Last Updated on Apr 20, 2021 by Manonmayi

Fixed deposits have always been a favoured investment in India for risk-averse investors. It acts as a much-needed umbrella in the turbulence of financial markets. The best part about a fixed deposit is guaranteed returns with the lowest risk; however, it has its share of problems. This arises when interest rates fall in an economy, reducing the returns on your fixed deposit amount.

This article covers:

Table of Contents

Falling interest rates

India as an economy is currently amid a pandemic, with the second wave sweeping the country. Our economy has still not recovered from the lockdown imposed last year, and many businesses were shut as a ramification of that. Thus, the interest rates have been pretty low for many months now in order to induce spending and boost consumption. And this is influenced by repo rates. Repo or repurchase rate is the rate at which the central bank (Reserve Bank of India or RBI) lends money to other commercial banks. As a result, the returns on the fixed deposits suffer. You can calculate them using an FD calculator available online.

How repo rate influences interest rate

The central bank reduces the repo rate to inject money into the system whenever there is a lack of liquidity in the economy. The RBI conducts monetary policy meetings on a bi-monthly basis, wherein they decide the repo rate. There are other rates decided in this meeting, such as Current Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), reverse repo rate, and so on.

A decrease in repo rate means the interest rates on FDs will also reduce, making them unfavourable as an asset class. The reason behind this is simple; commercial banks can borrow money from the central bank at a lower rate, and thus they don’t need depositors’ money. However, the fall in the FD interest rates might not be immediate in line with the drop in the repo rate.

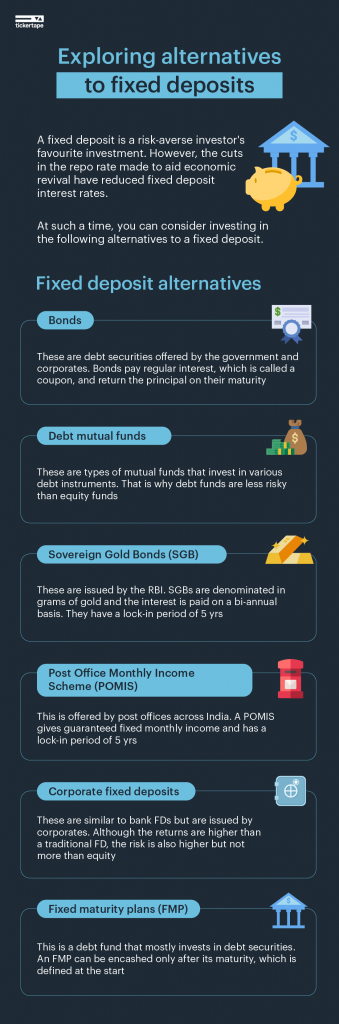

Alternatives to a fixed deposit

Fixed deposits are super safe with decent returns, but we saw that they are not as favourable in a low-interest rate scenario. There are many alternatives to these FDs, which also offer handsome returns with minimal risk. These are

Bonds

These can be Government securities (G-sec) or bonds wherein the corporates or the government issue these debt securities to raise money. In return, these institutions pay regular coupons, and the principal amount is given at the maturity of these bonds.

This is similar to a fixed deposit where coupons are equivalent to interest payments in an FD, and the principal amount is returned at maturity in both these asset classes. The risk is the least in government bonds since they would not default on their repayment obligations.

Debt mutual funds

These are the types of mutual funds that predominantly invest in various debt instruments. These funds are managed by professional and skilled fund managers who know the debt asset class in great detail. It means that your investments are at a relatively lesser risk than they are in equity mutual funds, and the returns are almost in line with what an FD will provide. However, there is an element of risk even with debt funds as they are linked to markets.

Debt funds are less risky compared to their equity funds counterpart as the latter is linked to the share market’s performance, which is highly volatile. You can use Tickertape to evaluate any mutual fund scheme, analyse their past returns, and compare it with other mutual funds. You can also compute the returns after the tax deduction using Tickertape.

Sovereign Gold Bonds (SGBs)

This is a relatively new way to invest in gold, unlike traditional gold, which is in physical form. Physical gold has safety issues such as theft and the additional cost of making charges that are not present when you invest in an SGB.

The Reserve Bank of India issues these bonds, and these are government securities denominated in grams of gold. They have a lock-in period of 5 yrs with a usual tenor of 8 yrs, and the interest is paid on a bi-annual basis. You can compare its returns with an FD using an online FD calculator.

Post Office Monthly Income Scheme (POMIS)

This is a post office savings scheme that offers a guaranteed fixed monthly income on a lump sum investment. It is suitable for risk-averse investors as there are no risks of losing capital.

Apart from being a risk-free investment, the interest rate on these deposits goes up to 7.5%, with the current interest rate being 6.6% in the Apr-Jun quarter of 2021, making it a lucrative investment. The payout in these post office savings schemes happens monthly. The lock-in period of these deposits is 5 yrs, and the maximum amount you can deposit is Rs 4.5 lakh.

Corporate fixed deposits

They are akin to traditional bank FDs, but corporates take care of them instead of banks. The risk factor in this type of FD is comparatively higher but still lesser than equity investing. Thus, the returns in the form of interest are also higher in these FDs when compared to bank FDs, and the flexible tenor option is the cherry on the cake.

The only caveat in a corporate FD is you should choose only reputed companies to invest in to mitigate the impact of risk. To gauge the safety of your fixed deposit, the CRISIL (Credit Ratings and Information Services of India Limited) rating plays a significant role. It suggests the credibility of an investment product.

Fixed maturity plans (FMP)

These plans are investment options in which a set maturity duration is defined at the start. Fixed maturity plans or FMPs is more of a debt fund that mostly invests in debt securities, debentures, or bonds.

For instance: if an FMP is of 1 yr, the investment would be in fixed-income securities with a maturity of not more than a year. A drawback is the absence of early withdrawal, and you can encash the plan only after its maturity. Thus, liquidity is a concern. Keep this in mind before investing in any FMP over a fixed deposit.

There are other asset classes in India and the likes of equity investing, commodities trading, futures and options (F&O) trading, real estate, currency trading and so on. However, these asset classes are way too risky, and you may incur heavy losses instead of booking profits. Thus, if you have a low appetite for risk, then prefer the alternatives to a fixed deposit, which are described in detail above.

- 10 Mind-blowing Facts About Harshad Mehta - May 30, 2025

- How DSP’s ETF Campaign Succeeded on Tickertape? - May 7, 2024

- Earnings Per Share Guide 2022 – Importance, Formula and Calculation - Aug 20, 2021