Last Updated on Jun 4, 2025 by Aishika Banerjee

It is well-known that different types of mutual funds are available in the market. These mutual funds differ based on their functionality, duration and more. But did you know mutual funds also differ with respect to how the returns are distributed? There are two alternatives in mutual funds returns disbursement – growth and IDCW (Income Distribution cum Capital Withdrawal). In this article, let’s learn about IDCW, growth plan, IDCW vs growth and which is better.

Table of Contents

What is IDCW in Mutual Funds?

In IDCW, previously known as the dividend option, the profits earned are paid to the investors at pre-decided intervals. The intervals at which these dividends are paid depend on the fund. It can be annually, monthly, quarterly, or daily. The dividend rate is not fixed; it differs with each payout cycle. As per SEBI, it is mandatory to pay dividends only from the profit earned by the mutual fund.

What is Growth in Mutual Funds?

In growth funds or mutual fund growth options, profits earned on the mutual fund are reinvested in the scheme. It provides the investor with a chance to earn profits on profits.

IDCW vs Growth in Mutual Funds

Here’s a detailed difference between IDCW and growth in mutual funds.

| Features | IDCW | Growth |

| Profits | Paid out to the investors. | Reinvested in the scheme. |

| NAV | Dividends are paid from the NAV. Hence the NAV is low compared to the growth plan. | The reinvested profit can increase in value over time. Hence the NAV is high compared to the IDCW plan. |

| Taxation | Dividend income is taxed as per the investor’s income tax slab. If the investor doesn’t have any other income source, a TDS of 10% is deducted from the dividend income (if the dividend is more than Rs. 5,000). | Short-term or long-term capital gains are applicable as per the investment tenure. |

| Total returns | Due to the periodic dividend payouts, the returns are low compared to the growth option. | As the plan focuses on long-term wealth creation, the returns are high as compared to the IDCW plan. |

| Suitable for | Investors looking for an investment option that pays profits at regular intervals. | Investors looking for long-term wealth creation options. |

| Example | Assume a fund has a NAV of Rs. 20 on 1st April 2020, and the investment amount is Rs. 10,000 for the number of units 500. The NAV on 31st March 2021 is Rs. 25, and a dividend of Rs. 5 is declared. The investor will receive a dividend of Rs. 2,500. Post dividend, the NAV will be Rs. 20. Units issued against the dividend will be Rs. 125 (2,500/20). The total number of units held will be 375 with a NAV of Rs. 20. And the total value of an investment will be Rs. 7,500. | Assume a fund has a NAV of Rs. 20 on 1st April 2020, and the investment amount is Rs. 10,000 for the number of units 500. The NAV on 31st March 2021 is Rs. 25, and as there is no dividend paid out, the total value of the investment will be Rs. 12,500. |

Growth vs IDCW – Which is Better?

The only difference between growth and IDCW plans in mutual funds is how the returns are distributed. The growth plan is suitable for investors looking for long-term wealth plans, and it also provides the advantage of compounding as the profits earned are reinvested into the scheme. While on the other hand, IDCW is for investors looking for regular payouts from their investments. However, the best one between growth or IDCW plan depends on the investors’ investment needs.

What Should Investors Consider While Switching from IDCW to a Growth Plan?

Investors planning to switch from IDCW to a growth plan should understand the primary and important difference between both plans, i.e., how returns are distributed. Once that is clear, note that switching from one plan to another in the same scheme is considered a ‘sale’. And for the switch, there is an exit load charged. Along with the exit load, there can be capital gains tax levied depending on the investment tenure.

How to Get the List of IDCW Funds in India?

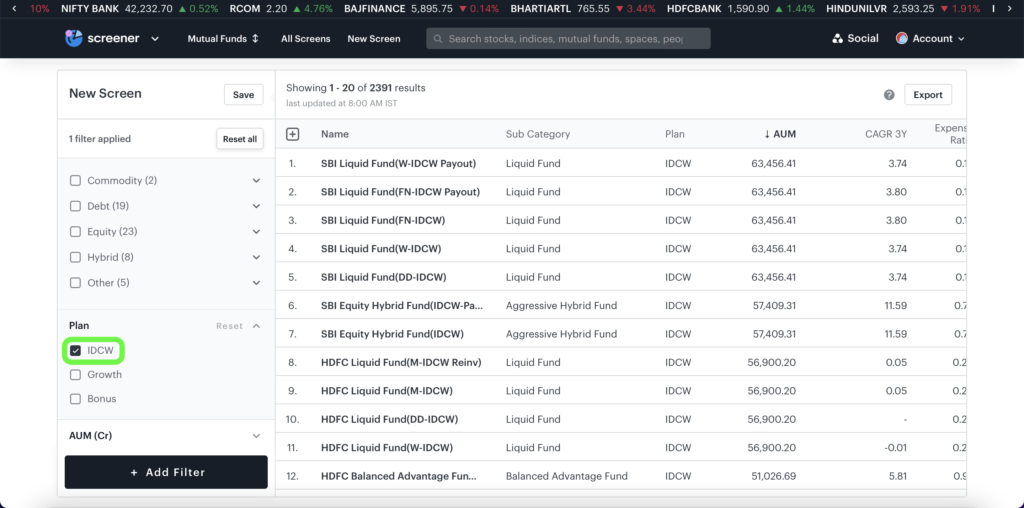

Follow the steps below to get the list of IDCW funds or IDCW option in mutual funds in India:

- Log in to Tickertape

- Launch Mutual Fund Screener

- On the left, go to ‘Plan’ and Select ‘IDCW’

Sort the list of funds according to your favourite parameter like AUM, NAV, 5Y CAGR, 3Y CAGR, etc.

Conclusion

Both growth and IDCW are good mutual fund choices. Choosing between growth and IDCW depends on your investment goals. Talk to your investment advisor and make a wise decision. You can use Tickertape Mutual Fund Screener to find the top mutual funds for both growth and IDCW plans in India.

Frequently Asked Questions About IDCW vs Growth

1. How to get the list of growth funds in India?

Follow the steps below to get the list of growth mutual funds India using Tickertape.

– Log in to Tickertape

– Visit the Mutual Fund Screener

– Under ‘Plan’ select ‘Growth’

2. How to get the list of top IDCW mutual funds in India?

You can get the list of IDCW mutual funds India on Tickertape by following the simple steps below:

– Log in to Tickertape

– Visit the Mutual Fund Screener

– Under ‘Plan’ select ‘IDCW’

– Sort the list by different parameters like AUM, NAV, CAGR 3Y or more depending on your need to get the top IDCW funds.

- Best Blue Chip Mutual Funds – List of Top Large-Cap Funds - Jun 6, 2025

- List of Top Fundamentally Strong Stocks in India for 2025 - Jun 4, 2025

- IDCW vs Growth – Which Is Better? - Jun 4, 2025