A portion of the profits that a company distributes to its shareholders is called dividends. The dividend yield is a commonly used financial ratio that helps investors analyse the returns they generate based on the stock’s price. The higher a company’s dividend yield, the greater dividends the investors receive on the shares.

Read on to understand the concept of dividend yield and how it is calculated.

You will Learn About:

What is dividend yield?

The dividend yield is a popularly used financial ratio that helps ascertain the dividend value paid to the investors compared to the shares’ market value.

The dividend yield is expressed as a percentage of the stock’s market value, and investors can use it to calculate their expected earnings from the investment. It is highly dependent on the market, and it changes whenever there is a price change.

If a company’s dividend yield is high, it naturally pays more to the investors from its share of profits. Now, every industry has a standard dividend yield based on different factors.

You can compare the dividend yield ratio of your stocks with the industry market average to assess their performance.

Dividend Yield – Salient Features

- Dividend yield helps the investors understand the dividends they would receive against the share’s market price.

- Higher the dividend yield, the higher the earnings.

- A dividend yield above 3% is considered ideal.

- Industries may have varying dividend yields based on different factors.

- You will require information on dividends and the current share price to calculate the dividend yield.

Understanding dividend yield

The concept of dividend yield is relatively easy to understand.

For instance, if a stock’s dividend yield is 0.1% and the share’s price is Rs. 100, you will get Rs. 10 as the dividend. Use Tickertape Stock Screener to find the current price of a stock.

Additionally, the dividend yield ratio gives you an estimate of the returns you will earn on your stock investments. Even if the stock price falls, the stock’s dividend yield could rise as no change is made to the company’s dividend payout. However, if the dividend amount remains unaltered and the price of the stock increases, the dividend yield ratio will fall. Therefore, you need to understand the stock’s price movement to understand the impact on the dividend yield.

Growing companies may not pay huge dividends on their stocks (as they retain their profits for reinvestment). However, most well-established and mature companies pay decent dividends to their investors. Hence, in most cases, the dividend yield of mature companies will be better than that of small, growing companies.

Difference between dividend rate vs dividend yield

The terms dividend rate and dividend yield are used interchangeably by several investors. However, the concepts are slightly different from each other.

The dividend rate captures the total expected income that an investor will earn from a stock. On the other hand, the dividend yield gives you the rate of return for your stock.

For instance, assume you invest Rs. 2,00,000 in a company at Rs. 100 and get 2,000 shares in return. The company declares Rs. 10 as a dividend on a share. Now, this is the dividend rate. Therefore, you will receive a total dividend of Rs. 20,000.

Now, let’s calculate the dividend yield, which is

Rs. 20,000 X 100/2,00,000 = 10%

The dividend rate shows the total expected dividend payment you will receive from a particular investment. In contrast, a dividend yield shows the ratio between the dividend and the stock’s market price.

How to calculate dividend yield?

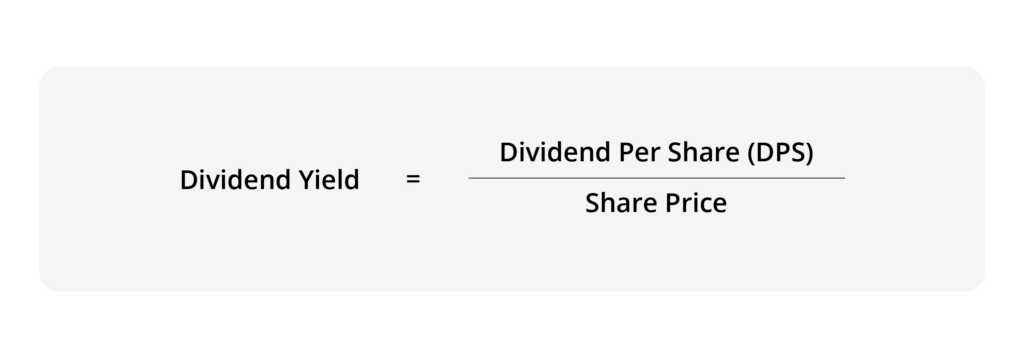

If you are wondering how to calculate dividend yield, you must know the formula used in the calculation. The fairly simple formula includes the dividend paid by the company and the share price of the company.

The dividend yield formula is:

Dividend yield = Annual dividends per share / Price per share

You can use this formula to calculate the dividend yield of different stocks and then compare them to make better investment decisions.

Alternatively, use Tickertape Stock Screener to find the dividend yield of a stock and sort the companies according to the ratio. Not just that, on the Stock Screener, you can use filters like ‘Dividend Yield vs Sector’ and ‘Dividend Yield vs Sub-sector’ to compare the dividend yield of a company with the sector and sub-sector, respectively.

Dividend yield example

Now that you know how to calculate dividend yield, let’s take another example to understand the concept better.

For instance, an investor buys shares worth Rs. 20,000 of a company with a dividend yield of 4%. The price of one share is Rs. 200. The investor has 100 shares of the company, and every share gives a dividend of Rs. 8. Therefore, the total dividends the investor would earn is

=100 X Rs. 8 = 800

Evaluating dividend yield

You can calculate the dividend yield by dividing the dividend per share by the market value of the share. If you plan on evaluating the dividend yield, you can get the figures from the company’s financial statements. Investors can look at the quarterly reports to better evaluate the dividend yield.

What’s a good dividend yield?

As per industry standards, a share with a dividend yield ratio greater than 3% is considered ideal. The greater the yield percentage, the better it is for the investors.

Merits of dividend yields

Most securities pay dividends, and hence the metric is popularly used. There are some pros to using the dividend yield metric, as stated below–

- When a company focuses on improving its dividend yield ratio, it focuses on enhancing its investors’ returns.

- Dividend yields promote investments as most investors tend to reinvest their dividend earnings back into their stocks. As a result, the dividend grows due to the compounding effect.

Demerits of dividend yields

When a company promises a certain dividend yield, it must spare a huge amount from its profits to pay these dividends. This may end up compromising a company’s growth.

Also, many companies do not revise their dividend yield data regularly, and thus, you may not get a true picture of what you will receive as dividends.

Conclusion

Investors are always on the lookout for metrics that help them understand the performance of their investments. If you have invested in securities that pay dividends, you can use the dividend yield ratio to get a fair idea of the dividends you will receive on your investments. Also, if you are planning to invest and are confused between two shares, you can check their dividend yield to decide. The greater the dividend yield of the security, the better the investment.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.