Last Updated on Jul 28, 2021 by Aradhana Gotur

When purchasing anything small or big in value, be it vegetables or consumer durables, you look to pay a fair price for it, not less not more. Sometimes, you may also look to buy it for a price lower than its fair value. The same goes for stocks.

The intrinsic value of a stock is more like its fair price in your view. Click To TweetLet’s learn more on the subject.

This article covers:

- Are stocks priced fairly on bourses?

- What is the intrinsic value of a stock?

- How to calculate the intrinsic value of a share?

- Using dividend discount model

- Using discounted cash flow analysis

- Using relative valuation method

- Do all stocks trade at a price higher than their intrinsic value?

Table of Contents

Are stock priced fairly on bourses?

You may be aware that stock prices are influenced by various aspects, both internal and external to the company. These include recent developments in a company, demand and supply of the stock, and macroeconomic conditions. This means, the stocks listed on the exchanges may or may not be available at a fair price.

If, for example, HUL is in high demand because of its recent expansion plans, the stock price may be inflated because scores of investors are looking to add it to their portfolio. At such a time, if you want to purchase the stock, you would be paying a higher price for it.

However, paying a fair price for a stock gives you a better return on investment. But the question remains: how to ascertain whether a stock is commanding a fair price or not. This is when the intrinsic value of a stock comes into the picture.

What is the intrinsic value of a stock?

As we know, a stock is the portion of the capital of a business. Owning one makes you a part-owner of the company. That said, the intrinsic value is its fair value as far as you or the analyst is concerned.

The intrinsic value of a stock helps you understand whether it is undervalued or overvalued in your view. Click To TweetHere’s a simple example to understand the concept of intrinsic value. Let’s say that you want to buy a house to earn a rental income from it. This makes it an investment as you are expecting future cash flows or returns from it. Suppose you want to hold it for 15 yrs. You would only buy it if it generates an aggregate cash flow that is higher than what you pay today. For accuracy, future cash flows and the resale value of the house can be adjusted for inflation and various kinds of risks.

In other words, you will only want to pay a sum lower than the cumulative rent that the house can generate in 15 yrs plus its resale value. Otherwise, it makes no sense to invest in the house. Ergo, you would do certain calculations to arrive at the fair price that you may be willing to pay to acquire the house in order to enjoy returns. That’s quite simple to understand. But how would you calculate the expected future income of stock? Well, it’s simple too.

How to calculate the intrinsic value of a share?

There are a number of ways of ascertaining the intrinsic value of a share. In this article, let’s look at:

Let us look at each of these in brief.

