consultant, analyst, etc, who have knowledge of material inside information which is not available to the general public.

Insider trading takes place legally every day, when corporate insiders – officers, directors, or employees – buy or sell stock in their own companies within the confines of company policy and the regulations governing this trading. Hence Insider trading can be legal as long as it conforms to the rules set forth by SEBI

Legal examples of Insider Trading

CEO or a board member of company ABC buys 2,000 shares of stock in the company ABC. The trade is reported to the SEBI.

An employee of a company exercises his stock options and buys 500 shares of stock in the company that he works for.

Illegal examples of Insider Trading

A member of the leadership team of a company overhears a meeting where the CFO is talking about how the company is going to be driven into bankruptcy as a result of severe financial problems. The employee knows that his friend owns shares of the company. The employee warns his friend that he needs to sell his shares right away.

A government employee is aware that a new regulation is going to be passed that will significantly benefit an electricity company. The government employee secretly buys shares of the electricity company and then pushes for the regulation to go through as quickly as possible

Latest Regulations in India

On 18th January 2019, the Securities and Exchange Board of India (SEBI) decided to hold promoters of the company, irrespective of their shareholding status, responsible for violation of insider trading norms if they possess non-published price-sensitive information (UPSI) regarding the company without any a legitimate purpose.

SEBI specified “that the term legitimate purpose will include sharing of the non-published price-sensitive information (UPSI) in the ordinary course of business by an insider with partners, collaborators, lenders, customers, suppliers, merchant bankers, legal advisors, auditors, insolvency professionals or other advisors or consultants, provided that such sharing has not been carried out to evade or circumvent the prohibitions of these regulations.”

This amendment is introduced under “Prohibition of Insider Trading”.

Read more information on Insider Trade regulations

Bulk & Block Deals

These are large transactions made by promoters, mutual funds, financial institutions, insurance companies, banks, venture capitalists, and foreign institutional investors that have the power to control the movement of stock prices.

Bulk and block deals done on exchanges are keenly watched by market participants daily as they indicate the interest of big investors in the stock. Though these two terms sound similar, there is a difference between them. Here’s what they mean and how investors should interpret them

Block deals

Block deal is a trade, with a minimum quantity of 5 lakh shares or minimum value of Rs. 5 crores, executed through a single transaction, on the special “Block Deal window”. The window is opened for only 35 minutes in the morning trading hours. A Block deal happens when two parties agree to buy or sell securities at an agreed price between themselves and inform the stock exchange. The orders in a block deal are not shown to the people who trade from the normal trade window.

Market regulator SEBI (Securities and Exchange Broad of India) has also made it mandatory for the stockbrokers to disclose on a daily basis.

Stock exchanges should disclose the information on block deals to the public on the same day after market hours. This should contain information bits like the name of the scrip, name of the client, the number of shares, traded price, etc

Bulk deals

A bulk deal is a trade, where the total quantity bought or sold is more than 0.5% of the number of equity shares of a listed company.

Bulk deal can be transacted by the normal trading window provided by brokers throughout the trading hours in a day. Bulk deals are market-driven and take place throughout the trading day.

The stockbroker, who facilitates the trade, is required to reveal to the stock exchange about the bulk deals on a daily basis.

Bulk orders are visible to everyone. If the bulk deal happens through a single trade, it should be notified to the exchange immediately upon the execution of the order. If it happens through multiple trades, it should be notified to the exchange within one hour from the closure of the trading

Regulatory requirements

To facilitate block deals, stock exchanges provide a separate trading window for only 35 minutes at the beginning of the trading hours.

The transaction price of a share ranges from +1% to -1% of the previous days closing or the current market price. These transactions take place on a delivery basis.

Transparent disclosure of trade transaction details such as the name of scrip, name of the clients (Buyer and Seller), the number of shares bought/sold, and traded price have to be made by the broker to the exchange immediately. The exchange has to furnish all the transaction-related information to the public markets on the same day as the block deal transaction, after the closing of trading hours

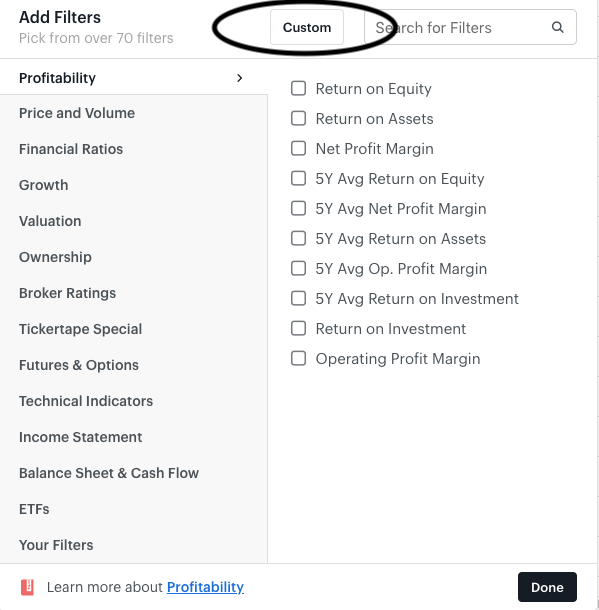

Custom Filters

While the Screener comes with a host of in-built filters that you can use to shortlist stocks, it also gives you the ability to create your own filter. The Custom Filter feature is available to all users.

A custom filter is a stock filter that has been created by a user. Such a filter can be created by using two to five data items on Screener. Custom filters are useful because they allow you to dig deeper into the stock universe and search for companies that match your specific criteria.

While the default filters are more than useful for most users to filter stocks, savvier users can create custom filters to be able to carry out deeper research.

