Last Updated on May 24, 2022 by Aradhana Gotur

When it comes to investing, there is a multitude of opportunities at your disposal. Out of the many options available, mutual funds and ETFs are the common ones. However, you need to understand the nature of these funds before investing in them.

In order to make things simpler, we discuss the fundamental aspects to consider before choosing a suitable fund to invest in.

Table of Contents

Fundamentals of exchange traded funds

Also known as ETF, exchange traded funds are essentially a type of security that replicate a composition of a market index. ETFs were first launched in 1993 in the USA and have seen a substantial increase in terms of investment and popularity. The very first ETF launched in India was BeES (Nifty-Benchmark Exchange-Traded scheme).

ETF is a type of fund that holds multiple underlying assets, i.e. different stocks, bonds and commodities depending on the index in consideration. An ETF is quite similar to mutual funds but it’s not the same. Unlike the value of a unit of a mutual fund, which is calculated based on the net asset value at the end of each trading day, the price of an exchange traded fund fluctuates during the trading hours based on the demand and supply. By owning an ETF, you get the diversification of an index fund along with the liquidity of a stock.

In order to invest in an ETF, all you need is an active trading and Demat account. Since ETFs are traded during market hours, you can purchase a unit of any ETF from the secondary market using your trading account. The units purchased will then be delivered to your Demat account. ETFs can be actively or passively managed.

In the case of an actively managed ETF, a dedicated portfolio manager analyses the market conditions and then invests in securities with high growth potential. Whereas, a passively managed ETF simply mimics the trends of a particular market index and only invests in its constituents. Before investing in an ETF, make sure to understand the important checkpoints.

The very first ETF launched in India was Nifty BeES, which is the Nifty Benchmark Exchange-Traded Scheme. Click To TweetFundamentals of mutual funds

A mutual fund is a type of investment that pools the money of several investors and invests it in different asset classes such as stocks, bonds, money market instruments, and debt. Mutual funds are a popular form of investment for retail investors in India. Ever since mutual funds were brought into the Indian market by the UTI Act of Parliament in 1963, the asset class has seen remarkable growth.

There are many similar characteristics between mutual funds and ETFs. Mutual funds trade on the basis of their Net Asset Value (NAV), which changes every day and the units can be bought and sold only based on their price at the end of market hours. Unlike the ETF, mutual funds are closely monitored and an actively managed asset class. Based on the underlying asset of a scheme, mutual funds are available in various types.

If you are looking to invest in an index fund, having a Demat account is a prerequisite. For other funds, simply having a trading account will suffice. Here’s a detailed article on how to invest in mutual funds.

Differences between ETFs and mutual funds

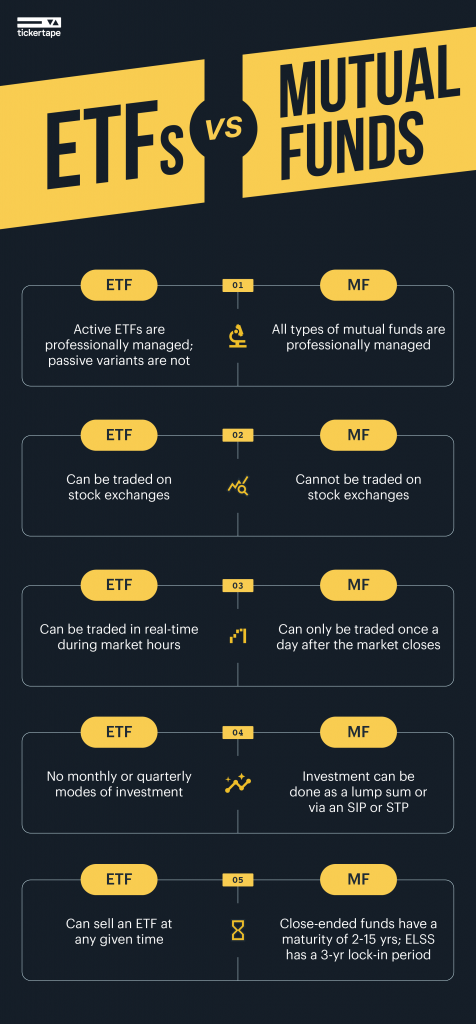

| Differences | ETF | Mutual funds |

| Can it be traded on the stock exchange? | Yes, ETFs can be traded via the stock exchange | No, mutual funds cannot be traded on the stock exchange |

Real-time price | ETFs trade in real-time during market hours | The value of a mutual fund is dependent on the NAV and can only be gauged once the market ends for the day |

| Systematic investment | There are no monthly or quarterly investment plans for ETF | Investment in a mutual fund can be done as a lump sum or via an SIP or STP |

| Diversification | ETFs are moderately diversified. Based on the objective of the particular fund, managers decide on the level of diversification | Mutual funds provide a broader diversification option as the portfolio is actively managed by a fund manager who makes the important changes based on the funds’ performance and average returns of the fund |

| Cost of investment | ETFs charge several fees such as brokerage fee and commissions | Mutual funds attract various charges such as load fees asset management fee, and account fee |

| Lock-in period | Since ETFs are bought and sold like stocks during the trading hours, you can sell a fund at any given time | While open-ended funds don’t have a maturity period, close-ended funds come with a maturity period ranging from 2-15 yrs. Equity linked saving schemes (ELSS) have a lock- in period of three years. |

Now that you have read through this article, you may have grasped a fair understanding of the two asset classes and their differences. A few other things to keep in mind before investing in either of the asset classes would be the age, time horizon, trading volume, liquidity, expense ratio and a low tracking error. In other words, it is imperative that you evaluate your personal needs and do thorough due diligence before investing in any fund.

- ETF vs Mutual Funds: What Should You Invest In? - Aug 5, 2021