Last Updated on Apr 19, 2023 by

Indian investors have various options for online investment in gold with exchange-traded funds (ETFs) and sovereign gold bonds (SGBs). But can you invest in other precious metals, such as silver or platinum? The answer is yes. In this article, let’s discuss investing in precious metals, along with the pros and cons of investing in them.

Table of Contents

What are the different types of metals?

There are several kinds of metals that investors can invest in, usually categorised as ‘precious’ or ‘base.’

What are precious metals?

Precious metals are rare, organically occurring metallic elementals with inherent value. They do not usually oxidise or corrode and are naturally anti-tarnish.

The main precious metals are gold, silver, palladium, and platinum – all used in jewellery and have various applications.

Precious metals have been used for currency and jewellery throughout human history. It would surprise many that metals like gold are used in devices, including iPhones and computer hardware. Precious metals are often considered safe havens, especially during market uncertainty.

What are base metals?

Base metals are common metals that naturally oxidise, rust or tarnish. This includes copper, lead, nickel, and zinc. These metals are used to make products such as copper pipes or alloys such as nichrome, an alloy of nickel and chromium. Copper is also a popular sculpture material, with icons including the Statue of Liberty getting its green hue from oxidised copper.

What are the different precious metals to invest in?

Generally, four primary precious metals are commonly invested: Gold, Silver, Platinum, and Palladium. These all have a range of applications, not just as a historical store of money or for their use in jewellery but also in industry, electronics, medicines, and alloys.

Gold

Gold has been used in the production of expensive goods for millennia. Even today, gold is the most preferred asset of choice for many investors during market uncertainty.

Silver

Silver has a range of applications, including in batteries, dentistry, and water purification. Silver is also dear in Indian households as utensils or articles for worship, apart from jewellery.

Platinum

Platinum, in its pure form, is used in jewellery and dental work. However, it is also popular as an alloy – for example, the alloy of platinum and cobalt is used to make magnets.

Palladium

Palladium is a congener with platinum – meaning the two metals share a common structure, origin, or function. Palladium is majorly used in converting toxic gases like nitrogen dioxide and others into substances of lesser harm. It is also used in catalytic converters for many cars.

How to invest in precious metals?

Everyone knows the traditional method of investing in these precious metals, that is, buying the physical metals be it jewellery, coins or biscuits. But apart from the traditional way, there are a few other ways you can invest in precious metals in India.

Exchange-Traded Funds

As a savvy investor looking to capitalise on long-term capital gains, investing in a metal-based ETF may be considered. You can choose from several funds focussed on a single metal like gold or silver, as well as opt for a combination fund that tracks the basic commodity and the commodity futures.

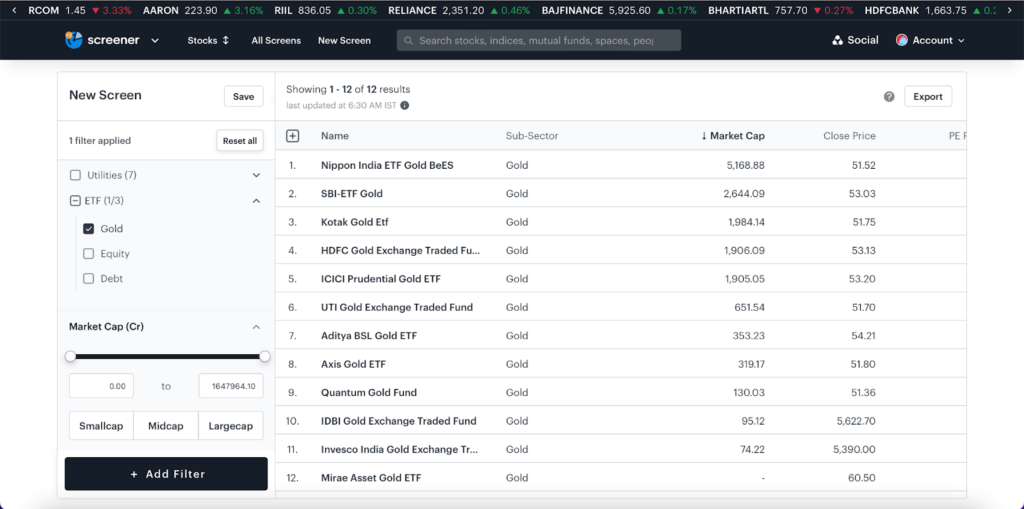

Investing in Gold ETFs is simple like never before. You can get the list of Gold ETFs using Tickertape.

- Open Stock Screener

- Go to ‘ETF’ under Sector

- Select ‘Gold’

You can sort the Gold ETFs as per your preferred parameters like CAGR 5Y, 1-yr returns, or market cap, etc.

- Once you have selected your preferred Gold ETF, you can visit the individual asset page and buy them online hassle-free.