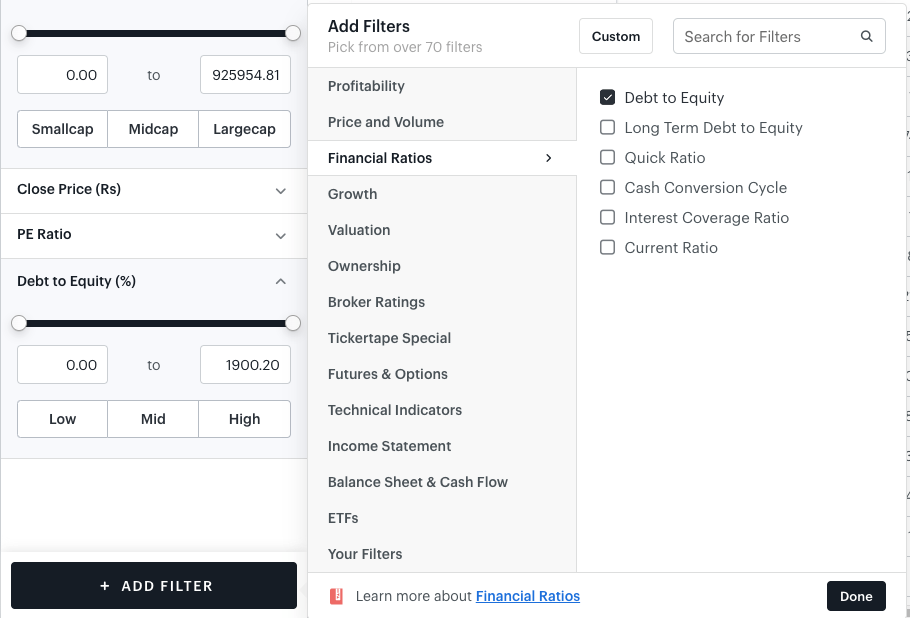

Let’s understand this with the example of Quick Ratio, which is a custom filter that you can create on Screener. Quick ratio is an extension of the existing filter–Current Ratio.

Current ratio is a measure of a company’s ability to pay off its debts.

Current ratio is calculated as current assets divided by current liabilities. If the current liabilities of a company are lower than its current assets, it means that the company has sufficient assets (cash in bank, receivables, etc) to pay off liabilities like interest on loans as and when required. Hence, the higher the current ratio, the better a company is equipped to repay liabilities on time. A higher current ratio depicts good financial health of the company.

While current ratio tells us how likely a company is to pay off its debts in the near term, it doesn’t take into account an important factor, which is the company’s inventories. This is where Quick Ratio comes into the picture.

Quick ratio = (current assets – inventories) / current liabilities

Here, inventories are important because it is difficult to sell then quickly and use the cash to pay off a company’s debt. A company’s ‘quick assets’, which are assets that can be used immediately are a more accurate gauge of how likely a company is to pay off the debt. Inventories are assets, but cannot be used in the near future. Hence, quick ratio goes one step ahead of current ratio and removes inventories from the equation.

Quick ratio is one custom filter that can be created on the Tickertape Screener by using three data items–current assets, current inventories and current liabilities. There are many other data items that can be used to create other custom filters.

Creating a custom filter

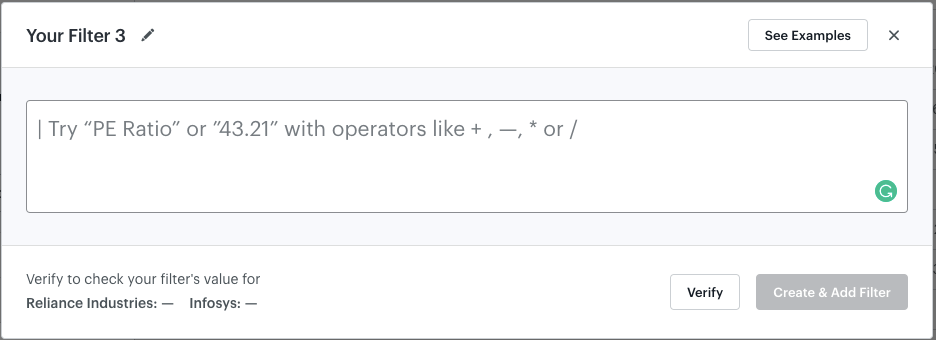

To create a custom filter, you have to click on the ‘Add Filter’ button and then go to the ‘Custom’ option on the top.

You can then type in the data items you need in your filter and create it. You can give the filter a name of your choice and verify it as well.

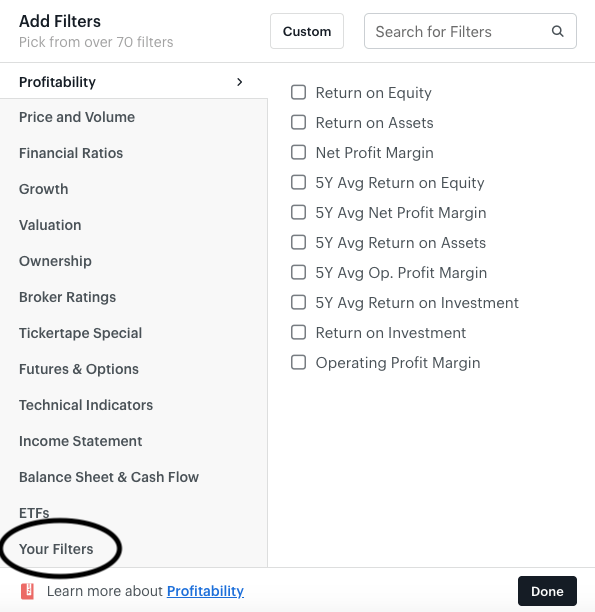

All of your custom filters appear under the ‘Your Filters’ tab.

This is how you can create and use custom filters on the Tickertape screener to build a portfolio of stocks that fit your needs and ideas.

Mutual Fund Holding

This data item is calculated as the sum of shares held by the entire universe of equity mutual funds divided by the total shares outstanding of the company. Examples of equity mutual funds are Reliance Small Cap fund which is from the Reliance AMC; HDFC Equity fund, which is from the HDFC AMC, etc.

Mutual funds have superior research capabilities and perform extensive analysis about the company before investing in it. A high mutual fund stake in a company is considered to be an endorsement about the company’s prospect.

Mutual Fund Holding Change – 3M

This data item is calculated as the difference between the current mutual fund ownership percentage and the percentage 3 months ago. Suppose, mutual funds held 40% stake in the company 3 months ago and currently they hold only 34%, the ownership change percentage is (34 – 40) = -6%.

