During the course of business, there are different sources from where cash flows into the business. Moreover, there are multiple cash outflows as well. A cash flow statement is prepared to account for this inflow and outflow of cash.

Let’s understand the cash flow statement meaning and more.

You will Learn About:

What is a cash flow statement?

A business prepares three financial statements – Profit and Loss, Balance Sheet and Cash Flow Statement.

A cash flow statement is a financial statement that accounts for the inflow and outflow of cash in the business during a financial year. The statement also depicts the sources of inflow as well as the expenses towards which the cash is being allocated.

The cash flow statement measures how the business uses cash and its ability to generate liquid funds when needed. Read below to learn about the components of the cash flow statement.

Return on equity: Highlights

- A cash flow statement is a statement showing cash outflows and inflows.

- The statement contains three different sections – operating, investing and financing activities.

- The statement is an important parameter for measuring business performance and is used by the management as well as by stakeholders.

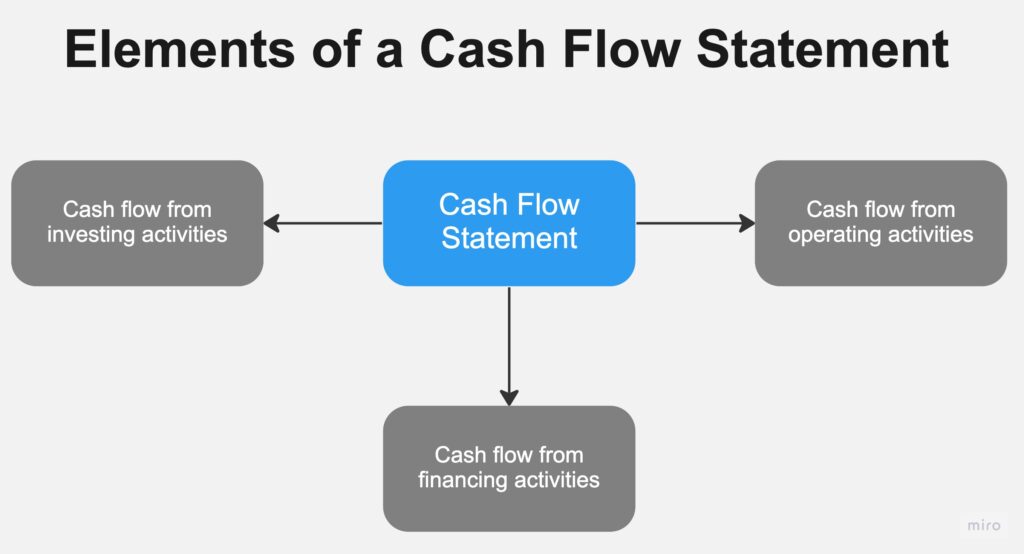

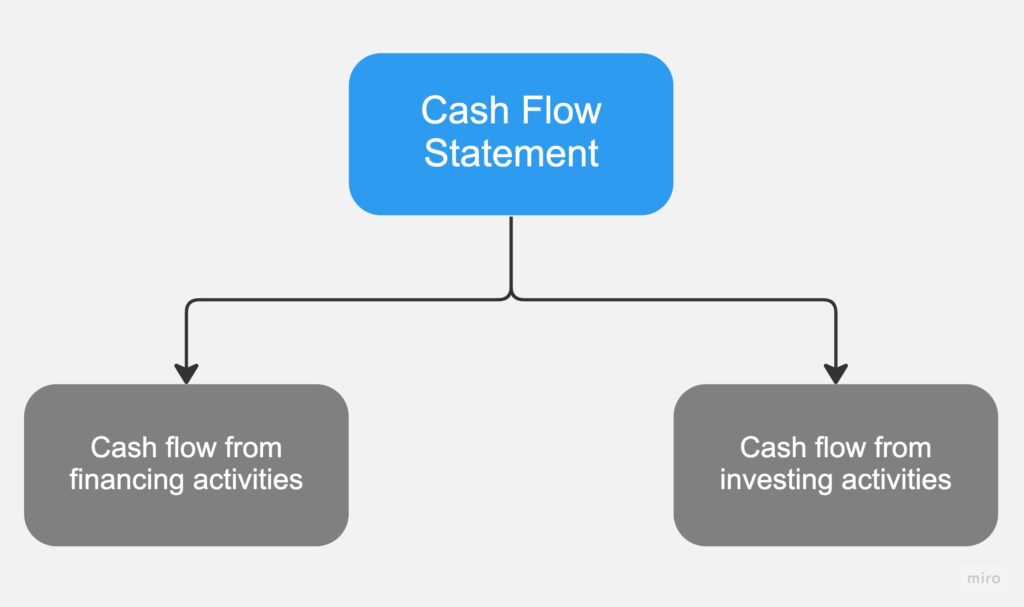

Sections of the statement of cash flows

A cash flow statement has different sections. These sections are as follows –

- Cash flow from operating activities

Under this section, the cash flow generated from the everyday activities of the business is recorded. The operating activities are undertaken to generate revenue for the business. Common examples include payment of tax and interest, income received from selling goods or services, salaries and wages, rent, etc.

