Last Updated on May 24, 2022 by Anjali Chourasiya

Market volatility is a large part of what makes stock market investments and stock market-linked investments like mutual funds risky. But, the same volatility can give rise to excellent trade opportunities.

If share prices did not rise and fall hypothetically, there would be no opportunity for investors to make any earnings in the markets. Given that mutual funds pool investor capital and invest in the stock market, mutual funds, too, would not have the ability to develop earnings without market volatility.

Table of Contents

SIP and lump sum

SIP (Systematic Investment Plan) and lump sum are two investment mechanisms/routes for investing in mutual funds. SIP can be defined as small investments made in a specified fund for a specified amount on a regular basis. On the other hand, lump-sum allows investors to purchase more units at a particular price in one instance.

Both these mechanisms are opposites and enjoy their respective pros and cons. That said, SIP is popular as it targets smaller investments that don’t burn a hole in the pocket and is deemed a counter to market volatility.

How SIP dilutes volatility?

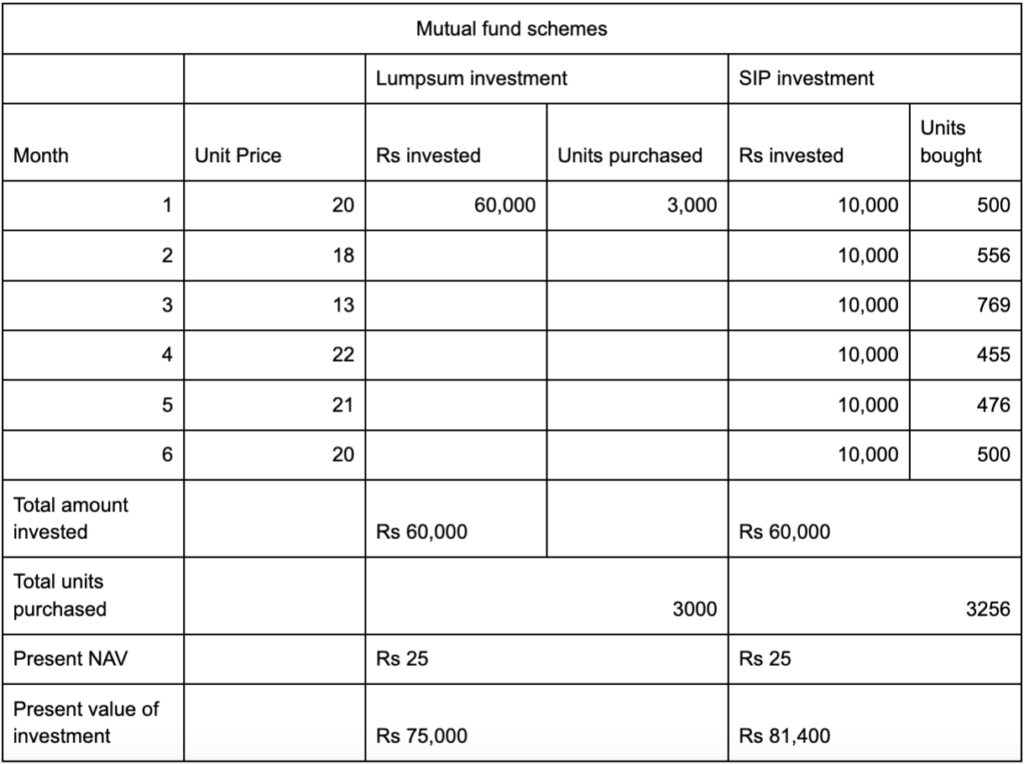

One could either watch mutual fund NAV prices and the stock market daily for a couple of weeks to a couple of months before investing or take the risk of buying at a precarious price point. But there is a third option – that is, to buy in such a way that you average out the highs and lows of mutual fund unit prices through SIPs. Observe the two scenarios below:

Scenario 1: Mr A watches the market daily for 10 mth and buys 1000 mutual fund units at Rs. 200 per unit worth Rs. 2 lakh as a lump sum. He is aware that the market is unpredictable, and there are times that the price may drop even lower, but he is not sure when this will happen, so he settles for Rs. 200 per unit. In about 2 yrs, he sells all the units for Rs. 3.36 lakh.

Scenario 2: Mr B has no time to watch the markets and instead signs up for a SIP. He decides he will invest Rs. 20,000 per month for the next 10 mth. In some months, Mr B may get 100 units for his SIP amount, and in some other, 80, yet other, 120. When he takes an average, he may realise that he has purchased the units for an average or near the value of Rs. 200 per unit; the same as Mr A.

What observations can one make from the scenarios above?

Effort: If Mr B sells at the same price as Mr A, they get the same returns but note that Mr B is able to do so with lesser effort – he did not have to watch the market constantly for 10 mth as Mr A did before making his purchase of mutual fund units.

Uncertainty: Despite his efforts in timing the market and studying it carefully, Mr A would, in all likelihood, face tremendous uncertainty about whether he was choosing the right product or entry price. Mr B activated a SIP that let him explore the fund’s performance over time even as he earned interest on interest.

Liquidity: Investing the entire Rs. 2 lakh at one go, Mr A cramped liquidity while also hoping that his capital will not get eroded by market fluctuations on the downside. Mr B meanwhile enjoyed liquidity (cash at hand) and took a calculated risk by exposing his portfolio to market risk in small quantities only.

Lost opportunity: In the process of gathering Rs. 2 lakh for his lump sum investment, and while waiting for the right time to enter, Mr A’s capital could have been invested elsewhere that could have started earning.

When you invest in a SIP (Systematic Investment Plan) – you invest the same amount at fixed intervals. The market, meanwhile, follows no calendar. It responds to dynamic forces and both systematic and unsystematic risks.

In some months, the market will be up. In other months, it is likely to be beaten. This will impact the unit prices of the mutual fund that you have chosen for your SIP. In the months when the market is down, or prices are low, you will be able to buy more units for your fixed price, and in other months, when the market is rallying, and prices are high, you will automatically lose out because you are buying at higher prices.

However, in the end, because of choosing a SIP route, your prices typically average out. This is called rupee cost averaging, a feature unique to SIP investments.

Is SIP the best way to enter at a low price?

If you do have the time to watch the market like a hawk, you may actually be able to invest at a lower price than the average and therefore emerge with potentially higher earnings. That’s a big might, and most people have neither the time nor the market knowledge for predicting market movements.

That said, it is important to remember that even the most experienced investors and advisors are only making predictions. There is no foolproof method of knowing with 100% accuracy which way the market will move.

Conclusion

SIPs can help average out the highs and lows of fluctuating mutual fund prices by investing the same amount (whether the market is up or down) at regular intervals. Investors who do not have the time, bandwidth, or expertise to watch prices prior to their investment might opt for the SIP mode of investing. This can help them dilute market volatility and lower the risk of buying at too high a price. Consult your advisor before investing.

- How To Declare Mutual Funds in ITR & Disclose Capital Gains in India? - Jun 6, 2025

- How To Sell or Exit Your Mutual Funds in India? - Jun 6, 2025

- Fund of Funds (FOF): Meaning, Types & Advantages - May 13, 2025