Mutual funds have superior research capabilities and perform extensive analysis about the company before investing in it. A high MF stake in a company is considered to be an endorsement about the company’s prospect. A drastic increase or decrease in MF ownership percentage is a signal of potential change in fortunes of the company.

Mutual Fund Holding Change – 6M

This data item is calculated as the difference between the current mutual fund ownership percentage and the percentage 6 months ago. Suppose, mutual funds held 42% stake in the company 6 months ago and currently they hold only 34%, the ownership change percentage is (34 – 42) = -8%.

Extreme spike or fall in MF ownership level is an indicator of potential change in performance of the company. If MFs anticipate that the company might register improved performance in the future they are likely to increase their stake in the company and vice versa.

Promoter Holding

This data item is calculated as shares held by promoters divided by total shares outstanding of the company. Promoters are individuals or corporations who invest for the purpose of gaining and holding onto stake in the company for very long periods of time. They are interested in running the company and may even hold board positions.

A very high or very low promoter ownership percentage is not desirable. A very high promoter stake will automatically lead to lesser holdings by institutional and retail investors. In such a situation, promoters might take decisions that is adversarial to retail shareholders interest. A very low promoter stake means promoters are not sufficiently invested in the company and might not be interested in running the company.

Promoter Holding Change – 3M

This data item is calculated as the difference between the current promoter ownership percentage and the percentage 3 months ago. Analysing promoter ownership change is tricky as a lot of factors have to be considered before deciding on whether the change is positive or negative for the company.

- If the promoter is selling off stake when the company is reporting poor fundamentals, it means that the entity has lost hope in the future of the company

- A promoter entity increasing stake in the company when share prices are falling either due to weak market conditions or poor fundamentals usually signifies that the long-term potential of the company is strong and that share price fall is a temporary phenomenon

- A marginal stake dilution to bring in other promoter partners is usually seen as positive endorsement of the company. For example, real estate company DLF recently sold 40% stake in a subsidiary company to GIC of Singapore. Markets reacted positively to the news

- A marginal stake dilution when promoter entity has very high holding is considered positive, as the number of shares freely available to buy and sell increases

- If the promoter entity increases stake in the company via market purchase route or preferential allotment at market price or above market price, it is considered positive for the stock

Promoter Holding Change – 6M

This data item is calculated as the difference between the current promoter ownership percentage and the percentage 6 months ago.

Pledged Promoter Holding

Pledging refers to the act of taking loans against the shares one holds. Sometimes, promoters of companies will raise funds, either for personal or professional use, by taking loans using shares of the company that they own as collateral.

Typically, the bank or NBFC lending money will lend an amount that is less than market value of the shares. For example, suppose X is the promoter of Aarti Industries. The total shares outstanding of the company is 10,000 and X holds 60% stake in the company i.e 6,000 shares. If the current market price of each share of Aarti Industries is Rs 20, then X’s total holding is worth Rs.1,20,000 (6000 * 20). X needs Rs.50,000 for his personal use and is planning to pledge some of the shares of Aarti Industries in order to raise the money. Suppose the bank lends Rs.80 for every Rs.100 collateral pledged, X will have to then pledge Rs.62,500 worth of shares to raise Rs.50,000. This translates to 3125 shares (62,500 / 20). So, out of the total shares outstanding 31.25% is pledged (3,125 / 10,000). The difference between the amount of collateral and the amount of money received as loan is the margin amount.

Now, if the share price of the company starts falling, the margin starts getting eroded and the lender can then ask X to either return some part of the loan or pledge more shares in order to make up for the margin shortfall. If X is not able to do so, the lender will then sell the shares in the stock market to raise the required amount and maintain the margin.

In case of volatile markets, holding shares of companies with high pledged percentage is very risky. This is because, if the stock price falls sharply, lenders will sell the shares and this sudden increase in supply of the shares will further push down the price of the stock and investors might incur significant loss.

Domestic Institutional Investor (DII) Holding

This data item is calculated as shares held by institutional investors based in India divided by the total shares outstanding of the company. DII refers to large financial institutions like mutual funds, pension funds, insurance companies, endowment funds etc, which are based in India. Examples of DIIs are Life Insurance Corporation of India and HDFC Mutual Fund.

DIIs conduct extensive research about the prospects of the company & related sector, perform due diligence about capabilities of the management & corporate governance as well as other related factors before investing in a company. Generally, once DIIs decide to invest in a company, they hold onto the shares of the company for a long period of time. A high DII stake in a company is considered to be an endorsement about the company’s prospects.

DII Holding Change – 3M

This data item is calculated as the difference between the current DII ownership percentage and the percentage 3 months ago. Suppose, DIIs held 14% stake in the company 3 months ago and currently they hold 18.5%, the ownership change percentage is (18.5 – 14) = 4.5%.

A drastic increase or decrease in DII ownership percentage is a signal of a potential change in the fortunes of the company.

DII Holding Change – 6M

This data item is calculated as the difference between the current DII ownership percentage and the percentage 6 months ago. Suppose, DIIs held 20% stake in the company 6 months ago and currently they hold 18.5%, the ownership change percentage is (18.5 – 20) = -1.5%.

An extravagant change in DII ownership percentage is a signal of potential change in the fortunes of the company. A drastic increase indicates possible improvement in performance of the company and vice versa.

Foreign Institutional Investor (FII) Holding

This data item is calculated as shares held by institutional investors based outside of India divided by the total shares outstanding of the company.

Foreign institutional investments are investments by foreigners in Indian securities including shares, government bonds, corporate bonds, convertible securities, infrastructure securities etc. The class of investors who make investment in these securities are known as Foreign Institutional Investors (FII). According to SEBI regulations, any equity investment by foreigners that is less than or equal to 10% of the capital of a company is called portfolio investment.

Investments by Non-resident Indians is not considered as FII investment.

A high FII stake in a company, especially by sovereign wealth funds, endowment funds etc, is considered to be an endorsement about the company’s prospects. These entities conduct extensive research about the prospects of the company and related sector before investing in the company for the long-term.

