Groww Mutual Fund (formerly Indiabulls Mutual Fund) has recently launched India’s 1st Total Market Index Fund – Groww Nifty Total Market Index Fund – an open-ended scheme replicating/tracking the Nifty Total Market Index.

For the uninitiated, the Nifty Total Market Index tracks the performance of approximately 750+ stocks listed on the National Stock Exchange (NSE), meaning the fund returns would be based on the performance of the index, subject to tracking error.

But why bring in a Nifty Total Market Index Fund in a market that already has a basketful of Nifty50 index fund schemes? Let’s dive in.

Table of Contents

The broader indices story

The Nifty50 index stands out as one of the most widely recognised and popular indices in India’s financial landscape. It meticulously monitors the top 50 companies listed on the NSE, carefully selected based on their market capitalisation. It’s the foundation upon which the broader Nifty100 index is built, encompassing the 100 largest large-cap companies.

However, beyond this realm of large-cap giants lies a vast sea of companies, including mid-cap, small-cap, and macro-cap entities. These companies, although smaller in market capitalisation compared to their large-cap counterparts, hold substantial potential to shape India’s growth narrative.

Now, you might wonder, “Don’t we already have the Nifty Midcap 100 and Smallcap 100 indices to keep tabs on these relatively smaller companies?” It’s true that these indices exist, but keeping tabs on each one can be a cumbersome task. This is where the Nifty Total Market Index steps in—a single index that meticulously tracks approximately 750 stocks.

It’s safe to assert that the Nifty Total Market Index provides a far-reaching and holistic perspective of the Indian stock market compared to any other index. But how does it measure up against its counterparts?

Let’s talk numbers

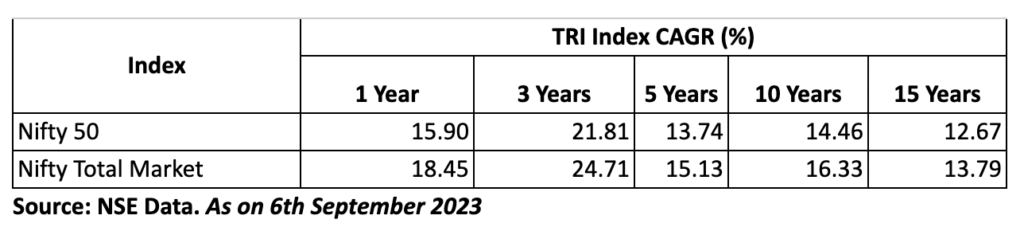

Of course, if we are talking about an index, we need to have a clear understanding of its past performance. Though the past performance of an index is never a metric to judge how the index or a scheme tracking the index is going to perform, it still gives a fair idea of its potential.

Just for comparison’s sake, let’s compare how the Nifty Total Market Index has fared against Nifty 50.

Disclaimer: Past performance may or may not be sustained in future. All information contained is for illustration purposes only. The performance of the index shown does not in any manner indicate the performance of the scheme.

Interestingly, the Nifty Total Market Index has outperformed the Nifty 50 since its inception. Also, the Nifty Total Market Index represents a staggering *96% of the NSE’s total market capitalisation against the 49% covered by the Nifty50, meaning the index gives a much deeper insight into the Indian stock market than Nifty 50. Let’s take a look at the market-cap split for Nifty Total Market Index.

Nifty 50 vs Nifty Total Market Index drawdowns (Last 10 yrs): An outlook

Drawdowns are typically expressed as a percentage and represent the extent to which an investment or index has lost value from its previous peak or high point. Interestingly, the Nifty Total Market Index has had similar drawdowns compared to the Nifty 50 index in the last ten years.

Disclaimer: Past performance may or may not be sustained in future. All information contained is for illustration purposes only. The performance of the index shown does not in any manner indicate the performance of the scheme.

A better Sharpe Ratio, too?

The higher the Sharpe Ratio, the better the risk-adjusted return. A higher ratio suggests that an investment has provided greater returns for the level of risk taken. Conversely, a lower Sharpe Ratio indicates that the investment may not have delivered sufficient returns considering the associated risk. Again, the Nifty Total Market Index has seemingly bettered Nifty 50 in this context.

Now, coming back to the scheme

The recently launched Groww Nifty Total Market Index Fund will track the Nifty Total Market Index, and its returns will be based on the performance of the index, subject to tracking error. The scheme is open for subscription till 17th October 2023.

Should you consider investing in this scheme entirely depends on your risk appetite, financial goals, investment objective and other factors. Always consult your financial advisor so that you can make an informed investment decision.

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.