Last Updated on May 24, 2022 by Anjali Chourasiya

A few decades ago, the only financial instruments people invested in were fixed deposits and government savings certificates. Today, we have come a long way with equity and debt mutual funds, ETFs, corporate bonds and much more. Debt instruments and fixed deposits are generally regarded as safer instruments for those with a low-risk appetite. Let’s take a look at both these instruments that can help diversify your portfolio.

Table of Contents

Understanding debt mutual funds

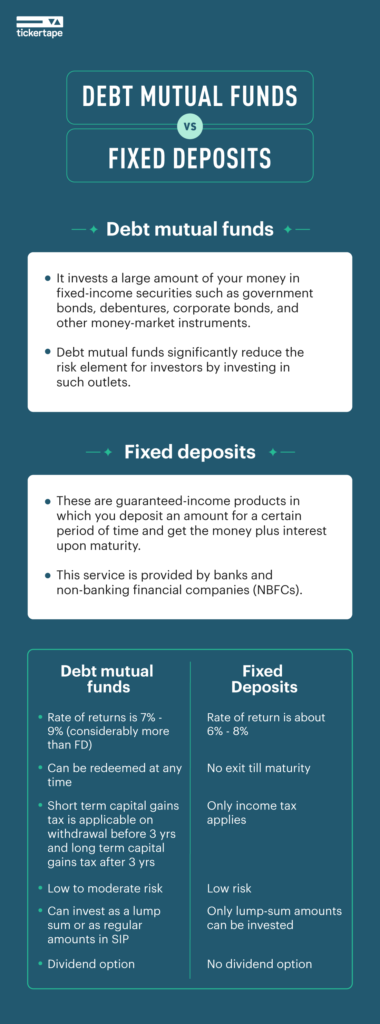

A pool of money gathered from a group of investors is channelled into various securities in mutual funds. Most people are familiar with equity-based mutual funds, but some hesitate to invest in them because they fear that charges may be high and returns may be diluted. In such cases, debt mutual funds can offer an attractive alternative because the pool of investor money is channelled into safer debt instruments like bonds, government securities, commercial papers, state government loans, certificates of deposits and others.

Debt mutual funds are fixed income instruments because they have a maturity date and a fixed interest rate. They are not affected by market vagaries. They also come with credit ratings that tell about the possibility of default and, therefore, the security quality. Debt fund managers can choose accordingly.

Types of debt funds

Here is a table showing the types of debt funds at a glance:

| Type of fund | Feature |

| Liquid fund | Invest in money market instruments maturing in 91 days |

| Money market fund | Invest in money market instruments maturing in 1 yr |

| Overnight fund | Invest in money market instruments maturing in 1 day |

| Dynamic bond fund | Invest in various securities with different maturities |

| Gilt funds | Invest 80% corpus in G-secs. No credit risk but high interest rate risk |

| Corporate bond fund | Invest 80% corpus in corporate bonds having the highest ratings |

You can choose debt funds based on their research and risk appetite.

Understanding fixed deposits

Fixed deposits are assured-income instruments, where you deposit a sum for a specified period and get the sum plus interest upon maturity. Banks and non-banking financial corporations (NBFCs) offer this service. You can withdraw the fund before maturity. Some categories of investors like senior citizens are incentivised to use these instruments with higher interest rates.

The primary benefit is the certainty of returns and the safety of the money. They help diversify the risk in an investment portfolio because the rate never changes irrespective of the market conditions. The same interest rate applies throughout the fixed deposit term.

Debt funds vs FD

Debt funds and fixed deposits vary in many ways, and understanding them can help you decide how much of each to have in your portfolio.

1. Risks involved

In debt funds, there are three main types of risks:

- Credit risk wherein the issuer may default on paying the principal and interest.

- Interest rate risk wherein the fund’s overall return may be diluted due to a change in the interest rate of individual securities.

- Liquidity risk wherein the fund may not be able to allow people to redeem their money.

FDs, in contrast, have much lower risk, especially when issued by public-sector banks. The interest rates don’t change throughout the term and can be easily renewed.

2. Returns

FDs are preferred by conservative investors due to the assured returns, but they depend largely on the repo rate. However, debt mutual fund returns depend on the performance, with the NAV fluctuating according to the interest rates. They have lower returns than equity mutual funds. At the same time, debt funds may generate higher returns than FDs when the markets are doing well.

3. Tax liability

Fixed deposits are taxed at source (TDS), which can later be adjusted when filing ITRs if it is a tax-saving FD under Section 80C of the IT Act. It applies annually at a marginal tax rate.

Debt mutual funds attract short term capital gains tax or long term capital gains tax based on how long you hold the units. The STCG tax is the same as the marginal rate, which is 15% and applies at the exit from the fund. The LTCG tax is 20% with indexation. The debt fund manager will also deduct dividend distribution tax from the dividends.

Summary – FD vs debt funds

| FD | Debt mutual funds |

| Fixed income with assured returns | Regular returns but vary according to prevailing interest rate |

| No exit till maturity | Can be redeemed at any time |

| Only income tax applies | Short term capital gains tax before 3 yrs and long term capital gains tax after 3 yrs |

| Low risk | Subject to credit, liquidity, and interest rate risk |

| Low liquidity (tax-saving FDs must be maintained for 5 yrs) | Can be redeemed at prevailing Net Asset Value |

| Lump-sum amounts to be invested | Can invest as a lump sum or as regular amounts in SIP |

Conclusion

The more you diversify your portfolio, the safer your investment is likely to be. To that end, both debt funds and mutual funds are helpful. You can decide what to invest in based on your financial goals and lifestyle needs.

Before ending this article, we’ve got a special surprise for you! On account of Diwali 2021, we are gifting you a free Tickertape PRO upgrade! Just sign up on Tickertape and avail the offer!

Note: The pro upgrade offer is valid only till 30 November 2021.

- How To Declare Mutual Funds in ITR & Disclose Capital Gains in India? - Jun 6, 2025

- How To Sell or Exit Your Mutual Funds in India? - Jun 6, 2025

- Fund of Funds (FOF): Meaning, Types & Advantages - May 13, 2025