The direct cost a business incurs on producing goods is called the Cost of Goods Sold (COGS). Ultimately, the cost of goods sold is a key factor that goes into determining whether your business is profitable.

A high COGS can adversely affect a company’s operating profits, thereby hampering its reputation among investors. Let’s read more about COGS.

You will Learn About:

What is the cost of goods sold?

Also known as the ‘cost of sales’, the cost of goods sold represents the total direct expenditure made by a company in producing the goods that it sells. Only the expenses directly related to the production of goods are included in the cost of goods sold, like labour costs, material costs, manufacturing overheads etc.

It is essential to note that the cost of goods sold does not take into account indirect costs like marketing and distribution.

The cost of goods sold is recorded as an expense on the income statement.

The cost of goods sold is also a key component for determining a business’s gross profit and gross margin. The higher the cost of goods sold, the lower the business’s net income and net profit.

Return on equity: Highlights

- All the expenses directly related to the production of final goods are collectively referred to as the cost of goods sold.

- The cost of goods sold excludes all indirect expenses, including marketing and overhead expenses.

- The valuation method and accounting standards you use for calculating inventory will significantly impact the cost of goods sold and the gross profit.

- You arrive at the gross profit or gross margin by deducting the cost of goods sold from total revenue/sales. The higher the cost of goods sold, the lower will be the gross profit.

- The cost of goods sold (COGS) is different from operating expenses. The latter includes expenses that are not directly related to the production of goods.

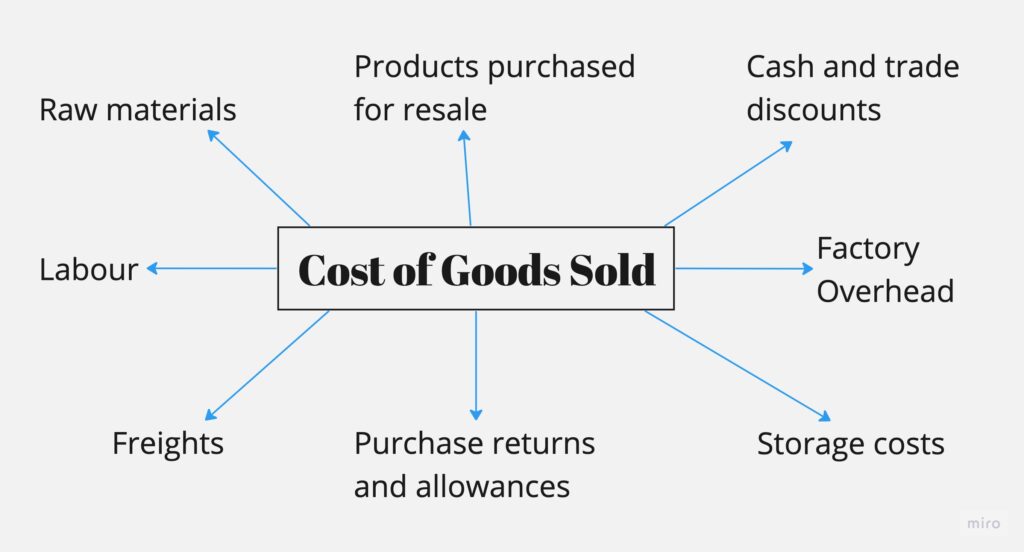

What is included in the cost of goods sold?

The following are the main expenses included in the cost of goods sold:

- Raw materials

- Freights

- Products purchased for resale

- Cash and trade discounts

- Purchase returns and allowances

- Factory overhead

- Labour

- Storage costs

Here, materials include all the expenses on raw materials, spare parts, and other supplementary items required to manufacture and assemble products. The labour costs will include the expenses incurred by the workforce to manufacture, assemble, and ship products.

In this sense, the wholesale price of a product is essentially the cost of goods sold, as it accounts for all the direct expenses incurred on each product manufactured.

How to calculate the cost of goods sold?

The cost of goods sold formula is given below:

COGS = (Opening inventory + Purchases) – Closing inventory

Though the formula for calculating the cost of goods sold is quite straightforward, the calculation can be a little complicated. Here’s how you can calculate the cost of goods sold with the below steps:

- Identify the opening inventory of raw materials, work-in-process inventory, and finished goods.

- Determine the cost of purchases of raw materials incurred during the manufacturing process, including discounts, freight charges, etc.

- Identify the closing inventory balance.

- Ensure that you have included all the direct expenses related to the production of goods.

How to calculate the cost of goods sold from the income statement?

There are two ways you can calculate the cost of goods sold from the income statement:

- Method 1

In this method, you begin by identifying the opening and closing amounts of inventory. Second, you differentiate between the direct and indirect expenses in relation to the manufacturing of products. Third, you calculate the total amount of purchases. You can calculate the COGS by adding purchases to the opening inventory and subtracting the closing inventory from the sum.

- Method 2

The second method requires you to measure the changes in inventory to calculate the cost of goods sold. For example, consider a total of 300 units have been manufactured or purchased, and the inventory has also increased by 100 units. Then the cost of 200 units shall be the cost of goods sold.

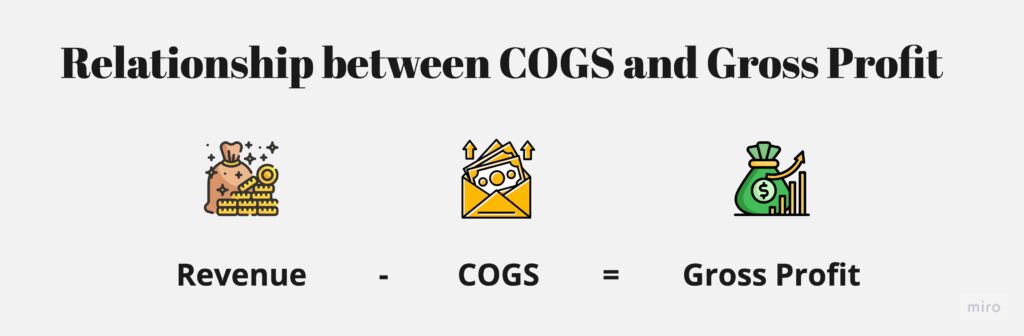

Relationship between COGS and gross profits

Gross profits are often discussed along with the cost of goods sold. This is because they share a direct relationship. Gross profit is arrived at by deducting COGS from net revenue or sales.

If the COGS increases for a period, the gross profits take a direct hit, and vice versa. For a company to succeed, equal importance must be given to both COGS and gross profit.

Conclusion

The cost of goods sold is the company’s direct expense to manufacture finished products. The cost of goods sold can vary depending on the direct costs, which include labour, raw materials, etc. It can be calculated using several methods but mainly requires the opening and closing inventory and the purchase values. The cost of goods sold directly impacts a company’s gross profits and hence must be studied carefully.

FAQs

Did you Like the Explanation?

Authored By:

I am a finance enthusiast who loves exploring the world of money through my lens. I’ve been dedicated to building systems that work and curating content that helps people learn.

As an insatiable reader and learner, I’ve spent the last two years exploring the world of finance. With my creative mind and curious spirit, I love making complex finance topics easy and fun for everyone to understand. Join me on my journey as we navigate the world of finance together!