FII Holding Change – 3M

This data item is calculated as the difference between the current FII ownership percentage and the percentage 3 months ago. Suppose, FIIs held 10% stake in the company 3 months ago and currently they hold 12.5%, the ownership change percentage is (12.5 – 10) = 2.5%.

If FIIs anticipate that a company will perform well over the long-term and can be relied upon to create shareholder value, they will increase their stake in the company. Else, if the company is expected to underperform, FIIs might sell out, thereby reducing their stake.

FII Holding Change – 6M

This data item is calculated as the difference between the current FII ownership percentage and the percentage 6 months ago. Suppose, FIIs held 7% stake in the company 6 months ago and currently they hold 12.5%, the ownership change percentage is (12.5 – 7) = 5.5%.

A drastic increase or decrease in FII ownership percentage is a signal of potential change in the fortunes of the company.

Balance Sheet

A balance sheet lists the assets, liabilities and capital structure of a company as of a specific date, usually the last day of the financial period. Here, this date will be 31st March 2018. It helps understand what the company owns, what it owes and the amount of money invested by shareholders and debt holders.

Cash and Short-term Investments

Cash & short-term investments is the sum of cash available with the company and amount invested by the company in short-term investment options. Short-term investment options include investments made in liquid securities that usually have a maturity of less than 1 year and can be easily converted into cash. Excess cash amount, which is not required for daily business operations, is usually invested in liquid securities.

In case of banks, the data item also includes cash that has been lent to other banks on a short-term basis.

Cash & short-term investments is on the assets side of the balance sheet in the current assets section.

Total Receivables

Total receivables is the total amount of money that is owed to the business by its customers. Most business sell their goods/services to customers on a credit basis. The customer will be required to pay the due amount to the business within a specific period of time. Between the date of sales and the date on which the customer pays for the goods or services, the due amount is recorded under the total receivables head.

The data item is relevant only in case of industrial, utility and insurance companies.

Total receivables is marked on the assets side of the balance sheet under the current assets section.

Total Inventory

Inventory is the sum of finished goods waiting to be sold, work-in-progress items and raw materials that will be used to manufacture finished goods.

This data item is relevant only in case of industrial and utility companies.

Total inventory is marked on the assets side of the balance sheet under the current assets section.

Other Current Assets

Other current assets in case of industrial & utility companies refers to the sum of all the other current assets apart from cash & short-term investments, total receivables and total inventory. This might include items like overpaid taxes or taxes paid in advance, current assets of discontinued business, assets being held for sale, etc.

In case of insurance companies, this data item includes prepaid expenses. Prepaid expense refers to the future expense for which the company has already paid money. For example, if the company has paid in advance for 1 years’ supply of printer cartridge, the expense will be recorded as prepaid expense.

This data item is not relevant for banks.

Other current assets is marked on the assets side of the balance sheet under the current assets section.

Total Current Assets

Total current assets refers to the sum of all data items like cash and short-term investments, receivables, inventory and other current assets.

Net Loans

This data item is specific to banks and financial institutions. It refers to the total amount of loans lent by the company minus possible default losses.

Let’s say a bank has 10 customers and it has lent Rs.10,000 to each one of them. It estimates that about 2% of the total loan amount might never be returned and makes provisions for the same. So, the total loan amount is Rs.1,00,000 (10,000 * 10). Loan loss provision is Rs 2,000 (2% * 1,00,000). Hence, the net loan amount will be Rs.98,000 (1,00,000 – 2,000).

Net loans is recorded on the assets side of the balance sheet.

Net Property/Plant/Equipment

Property, plant and equipment refers to the total fixed assets held by the business. These assets are vital to the business and cannot be easily converted to cash. The assets are expected to generate economic benefits for the business over a period greater than 1 year.

Let’s say a business owns 2 pizza baking ovens valued at Rs.35,000 each, furniture valued at Rs.25,000, a car valued at Rs.6,00,000, fridge valued at Rs.12,000 and an a/c unit valued at Rs.18,000. The property, plant and equipment value of the business would be Rs.7,25,000 (35,000 * 2 + 25,000 + 6,00,000 + 12,000 + 18,000).

This data item is recorded on the assets of the balance sheet.

Goodwill and Intangibles

Intangible assets refer to assets that a company derives benefit from, but unlike fixed assets these assets cannot be physically touched or counted. Copyrights, patents and trademarks are all examples of intangible assets. A publishing company has copyright to lots of different books. These books can be printed and sold exclusively by the company due to the copyright, and that is how the business earns revenue. The copyright here is an asset, albeit an intangible one, because it allows the company to generate economic benefit.

Goodwill is a special category of intangible assets. Let’s say a pizza company, Roma, decides to buy out another pizza outlet named “Italiano”. The total assets of Italiano amounts to Rs.10,00,000 and this is the amount that would ideally be paid to the owners of Italiano for buying out their business. However, since Italiano has a loyal customer base and is located in an area that attracts lot of footfalls, the owners demand a premium of Rs.3,00,000 to sell their business. If Roma decides to pay the higher price and purchase the business, the additional Rs.3,00,000 paid will be recorded as goodwill on the assets side of Roma’s balance sheet.

Long Term Investments

Long-term investment refers to the investment made by the company in debt papers, stocks, real estate, etc with the purpose of holding them for more than 1 year. Companies that generate a significant amount of cash may sometimes decide to invest the excess money, which cannot be deployed back into the business, in real estate or debt or equity instruments. If the idea is to stay invested in these assets for more than 1 year, then they are classified as long-term investments.

This data item appears on the assets side of the balance sheet.

Other Assets

Other assets refers to all assets of the company that are not part of current assets, property, plant & equipment, goodwill & intangibles and long-term investments.

Total Assets

This data item indicates the sum of all assets of the company. The sum of total current assets, property, plant & equipment, goodwill & intangibles, long-term investments and other assets should be equal to the amount of total assets.

Accounts Payable

Accounts payable refers to the total amount of money that a company owes its creditors for materials and services sold on credit. The due amount should usually be paid off within a short period of time and is different from other short- and long-term business debt. The accounts payable head also includes the amount of accrued expenses. Accrued expenses refers to the expenses that the company has incurred but not yet paid.

