The balance sheet is an important financial statement which can help investors and all stakeholders understand the true worth of a company. A balance sheet portrays the relationship between a company’s assets, liabilities and equity at any given time.

Read on to discover balance sheet meaning, how to analyse a balance sheet, how to read a balance sheet and much more.

You will Learn About:

What is a balance sheet?

A balance sheet represents a company’s assets, liabilities and shareholder equity for a defined time period. In other words, a balance sheet depicts a business’s worth at a specified time and helps understand what a company owns and owes.

Balance sheet analysis is critical for potential investors and stakeholders to make financial decisions. When combined with the income and cash flow statements, a balance sheet portrays the exact financial conditions of the business and can help determine the growth and profitability of a company.

Balance sheets are prepared as per accounting standards and can be generated annually or quarterly.

Return on equity: Highlights

- A balance sheet depicts the assets, liabilities and shareholder equity associated with a business at a given time.

- The balance sheet should always balance out. In other words, assets must always be equal to the sum of shareholder equity and liabilities.

- Ratio analysis helps in conducting an in-depth analysis of the balance sheet.

- A balance sheet is critical in analysing the company’s financial status, liquidity and growth.

What is the purpose of a balance sheet?

Let us comprehend why a balance sheet is prepared:

- To evaluate asset value and determine how assets are contributing to revenue and profits

- To assess liquidity

- To compute financial and other important ratios

- To depict the financial position of a company

- To understand the company’s debt and equity structure

- To determine future growth

- To aid comparison with peers

What items are there on a balance sheet?

A balance sheet consists of the following items:

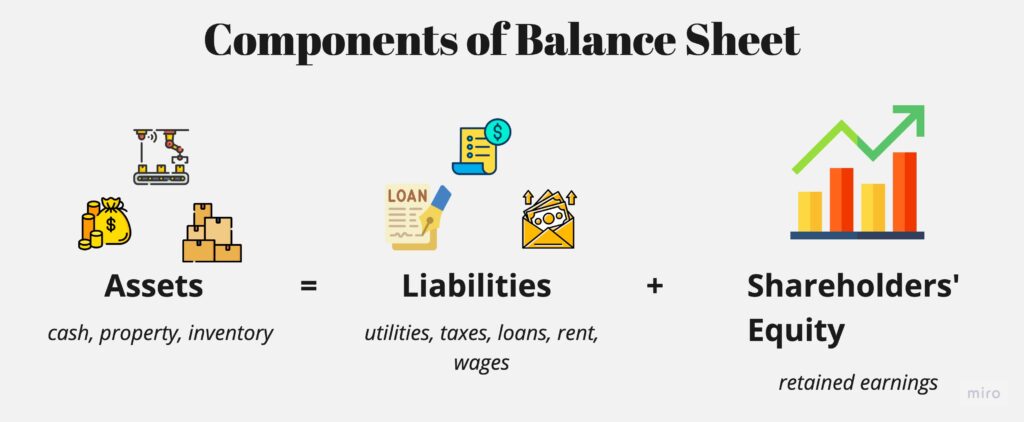

Assets

The asset section of a balance sheet determines a company’s acquired assets. The assets are subdivided into two categories:

- Current Assets – These assets can be liquidated/converted into cash readily, such as inventory, marketable securities, cash and cash equivalents, accounts receivables, and prepaid expenses.

- Non-current Assets – Non-current assets cannot be converted into cash immediately and comprise long-term securities, fixed assets, and intangible assets.

Liabilities

The amount a business owes in debt constitutes the liabilities section. Liabilities are further subdivided as shown below:

- Current liabilities – These include rent, taxes, payments toward short-term debts etc.

- Non-current liabilities – The long-term dues associated with a company include long-term loans, deferred liabilities, deferred income taxes and more.