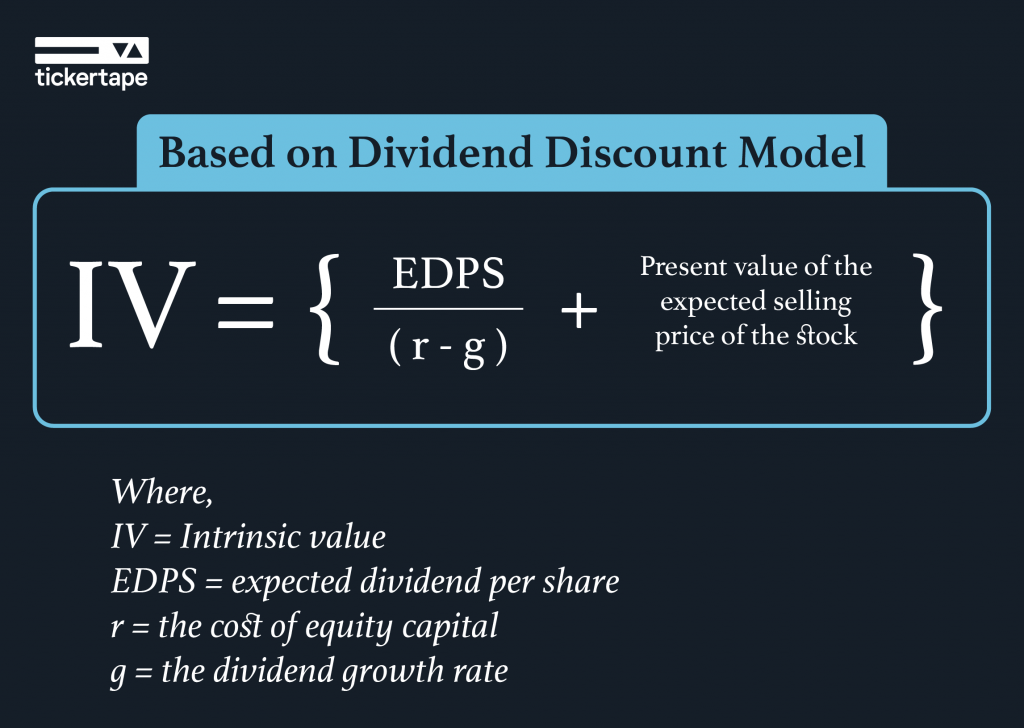

1. Dividend discount model

Also knows as DDM in short, the dividend discount model predicts a stock price based on the present value of the sum of its future dividend payments. In other words, it discounts the sum of all the future dividends expected to be offered by a company to arrive at their present values. If the stock price derived from the DDM is higher than the current value, it is undervalued and if it is lower, the stock is overvalued. That said, if you opine that a stock is significantly overvalued, you may not buy it. In contrast, if you are of the opinion that the stock is significantly undervalued, it could be a good buy.

Discounting factor

Estimating the future dividends of a company in order to discount them requires certain assumptions. You could, maybe, identify historic trends of the dividend payments to estimate the future dividends. You then take cues from it to calculate the intrinsic value of a stock based on the dividend discount model. For this purpose, you need two factors handy: r and g.

Estimating the r: when you invest in a stock, you take a risk in terms of a probable decline in its value. In return, you expect to be compensated, which is represented by the firm’s cost of equity capital. This is called the expected rate of return and is represented by ‘r’. You can estimate r by using the Dividend Growth Model or the Capital Asset Pricing Model.

Estimating the g: this variable represents the dividend growth rate of a company. If the growth rate is constant, then ‘g’ will be 0

One of the effective ways of discounting future dividends is by deducting the dividend growth rate from the expected rate of return (r – g).

Notes:

- To estimate the dividend growth rate, multiply the return on equity (ROE) by the retention ratio

- Retention ratio is the opposite of the dividend payout ratio or 1 minus the dividend payout ratio. If the latter is 1%, the retention ratio would be 99%

- The rate of return on the stock has to be more than the rate of growth of future dividends

Shortcomings of DDM

- There are chances that a company pays dividends even when incurring a loss or whose earnings are relatively lower. The DDM fails to take this possibility into account

- All three variables of the formula to calculate the intrinsic value of a stock are estimates, which can render an inaccurate result. For instance, the dividend may grow at a constant rate, a higher rate or even a lower rate. This could still work in case of a company that has displayed a constant dividend payout in the past years. However, it will not work in case of a company that doesn’t pay constant or regular dividends