For example, a pizza company buys pizza dough, cheese and vegetables in bulk from a single vendor. The vendor supplies the required raw materials every week but receives payment for the same only once in 2 months. Suppose the company orders about Rs.15,000 worth of goods every week, then at the end of every alternate month the accounts payable of the company would be Rs.1,20,000 (15,000 * 8).

The utilities bill of the company is Rs.2,000 every month. The company pays the total bill amount of Rs.6,000 at the end of each quarter. So at the end of 1st month, the accrued expense is Rs.2,000 and it is Rs.4,000 at the end of second month.

Total Deposits

This data item is specific to banks and financial institutions. It refers to the sum of all deposits (like savings bank deposits, fixed deposits etc) that have been made with the institution.

Other Current Liabilities

This data item refers to all other current liabilities that are not part of the accounts payable & accrued expenses heading. It includes items like short-term debt, dividends payable, advances received from customers, income taxes payable etc.

Total Current Liabiities

Total current liabilities refers to the sum of accounts payable and other current liabilities. In case of banks and financial institutions the data item also includes total deposits.

Total Long Term Debt

Total long-term debt indicates the debt taken on by the company that is due to be paid after more than a year. The debt might be in the form of borrowings from banks/financial institutions, bonds issued by the company, etc.

If a company has taken up a debt of Rs.12,00,000 from a bank and Rs.1,00,000 is up for repayment within 1 year then the balance Rs.11,00,000 is the long-term debt on the books of the company.

Total Debt

Total debt refers to the sum of short- and long-term debt of the company. Short-term debt is the debt of the company that needs to be repaid within 1 year.

Deferred Income Tax

Deferred income tax refers to the taxes that will have to be paid by the company at the end of the fiscal year but has not yet been paid. A deferred income tax item recognises that the company will in the future pay more tax because of a transaction that took place during the current period.

For example, let’s say a pizza comapny receives an order for 1,000 pizzas at a party that will be held next quarter. The sale price of each pizza is Rs.200 and the cost of revenue per pizza is Rs.75. The person who ordered the pizza pays an advance of Rs.50,000 for 250 pizzas. This is the revenue that the company has already received without providing service. The profit on each pizza is Rs.125 (200 – 75). So the advance profit earned is Rs.31,250 (250 * 125). Suppose the tax rate is 25%, then the company owes the government Rs 7,813 (31,250 * 25%). This is the tax amount that has not yet been paid but will have to be paid once the order is fulfilled and revenue is recognised, and will be recorded as deferred income tax.

Minority Interest

Minority interest refers to the amount of interest of subsidiaries that belongs to shareholders other than the parent company.

A subsidiary is a company that is owned or controlled by the holding company. Let’s say Roma, as a business entity, owns 100% of shares of Italiano. Here, Roma is the holding company and Italiano is the subsidiary company. In this case, the holding company has complete right over the profits as well as assets of Italiano.

If Roma holds 75% of shares of Italiano whereas 25% of the shares are held by the previous owner, Roma will still be the holding company and Italiano the subsidiary. Roma will be entitled to only 75% of the profits and assets of Italiano whereas the rest accrues to the other shareholders. 25% of the value of the company is shown in the balance sheet of Roma as minority interest under liabilities.

Other Liabilities

Other liabilities includes liabilities arising from discontinued operations, underfunded pension benefits, etc.

Total Liabilities

Total liabilities refers to the sum of all liabilities of the company. The sum of total current liabilities, total debt, deferred income tax, minority interest and other liabilities should be equal to the amount of total liabilities.

Common Stock

Common stock is a security that gives the holder of that security ownership of the portion of the company. Holders of common stock have a say in the running of the company and the power to vote on corporate policies and decisions. All the profits of the company accrues to the common stockholders. Common stock of the company is issued at a certain face value like Rs.1, Rs.5 or Rs.10. Total common stock refers to the sum of face value of all shares of common stock issued.

For example, if a company issues 10,000 shares of common stock at a face value of Rs.10, the total common stock will be Rs.1,00,000 (10,000 * 10).

Additional Paid-in Capital

Sometimes, a company issues shares of common stock at a premium to the face value. Though the face value of the common stock is Rs.10, the company might issue the stock at a premium of Rs.5. So the buyer will now have to pay Rs.15 for each share of common stock instead of the earlier Rs.10.

If 10,000 shares have been issued at a price of Rs.15, with the premium being Rs.5. Rs.1,00,000 (10,000 * 10) will be the total common stock and Rs.50,000 (10,000 * 5) will be the additional paid-in capital.

Retained Earnings

When a company earns profits, it can either decide to retain the same and invest it in the business or distribute the profits to the shareholders of the company. This retained profit is called retained earnings. It is the residual earnings from operations that is not distributed to shareholders.

Other Equity

Other equity-related data items that are not part of the above mentioned list are accommodated under the head “Other Equity”.

Total Equity

Total equity is the sum of common stock, additional paid-in capital, retained earnings and other equity.

Total Liabilities & Shareholders Equity

Total liabilities and shareholders equity refers to the sum of total liabilities and total equity.

Total Common Shares Outstanding

Common shares outstanding is the total shares of common stock of the company that have been issued.

Total Preferred Shares Outstanding

Preferred stock refers to a class of stock that ranks higher than common stock. In case the company decides to pay dividends, the preferred shareholders are paid before common stockholders. In case of bankruptcy as well, preferred shareholders are entitled to be paid from the company’s assets before common stockholders get any compensation. However, the downside is that while common stockholders have the right to vote on company policy, preferred stockholders do not get to do the same.

Total preferred shares outstanding refers to the sum of total shares of preferred stock of the company.

Policy Liabilities

This data item is specific to insurance companies and represents the total liabilities related to insurance operations of an insurance company. It includes payables for claims & losses to policyholders, reserves created for policy benefits, payables by the insurance company to reinsurers etc.