Shareholder’s equity

Shareholder’s equity refers to –

- Amount of money invested into a business by its shareholders

- Amount of funds generated by a business

- Any donated capital

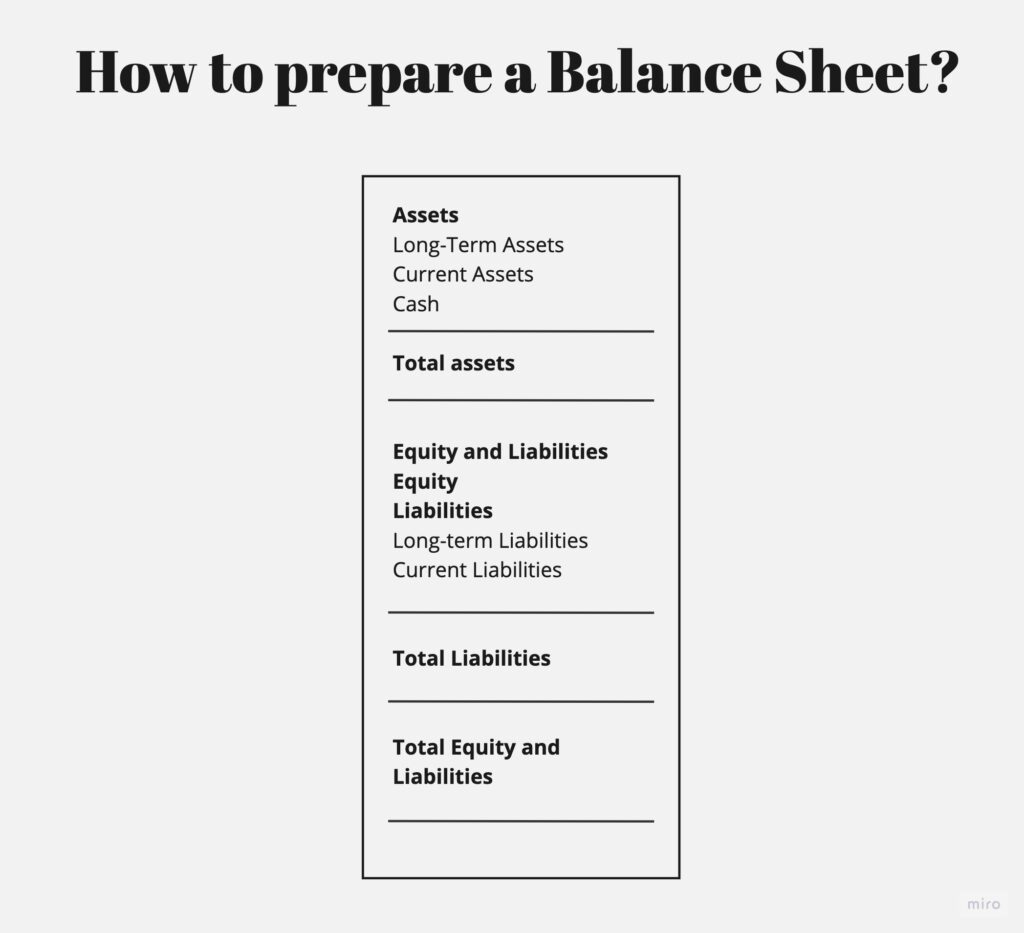

Balance sheet format

In India, there are two formats for preparing a balance sheet:

- Horizontal Format

This involves placing figures under the categories of assets and liabilities.

- Vertical Format

This classifies the balance sheet entries as sources of funds (liabilities) and application of funds (assets)

The formats primarily differ in the presentation. The below format might be useful while understanding how to prepare a balance sheet.

Balancing a balance sheet

A balance sheet illustrates how a business finances its assets, i.e. via debt or equity. Individuals seeking an answer to – how to make a balance sheet must pay close attention to the below formula:

Assets = Liabilities + Shareholder’s equity

Balance sheet example

Let us look at the balance sheet presented by Reliance Industries.

Does a balance sheet always balance?

A balance sheet must always balance.

In other words, the total assets must equal the sum of liabilities and shareholder’s equity each time. The reason behind this is the principle of double entry used in accounting. Transactions are recorded across two accounts to ensure consistency in the entries.