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds are digital investments in gold that the Central government issues through the RBI. They are essentially government bonds with a fixed holding period of 8 yrs. The USP of investing in gold as a commodity through SGBs is the premise of earning a fixed yield, that is, you can earn an annual interest to the tune of 2.5% annually on the value of gold.

Commodity exchanges

Commodity exchanges like the Multi-Commodity Exchange (MCX) and Indian Commodity Exchange (ICEX) facilitate the trade of a whole host of commodities, including but not limited to precious metals. If you’re interested in taking a position on the commodity and/or hedging the same with commodity futures, these exchanges are the preferred path to tread.

Mutual funds

FoFs gold mutual funds invest in different funds, primarily trading in gold securities. Their portfolios include gold trading companies or mutual funds involved in gold securities. Open Tickertape Mutual Fund Screener and look for ‘FoFs Gold’ in ‘Category’. You can sort these funds using your preferred parameters like CAGR 3Y, CAGR 5Y, etc.

What affects the price of precious metals?

Supply and demand

As with any product or service, a shortage of precious metals – or an increased need for them – makes them more valuable. For example, if a strike at a major silver mine interrupts production, silver prices could increase over the short term.

An improvement in mining equipment, on the other hand, could have the opposite effect, speeding up production and saturating the market, thus driving prices down (assuming demand remains constant )

Economic uncertainty

In times of economic and political instability, precious metals are traditionally viewed as safe havens due to their lasting value. One can recall this theory in action in 2016 when Donald Trump’s election to the US presidency caused gold to rally as nervous investors flocked towards precious metals, fearing uncertainty.

Industrial output

Precious metals have a massive range of industrial uses, including the manufacture of automotive parts, medical devices, electronics, and jewellery. As demand for these goods grows, so does the demand for precious metals and, therefore, the prices.

Strength of the dollar

Given that precious metals are dollar-denominated, they are particularly susceptible to fluctuations in the greenback value. When the dollar falls, precious metals are an excellent place to store USD – meaning it is likely to increase the price of precious metals.

Interest rates

Precious metals offer a desirable alternative for fixed-income investors, whose investments offer a lower yield when rates are slashed. As such, government decision-making may guide investors towards these safe-haven opportunities.

Nevertheless, the Fed’s impact on precious metals should not be overstated. What remains of more importance is how interest rate announcements in the US affect the dollar, which may trigger a series of price changes.

Quantitative easing

Precious metals generally perform better in a rising inflation environment. This is because quantitative easing – or money-printing – dilutes the currency’s value in circulation and makes it more expensive to buy assets that are viewed as a reliable store of value.

Benefits of investing in precious metals

- Diversification: Precious metals can offer diversification benefits to an investment portfolio. They tend to increase in value and have low risk, making them an ideal investment for portfolio diversification.

- Inflation hedge: They are often seen as a hedge against inflation. Due to inflation, when the value of the paper currency decreases, the value of precious metals rises.

Disadvantages of investing in precious metals

- Regulatory risks: The precious metals industry is subject to regulations that can affect prices and supply. Changes in regulations, such as mining regulations or taxation policies, can impact the value of precious metals.

- Price volatility: Precious metals can be highly volatile in nature. The price of these metals keeps changing every day, and they fluctuate based on factors like economic, geopolitical, supply and demand, etc.

Are precious metals a good investment?

Many investors regard precious metals as a good investment – particularly gold, as they store value, are anti-inflationary and provide great capital protection and appreciation in turbulent times. Precious/non-precious metals are the backbone of many industries and related production, directly impacting the direction of the economy. However, before investing in any precious metal, it is important to consider your investment objective and risk appetite. Be it a traditional form of investment (buying physical metal) or other investment ways, understand it’s working before making a decision.

A few things to remember while investing in precious metals

- Gold, perhaps the most popular precious metal, is a good portfolio diversifier and offers a hedge against market risk.

- Apart from gold, investors can also invest in other precious metals like silver, platinum, and palladium.

- Buying physical metal isn’t the only option. Investors can also invest in precious metals through bonds, derivatives, metal ETFs, mutual funds, and mining company stocks.

Conclusion

The Indian subcontinent has been a pioneer for more than a century in investing in precious metals. With online trading made extremely simple and renewed investment options like ETFs, mutual funds, and derivatives, investors have excellent opportunities to diversify and hedge themselves. Overall, understand the working of an investment, consider their pros and cons and invest.

FAQs

What are the factors that can influence the price of gold?

There are several factors, like economic conditions, geopolitical events, supply and demand, etc., that can influence the price of gold.

Physical gold or Gold ETFs – Which is better for investment?

Deciding between physical metal or Gold ETFs depends on your investment objective and risk appetite. Understand the working of Gold ETFs, their pros and cons and compare it with physical gold investment. Select the one that suits your requirements. Talk to your financial advisor before making a decision.

- How To Withdraw Mutual Funds? - Jun 6, 2025

- Top Maternity Insurance With Low Waiting Periods - Jun 5, 2025

- ROE vs ROCE – What are the Differences? - Jun 5, 2025