Cash Flow Statement

A cash flow statement helps understand the actual amount of money that has entered the bank accounts of the company and the money that went out. It provides information about all the cash inflow that a company received via its ongoing operations, investments received by the company, assets sold as well as cash outflow via asset purchase, dividends paid etc. Just like an income statement, cash flow statement is also calculated for a specific period like quarter or year.

Changes in Working Capital

Working capital refers to the difference between total current assets and total current liabilities. Working capital helps us understand the short-term financial health of the company. If the working capital is positive it indicates that the company has enough short-term assets to pay off its short-term liabilities.

Cumulative effect of change in current asset and current liability over the past year is captured in the data item changes in working capital.

| Components of working capital | Change | Effect on working capital |

|---|---|---|

| Current assets | Increase | Increase |

| Decrease | Decrease | |

| Current liabilities | Increase | Decrease |

| Decrease | Increase |

When current assets of a business are increasing, it is usually because items like accounts receivable, inventory and prepaid expenses are increasing. This means cash is going out of the business as sales are not being made or it is being made on credit. Because of this, change in working capital is positive.

When current liabilities of a business are increasing, it is because accounts payable, accrued expenses etc. is increasing i.e. company has been slowing down the payment of dues and retaining cash. Change in working capital is negative because of this.

Cash Flow from Operating Activities

Cash flow from operating activity refers to the amount of money that a company has earned from its regular business activity such as selling goods/services. It excludes any money brought into the business via borrowings or sale of assets.

Cash flow from operating activity can be calculated by using the following formula:

Profit before interest & taxes + depreciation & amortization expense + gains & losses from financing & investment activities + changes in working capital

Cash flow from operating activities should always be compared with the company’s net income. If the cash flow from operating activities is consistently higher than the net income, then the company’s earnings are of high quality. If that is not the case, then one has to attempt to understand why reported net income is not being converted into cash inflow by the company.

Capital Expenditures

Capital expenditure (capex) refers to the amount of money that the company has spent on purchasing property, plant & equipment that will be utilised in business operations. The assets purchased are expected to generate economic benefit for the business over the long-term. Usually, the amount spent on capex will be high compared to the total amount of fixed assets held by the business.

For example, if a pizza company decides to purchase another pizza baking oven, the amount spent on the same will be considered as capital expenditure. However, money spent on buying a spare part for the oven will be considered as operational expense because of its low significance and associated low cost.

Cash from Investing Activities

Cash from investing activities refers to the cash flow generated by the company via purchase and sale of plant, property & equipment (PP&E) or purchase & sale of subsidiaries or investments in marketable securities. For example, if a company has made any purchase of PP&E, then money moves out the company and proportional amount of assets comes in. On the contrary, if a company has sold an asset then PP&E amount will decrease and cash balance will increase.

A positive cash from investing activities balance indicates that money has flown into the company because of net sales of assets whereas a negative balance indicates that assets have been bought by the company.

Total Cash Dividends Paid

This refers to the actual dividend amount that has been paid to common share and/or preferred shareholders of a company. While a company might declare dividends during a particular quarter or financial year, the actual payment of dividends might not always happen during the same financial period.

This data item only considers the actual cash payment made towards dividends during a specific period. Higher the cash dividends paid, greater the cash outflow from the business and lower the cash from financing activities.

Cash from Financing Activities

Cash from financing activities refers to the amount of money that the company has raised by issuing bonds and stocks or the amount of borrowed money that has been repaid. It helps understand the transactions that have taken place within the capital structure, i.e debt and equity.

Increase/decrease of long-term and short-term borrowings and share repurchase as well as share sale are considered while calculating cash from financing activities.

A positive cash from financing activities balance indicates that money has flown into the company either via sale of common stock or debt instruments, i.e. the company has raised money from the market. A negative balance indicates that the company has either paid dividends or repaid a part of its debt or repurchased shares.

Foreign Exchange Effects

It is possible that a company has subsidiaries in foreign locations and the financial statements of such subsidiaries are reported in the currency of the country in which it is located. If an Indian company owns an outlet in New York through a subsidiary, then the subsidiary will report its numbers in USD whereas the Indian company will report numbers of its Indian operations in INR. If the company has to prepare a consolidated financial statement, then it has to convert the numbers of its New York subsidiary into INR.

So if the consolidated statement is being prepared for the 1st Jan 2018 – 31st March 2018 period, cash flow and income statement items are converted into INR using average INR/USD exchange rate between the before mentioned dates.

However, balance sheet items will have to be converted using spot INR/USD rate as of 31st March 2018. The previous periods consolidated balance sheet will be prepared as of the period ending dates INR/USD rate.

Because of the average rate and the sport rate used for conversion, an imbalance is caused that could either increase or decrease the amount of the data item. This increase or decrease will have nothing to do with the actual cash flow and will be caused due to foreign currency fluctuation. This imbalance caused due to fluctuation will be captured in the data item foreign exchange effects.

Net Change in Cash

This data items indicates the difference in cash balance between the start and end of a financial period. If the financial period runs between 1st Jan 2018 and 31st March 2018, net change in cash considers the cash the business holds on 31st Dec 2017 and 31st March 2018 and states the difference between the two. A positive balance indicates that the cash with the company has increased and vice versa.

Total Revenue

To understand Income Statement, let’s begin with the example of Navya, who has been running 3 pizza outlets, named “Roma”, in different parts of her city since the last 3 months. Her outlets are located in strategic locations and attract a lot of people, leading to high sales. It is now time to file taxes and she has to prepare the income statement, balance sheet and cash flow statement of her business to understand whether she has made profits or losses during the previous financial quarter and to understand what her business owns & owes.

The income statement helps understand a company’s performance over a specific period of time. Let’s assume a time frame between 1st January 2018 and 31st March 2018. An income statement helps us understand how much money the business earned, during that specific 3-month period, by selling the goods/services it produced. It also lists out the expenses that the company incurred during the specific period and finally arrives at the profit loss number.

Let us discuss various items in these financial statements to understand them better.

Total revenue

Revenue is the income that a business earns by selling merchandise or offering specific services. It is also referred to as sales or turnover. Revenue is calculated for a specific period like a quarter or a year. Revenue is calculated after adjusting for discounts and product returns.