- Cash flow from investing activities

If the company makes any investments and gets returns from them, it falls under this section. Investments include buying and selling of non-current assets, mergers, acquisitions, etc.

- Cash flow from financing activities

Cash flow resulting from borrowing and change in the capital structure falls under this head. For instance, the cash raised from the issue of shares, borrowing or paying off loans, paying dividends, etc., are all recorded under this section.

Format of a cash flow statement

The cash flow statement format is simple, wherein the cash flows are recorded as per the three sections discussed above. There are three columns –

- The sections and their respective cash flows are recorded in the first column.

- The second column helps add the cash flow from each section.

- The third column represents the section totals of all three sections and the final cash flow at the end.

Cash flow statement example

Let’s assume a business, M/s XYZ, had the following cash flows during the year –

- Rent paid for office premises – Rs. 40,000

- Revenue from sales – Rs. 5 lakh

- Wages paid – Rs. 2 lakh

- Interest paid – Rs. 10,000

- Purchase of equipment – Rs. 2 lakh

- Interest received on investment – Rs. 20,000

- Issuance of bonds – Rs. 4 lakh

- Paid to creditors – Rs. 1 lakh

The cash flow statement of the business would be prepared in the following manner –

| Particulars | Amount | Amount |

| cash flow from operating activities Rent paid Sales revenue Interest paid Net cash flow from operating activities | (Rs. 40,000) Rs. 500,000 (Rs. 10,000) | Rs. 4,50,000 |

| cash flow from investing activities Equipment purchase Interest on investment Net cash flow from investing activities | (Rs. 200,000) Rs. 20,000 | (Rs. 1,80,000) |

| cash flow from financing activities Issuance of bonds Payment to creditors Net cash flow from financing activities | Rs. 400,000 (Rs. 100,000) | Rs. 3,00,000 |

| Net cash flow during the year | Rs. 5,70,000 |

This shows that the business has a cash balance of Rs. 5.7 lakhs at the end of the financial year

Interest and cash flow

According to Ind AS 7 – Statement of cash flows, any interest paid by a business would fall under the ‘cash flow from financing activities’ section. On the other hand, interest received would fall under the ‘cash flow from investing activities’.

Free cash flow

Free cash flow is what is left with a company after deducting the operating and capital expenses. It depicts a company’s ability to pay dividends to its shareholders.

How to prepare a cash flow statement?

There are two ways to prepare a cash flow statement. These are explained below –

- Direct method

The direct method adds up all the cash inflows and subtracts all the outflows. The remaining balance shows the net cash flow of the business.

- Indirect method

The indirect method uses the accrual basis for preparing the cash flow statement. Under this method, the inflows and outflows are recorded when the transaction is done, even if the actual cash is not transferred.

What does the statement of cash flow tell?

The following can be interpreted from the cash flow statement –

- The company’s performance during the financial year

- The company’s ability to pay its operating and investing expenses without depending on borrowing or raising fresh capital.

Importance of a cash flow statement

Here are some points that establish the advantages of a cash flow statement –

- The statement helps businesses take suitable short-term decisions to maintain their profitability and liquidity.

- The statement shows the primary expense and revenue areas. This information can be used by the management to increase the inflows and reduce the outflows.

- The cash flow statement serves as a yardstick to check areas of concern.

Why is the cash flow statement prepared?

The cash flow statement is one of the three primary financial statements of the company besides the profit and loss statement and the balance sheet.

It gives useful information to the company and its management. Moreover, investors and stakeholders can also assess a company’s performance and solvency through the statement.

How to interpret a cash flow statement?

A cash flow statement can deliver two possible figures – positive or negative. Here’s how to interpret them –

- Positive cash flow

A positive cash flow means that the company has a cash balance left in hand after paying off all its expenses. This is a good sign and shows that the company can meet its short-term needs.

- Negative cash flow

Negative cash flow is when the outflows are higher than the inflows. This shows that the business is incurring higher expenses without having the funds to pay for them. Consistent negative cash flows can be a red flag.

Conclusion

A Cash flow statement is one of the three financial statements that companies are required to prepare. It records the total cash inflow and outflow. It measures the company’s liquidity and helps assess where the company funds are employed. Understand the uses of cash flow statement and how it is prepared to learn a company’s primary expenses and income sources. You can check the cash flow statement of any company using Tickertape’s Stock Pages. Here is an example of the cash flow statement of Reliance Industries Ltd –

To access the cash flow statement of any company, follow these steps:

- Go to Tickertape

- Search for the stock/company of your choice

- Click on ‘Financials’ and then click on ‘Cash Flow’

FAQs