Last Updated on Jan 20, 2023 by

It is believed that an Ostrich digs its head into the ground when scared or frightened. With the danger out of visible sight, it probably believes that the threat would disappear. That is quite like an investor who scans their investment account for winners and losers, only sells profitable ones, and ignores the loss-making ones. They hold the loss-making investments for the long run, hoping they will recover one day.

Realizing losses for most investors is so painful that they are willing to hold onto them indefinitely, hoping they will recover and break even one day. They do not realize that these investments are down from the purchase price because of deteriorating fundamentals or that the purchase was made when the market was excessively euphoric about its prospects. And now, with the tide turning away and the market realizing that it had priced in the unlikely hyperbolic scenario, it’s unlikely that these investments would recover anytime soon. Temporary losses often turn into permanently lost capital.

Choosing where to invest one’s hard-earned savings is no easy task, even for professional managers, let alone gullible retail investors. When faced with a complex decision, such as choosing a stock, mutual fund, or bond, most people try to simplify the process by relying on incomplete information, shortcuts, tips, and gut feeling rather than acting rationally. Such approaches are quick and intuitively appealing but often lead to making big mistakes.

Behavioural finance studies the effects of psychology on investors and financial markets. It explains why investors often lack self-control, act against their best interests, and make decisions based on personal biases instead of facts. One such behavioural trait that can lead to a long-term negative impact on an investor’s financial position is loss aversion.

Table of Contents

What is loss aversion?

Simply stated, we hate losses more than we love gains. Loss aversion is the tendency to strongly prefer avoiding losses to achieving gains. “I won’t sell before I get my money back” or “selling now is like accepting a mistake, which won’t look good on my investment track record” are common statements that depict an investor exhibiting loss aversion.

Rational investors should accept more risk to increase gains, not to mitigate losses. Paradoxically, in real life, investors tend to accept more risk to avoid losses than to achieve gains. Loss aversion leads investors to hold their losers to avoid recognizing losses and sell their winners to lock in profits. The resulting portfolio thus often becomes riskier than the optimal portfolio based on the investor’s risk-return objectives.

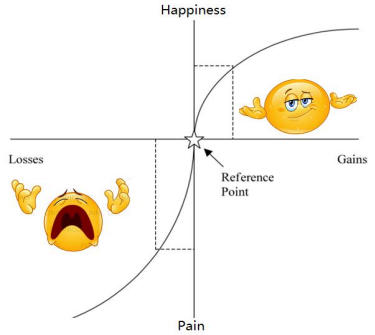

Empirical evidence (Kahneman and Tversky (1979)) suggests that we hate losses about twice as much as we enjoy gains. Thereby suggesting that the pain of losing Rs. 10,000 is equal to the happiness associated with the gain of Rs. 20,000.

Our preferences towards gains and losses are asymmetric, with a greater impact of losses than gains on happiness for the same amount in absolute value. This also means that investors take more risks to avoid losses and avoid risk-taking for gains. When faced with losses, investors are willing to suffer a bigger loss in the attempt to simply break even through acts such as “double or nothing”, “do or die”, and “let’s go all-in now”.

Investors’ actions are based on emotions, not logical reasoning. If the investor did some research, they might learn that the company in question is experiencing difficulty and that holding the investment adds to the risk in the portfolio. Conversely, the winners are making money. You can use the Scorecard on Tickertape Stock Pages to analyse the performance, valuation, growth, profitability and more of a company.

In this case, if the investor researched, they might learn that the company improves the portfolio’s risk-return profile. By selling the investment, not only is the potential for future losses eliminated, but the potential for future gains is also eliminated. Combining the added risk of holding the losers with eliminating potential gains from selling the winners may make investors’ portfolios less efficient than portfolios based on fundamental analysis.

Consequences of loss aversion

No one likes to realize a loss, but loss aversion can cause you to lose more money or make less than you feared to lose. Investors can identify if they are exhibiting loss aversion if they are doing the following:

1. Selling winners and holding on to losers: Sell investments in a gain position earlier than justified by fundamental analysis out of fear that the gains will erode and hold onto losers with the hope of breaking even one day. Refusing to sell even if there are better alternative investment options available. Ultimately, when the investor sells the stock or fund, a long time may have elapsed, and the return on the investment is very low.

2. Holding on to properties: Loss aversion is commonly seen in property or real estate investments. Investors refuse to sell their property at a loss and hold on to it, hoping the investment will turn profitable someday. Throughout the holding period of the investment, they pay interest on their loans which could have been avoided if they had sold earlier.

3. Excessive trading: Trade excessively as a result of selling winners. Excessive trading leads to lower total investment returns.

4. Additional risk: Investors seek additional risk to avoid booking a small loss. They use strategies such as “double or nothing” to break even.

5. Risky alternatives: When investors suffer losses, they view risky alternatives as a source of opportunity; when they gain, they view choices involving additional risk as a threat.

For example, an investor with a net loss is more likely than the average to choose the riskier investment, while a net gainer is more likely to choose a less risky alternative.

How to avoid loss aversion?

It is also important to realize that a 50% loss requires a 100% gain to recover, and an 80% loss necessitates a 500% gain to get back to where the investment value started. And the chances of such a meteoric rise are often unlikely.

Overcoming any behavioural bias first requires acceptance of its existence. Investors need to look at their portfolio performance and trade over time for evidence of the above-discussed issues. Investors can improve economic outcomes by understanding these biases, recognizing them in themselves and others, and learning strategies to mitigate them.

The second step is overcoming the pain of booking a loss. A good financial advisor can help you overcome this behavioural bias by helping you set realistic financial goals and have a rational and objective portfolio performance evaluation process. Do what is right to meet your financial goals, including selling underperforming funds consistently and switching to better funds. A disciplined investment approach is a good way to alleviate the impact of the loss aversion bias.

For any loss-making investment, start by asking the following questions: If this investment was not a part of my portfolio, would I still consider purchasing this today afresh? Are the underlying fundamentals of the asset intact? Are the prospects of the asset positive? If the answer to any questions is NO, then realizing the loss sooner than later may be wise.

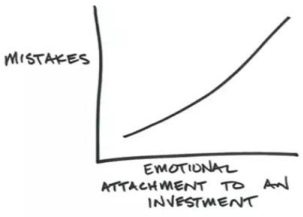

Avoid loss aversion by not getting too emotionally involved in your investments. There are risks involved in investments, many of which are beyond your control, and you cannot always be right. Sometimes, it is better to book a loss and move on to alternative investment options. It is difficult to separate emotions from investing, but that differentiates successful investors from the ones who often underperform.

- Real Estate Investment Trusts in India (REITs): An Introduction - Apr 21, 2023

- Loss Aversion – Consequences and How To Avoid It - Jan 19, 2023