Let’s assume you run a mid-size firm and sell your machinery for Rs. 10 lakh. Then, your assets would decrease by Rs. 10 lakh, but your cash/cash equivalents increase by the same amount, i.e., Rs. 10 lakh.

How to analyse a balance sheet?

Balance sheet analysis helps prospective investors and stakeholders gain insight into the company’s financial condition. The most effective technique used to analyse a balance sheet is ratio analysis. Activity, solvency, valuation and liquidity ratios can be used to analyse a balance sheet.

You can also study separately how the company is utilising its debt or how the cash flow is being managed to gauge a company’s actual standing.

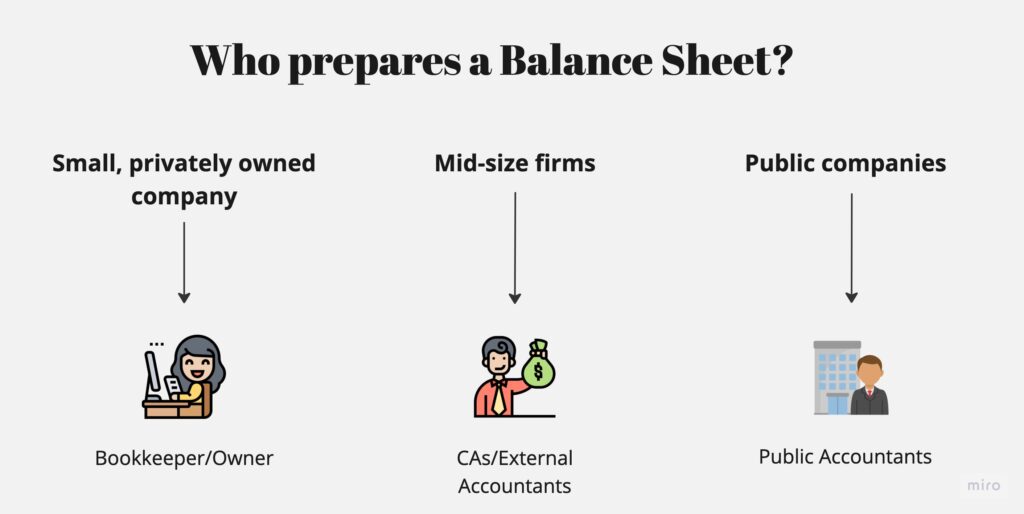

Who prepares a balance sheet?

There may be different parties involved in preparing a balance sheet based on the company’s size, as stated below –

- In the case of small, privately-owned businesses, the bookkeeper or the owner might prepare the balance sheet.

- Mid-sized firms usually employ the services of CAs and external accountants to prepare their balance sheets.

- Public companies must obtain external audits from public accountants.

How often is a balance sheet prepared?

Though a balance sheet statement can be prepared at any time, they are usually prepared at the end of an accounting year.

Importance of the balance sheet

Here is an overview of the importance of a balance sheet

- Financial status – The balance sheet gives an insight into the company’s financials. This helps investors, stakeholders and creditors get an extensive overview of a company’s liquidity and business accomplishments.

- Growth status – The balance sheet helps determine a company’s growth over the years.

- Business loan – To qualify for a business loan, it is essential to submit the balance sheet to a bank.

- Future strategies – A balance sheet can help formulate future strategies for a business, such as future expenses and business expansion.

Conclusion

A balance sheet is a statement that represents the assets, liabilities and equity of a company. It helps investors, stakeholders, and creditors assess a company’s financial health. Effective balance sheet analysis can help investors and stakeholders analyse a company’s future growth potential to make more effective investment decisions.

FAQs

Did you Like the Explanation?

Authored By:

I am a finance enthusiast who loves exploring the world of money through my lens. I’ve been dedicated to building systems that work and curating content that helps people learn.

As an insatiable reader and learner, I’ve spent the last two years exploring the world of finance. With my creative mind and curious spirit, I love making complex finance topics easy and fun for everyone to understand. Join me on my journey as we navigate the world of finance together!