Let’s suppose between 1st January 2018 and 31st March 2018, Navya sells 10,000 pizzas and the price of each pizza is Rs.200. Her revenue earned during the quarter would be Rs.20,00,000 (10,000 * 200).

Looking at a company’s revenue is important because companies that are able to increase their sales year after year are desirable.

In case of industrial and utility companies, the total revenue is calculated as revenue from all of a company’s operating activities after deducting any sales adjustments.

In case of insurance companies, the total revenue is the total insurance related premium that the company has earned during the period.

In case of banks, total revenue is the sum of interest and non-interest income earned by the bank. Non-interest income includes fees & commissions, credit card fees, foreign currency gains etc.

Cost of Revenue

Cost of revenue is the cost directly incurred in producing the product sold or services rendered. This amount includes the cost of the materials used in creating the product along with direct labor charges and other costs, like electricity expense, directly incurred in producing the product or service. Only direct costs incurred are considered here. Just like revenue, the corresponding cost of revenue is also calculated for a specific period like a quarter or a year. In fact, all income statement items are calculated for a similar time period.

Let’s suppose the raw material required to make a pizza – dough, cheese, vegetables etc – together cost Rs.50 per pizza. Electricity charge incurred in running the oven is Rs.30 per hour and the employee making the pizza gets paid Rs.20 for every pizza he makes. Assuming 6 pizzas can be made in an hour, the electricity charge incurred in making each pizza is Rs.5 (30/6). The cost of revenue is Rs.75 per pizza (50 + 20 + 5). So during the 1st quarter of 2018, Navya’s total cost of revenue was Rs.7,50,000 (10,000 * 75).

Companies that are able to either maintain or decrease their cost of revenue in relation to their sales are desirable.

In case of industrial companies, the cost of revenue is calculated as total operating expense directly related to the goods and services provided. In case of utility companies, along with direct operating expense, operations & maintenance as well as fuel expense is considered.

In case of insurance companies, cost of revenue includes losses & benefits paid to policyholders, underwriting commissions and reinsurance expense.

In case of banks, cost of revenue is the sum of the total interest expense and non interest expense. Total interest expense is the interest paid on deposits and other borrowings. Non interest expense includes labour costs, foreign currency loss, litigation expense etc.

Gross Profit

Gross profit is the difference between total revenue and cost of revenue. It is the profit a company makes after deducting the cost directly associated with making the good or providing the service.

In the example above, the gross profit would be Rs.12,50,000 (20,00,000 – 7,50,000).

Companies that are able to increase or at least maintain their gross profit in relation to sales are desirable.

Operating Costs

This is the cost incurred in administering & maintaining a business on a day-to-day basis. It is the amount expended by a company just to maintain its existence.

Suppose Navya pays Rs.10,000 every month to the manager of each of the pizza outlets, Rs.2,000 every month as cleaning charges of each outlet, and Rs.5,000 towards other sundry expenses, then the operating expense of her company would come to Rs.41,000 every month (10,000 * 3 + 2000 * 3 + 5000). Hence, the total operating expense during the quarter was Rs.1,23,000 (41,000 * 3).

Just like in case of cost of revenue, companies that are able to either maintain or decrease their operating costs in relation to their sales are better.

In case of industrial and utility companies, operating expense is calculated as the sum of selling & general expenses, research & development costs, unusual expenses like restructuring charge & litigation expenses and any other operating expense resulting due to foreign currency adjustments, etc.

In case of insurance companies, the operating expense is calculated as the sum of selling & general expenses, unusual expenses like restructuring charge & litigation expenses and any other operating expense resulting due to foreign currency adjustments, etc.

In case of banks, loan loss provision is a part of the operating expense head. Loan loss provision refers to the provision created for the possible default on loans given out by the bank.

EBITDA

EBITDA stands for earnings before interest, taxes, depreciation and amortization. EBITDA is a measure of the company’s operating performance. This data item helps understand the profits generated by the company via its operations.

In Navya’s case, EBITDA is calculated as gross profit minus operating costs. The amount of EBITDA is Rs. 11,27,000 (12,50,000 – 1,23,000).

Companies with higher EBITDA in relation to their sales are better than companies with lower EBITDA in relation to sales.

Depreciation/Amortization

Depreciation is the planned and gradual reduction in the value of a fixed asset over its useful life. Depreciation is applied to fixed assets like cars, computers, machinery etc, as these assets lose their value as well as utility over the years.

Amortization works on the same principle as depreciation and is applied to intangible assets like patents, copyrights etc.

Let’s say Navya buys a new car for Rs 6,00,000 at the start of the year for business use. If after using it for a year she attempts to sell the same at the end of the year, the resale value will definitely be lower than the purchase price of Rs 6,00,000. The resale value is the depreciated value of the car and the difference between the original purchase price and the resale price is the amount of depreciation. Even if Navya does not want to sell the car, she will reduce the value of the car each year in her books and mark the amount of reduction in her profit and loss statement as depreciation expense. Let’s assume that Navya marks Rs.60,000 each year as depreciation; the quarterly depreciation will be Rs.15,000.

While industrials, utilities and insurance companies mark depreciation, banks usually have very few fixed assets and hence do not mark depreciation.

PBIT

PBIT stands for profit before interest and taxes and is calculated as the difference between EBITDA and depreciation & amortization.

Navya’s PBIT is Rs.11,12,000 calculated as 11,27,000 minus 15,000.

Interest & Other Items

Interest expense refers to the amount of interest paid by the business on borrowed funds. Suppose Navya had borrowed Rs.12,00,000 from a bank at an interest rate of 10% per annum to fund her business. Rs.1,20,000 (10% * 10,00,000) is the annual interest expense and Rs.30,000 is the interest expense each quarter.

PBT

PBT stands for profit before taxes and is derived by subtracting interest & other items from PBIT. In Navya’s case PBT will be Rs.10,82,000 (11,12,000 – 30,000).

Taxes & Other Items

This is the tax on profit earned that a company owes to the government. This tax is very similar to the income tax that an individual pays on his income. In India, a flat 25% tax is levied on profits earned by domestic companies.