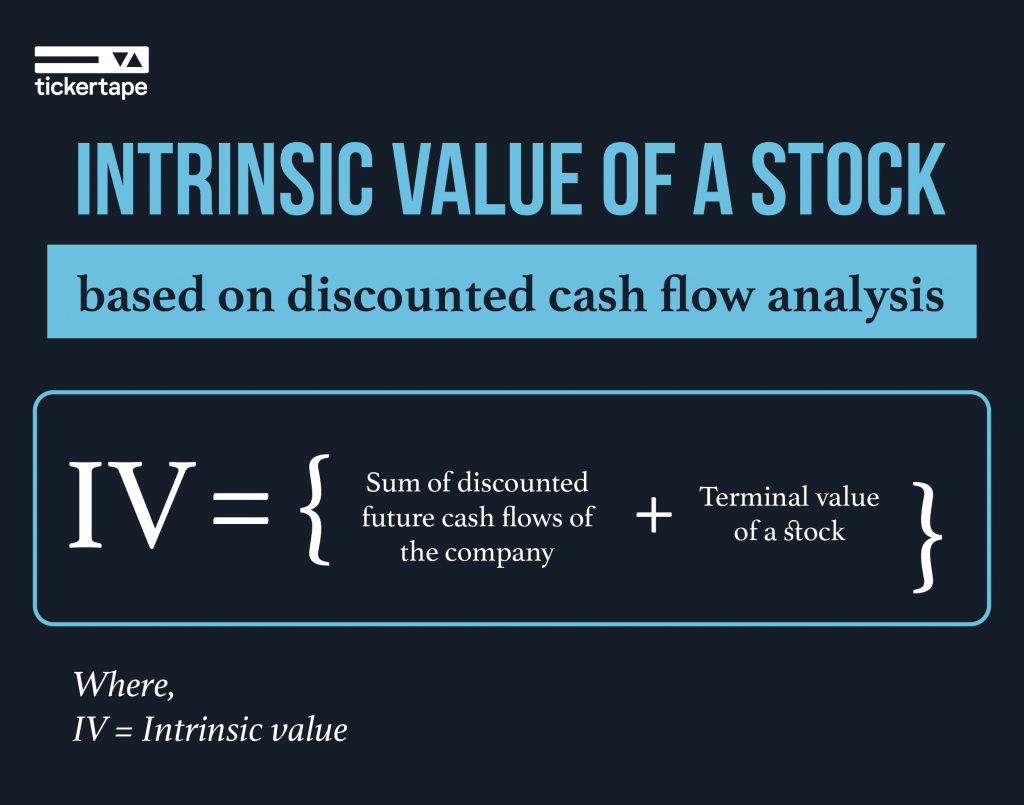

2. Discounted cash flow analysis

Long for DCF, the discounted cash flow is a method used to ascertain the value of an investment or a stock based on the free cash flows that are expected to be generated by the company in the future. These future cash flows are discounted to arrive at their present value by applying a discount rate.

The discounted cash flow analysis assumes that a rupee earned today is better than a rupee earned tomorrow. The rationale is simple. If you invest the rupee that you have in your hand today you can increase its value subsequently. That is also the whole point of investing.

The discounted cash flow analysis uses the time value of cash to ascertain the intrinsic value of a stock. Click To TweetSteps to calculate discounted cash flow

You can analyse the DCF of stock in three simple steps:

- Forecast the future cash flows from an investment

- Arrive at an accurate discount rate and apply it to the future cash flows to ascertain their present value

- Add these discounted future cash flows and the terminal value of the stock or the present value of the expected future selling price of the stock

Note:

- To arrive at the discounted future cash flows of the company, apply an accurate discount rate to all the future cash flows through the holding period and then add them

- Typically, the discount rate is a company’s Weighted Average Cost of Capital (WACC). This represents the required rate of return that you, as an investor, expect from buying their stock

- Terminal value of stock = {CF*(1+growth rate)}/(discount rate – growth rate). Here, CF is the net cash flow

Alternatively, you can also ascertain the DCF of stock using the following formula.

Discounted cash flow = CF1/(1+r)1 + CF2/(1+r)2 + CFn/(1+r)n + terminal value of the business

where,

CF = the cash flow of the nth year

r = the rate of discount

DCF is used by both investors and businesses. As an investor, you can use it to make calculated decisions when investing in the stock of a company. Businesses, on the other hand, use DCF analysis as part of their decision-making process when acquiring a company, doing capital budgeting or calculating operating expenditures.