Navya’s pizza company has earned Rs.10,82,000 profit before tax during the first quarter. Assuming a 25% tax rate, the tax amount will be Rs.2,70,500 (10,82,000 * 25%).

Net Income

Net income is the profit earned by the company from its business operations after accounting for all operational & non operational expenses, interest costs and taxes. It is the amount of money that is available to the shareholders of the company after accounting for all kinds of cost associated with running a business venture.

Navya earned a net profit of Rs 8,11,500 (10,82,000 – 2,70,500) during the first quarter of the year.

Companies with higher net income in relation to their sales are better than companies with lower net income in relation to sales.

EPS

Calculating earnings per share (EPS) involves 2 different items–net income and total common shares outstanding. EPS is calculated as net income divided by total common shares. It represents the portion of a company’s profit that can be allocated to each outstanding common share of the company. The higher the earnings per share of a company, the better is its profitability.

Companies that are able to increase their earnings per share year after year are desirable.

Navya’s company, Roma has issued 10,000 shares of common stock and the net profit earned during the first quarter is Rs.8,11,500. Hence, the EPS is Rs.81.15 (8,11,500 / 10,000).

DPS

When a company earns profits, it can either decide to retain the same and invest it in the business or distribute the profits to the shareholders of the company. This distributed profit is called dividend. Dividend per share (DPS) is calculated as total dividend divided by total common shares. It represents the portion of a company’s profit that has been paid out to each outstanding common share of the company.

From the previous example, we have seen that common shares outstanding is 10,000 and the EPS is Rs.81.15. Suppose the company decides to pay 25% of its EPS as dividends, the DPS would be Rs.20.3 (81.15 * 25%).

Payout Ratio

Payout refers to the amount of profits of the company that has been paid out as dividends and has not been utilised in the business.

Payout ratio is calculated as dividend per share (DPS) divided by earnings per share (EPS) and is typically expressed as a percentage. Suppose the EPS is Rs.10 and Rs.2 is paid out as DPS, the payout ratio would be 20% (2 / 10 *100).

Research & Development

Research & development (R&D) expense refers to the cost associated with the research & development of a company’s goods and/or services. R&D activities involve conducting systematic research in order to attempt to discover specific solutions to a problem or create a new product.

R&D expense is usually very high in fields like pharma, oil & gas and specific kinds of technological firms. When assessing companies from these sectors, it is important to check whether R&D expense on an absolute basis as well R&D expense in relation to sales is increasing or at least stable. A company that does not invest sufficiently in R&D will lose its competitive advantage over a period of time as it will not be able to develop any new product or service.

Selling/General/Administrative Expenses

As the name suggests, selling, general and administrative expense (SG&A) refers to the expenses incurred in administering a business as well as selling the products/services created by it.

General & administrative costs include all expenses incurred in operating a business other than the cost directly incurred in producing the product sold or services rendered. Items like salaries of top executives & office staff, rent of office building, auditor fee etc. are part of this head.

Selling expense includes the cost of advertising and other promotional expenses.

Interest Income

Interest income is the sum of all interest earned by the bank either via any kind of lending or investing activity. This includes interest & fees on loans made out, interest & dividends from investment in various securities, interest income earned from deposits with other institutions, returns earned on trading account security etc.

A bank/financial institution (FI) that is able to increase its interest income every year is desirable.

Total Interest Expense

The item total interest expense is specific to banks and non-banking financial institutions. It is the sum of interest paid on deposits from customers as well as interest paid on borrowings from other sources via bonds & notes issued.

A bank/financial institution (FI) that is able to maintain or decrease its interest expense, every year, in relation to its interest income is desirable.

Net Interest Income

Net interest income is specific to banks and non-banking financial institutions and is defined as the difference between interest income, bank and total interest expense. It is the difference between the sum of all interest incomes of the bank and the sum of all of its interest expense.

Loan Loss Provision

Loan loss provision refers to the provision created for possible default on loans given out by the bank or financial institution.

Banks and financial institutions lend to a wide range of customers like individuals, medium & small enterprises (MSME) and giant corporations. Due to a range of reasons, some of these loans might not be returned, i.e they might turn bad and in other cases, loans might not be returned on time. Hence, in order to cover these possible losses, the bank sets aside a portion of the repaid loan amount. The loan loss provision acts as an internal insurance fund.

Net Interest Income after Loan Loss Provision

This amount is the difference between net interest income and loan loss provision. It indicates the gains from loan operations of the company after considering the cost of the loan and providing for unexpected losses via loan loss provisions.

1W Change in Call OI

1w change in call open interest is calculated as percentage change between current days call OI and the call OI 5 trading days ago. Suppose current day’s call OI is 120 and the call OI 5 trading days ago was 98, 1w change in call OI is 22.44% ((120/98) – 1)*100.

A positive change in call OI indicates that more people have bought call contracts compared to 5 days ago. This suggests that participants are bullish on the stock. On the contrary if the output is negative it indicates that investors have squared off their open positions and are not confident about the future price rise.

Introduction to Futures

Let’s start with a small story that will allow us to better understand the working of futures market. Two women, Sita and Noor are both active in the housing market of Mumbai. Sita is looking to buy a 2 bedroom apartment. Noor is planning to sell her 2 bedroom apartment for about Rs.1 crore and utilize the proceeds to set up a catering business.

Sita does like Noor’s apartment but is not able to pay immediately. Her money is locked in fixed deposit which will mature in 6 months and Sita does not want redeem it before the maturity date. However she wants to seal the deal and agree on the purchase consideration as she is concerned that prices might go up in the future. Noor is also keen to seal the deal. However since she has not yet found another rented accommodation to move into, she wants some grace time before handing over the possession of the apartment to Sita. Hence Sita enters into an agreement with Noor to buy the house after six months for a consideration of Rs 1.1 Crore. This way both were able to achieve their respective objectives.

This is a basic futures contract. Sita has agreed to buy the house and hence holds the long position. Noor has agreed to sell the house and hence holds the short position. A long position holder buys the “underlying” asset whereas short position holder agrees to sell the asset.