If the intrinsic value of a stock derived using discounted cash flow analysis is more than its current price, then it would generate positive returns. If its lower than the current price, the stock could generate negative returns. Click To TweetNote that the DCF is not the same as the net present value (NPV). The latter has an additional step of deducting the upfront cost of the investment from the DCF.

Shortcomings of DCF

- DCF is based on many assumptions such as the estimated future cash flows from the investment. The future cash flows are in turn based on a number of factors such as the state of the economy, market demand, technology, competition, contingencies, and potential opportunities. Ergo, the discounted cashflows could be inaccurate

- DCF is not feasible when you cannot determine the future cash flows. Ergo, at such times, it is best to use other methods to calculate the intrinsic value of stock

- An unrealistically high estimate of the future cash flows can make an otherwise impractical investment look feasible. And if you go ahead and invest in the same, you may end up earning lower profits or incur a loss. In contrast, a low estimation of future cash flows can make the investment look expensive, discouraging you from an otherwise attractive opportunity

3. Relative valuation method

This method compares the price of the stock with the company’s fundamentals such as revenue, net income, profits, and the book value of equity shares. When you buy a stock, it makes you a part-owner of the company issuing it. As a result, you also own a portion of these key fundamentals.

Relative valuation method of deriving the intrinsic value of a stock involves comparing the company’s fundamentals such as the PE ratio and book value of equity shares with that of their peers'. Click To TweetOne of the key ratios you can use for relative value analysis is the price to earnings (PE) ratio. So if the stock price is Rs 100 and the company’s earnings per share is Rs 10, the PE ratio will be Rs 10. This means that you pay Rs 10 for each rupee of the company’s earnings. To see if this price is fair, compare it with the PE ratio of the company’s peers. If the company’s PE ratio is lower than the average PE of its competitors, you get the stock for a cheaper price and vice versa.

Shortcoming of the relative valuation method

In this method, you consider the company’s fundamentals as of today. However, these figures are subject to change with important developments within the company and the economy. This will certainly have a significant impact on the value of the stock.

Do all stocks trade at a price higher than their intrinsic value?

Not all stocks trade at a price higher than their intrinsic value. Some may be trading at par with it or even lower.

Ascertaining the intrinsic value of a stock is both an art and science. You will be the judge of what is the fair value of a stock as per your assumptions and calculations. Click To TweetWhen you buy a stock at its intrinsic value or a price lower than that, you can be in a position to make a relatively higher profit. It’s a no-brainer actually: lower the purchase price, higher the profit and higher the purchase price, lower the profit, provided the selling price or the end value of the investment in consideration remains constant.

Here’s a numeric example. Suppose that RIL’s market price is Rs 1,000 and its intrinsic value as per your calculations is Rs 1,200. This means the stock is trading at a discount on its intrinsic value. In contrast, if RIL’s market value is Rs 1,500, then it is said to be trading at a premium. Regardless, you can only buy the stock at its current market price.

However, whether to buy the stock or not is your call. A value investor like Warren Buffett would buy RIL in the first case but would not in the second case.

Stocks trading at a price below their intrinsic value are called undervalued stocks. Click To TweetThe significance of such stocks is that they have a higher tendency to move up subsequently. This can happen in 2 stages:

- First, the market recognises this undervalued stock. Therefore, it will have more buyers than sellers. As a result, the price will start rallying and continue till it equals the intrinsic value

- Second, the price surpasses intrinsic value and continue the forward momentum. The stock thus becomes overvalued

By now you may have understood what is the intrinsic value of a stock and how it can help you make a calculated investment decision. But be informed that the analysis of the intrinsic value of stocks is criticized despite its wide application mainly because many assumptions come into play. Nonetheless, this can be a good starting point to analyse a stock before you buy it.

- Best Performing Index Funds in India (2025) - Jun 5, 2025

- Issue of Shares – Meaning, Types, Examples and Steps - Jun 4, 2025

- Banking Mergers in India – List of Merged PSU Banks, Advantages, and Challenges - Jun 3, 2025